Will Using A Dba Name Affect How My Business Is Taxed In New York

A DBA name does not give you specific legal rights. A DBA name is simply another persona under which to operate your business. Having a DBA name also doesnt change how you are taxed at the local, state, or federal level. You can read more about the different business structures, DBA name requirements, liability, life span, and taxation here.

ZenBusiness experts are on standby to assist you with business formation in New York. Business formation support, together with compliance, means your business dreams are always in good hands.

What Is A Fictitious Name

If you are starting a business as a sole proprietor or partnership you must file a document with the city, county or state as required by the laws of the state in which your business will be conducted. The name you choose for the business is a fictitious name. It is also called a DBA . The laws are intended to protect those doing business with the company by providing a public record of the owners identity and the address of the business.

In many states, corporations and LLCs may file assumed name certificates if they wish to conduct business under a fictitious name.

In New York State A fictitious name refers to a foreign corporation that must qualify in New York under another name because its original name conflicts with an existing New York entity. Nonetheless, many people use the term interchangeably with doing business as .

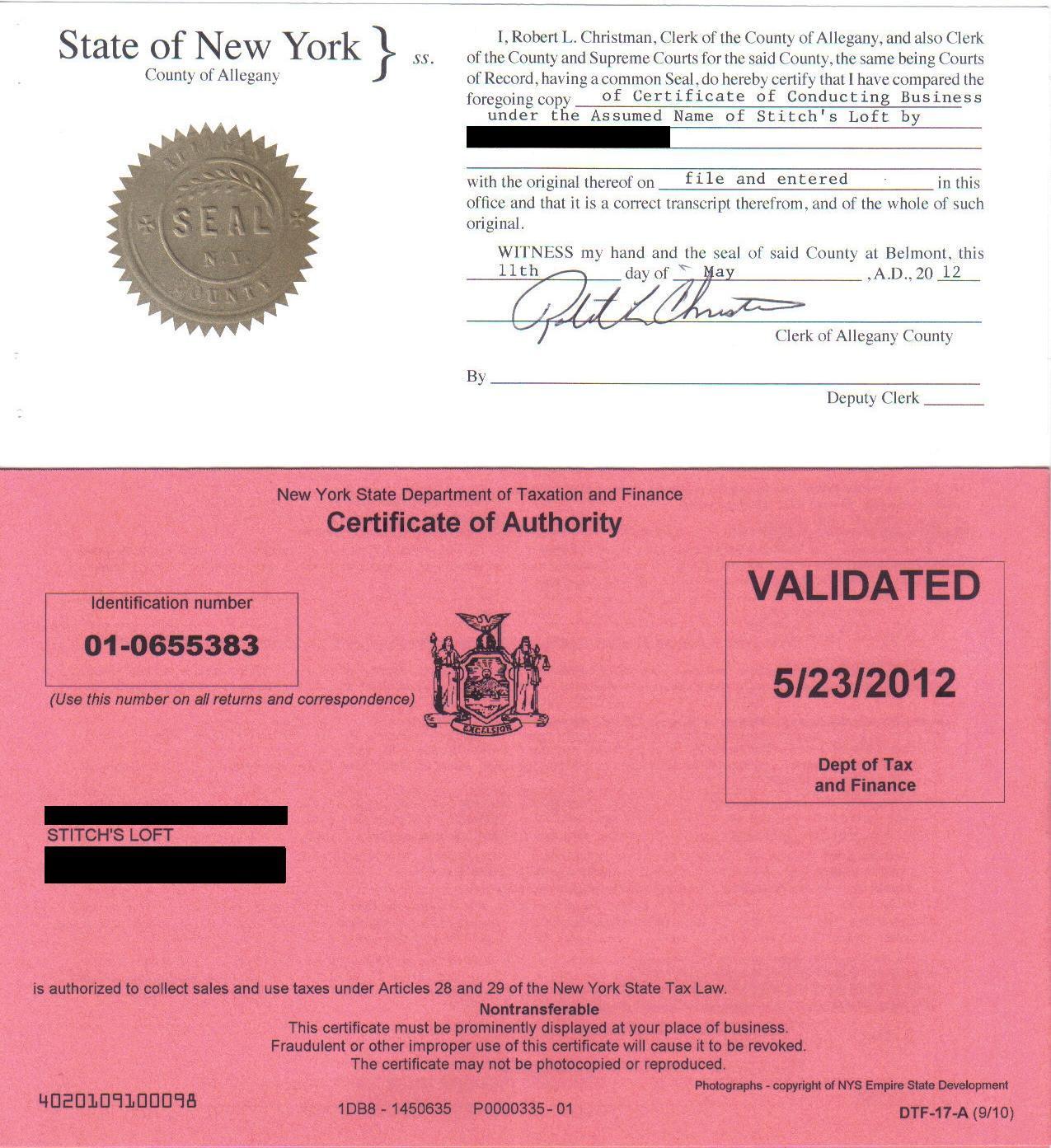

In New York, a DBA certificate is filed with the County Clerk in the county in which the company is located and an assumed name certificate for LLCs and corporations is filed in the Department of State.

Filing A Dba: Key Points To A Successful Filing

To do business under a DBA, you must complete and file the appropriate DBA forms and pay a filing fee, after which point you receive a DBA certificate. Depending on the state you may be able to file with a local or county clerks office, with a state agency, or both. Thus, be sure to verify all the relevant local governing authorities for DBA filings in the states you are, or will be, doing business in. Then confirm all the DBA filing requirements for your business or entity type.

In some states, filings are made in different offices for sole proprietors and general partnerships than they are for corporations, LLCs and other statutory entities. The forms may be different too. Upon successful completion of the filing and receiving an fictitious name certificate, you may begin using your DBA name.

Your business name is a valuable asset that you want to protect. Using a DBA name can be an important part of your business strategy. And if so, making the appropriate filing to register the DBA name, and making sure the registration does not expire are crucial steps. Now that you have some basic facts about DBA names and DBA filings, work with your business advisor and compliance partner to make sure theyre done right.File a DBA Online Now

You May Like: How Much Is A Flight To Dubai From New York

Office Of The Internal Revenue Service

The local office of the Internal Revenue Service is located at: 999 Stewart Ave.

Bethpage, NY 11714Ph: 800-829-4933 / 516-576-7428

New York State Sales Tax

For information concerning the collection and filing of sales tax, contact: New York State Department of Taxation and Finance

Sales Tax Registration

Establishing A Business Tax Id

Some business entities must establish an employer identification number with the IRS. This can be done online and does not require a fee. Although this may not be required if you do not incorporate, you can use the EIN to help separate your business and personal expenses.

The EIN is a nine-digit number that identifies your business for tax purposes, much like an individual Social Security number. You must get an EIN if you have employees as it allows you to withhold and report employment taxes. You may also be required to use this number if you are required to pay sales or excise tax in New York.

Some banks may also require you to have an EIN to open a business bank account or line of credit. This number can prevent identity theft by protecting your personal Social Security number.

Don’t Miss: How To Get Adderall In New York

Structure As A Partnership

A common misconception is that ‘Cede and Company’ is merely a fictitious legal name used to refer to Depository Trust Company. In fact, Cede is actually a New York City-based partnership of certain employees of DTC. Cede is a separate legal person from Depository Trust Company, which is owned by DTC Participants, who are banks and brokerage houses, and not employees of DTC.

One reason Cede is structured as a partnership is that each general partner can order transfers of stock registered in the name of the partnership without the need for presenting a separate corporate resolution to the stock issuer’s transfer agent or stock registrar to validate the authority of the transfer.

Choose A Registered Agent

A registered agent is an individual or business entity responsible for receiving important legal documents on behalf of your business. A member of your LLC may act as a registered agent or you can hire a professional service to fill this role.

While hiring a registered agent service incurs an additional expense, it offers several advantages from increased privacy and convenience to peace of mind.

Recommended Reading: How To Plan A Cheap Trip To New York

When To Amend A Certificate Of Authority

You must amend your Certificate of Authority within 20 days whenever your business changes any of the following:

- business name

- owner, officer, or responsible person information or

- business activity.

You do not need to apply for a new Certificate of Authority to make these changes, but you must amend your current certificate. If, however, you have changed your form of business you must surrender or destroy your current Certificate of Authority and obtain a new one. See When to surrender a Certificate of Authority.

When You’re Ready To Take The Next Step

A DBA can be an excellent way to dip your toe in the water and try a new business or product idea without going all in. If you are using a DBA as part of a sole proprietorship or partnership, don’t wait too long after you have proof of concept to move to the next step. Whether that means starting your LLC or incorporating your DBA, building a strong business starts with protecting yourself legally.

This portion of the site is for informational purposes only. The content is not legal advice. The statements and opinions are the expression of the author, not LegalZoom, and have not been evaluated by LegalZoom for accuracy, completeness, or changes in the law.

You May Like: What Is Kate Spade New York

For Individuals And Partnerships

If you conduct business under an assumed name as an individual or partnership, you must file a certificate of assumed name or business certificate in the county in which you conduct business. Such certificate basically has to set forth the real name and the address of your business and certain other information .)

In New York County, you have to file your business certificate with the County Clerk in the basement at 60 Centre Street. The necessary form can be purchased at the little coffee shop on the first floor next to the security lines at the entrance . The filing fee is $100. For more information see here.

If you have more than one business under assumed names, you can file more than one business certificate.

What Is A New York Doing Business As Name

DBA names are referred to as many things, such as fictitious name,trade name, or assumed name. New York officially uses the term assumed name.

Even though a DBA name is not an officially recognized legal entity, if you trade under a name other than your legal one, you must register it. The exception is general partnerships, which must file for an assumed name even if they plan to operate under their legal names. Also, a DBA name does not impact taxation. It is simply an alias under which your business can trade.

Often, two distinct business groups seek DBA names. These are:

- Sole proprietorships and partnerships: These businesses may want to use a DBA name to protect their privacy. With a DBA name, the business would be referred to as the alias instead of the owners personal name. However, keep in mind that general partnerships are required to file for an assumed name even if they plan to operate under their legal names.

- Corporations and limited liability companies : These business entities may want to use a DBA name to launch a new product, drop an entity designator, or use a name that more accurately represents their business.

Some of the advantages of trading under an assumed name in New York include but are not limited to:

You May Like: How To Win The New York Lottery

Filing A Dba In Ny With The County Clerk

If your business is a sole proprietorship or partnership, then you are required to file a business certificate with the appropriate county clerks office in order to operate under a DBA.

Knowing which county to file in is simple: you must file in any county where your business conducts or transacts business.

In New York State, ALL PARTNERSHIPS, whether operating under an assumed name or not, must register a Business Certificate for Partnerships with the appropriate county clerks office. Continue reading this section for instructions on completing this step.

We will give you step-by-step directions to get a New York County DBA . If you need to register your DBA in a different county than New York County, youll need to get in touch with the county clerk for the registration requirements.

You can find your counties’ contact information here.

Filing aDBA in NYC Contact Information:

Kings County– 404-9750New York County– 386-5955

How to File a New York County DBA

At this point, you shouldve already chosen a name for your business and completed the name searches in Step 1 above.

New York County suggests searching their assumed name records before you start the DBA filing process. Those records can be found at the New York County courthouse basement at 60 Centre Street in Manhattan.

Forms

- X-74 Business Certificate form for Partnerships

- X-201 Business Certificate form for Sole Proprietorships

You Must Submit Your Business Certificate In Person

Walk In Location

Payment

To Establish A Sole Proprietorship In New York Here’s Everything You Need To Know

In New York, you can establish a sole proprietorship without filing any legal documents with the New York State Government. There are four simple steps you should take:

To find out how to establish a sole proprietorship in any other state, see Nolo’s 50-State Guide to Establishing a Sole Proprietorship.

1. Choose a Business Name

In New York, a sole proprietor may use his or her own given name or may use a trade name. If you plan to use an assumed name or trade name, state law requires that the name be distinguishable from the name of another company currently on record. It is also a good idea to choose a name that is not too similar to another registered business because of common and federal law trademark protections. To make sure your business name is available, run a search in the following government databases:

2. File a Fictitious Business Name

If you use a business name that is different from your legal name, New York requires you to file a certificate of fictitious business name. This is a mandatory requirement in New York. To file your fictitious business name, you must fill out an application available from the county clerk’s office in the location where you intend to do business. The filing fee will vary depending on the county.

Next Steps

You May Like: Where To Stay In New York

How Long Does A Dba Last

When you register a DBA, you will want to know and track its expiration date. Most states require the renewal of your DBA, but the time to renew may vary. For example, if you register your business in California, you’ll need to renew the DBA after five years. In Texas, you can use the DBA for 10 years, while in New York, no renewal is necessary as there is no expiration date.

In many states, a DBA registration is good for five years before it requires extension or renewal. It is important to keep track of expiration dates on your DBA for the welfare of your business.

What if you decide not to renew your DBA? If you no longer want to use your DBA, you should cancel the registration to avoid confusion and potential legal issues. Here are the steps you must take to cancel a DBA:

If your DBA is close to expiring, you could also just let it expire and not renew it.

New York Dba Filing & Registration

A filer for a DBA must insert the exact name of the entity seeking the DBA, which can be found on the filing receipt issued by the Department of State when the entity was formed or by searching the Corporation/Business Entity Index.

The filer must also check the appropriate box to indicate the law of New York State under which the entity was formed or authorized to transact business.

The filer must then insert the entity’s proposed DBA name, as well as the address of its principal place of business, which may be an out-of-state address but not a post office box.

The filer must also indicate the county or counties in which the entity does or intends to do business, and must insert the address of each location where business will be carried on under the fictitious name.

Finally, the Certificate of Assumed Name must be signed on behalf of the entity by a corporate officer, a general partner of a limited partnership or by a member or manager of a limited liability company.

In all cases the Certificate of Assumed Name may be signed by an authorized person for such entity, provided that person provides the name and title of the principal for whom he or she is acting.

The filer must also insert his or her own name and mailing address so they can receive the receipt that evidences the filing.

Also Check: When Do Mosquitoes Come Out In New York

When Is Filing A Dba Required In New York

A DBA is required whenever a business is operating under a name other than its legal name. In the case of a sole proprietorship, you will need a DBA if you are operating under a name other than your own personal name. Partnerships in NY must always file a DBA in all counties where they transact business.

How To Change From A Dba To A Llc

Determine whether the business has registered the DBA name. Use the online search option from the secretary of state’s office, and search for the name you want to use for the limited liability company . If you find the name in the database, you must modify or change the name of the business. If nobody else uses the name, you can register the DBA as the LLC name. From there, complete the following:

- Locate the LLC application and forms to complete so you can register the LLC.

- State the registered agent’s name, address, and phone number.

Also Check: How Much Is A Plane Ticket To New York City

Doing Business As Filings

In accordance with New York State General Business Law , the County Clerk accepts and files certificates of persons conducting business under an assumed business name. These transactions are commonly referred to as DBA filings.

The General Business Law requires that individuals or partners conducting commercial activity under a name that is not their real name must file DBA certificates with the County Clerk. Filing a DBA protects the business name from use by others in the county where it is filed.

Please note that the law requires that DBA certificates contain specific language. Forms for DBA filings, amendments and discontinuances may be obtained at the Monroe County Clerks Office or downloaded using the links below. Forms are also available at some stores which carry legal stationery or business supplies. A filer may also consult with an attorney to draw-up the appropriate forms, particularly if filing a partnership.

Please note that if your business is located in the City of Rochester, there are often additional business permit requirements. The City’s website has information and contacts related to the business permit process. You can also get information by visiting a city Neighborhood Service Center for locations and hours.

Frequently Asked Questions About A Database Administrator Salaries

The average salary for a Database Administrator is US$88,489 per year in New York City, NY, United States Area. Salaries estimates are based on 5 salaries submitted anonymously to Glassdoor by a Database Administrator employees in New York City, NY, United States Area.

The highest salary for a Database Administrator in New York City, NY, United States Area is US$105,038 per year.

The lowest salary for a Database Administrator in New York City, NY, United States Area is US$74,547 per year.

Recommended Reading: How To Pay A Ticket Online New York