Draft Certificate Of Incorporation

The certificate of incorporation of your nonprofit is similar to its birth certificate. Once filed with New York state, the nonprofit is considered to have been created. It also serves as your nonprofits principal governance document, meaning that if there is a conflict between the certificate of incorporation and other internal governance documents, such as your nonprofits or policies, the terms of the certificate of incorporation will take precedence.

The information identified in earlier parts of the process, such as your nonprofits tax-exempt classification, name, corporation type, initial directors and legal notice address will help you put together the certificate of incorporation. It is important to draft the certificate of incorporation to meet both New York and IRS requirements right at the start. If not properly drafted, the certificate of incorporation could be rejected when filed with New York state, causing delays. Even worse, even if accepted by New York state, improper drafting could cause your federal tax-exemption to be denied pending necessary amendments to the certificate .

The New York Department of State, Division of Corporations, provides a basic form New York Not-for-Profit Corporation Certificate of Incorporation, as well as a set of instructions for the form. If completed, in accordance with the instructions, the certificate of incorporation should be accepted by the Department of State.

Identify Organizations 501 Or 527 Tax

When forming a nonprofit, we recommend starting by identifying the tax-exempt classification of the organization. The tax-exempt classification will drive the entire startup process. It will determine what legal documents should contain, and what paperwork needs to be filed. The purpose, activities, mission and vision of your nonprofit should all be consistent with its tax-exempt purpose.

Common tax-exempt purposes are as follows:

For more information about tax-exempt purposes, you can refer to IRS Publication 557, Tax-Exempt Status for your Organization.

Determine Address For Legal Notices

Unlike most states, New York does not require a nonprofit to appoint a registered agent to receive legal notices on the organizations behalf. While a registered agent may be appointed if desired by the nonprofit, the New York Secretary of State must be appointed to serve this function, and will forward all legal related documents to a United States address specified by the organization.

The address that the Secretary of State will forward legal notices is public information. Anybody who searches for the nonprofit in New York States corporation and business entity database will see the address. So, for privacy purposes, we normally recommend using an address you are comfortable with being made public, rather than a home address. P.O. Boxes and Virtual Mail Forwarding addresses are acceptable in New York.

You May Like: How To Start An Llc In New York State

Hold The First Meeting Of The Board Of Directors

The first board meeting for your business is often referred to as the organizational meeting of the board. During this meeting, the initial directors of the business will adopt the corporate bylaws, set the fiscal year, and appoint corporate officers.

This meeting and all future meetings of the board of directors must be recorded in corporate minutes. Minutes are documents that detail what was discussed and any decisions the business makes during meetings. They are kept with the corporate records.

Corporate minutes are required for all New York nonprofit corporations by law. Falling behind on this critical task can cause your business to fall out of good standing, and even jeopardize its tax-exempt status. It is important to maintain a corporate minute book. Inside you may keep originals or copies of all the signed and approved minutes or Actions by Unanimous Consent from any special or annual meetings of the corporation’s shareholders and directors.

Prepare And File Your Nonprofit Articles Of Organization

You create your nonprofit entity by filing a certificate of incorporation with the New York Department of State. Your certificate of incorporation must include basic information such as:

- your corporation’s name

- the purpose or purposes for which the corporation is formed

- whether the corporation is a charitable nor noncharitable corporation–normally, it is charitable

- the county where the nonprofit’s office will be located

- the names and addresses of the initial directors

- a designation of the secretary of state as agent for service of process and the post office address to which the secretary of state should mail a copy of any process served on it as agent for the nonprofit

- any other provisions regarding the regulation of the nonprofit’s internal affairs, including distribution of assets on dissolution.

The incorporator must be at least 18 years old.

The Department of State has a fillable Certificate of Incorporation form on its website which you can use to create your nonprofit corporation. Complete and file your articles following the instructions provided on the Department of State’s website.

The articles form on the Department of State’s website has the minimal information necessary to create a nonprofit in New York. It does not include language required by the IRS to obtain 501 tax-exempt status. To receive 501 tax-exempt status from the IRS, your corporation must have certain specific language in its articles, including:

The filing fee is $75.

Recommended Reading: Are The New York Rangers In The Playoffs

How To Retain Your Non

After forming your New York not for profit organization, be sure to follow specific guidelines to retain your non-profit status.

- Keep detailed records of all sources of income.

- File annual reports.

- Keep unrelated activities separate from your non-profit and pay separate taxes on them. This income could jeopardize your nonprofit status if it makes up a substantial portion of your business.

- Ensure that the time and resources spent on your non-profit are related to your organization’s exempt status.

- Maintain detailed records of corporate meetings.

- Make sure your non-profit’s assets are distributed to another tax-exempt group when and if it dissolves.

- Do not make loans to any of your directors or officers.

- Do not issue shares of stock or pay dividends or other shares of income to members, directors or officers.

Get An Ein Number For Your Business

An EIN is a nine-digit number that is issued by the IRS and used to uniquely identify your business for tax purposes. Think of it as a Social Security Number for your business, except an EIN is less sensitive. Like an SSN, an EIN allows you to:

- Open business checking, savings, or investment accounts

- File taxes for the business

- Complete payroll for employees if applicable

- Obtain lines of credit and credit cards, and build credit for your business

- Apply for applicable business licenses when required

- File for tax exempt status

You will only need a few pieces of information to file, including your mailing address and legal business name. You can apply online Opens in a new tab with the IRS by downloading IRS Form SS-4

+How long does it take to start a nonprofit Corporation in New York?

Currently, according to the New York Secretary of State, the average processing time to incorporate a nonprofit should be completed within 18 days at the state level. This turnaround time is estimated and subject to change depending on certain factors including holidays or unexpected surges in nonprofit filings.

In order to keep your nonprofit in good standing, there are reoccurring requirements that must be met.

In order to form a corporation in New York, you will be required to pay various fees and taxes. The breakdown of the required fees is as follows:

In total, expect to set aside $450 – $850 to set up a nonprofit yourself in New York.

Recommended Reading: Is New York Presbyterian A Private Hospital

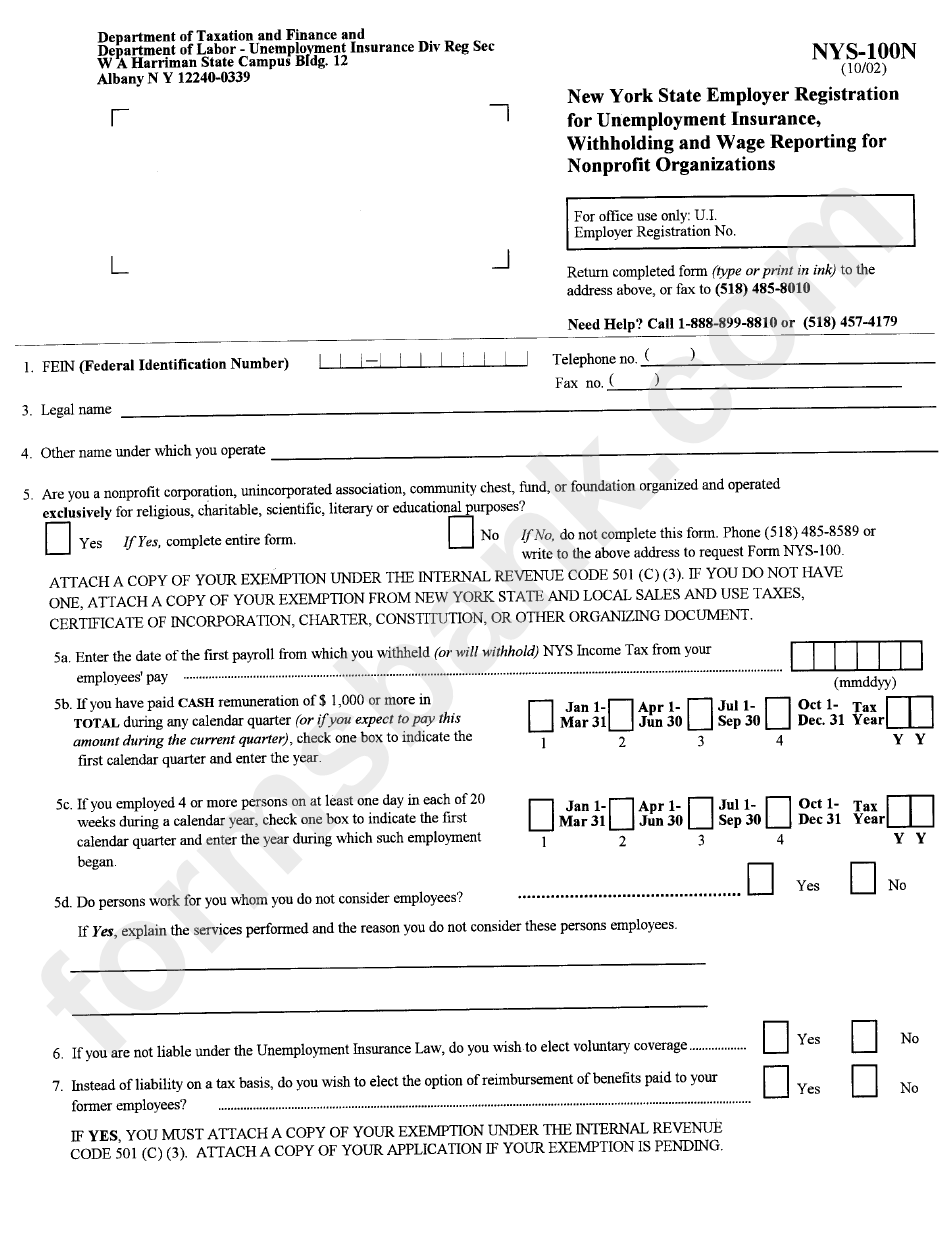

Register For State Tax Accounts

You will need to register for all applicable tax accounts with the State of New York and The City of New York . Read the states tax guidance for new businesses and file for the appropriate state and/or city accounts.For more information, you can call the Department of Taxation and Finance at 485-6027

Create Your Corporate Bylaws And Conflict Of Interest Policy

A nonprofit corporation is required to create bylaws in New York, and it is highly recommended that conflict of interest policies are adopted as well. Bylaws help maintain consistency in the way your business operates, as well as communicate organizational rules that help avoid conflicts and disputes. Bylaws are for your records only and are not submitted to the state.

If you are not sure how to create corporate bylaws, you can purchase MyCorporation’s customized Minutes and Bylaws package. Inside our package you will find internal documents required to fulfill your corporate formalities and properly operate your business after it has been incorporated.

Also Check: Is New York Times Free On Apple News

New York Nonprofit Compliance

Required annual filings

This guide covers the required filings to maintain a nonprofit corporation in New York. If you are looking to form nonprofit in New York, please visit our Start Your New York Nonprofit guide. The steps below apply to nonprofits that are both incorporated and foreign qualified in New York. Please note that this is a general list and may not be exhaustive or applicable to all nonprofits.

| Agency: | |

| Instructions: |

See Form 990 Thresholds to determine which form to file. Then see Current Form 990 Series for instructions. |

| Due: |

Not required

There is no renewal application for New York tax exemptions, however, businesses may be required to update address and officer information when changes occur.

Not required

There is no renewal application for New York tax exemptions, however, businesses may be required to update address and officer information when changes occur.

Not required

Domestic and foreign New York nonprofits are not required to file an annual/biennial corporate report with the New York Department of State.

Obtain New York Agency Approval

NY requires that certain businesses obtain the approval of the state agency that matches the purpose of their organization. You will need to reach out to the corresponding agency for your nonprofit type obtain written consent from them for starting your business then attach this consent to your Certificate of Incorporation when its filed.

Here are a few business types and their corresponding agencies:

- Substance abuse or dependence program 404: Office of Alcoholism and Substance Abuse Services

You May Like: How Do I Order My Birth Certificate From New York

When I File The Certificate Of Incorporation What Will I Receive From The Department Of State

Once you file your Certificate of Incorporation, the Department of State sends a filing receipt to the Incorporators listed address.

This receipt will include the date you filed, the name of your organization, a snapshot of the information in the certificate, and an outline of the fees paid.

Confirm that all the included information is correct, as this is your proof of filing. Keep it in a safe place with your other records, too, since you cant get another copy.

New York City General Corporation Tax Exemption

Application: No form available. Prepare an affidavit, signed by an officer of the nonprofit, with the following information:

Additional Information: The following documents should be attached as exhibits to the affidavit:

- Certified copy of the nonprofits certificate of incorporation

- Nonprofits bylaws, stating date of adoption, certified by an officer of the nonprofit

- Nonprofits profit and loss statement , and balance sheet, for the most recent year

- IRS determination letter confirming that nonprofit has been recognized as exempt from federal income tax and

- Copies of all federal, state and local tax returns filed by the nonprofit for the three most recent years, if any.

Recommended Reading: How Much Is A Flight From Florida To New York

Select Your Directors & Officers

The directors of an organization come together to form a board of directors. This board of directors is responsible for overseeing the operations of the nonprofit.

The president, secretary, and other members of nonprofit who have individual responsibilities and authorities are known as officers.

The organization structure of your nonprofit in New York MUST include:

To learn more about electing a New York nonprofit board of directors, read our full guide.

Apply For State Tax Exemption

With your IRS Determination Letter in hand, make sure you familiarize yourself with your states requirements for recognizing your nonprofits tax-exempt status. This is an area where requirements vary state-by-state. Many states issue their own tax-exempt certificate that can be used for sales and use tax purposes, but it may require application and periodic renewal.

To file to obtain exemption from state income tax:

| Agency: | New York State Department of Taxation and Finance |

| Form: | |

| Notes: |

Certain not-for-profit and religious corporations are exempt from the New York State corporation franchise tax. You must file Form CT-247 to apply for exemption. |

To file to obtain Sales Tax Exemption:

| Agency: | New York State Department of Taxation and Finance |

| Form: | |

| Agency Fee: |

Nonprofits can apply for exemption from NYS property taxes through the Office of Real Property Tax Service.

| Overseen by: | |

| Exemption Administration Manual – Nonprofit Organizations and Exemption Administration Manual – Nonprofit Organizations | |

| Form: | Property tax exemption forms listing. Start with RP-420-a-Org, RP-420-a/b-Use, or RP-420-a/b-Vlg and attach supplemental forms as required. |

| Filing Method: | |

| Fee: | $0 |

Nonprofits in New York City may apply for property tax exemption with the New York City Department of Finance..

Don’t Miss: What Does New York Life Do

New York Nonprofit Registration: Everything You Need To Know

New York nonprofit registration is the formation of a New York nonprofit organization which you can form if you want to help others.3 min read

New York nonprofit registration is the formation of a New York nonprofit organization. If you want to help others, whether it be in the category of religion, education, animal welfare, wildlife habitat, nature, or human services, you can form a nonprofit organization to help others. The primary goal of all nonprofit organizations is to help others and benefit the community as a whole.

In 2012 alone, there were greater than 92,000 nonprofit organizations in the state of New York. But before forming a NY nonprofit, you should check to see if there is already a nonprofit organization doing business in the state that is identical to the type of work you want to do. If so, you can join forces with that nonprofit business to expand and use the existing resources at hand.

Here Are The Steps To Form A 501 Nonprofit Corporation In New York

By Stephen Fishman, J.D.

Most nonprofits are 501 organizations, which means they are formed for religious, charitable, scientific, literary, or educational purposes and are eligible for federal and state tax exemptions. To create a 501 tax-exempt organization, first you need to form a New York nonprofit corporation. Then you apply for tax-exempt status from the IRS and the state of New York. Here are the details.

Don’t Miss: How To Move To New York Without A Job

Is There Anything Weird About Incorporating In New York State

If your nonprofit has a charitable purpose other than religious, you will need a written consent attached to your certificate of incorporation from another NY agency such as nonprofits helping neglected children need approval from NY Office of Children & Family Services. See our NY Nonprofit Agency Approval Contact page for details.

Nonprofit Regulation In New York

This article does not contain the most recently published data on this subject. If you would like to help our coverage grow, consider donating to Ballotpedia.

| Civil Liberties Policy |

|---|

| Privacy Policy Project |

| State information |

Nonprofit regulation in New York involves a complex set of rules that govern nonprofit organizations and charitable giving throughout the state. Major issues surrounding nonprofit regulation nationwide include the following:

-

- contribution limits,

- the redefinition of issue advocacy.

New York is one of 39 states that require charitable organizations, and those intending to solicit on their behalf, to register with the state in order to solicit contributions, whether they are a New York organization or based out-of-state. In New York, a number of groups and organizations are exempt from registration. These groups must file for exemption it is not automatic.

New York is one of three states that require organizations to file copies of IRS Form 990 Schedule B attachments, which list names and addresses of contributors who gave over $5,000.

New York is also one of 32 states that allows registrants to use either the Unified Registration Statement or the state registration form. Only seven states requiring registration do not accept the URS.

Don’t Miss: What Airlines Fly To Cabo San Lucas From New York