S After Forming An Llc

After forming your LLC, it’s important to:

- Open a Business Bank Account. A business bank account legally separates personal finances from business finances. This separation is required to maintain your LLC’s corporate veil .

- Research New York Business Licenses and Permits. For help, visit our How to Get a New York Business License guide. There are also business license services that can help.

- File Your New York LLC Biennial Report. File online with the New York Department of State every two years by the end of the month in which the LLC was formed.

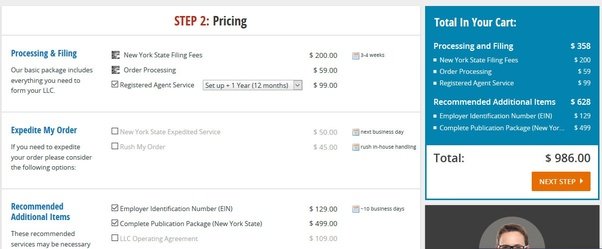

Need Help Forming an LLC?

Read our Best LLC Services review to learn more about pricing and packages.

What Is A Limited Liability Company

Before you learn about the procedures involved in how to form an LLC in New York, it is necessary that you understand what an LLC is about. A limited liability company The limited liability business structure combines the elements of a corporation, sole proprietorship, and partnership.

Having limited liability means that the owners or members of the limited liability company will typically not be held responsible if the business becomes involved in lawsuits. The same condition applies to debts. The personal assets of the owner and members will remain safe when the company is registered as an LLC in the state of New York.

Keep reading to understand the steps required to open a New York LLC. If you need help with any part of the process, contact the professionals at LLC Formations so we can help you get your business up and running.

Set Up Business Banking Credit Cards And Accounting

Using dedicated business banking and credit accounts is essential for personal asset protection.

When your personal and business accounts are mixed, your personal assets are at risk in the event your business is sued. In business law, this is referred to as piercing your corporate veil.

You can protect your New York business with these three steps:

1. Opening a business bank account:

- Makes accounting and tax filing easier.

Recommended:Learn about the best small business credit cards here.

3. Setting up business accounting

An accounting system helps you track the performance of your business and simplifies annual tax filings. Quality accounting software lets you download your bank and credit card transactions, making accounting fast and easy. Learn more about the importance of accounting and how to get started with accounting today. Or, hire a business accountant to help you navigate all your business accounting and tax needs from payroll to sales tax.

Recommended: An accounting service could be saving your business thousands of dollars a year. Schedule a consultation with a business accountant today.

Read Also: Can You Airbnb In New York City

Hiring Employees In New York

If you plan to hire employees for your new York LLC, stay compliant with the law by following these steps:

Find more information at the New York’s Department of Labor.

Recommended: Check out our Hiring for your Small Business Guide for resources like sample job descriptions, payroll service reviews, and more.

FAQ: Hiring Employees in New York

What is the minimum wage in New York?

The statewide minimum wage in New York is $12.50 per hour. In New York City, the minimum wage is $15.00 per hour. For Westchester, Nassau, and Suffolk counties, the minimum wage is $14.00 per hour.

How often do I need to pay employees in New York?

For manual workers, a weekly payday is required. For clerical workers and others, payments must be made twice per month.

Avoid Automatic Dissolution

LLCs may face fines and even automatic dissolution when they miss one or more state filings. When this happens, LLC owners risk the loss of limited liability protection. A quality registered agent service can help prevent this outcome by notifying you of upcoming filing deadlines, and even submitting reports on your behalf for an additional fee.

Recommended:ZenBusiness offers a reliable registered agent service and excellent customer support. Learn more by reading our ZenBusiness Review.

Get Business Insurance For Your Llc

Business insurance helps you manage risks and focus on growing your business. The most common types of business insurance are:

- General Liability Insurance: A broad insurance policy that protects your business from lawsuits. Most small businesses get general liability insurance.

- Professional Liability Insurance: A business insurance for professional service providers that covers claims of malpractice and other business errors.

- Workers’ Compensation Insurance: A type of insurance that provides coverage for employees job-related illnesses, injuries, or deaths. In Alabama, businesses with five or more employees are required by law to have workers’ compensation insurance. Note that officers and LLC members are counted as employees.

Find out how much it will cost to keep your business protected.

Read our review of the best small business insurance companies.

Also Check: How Much Does Hair Transplant Cost In New York

How Do I Form A New York Pllc

To form your New York PLLC you’ll need to:

- have the state license for each professional who will be a member of the company

- file articles of organization with the Division of Corporations within the New York Department of State

- within thirty days of filing your articles of organization with the DOC, file a certified copy of the same document with the relevant state licensing authority, and

- within 120 days of filing your articles of organization with the DOC, publish a copy of the articles for six consecutive weeks in two newspapers in the county where the PLLC’s office is located.

If you’re unsure regarding the publication or other formation requirements, check with a local business attorney.

You can download a blank articles of organization form . The downloadable form is specifically for PLLCs as opposed to regular LLCs. The form for PLLCs, unlike the form for regular LLCs, requires additional information such as the names and residential addresses of all PLLCs members or managers. The current filing fee is $200.

Provide An Official Address For Your Llc

Every LLC in New York must have a designated street address. This could be your companys office building, your home address or any physical address of your preference. The address can be outside the state of New York, but it cannot be a P.O. Box.You may also be able to use a virtual mailbox for your business address. Incfile can provide you with a New York virtual mailbox, where we’ll receive your mail and scan it for your online review. This can be especially desirable if you run a home-based business and don’t want your home address published as part of your businesss public record.

Read Also: Where To Get Weed In New York

Start An Llc In New York

This guide will show you everything you need to know about starting an LLC in New York.

If youre looking for a reliable DIY guide for starting an LLC in New York, look no further.

Below youll find all the information you need to launch your business and handle any associated costs. Follow each step carefully and your LLC will be established and ready to hit the ground running.

That said, the process can be complex, with various filings and costs, so if at any point you need help, you can hire an LLC registration service.

Who Needs An Ein

The EIN is needed for New York businesses that are either:

- Registered as a partnership, corporation, or multi-member Limited Liability Company, or

- A sole proprietorship or single-member LLC that has employees

The EIN is optional for sole proprietorships and single-member LLCs without employees as those business entities will use the owners social security number or Individual Taxpayer Identification Number . While its not required, using an EIN in place of the owners SSN can help protect the owner from identity theft.

You May Like: How To Become A Elementary School Teacher In New York

How To Form An Llc In Ny Yourself

Are you ready to make it official? To get your LLC on the books, you need to file Articles of Organization with the New York Department of State. If youve already registered in another state, you dont need to form another LLC. Instead, youll need to submit a Certificate of Authority for a New York foreign LLC. You can only file by paper, and you must attach a Certificate of Good Standing, Certificate of Existence, or Certificate of Status from your LLCs home state. The filing fee is $250.

To start a New York LLC, your first step is to file Articles of Organization.

Assign A York Registered Agent

Someone who receives official correspondence and is responsible for filing reports with the New York Secretary of State is known as a Registered Agent. If you have an LLC, New York requires you to have a Registered Agent. You’ll appoint your Registered Agent when you file the Articles of Organization to create your business.You can fill this position, assign another manager in your business or use a Registered Agent service. If your New York Registered Agent is a person, they must have a physical street address in New York and must be present during business hours to receive important documents on behalf of your company.All of Incfiles business formation packages include Registered Agent service. Its free for the first year and just $119 per year after that. You’ll also have access to a digital dashboard to view any document we’ve received on your behalf.

Read Also: How Much Is Rent In Queens New York

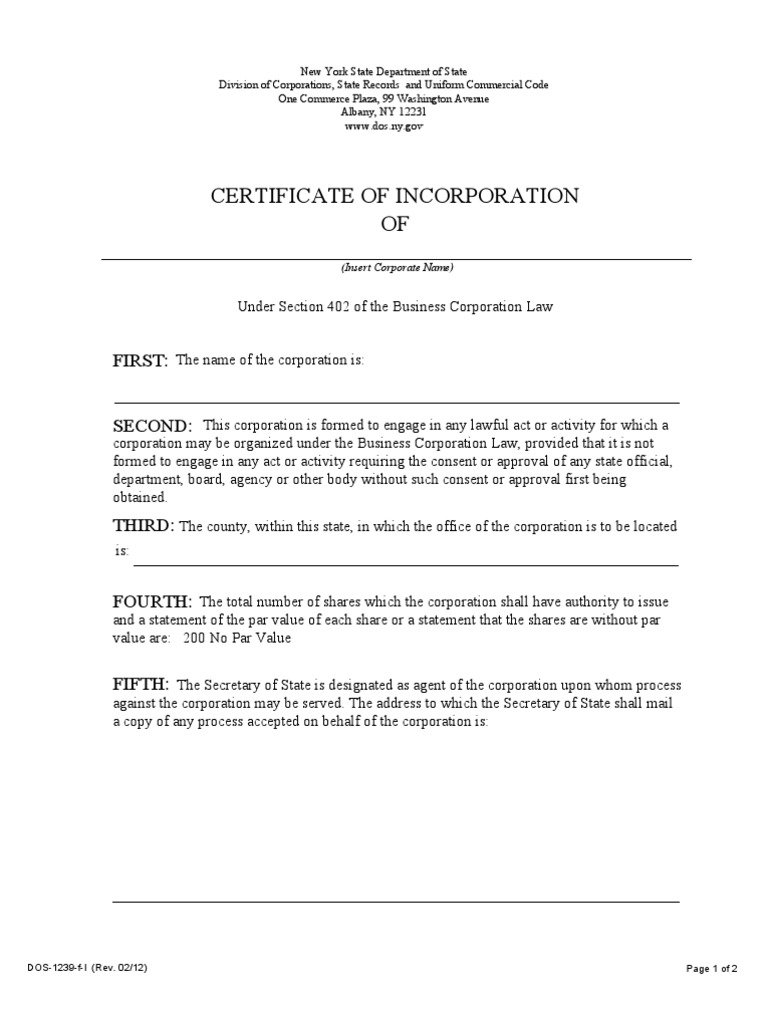

Complete And File The Articles Of Organization

To register an LLC in the state of New York, owners will need to file the business’s Articles of Organization , with the New York Secretary of State. The Articles include information like the business’s name, registered agent address, taxpayer identification number, licenses and permits and member’s signatures, and the filing fee. The Articles can be submitted online or by mail and costs about $200.

Submit An Address To Which Legal Papers Can Be Forwarded

In New York, the New York Department of State is automatically every LLC’s “agent for service of process.” The Department will accept legal papers on the LLC’s behalf if it is sued, and then forward the legal papers to your LLC. You must give the Department of State a name and address to which process and other legal papers can be forwarded. You can also appoint an individual New York resident or commercial registered agent as an additional agent to receive service of process.

You May Like: Is New York Still On Lockdown

Dissolving An Llc In New York

If at any point in the future you no longer wish to conduct business with your New York LLC, it is important to officially dissolve it. Failure to do so in a timely fashion can result in tax liabilities and penalties, or even legal trouble. To dissolve your New York LLC, there are two broad steps:

- Close your business tax accounts

- File the New York Articles of Dissolution

When you are ready to dissolve your LLC, follow the steps in our New York LLC Dissolution Guide.

Other Filings Required At Time Of Incorporation

Some states require additional filings or steps at the time of incorporation, such as a county level filing, publishing notice of the LLC formation in a local newspaper or an initial report filing. New York requires the following:

- Publication requirement.New York requires LLCs to publish notice of the incorporation for six consecutive weeks in two newspapers as assigned by the County Clerk in the county of the LLCs legal address. A Certificate of Publication should then be filed with the Department of State upon completion of the publication requirement.

You May Like: What Is A City Pass In New York

Prepare An Operating Agreement

Unlike most states, New York’s LLC law requires LLC members to adopt a written operating agreement. The Operating Agreement may be entered into before, at the time of, or within 90 days after filing the Articles of Organization. The Operating Agreement is the primary document that establishes the rights, powers, duties, liabilities, and obligations of the members among themselves and to the LLC. The Operating Agreement is purely an internal document and is not filed with the Department of State. New York law is silent on the consequences of not adopting an Operating Agreement.

For help creating an LLC operating agreement, see Form Your Own Limited Liability Company, by Anthony Mancuso or use Nolo’s Online LLC.

File The Articles Of Organization

In order to legally and officially form your LLC in New York, you need to file the Articles of Organization.

What is the Articles of Organization?The Articles of Organization is a legally binding document that is filed with the state government to officially and legally form your LLC.

Why do I need the Articles of Organization?Your New York LLC business will not be legally recognized by the Secretary of State without filing this document. Consider the Articles of Organization as part of your LLCs foundation.

What information is included in the Articles of Organization?

- The name of the LLC

- The location of the LLC

- The name and location of the registered agent

- The chosen LLC management structure

- The name and contact information of the organizer

- The statement of purpose

Other New York Filing Requirements Professional Service Businesses

New York permits certain professional service businesses to form a Professional Limited Liability Company .

The following professions generally form PLLCs:

- Accountants

A few points to consider:

- All members of the PLLC must be licensed in the profession of the business.

- The PLLC is only allowed to provide services for which the business was formed.

- The members are still subject to whichever licensing boards govern the PLLCs profession.

Don’t Miss: Is New York Presbyterian A Private Hospital

File A Certificate Of Publication

New York requires that all newly formed businesses owners publish a notice of business formation in two different newspapers for six consecutive weeks.

More Publication Facts:

- The LLC may publish the Articles of Organization

- The newspapers are selected by the County Clerk

- The cost for publication varies

- The deadline is 120 days within LLC formation

- The Certificate of Publication fee is $50

At the end of the run, each newspaper provides the LLC with an Affidavit of Publication that will be submitted to the Secretary of State along with the Certificate of Publication form.

Women In Business Tools And Resources

If you have a woman-owned business, many resources are available to help you concentrate on your businesss growth:

Our information and tools will provide educational sources, allow you to connect with other women entrepreneurs, and help you manage your business with ease.

Don’t Miss: How Much Is A Flight To Florida From New York

Dont Want To Form An Llc By Yourself

Let IncFile or IncAuthority guide you through the LLC formation process, so you know everything was done right. Only pay state fees!

Quick Reference

The Limited Liability Company is a popular entity structure for businesses starting in New York. The LLC provides personal liability protection and has the potential to save money on taxes. With our guide, you can learn how to form an LLC in New York without an attorney.

Unlike a sole proprietorship or partnership where the small business owner can be held personally liable for lawsuits against the business, the LLC is a separate legal structure, protecting the business owners personal assets.

Besides the liability protection, the Limited Liability Company provides several other benefits over the sole proprietorship, partnership, and corporation because of the multiple tax options, ease of administration, and management flexibility.

Register Your New York Business

Once youve chosen your business structure, the next step is to form your business. No matter what formal business structure you choose, there are a few common steps, including:

- Naming your business

- Choosing a registered agent: an individual or business entity that accepts tax and legal documents on behalf of your business.

- Getting an Employer Identification Number : a number assigned by the Internal Revenue Service to help identify businesses for tax purposes.

- Filing formation documents.

In addition to these steps, each business structure has its own requirements that are unique to that business structure.

Here are the steps you need to take to register your business:

Form an LLC in New York

LLCs are the simplest formal business structure to form and maintain. With less paperwork than other business structures, you can easily form an LLC in six easy steps.

To file the Articles of Organization for an LLC in New York, you must submit formation documents to the Department of State online, by mail, by fax, or in person, along with the $200 filing fee.

Read our full guide on How to Form an LLC in New York or have a professional service form an LLC for you.

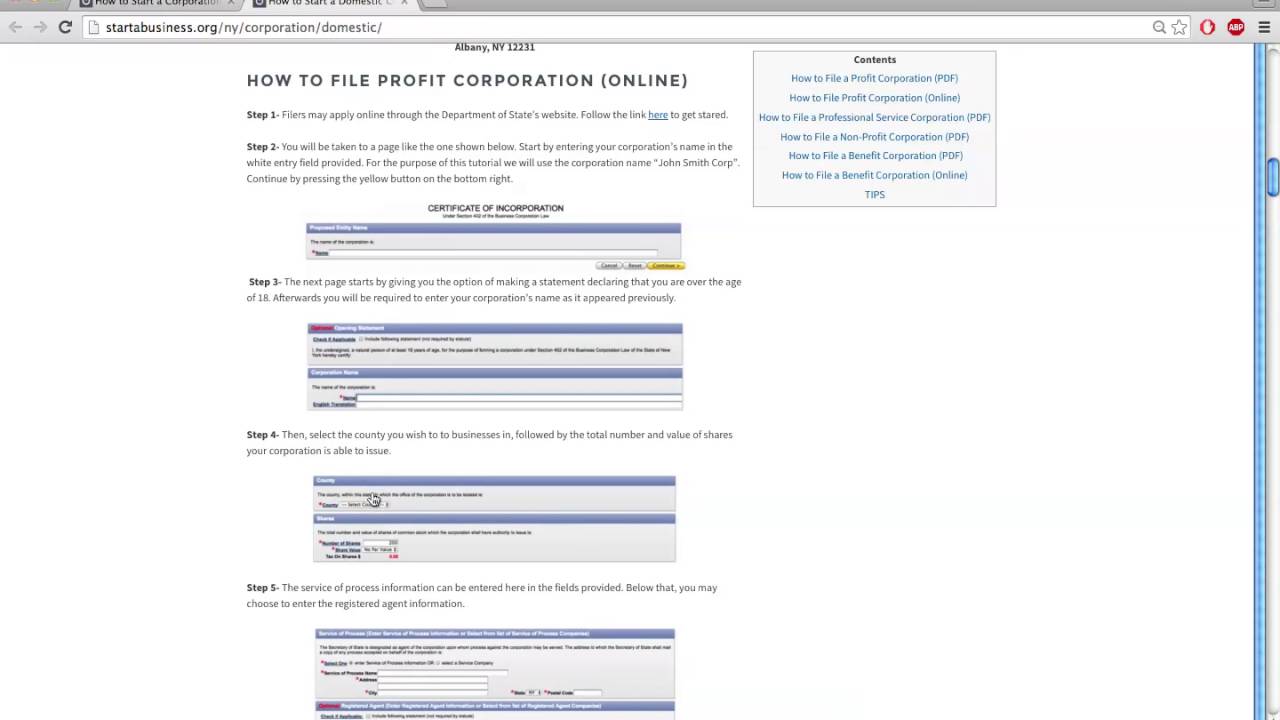

Start a Corporation in New York

Read our full guide on How to Start a Corporation in New York.

Form a Nonprofit in New York

Read Also: What Is Minimum Wage In Upstate New York

Build Your Business Website

After defining your brand and creating your logo the next step is to create a website for your business.

While creating a website is an essential step, some may fear that its out of their reach because they dont have any website-building experience. While this may have been a reasonable fear back in 2015, web technology has seen huge advancements in the past few years that makes the lives of small business owners much simpler.

Here are the main reasons why you shouldnt delay building your website:

- All legitimate businesses have websites – full stop. The size or industry of your business does not matter when it comes to getting your business online.

- Social media accounts like Facebook pages or LinkedIn business profiles are not a replacement for a business website that you own and control.

- Website builder tools like the GoDaddy Website Builder have made creating a basic website extremely simple. You dont need to hire a web developer or designer to create a website that you can be proud of.

Using our website building guides, the process will be simple and painless and shouldnt take you any longer than 2-3 hours to complete.

Recommended: Get started today using our recommended website builder or check out our review of the Best Website Builders.