Will I Need To Get A New Doctor

That depends. Major insurance providers, including Empire Blue Cross and UnitedHealthcare of New York, offer New York State of Health plans, but not all doctors accept them. You can talk to your primary care physician or use the New York State of Healths comparison tool to see whether a certain doctor or practice will accept a marketplace plan.

Spouse Or Partner Plan

If you have a spouse or partner with job-based insurance, you might be able to sign up for their plan. Though you can typically only join these plans during the companys annual open enrollment period, losing your job may qualify you for an exception. Check the rules. Even if you didnt join that plan before, it could be your best option if you get laid off.

Health Plans Dental Plans & Financial Help

The Qualified Health Plan Map and Essential Plan Map provide information about health plans offered in each county.

Compare dental plans here.

Learn about financial help for your coveragehere.

NY State of Health seeks input from all interested stakeholders in the planning and implementation of the Marketplace. Learn more about how to become involved in this process.

Don’t Miss: How Much Are Tolls From Virginia To New York

What Is The Marketplace

The Health Insurance Marketplace®, or Exchange, is an online shopping center based at HealthCare.gov. It’s where to go to apply for coverage, find out if you qualify for savings, and make changes to your health plan.

Visit to find out if your state uses the federal Marketplace or a state based Marketplace.

If your employer offers health insurance coverage, they may have a website where you can shop for plans. This is called a “private exchange,” and it’s different from the Federal or State Marketplaces.

The Marketplace makes it possible to find health care coverage that meets your needs and budget.

During the Open Enrollment Period, you can view, compare, and apply for Cigna individual medical plans online directly through Cigna. You can also see if you are eligible for federal financial assistance and apply that assistance to your Cigna plan.

Medicare For New York Seniors And Younger Adults With Disabilities

Medicare is a federal health insurance program generally for people 65 and older. But younger adults with disabilities and certain illnesses also qualify.

New York has the fourth-highest number of Medicare recipients in the country. More than 3.6 million residents enrolled as of 2018.

Roughly 6 in 10 enrollees have Original Medicare from the federal government. The rest have private Medicare Advantage plans. Both options provide Part A hospital and Part B medical insurance. But Medicare Advantage offers extra benefits, such as Part D prescription drug coverage.

Private companies also sell individual Part D drug plans, which are often paired with Original Medicare. Nearly 1.5 million New Yorkers have a separate Part D plan as of 2018.

Original Medicare enrollees can also add a Medicare Supplement plan, known as Medigap. New York, like most states, offers 10 standard Medigap plans. Policies help pay for covered out-of-pocket expenses, including copayments, coinsurance, and deductibles. Many policies also pay for qualified emergency care you receive in a foreign country.

Don’t Miss: Cost Of Tolls From Baltimore To Nyc

What Are My Obligations As A Small Business After Enrolling In A New York Group Plan

According to New Yorks Department of Financial Services, in order to participate in HealthyNY, a small business must meet all of the following criteria:

- As the employer, you contribute at least 50 percent to paying for monthly employee premiums.

- 50 percent of your eligible employees participate in the group health insurance program. Employees who have health insurance through another source can count toward the 50 percent participation requirement.

- The plan is offered to all employees who work 20 or more hours per week and are paid $43,000 or less .

- At least one employee who earns wages of $43,000 or less enrolls in the plan.

Once you offer group health insurance coverage and meet New York State requirements, your business may have access to significant tax advantages.

For example, the monthly employee premiums that your business pays are usually 100% tax deductible. Offering small business health insurance can also mean reduced payroll taxes.

What Does Health Insurance Cover

The Affordable Care Act instituted a number of controls on health insurance plans and providers. One of the biggest changes is that every health insurance plan, regardless of tier or provider, must offer at least some coverage for 10 essential benefits. Those benefits are:

These are the bare minimum services that every type of ACA-compliant plan must cover. Keep in mind that if you purchase a short term health insurance plan, these requirements dont apply.

Read Also: Where Is The Wax Museum In New York

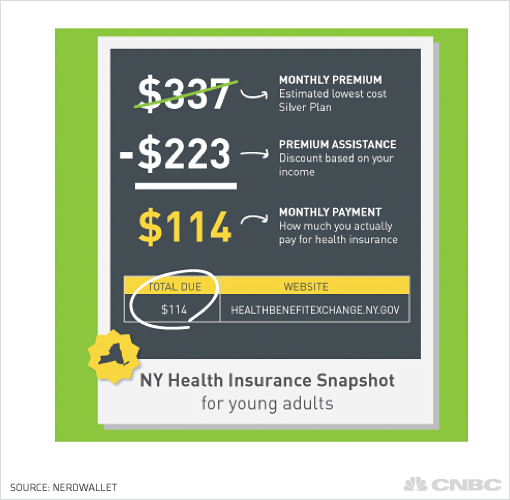

New York Health Insurance Costs

New York Marketplace premiums for 2021 have an average rate increase of 1.8%.7 Below are the average monthly premiums from 2020 to 2021.

- Average lowest-cost bronze premium: $418 in 2020 | $430 in 2021

- Average lowest-cost silver premium: $558 in 2020 | $588 in 2021

- Average lowest-cost gold premium: $706 in 2020 | $709 in 2021

For 2021, the state approved increases of 1.8% for individual plans, or a bump of $11 for the average unsubsidized plan.8

How Much Does Individual Health Insurance Cost

Its a common misconception that individual health insurance is more expensive than company sponsored group health insurance.

It makes sense, right? You would naturally think with all the employees at your firm, you would be getting a discount on your health insurance premiums, when in fact, it really doesnt work that way at all!

In 2015, the national average cost for single coverage was $346 per month and $667 per month for family coverage. In contrast, the average premium for group insurance coverage for a single was $521 per month and $1,462 per month for family coverage.

So given the huge disparity between the cost of individual insurance and group insurance, it makes sense that many employers have cancelled their group health plans and told their employees to buy their own health insurance plan. Then the employer reimburses the premium to the employee.

Wait a minute, is that legal?

Yes, it is legal for now but its a slippery slope with regards to the IRS. Somewhere within the 10,000+ pages of the Affordable Care Act it deems that reimbursing employees for individual coverage carries a huge fine to the employer. But for now the IRS has yet to issue a final ruling on the practice reimbursing premiums.

If you are like many employees that have been told to get their own health insurance plan or if you are self-employed looking for an insurance plan for you and your family, heres how to buy health insurance and avoid common mistakes that many people make.

Don’t Miss: How To Win The New York Lottery

Unitedhealthcare Is Closely Watching The Coronavirus

UnitedHealthcare continues to partner with state and local public health departments, following guidance and protocols appropriate to our members that are provided by the U.S. Centers for Disease Control and Prevention , and state and local public health departments that are appropriate for our members. Please review the UnitedHealthcare Coronavirus Information. To learn more, go to CDC.gov.

COVID-19 NY State PPE Fee Guidance

The New York State Department of Financial Services recently issued guidance stating that care providers should not charge members additional fees for items such as personal protective equipment . DFS expects New York care providers to refund any of these charges paid by the member that were more than the members financial responsibility on a claim. If you have questions, you may contact your provider or call the number on the back of your card for assistance with filing a complaint.

What About New Federal Assistance For Premiums

Every eligible household that pays insurance premiums that exceed 8.5 percent of annual income now qualifies for federal tax credits for insurance premiums. For example, a single 64-year-old filer earning $51,000 per year could potentially save more than $8,000 with the new tax credits, according to the Kaiser Family Foundation.

Don’t Miss: How To Pay A Ticket Online New York

Health Insurance: Tips And Programs

To make signing up for health insurance as easy as possible, gather as much of the below information and documents as you can for everyone in your household who is enrolling. Even if you do not have all of this information now, you can still start the process.

Household Information:

- Current employment and income information, such as pay stubs, tax statements or W-2 forms

- Insurance cards, if members of your household have health insurance

- Family health history, including any medications you take and the doctors you see

- A list of insurance plans accepted by your regular health care provider, if you have one

Immigration DocumentsItems that show your legal immigration status in the United States can include:

- Permanent Resident Card

- Employment Authorization Card

- Arrival/Departure Record

- ORR Verification of Release Form

- Passport

- US Visa with 1-94 Stamp

- I-797 USCIS Notice of Action

- I-549 USCIS Acknowledgment of Receipt

If you have concerns about how health insurance enrollment affects your immigration status, call ActionNYC hotline at 1-800-354-0365 for free, confidential legal assistance.

Also, you can be more prepared by learning about health insurance programs and coverage and commonly used terms. Insurance terms that you should learn include “deductible,” “copayment,” and “coverage period.”

You can get more information and help enrolling by visiting an NYC Department of Health Certified Application Counselor.

How Do I Qualify For Small Business Health Insurance In New York

To be eligible for group plans in New York, you must meet the following requirements as a small business owner, as per New Yorks Department of Financial Services:

- Your business must be located within New York State.

- Your business must have had between 1 and 50 full-time or full-time equivalent employees over the past calendar year.

- At least 30 percent of your employees must earn $43,000 or less in annual wages. The wage level is adjusted every year to account for inflation.

- Your business must not have previously provided group health insurance coverage to your employees within the past 12 months.

If you are the owner of a sole proprietorship in New York, you should know that you usually would not qualify for small business health insurance unless you had eligible full-time or full-time equivalent employees. As a sole proprietor with no employees, you would instead qualify for individual health insurance in New York. Learn more about affordable individual health insurance plans with eHealth.

Read Also: New Yorker Submissions Poetry

New York Childrens Health Insurance Program

CHIP is called Child Health Plus in New York. Its available to uninsured children under 19 who dont qualify for Medicaid. About 682,000 children are enrolled as of October 2019.16 Families can apply for the program through the New York State of Health Marketplace.

Children must be New York residents from low-income households to qualify. Some families get Child Health Plus for free, while others pay a small monthly premium.

For example, a family of three earning at or below $2,843 per month can get coverage with no monthly premiums. If the same family made up to $3,947 per month, they would pay a $9 monthly premium per child or a maximum of $27 for all covered children. There are no copayments, regardless of income.

Compare Types Of Health Insurance Plans

Youll encounter some alphabet soup while shopping the most common types of health insurance policies are HMOs, PPOs, EPOs or POS plans. The kind you choose will help determine your out-of-pocket costs and which doctors you can see.

While comparing plans, look for a summary of benefits. Online marketplaces usually provide a link to the summary and show the cost near the plans title. A provider directory, which lists the doctors and clinics that participate in the plans network, should also be available. If youre going through an employer, ask your workplace benefits administrator for the summary of benefits.

Comparing health insurance plans: HMO vs. PPO vs. EPO vs. POS

| Plan type | Do you have to stay in network to get coverage? | Do procedures & specialists require a referral? | Snapshot: |

|---|---|---|---|

| Yes, except for emergencies. | Yes, typically | Lower out-of-pocket costs and a primary doctor who coordinates your care for you, but less freedom to choose providers. | |

| PPO: Preferred Provider Organization | No, but in-network care is less expensive. | No | More provider options and no required referrals, but higher out-of-pocket costs. |

| EPO: Exclusive Provider Organization | Lower out-of-pocket costs and no required referrals, but less freedom to choose providers. | ||

| POS: Point of Service Plan | No, but in-network care is less expensive. | Yes | More provider options and a primary doctor who coordinates your care for you, with referrals required. |

Recommended Reading: Wax Museum New York New York

What If I Already Have Health Insurance

If you already have coverage through your employer or directly through an insurance provider but are eligible for lower premiums, you can switch to New York State of Health. But you may not qualify for tax credits if you opt out of your employers plan unless those premiums exceed a certain portion of your household income. The premiums would need to be more than 9.83 percent of your household income for individual coverage or more than 8.27 percent for family coverage in order for you to qualify for the tax credits. If you get coverage through the Consolidated Omnibus Budget Reconciliation Act of 1985 because you were terminated from a job or were put on reduced hours, you should be receiving a temporary COBRA premium subsidy that covers 100 percent of your monthly premium cost. This premium assistance, made possible through the American Rescue Plan, runs through the end of September or the end of your last month of COBRA eligibility, whichever comes first. If youre on COBRA, you may want to sign up for a marketplace plan that starts as soon as your COBRA coverage ends. If youre not sure about whether making this switch makes sense for you, you can ask for free advice from a certified insurance broker.

Have A Good Overall Retirement Plan

Covering your health costs whenever you retire early or late is important.

Having an overall plan for how to fund retirement is absolutely necessary.

A really good retirement plan defines how much money you have now and in the future and it describes how much you are spending now and in the future. The NewRetirement Retirement Planner is an easy-to-use tool that helps you figure this out. This tool was recently named a best retirement calculator by the American Association of Individual Investors .

Read Also: How Much Are Tolls From Virginia To New York

What Is Covered And How Much Will It Cost

Coverage and cost depend on where you live, the type of plan you choose, your household income and the age and disability status of you and your family. If you qualify for Medicaid, you will be able to get free or low-cost coverage and may not need to worry about premiums or copays, depending on your level of income. All New York State of Health plans cover 10 essential benefits, including:

- Emergency services and hospitalization

- Pregnancy, maternity and newborn care

- Mental health services

- Chronic disease management and pediatric care

- Prescription drugs

Insurance companies cannot deny coverage because of preexisting conditions. When you apply, you can identify your medical needs and choose a plan that makes financial sense for you and your family. All New York State of Health plans cover basic dental services for children, including cleanings and exams. But adults who want dental coverage must add it to their policy. Deductibles and out-of-pocket costs vary between plans enrolling in a family plan can cut costs.

How Does Medicaid Coverage Work

If you apply for Medicaid in New York, you will be asked to select a health plan managed by an insurance carrier, such as UnitedHealthcare or Empire BlueCross BlueShield. These insurance companies also sell individual health insurance policies and small-business coverage, and the plans themselves operate similarly.

Each Medicaid plan will come with a network of doctors and health care providers that accept the insurance.

However, health plans offered as part of the Medicaid program may have a different network of doctors when compared to other plans offered by the same insurance carrier. If you have a physician you prefer, it’s important to make sure they are covered in the new network.

Don’t Miss: Wax Museum Nyc Times Square

Find Affordable Healthcare That’s Right For You

Answer a few questions to get multiple personalized quotes in minutes.

HealthCareInsider.com is owned and operated by HealthCare, Inc., a privately-owned non-government website. The government website can be found at HealthCare.gov.

This website serves as an invitation for you, the customer, to inquire about further information regarding Health insurance, and submission of your contact information constitutes permission for an agent to contact you with further information, including complete details on cost and coverage of this insurance.

HealthCareInsider.com is not affiliated with or endorsed by any government website entity or publication.

If you are experiencing difficulty accessing our website content or require help with site functionality, please use one of the contact methods below.

For assistance with Medicare plans dial 888-391-5203

For other plans please dial 888-380-0672

Child Health Plus Coverage For Children

In New York, Child Health Plus is a health insurance program for children in households that have incomes too high to qualify for Medicaid but are less than 400% of the federal poverty level. Like Medicaid, Child Health Plus plans are managed by the same insurance carriers on the individual and small-business market.

For families with multiple children, the maximum contribution is three times the per-child premium. For example, if you fall into the $9-per-child threshold group, then the maximum you would pay for all your children would be $27, even if you purchase coverage for more than three children.

Maximum monthly income to be eligible for Child Health Plus: By number of children

| Cost per month |

|---|

Recommended Reading: How To Delete New York Times Account