Gather The Required Information

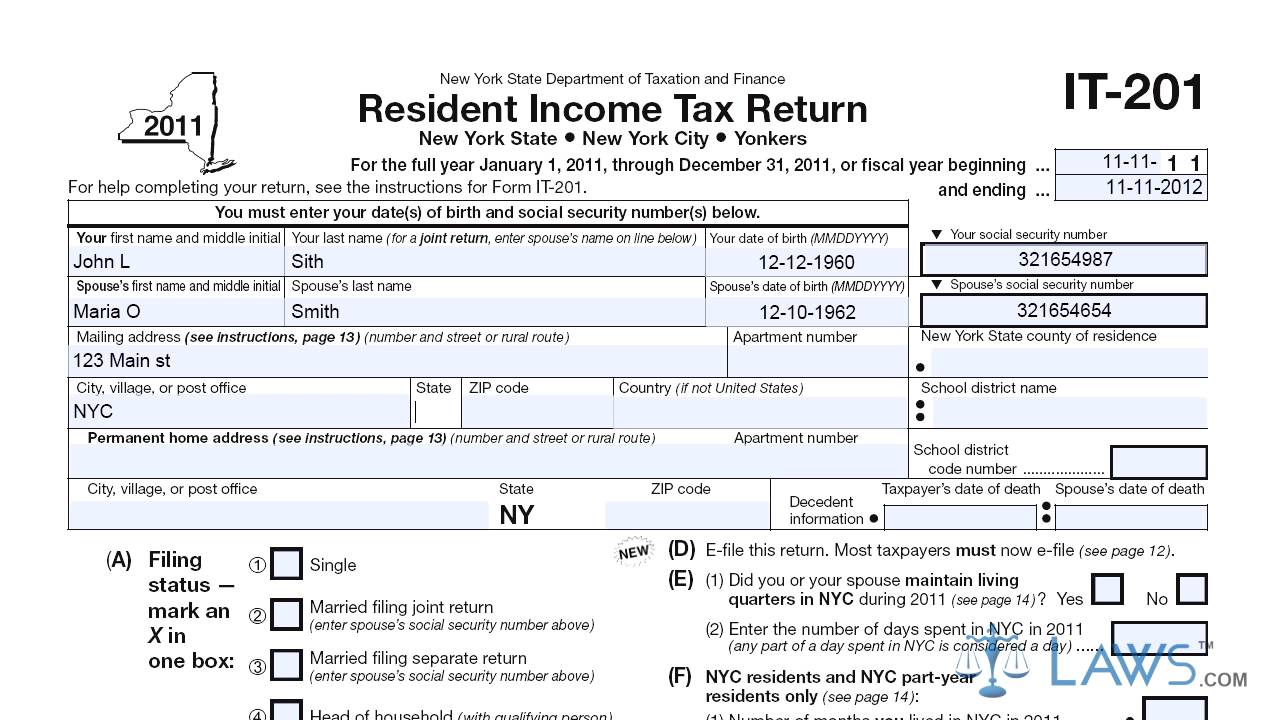

If you’re checking for the current tax year, gathering your documents and information is simple, provided you’ve organized your tax returns and stored them in a place where they are readily accessible to you. If you use an online filing program, such as those offered by the IRS or one of the many tax preparation companies, you have likely securely stored your tax return and relevant information in a folder on your computer, your online customer account or the cloud. Your current return is essential because you will need the precise amount you’re expecting to be able to check the status of your NY tax refund. In addition, you need your Social Security number. If you are checking the status of your refund from a joint NY tax return, ensure you have the correct Social Security number of your spouse or dependent.

Video of the Day

Was Your Refund Less Than You Expected

Owing money to any New York state agency can result in your income tax refund being seized. If youre behind on child support or have unpaid restitution or court fees, your state refund taxes can be used to pay those debts.

Your tax refund may be less than you expected because you made an error on your tax return. The Department of Taxation will notify you of the changes made to your return. Review the information provided to ensure you agree with the changes made.

When Can I Expect My Ny State Tax Refund

If you expect a refund from your New York personal income tax return, you can check the status of the refund 14 days after you e-file. If you filed a paper income tax return, youll need to wait six to eight weeks before checking its status. E-filing your return is the quickest way to file your income tax return.

Also Check: How To Transfer A Dba In New York

Wheres My State Tax Refund West Virginia

Check on your state tax return by vising the West Virginia State Tax Departments website. On the right side of the page, you will see a link called Wheres My Refund? This link will take you to the refund status page. Enter your SSN, the tax year and the amount of your refund in order to check your status.

The state is implementing new security measures for the 2017 tax year, which may slow down the turnaround time for your refund. It advises only calling to ask about your refund if more than eight weeks have passed since you filed.

How To Contact The New York State Department Of Revenue

Of course, you can also check the status of your New York state tax refund through the phone. They have a hotline dedicated for this that you can call. Simply dial 1-518-457-5149, and speak with a phone representative from the New York State Department of Taxation and Finance. The line is open 24/7.

Ideally, you should only check the status of your refund around 14 days after you e-file. However, if you filed a paper income tax return, it may take up to six to eight weeks before you can check your status.

We highly recommend e-filing your return. It is quicker to do, and youll receive your tax return sooner, too. In addition, you will also receive a confirmation through email when the New York State has received and accepted your return.

An email will also be sent to you once your direct deposit for the tax return is sent. A paper check, on the other hand, may take an additional week or two to process.

Read Also: How Much Is A Plane Ticket To New York City

What If My New York State Tax Refund Is Less Than I Expected

You may receive your New York state tax refund only to discover its less than you were expecting that can happen if the state makes adjustments to your refund amount. If the state adjusts your refund amount, it will send you a notice explaining the adjustment.

You can either accept the adjustment or disagree with it and provide documentation to support what you claimed on your return.

Reissuing Or Cancelling A Refund Check

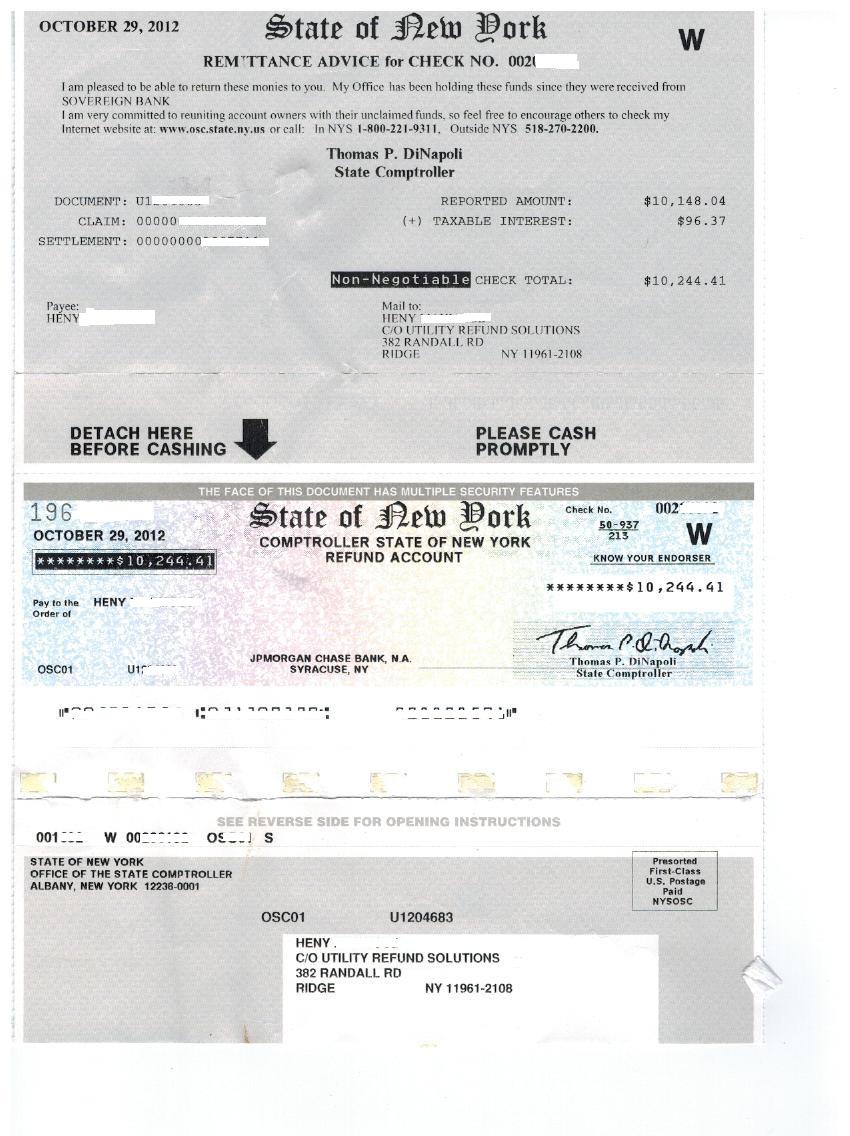

SECTION OVERVIEW AND POLICIES

The purpose of this section is to provide guidance to agencies regarding refund checks that are returned and/or need to be reissued. These checks can be easily identified by examining the face of the check. The heading reads: Comptroller State of New York – Refund Account. Refund checks also contain a letter P or W in the upper right hand corner and will contain one signature by the State Comptroller. Vendor checks have two signatures on the check one from the State Comptroller and one from the Commissioner of Tax and Finance. For additional information regarding vendor checks that are returned or need to be reissued, see Section 9.C Reissuing or Cancelling a Vendor Check of this Chapter.

Occasionally, the Post Office may return a check because of an incorrect address. Other times, a payee may request that a check be reissued because it was damaged, lost, stolen or never received. In addition, an individual can return a check to the agency and request the check be reissued to a different payee due to the death of the original payee. Depending on the reason the check is returned, various actions may be necessary by the payee, agency and the Office of the State Comptroller . These actions will result in reissuing the check with appropriate changes, if necessary, or closing the voucher and reversing the accounting entries of the original payment.

ADDITIONAL INFORMATION

#1. Looking Up a Refund Check Status in SFS

#2. Forgery Claims

You May Like: How To Get Adderall In New York

Wheres My State Tax Refund Alabama

You can expect your Alabama refund in eight to 12 weeks from when it is received. In order to check the status of your tax return, visit My Alabama Taxes and select Wheres My Refund? To maintain security, the site requires you to enter your SSN, the tax year and your expected refund amount.

Another thing to note with Alabama is that even if you filed for direct deposit of your refund, the state may send your refund as a physical check. This is an attempt to prevent fraud by sending a paper check to the correct person instead of sending an electronic payment to the wrong persons account.

Get Help With Your Taxes In

You need to make an appointment to visit a Taxpayer Assistance Center .

To make an appointment:

Note: In order to receive services, you will be asked to provide a current government-issued photo identification and a Taxpayer Identification Number, such as a Social Security number.

Caution: Many of our offices are in Federal Office Buildings. These buildings may not allow cell phones with cameras.

Virtual Assistance provides a safe, secure environment for taxpayers to get service in a face-to-face setting without visiting a traditional TAC. Virtual assistance involves taxpayers interacting with live assistors located in a different geographic location via an IRS computer. This method of face-to-face service is now available at selected IRS partner locations.

Don’t Miss: How To Plan A Cheap Trip To New York

Wheres My Refund New York

To check on your New York state refund status go to .

In order to view status information, you will be prompted to do the following:

- Select the Check Refund Status button

- On the next page, enter the provided security code displayed and then select Continue.

- On the Tax Refund Status page, select your:

- Tax year

- Form you filed

You can choose to receive notifications, including email notice when your refund is issued, by setting up an account online. To do this, visit Then, review the instructions under the What To Do While Youre Waiting section.

If you do not have access to a computer or prefer to check through another method, you can call the phone number: .

Wheres My State Tax Refund Kentucky

Check the status of your Kentucky tax refund by visiting the revenue departments Wheres My Refund? page.

If you e-filed and opted for direct deposit, you can expect your refund in two to three weeks. Getting a refund as a paper check will take three to four weeks. If you filed a paper return, youre refund will take significantly longer to arrive. The state says it could take eight to 12 weeks.

The Wheres My Refund Page only allows you to check the current years tax return. The status of previous tax returns are available if you call 502-564-4581 and speak to an examiner. It may take more than 20 weeks to process prior year tax returns.

You May Like: How To Move Furniture In New York City

Log In Or Create An Account

Once you’ve logged in to your Online Services account:

Filing Information sample form: Field 5: State/ProvinceField 6: Zip/Postal CodeField 7: Filing Method Option 1: Gross Weight Method Option 2: Unloaded Weight MethodField 8: Number of Vehicle Records to Report

Header cel: Electronic notification optionsBills and Related Notices-Get emails about your bills.Other notifications-Get emails about refunds, filings, payments, account adjustments, etc.Header cell: Receive email

Wheres My State Tax Refund Georgia

Track your Georgia tax refund by visiting the Georgia Tax Center and clicking on Wheres my Refund? in the middle of the page under Individuals. You will be able to check returns for the current tax year and as far back as four years ago. It is possible for a refund to take as long as 90 days to process. If you have not received a refund or notification within that time, contact the states revenue department.

Read Also: How Much Is A Vacation To New York

Wheres My State Tax Refund New Jersey

New Jerseys Division of Taxation allows taxpayers to check the status of refunds through its Online Refund Status Service. You will need to enter your SSN and the amount of your refund.

You can also check the status of a refund using the automated phone inquiry system. The automated system can tell you if and when the state will issue your refund. It cannot give you information on amended returns. The number is 1-800-323-4400 or 609-826-4400. Both options are available 24 hours a day, seven days a week.

In general, electronic tax returns take at least four weeks to process. Paper returns take significantly longer at a minimum of 12 weeks. If you send a paper return via certified mail, it could take 15 weeks or more to process.

Why Have I Not Received My Ny State Tax Refund

I have received my federal refund but not my NY State refund . New York State processing times vary. However, if you believe your refund is taking longer than expected, you can contact New York State Tax Department refund status anytime at 1-518-457-5149 or, contact the Department of Taxation and Finance.

Also Check: Is Niagara Falls In New York Or Canada

Wheres My State Tax Refund Minnesota

Through the Wheres My Refund? System, you can check the status of your Minnesota tax refund. You will need to enter your SSN, your date of birth, your return type , the tax year and the refund amount shown on your return. Its important to be aware that if your tax return does not have your date of birth on it, you cannot check its status.

The refund system is updated overnight, Monday through Friday. If you call, the representatives will have the same information that is available to you in this system.

Wheres My State Tax Refund Louisiana

The status of your Louisiana tax refund is available by visiting the Louisiana Taxpayer Access Point page and clicking on Wheres My Refund? at the bottom. You will need to enter your SSN and your filing status.

Refund processing time for e-filed returns is up to 60 days. Those who filed paper returns can expect to wait 12 to 14 weeks. As with many other states, these time frames are longer than in years past. Louisiana is implementing measure to prevent fraudulent returns and this has increased processing times.

Recommended Reading: Is Medical Marijuana Legal In New York City

Where Is My New York State Tax Refund Status

You can also find out when your refund will be issued by signing up for Tax Department email alerts. Visit the Tax Department homepage at www.tax.ny.gov and select subscribe at the bottom of the page. Dont have a computer or smart phone? Call the Tax Departments automated refund-status line anytime at 518-457-5149.

Read The Helpful Information

The NY Tax Department is proactive about addressing refund status FAQs. If you are wondering why you received a message that the tax department doesn’t have any information about your return, it’s likely due to the time it takes for electronically filed returns and mailed returns to actually post to the system. If your filed return contains errors or there is information missing, the department needs to review your return. In this case, you may get a message that indicates the review could delay remitting a direct deposit or cutting a check for your refund. When everything goes smoothly, it’s possible you will get your NY tax refund direct deposited in your bank account within a couple of weeks. If you chose to mail your tax return, and expect a check mailed to your home, it could take up to 30 days to receive your refund.

Read Also: How Much Is A Flight To Dubai From New York

Wheres My State Tax Refund New Mexico

The Tax & Revenue department of New Mexico provides information on their website about tax returns and refunds. To the check the status of your return, go to the Taxpayer Access Point page and click on Wheres My Refund? on the right of the page.

Taxpayers who filed electronically can expect a a refund to take six to eight weeks to process. The state asks that you wait at least eight weeks before calling with inquiries about your return. Paper returns will likely take eight to 12 weeks to process. The state advises waiting 12 weeks before calling with refund status questions.

Wheres My State Tax Refund Illinois

The State of Illinois has a web page called Wheres My Refund, where you can see if the state has already processed your tax return and initiated your refund. The only information you need to enter is your SSN, first name and last name. If the state has not processed your return yet, you can set up an email or text notification to let you know when it does.

Don’t Miss: How Do I Apply For Medicaid In New York State

When We Issue A Refund We Will Deliver One Of The Following Messages

- Your return has been processed. A direct deposit of your refund is scheduled to be issued on . If your refund is not credited to your account within 15 days of this date, check with your bank to find out if it has been received. If its been more than 15 days since your direct deposit issue date and you havent received it yet, see Direct deposit troubleshooting tips.

- Your refund check is scheduled to be mailed on . If you have not received your refund within 30 days of this date, call 518-457-5149.

Wheres My State Tax Refund New York

You can use this link to check the status of your New York tax refund. You will need to enter the exact amount of your refund in whole dollars in order to log in. This amount can be found on the state tax return that you filed.

Dont forget that if you paid any local income taxes for living in New York City or Yonkers, those taxes are included in your state return.

You May Like: How To Win The New York Lottery

Check Your 2014 New York State Return Status Wheres My Ny State Refund

You will need your social security number, numbers in your mailing address, your zip code, and your 2014 tax refund amount claimed on your 2014 New york tax return. Wheres My NY State Refund? Wheres My New York State Refund?

Checking your refund status after you file can set your mind at ease when your money hasnt come in. The IRS is easy to contact when you need to check your federal refund status, but your state tax refund status is a different story. Each state is totally unique in how to contact and check on your money, New York State being no different.

If you want to check your New York State tax refund status, there are a few ways to go about it.

Start at the WebsiteThe New York state tax office has recently redesigned their website expressly to make things easier for the taxpayers this tax season. One of the sections theyve redesigned is the page to check your state tax refund status.

On the upper left is a box with the title Popular Topics. There you should see a link for Check Refund Status. After you click that button, youll need to enter a series of numbers to enter the page. Read the numbers and input them in the form.

Now, to check your New York state tax refund status, youll need to answer a few questions. Namely youll need to put in your Social Security Number , your filing status, and the exact amount youre expecting. After that, you should get your state tax refund status.

NYS Tax Dept.