More Help With State And Federal Taxes

Its important to avoid state tax issues and potential financial liability. If you need help navigating your state tax obligations, get help with H& R Block Virtual! With this service, well match you with a tax pro with New York tax expertise. Then, you will upload your tax documents, and our tax pros will do the rest! We can help with your NY taxes, including federal deductions for paying state taxes.

Prefer a different way to file? No problem you can find New York state tax expertise with all of our ways to file taxes.

Related Topics

Getting married? Having a baby? Buying a house? Go through your life events checklist and see how each can affect your tax return with the experts at H& R Block.

Can I Fill Out Tax Forms By Hand

Yes, you can handwrite a 1099 or W2, but be very cautious when doing so. The handwriting must be completely legible using black ink block letters to avoid processing errors. The IRS says, Although handwritten forms are acceptable, they must be completely legible and accurate to avoid processing errors.

Business Return General Information

Important resources for Corporate filers can be found .

Due Dates for New York Business Returns

Corporations

- Original returns: April 15, or same as IRS, or for fiscal year filers the 15th day of the fourth month following the close of the year.

- Returns on Extension: Corporations can file for a six month extension by filing Form CT-5 by the due date of the return. Two additional three month extensions can also be filed.

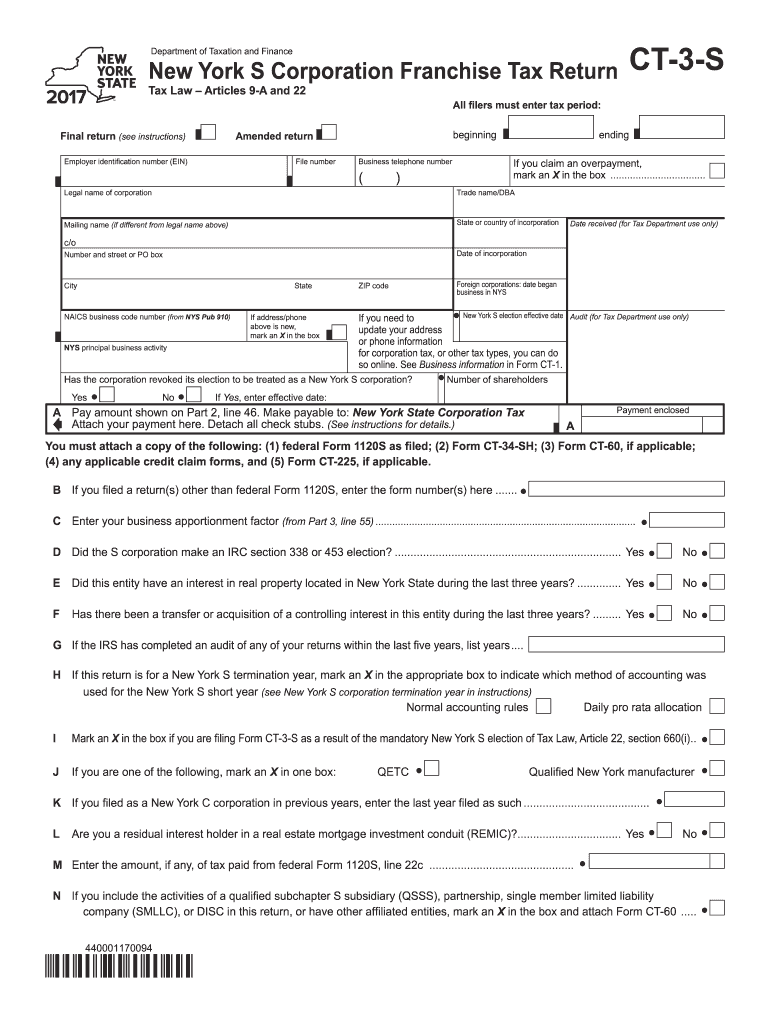

S-Corporations

- Original returns: March 15, or same as IRS, or for fiscal year filers the 15th day of the third month following the close of the year.

- Returns on Extension: S Corporations can file for an automatic six month extension by filing Form CT-5.4 by the due date of the return.

Partnerships

- Original returns: March 15, or same as IRS, or for fiscal year filers the 15th day of the third month following the close of the year.

- Returns on Extension: Partnerships can file for an automatic six month extension by filing Form IT-370-PF by the due date of the return.

Fiduciary

- Original returns: April 15, or same as IRS, or for fiscal year filers the 15th day of the fourth month following the close of the year.

- Returns on Extension: Fiduciaries can file for an automatic six month extension by filing Form IT-370-PF by the due date of the return.

Business Extensions

Extension requests can be filed through TaxSlayer Pro as well as online at the Department of Taxation and Finance website here.

Amended Business Returns

Don’t Miss: Do I Have A Warrant In New York State

Respond To A Department Notice

If you receive a bill or notice, respond online. It’s the easiest, fastest way. We’ll walk you through the process.

Note: If your refund status says we sent you a letter requesting additional information, see Respond to a letter for more information and to review our checklists of acceptable proof.

Be Aware Of Tax Scams And Fraud

Each year, scammers claiming to be IRS or other government employees ask students and scholars for money that is “owed” to avoid any so-called tax penalties or fees. Please be aware and cautious of such calls, emails, letters or unusual contacts. These scammers might even say that they will call the police if you hang up or you will get deported if you do not comply with their requests. Review our Tips to Avoid Scams and Fraud to protect yourself.

Also Check: Where Should I Stay When Visiting New York City

Business Return Electronic Filing Information

Business Electronic Filing Mandate – If a tax return preparer prepared at least one authorized tax document for more than 10 different taxpayers during the previous calendar year and will use tax software to prepare one or more authorized tax documents in the current calendar year, or were previously mandated to e-file, the preparer is subject to the e-file mandate. The mandate applies to both original returns and amended returns.

This mandate applies to Corporation, Partnership, and S Corporation returns, and there is no opt-out provision. Tax preparers are subject to a $50 penalty for each tax document that is not filed electronically unless it is due to reasonable cause and not due to willful neglect. Reasonable cause will be considered on a case by case basis.

E-File Registration Requirements – Electronic return originators authorized by the IRS to e-file federal corporation tax documents are also authorized to e-file corporation tax documents with New York State . NYSDTF does not require EROs to apply to their program, or to provide copies of their IRS acceptance letters to NYS.

Tax Years That Can Be E-Filed Current year and 2 prior years

Consequences Of Not Filing Your Tax Forms

Penalties for not complying with the filing requirement can include but are not limited to:

- Denials of future requests for a Change of Status

- Denials of visa renewals at American Consulates/Embassies

- Fines and interest will accrue on unreported income and could result in more money being owed to the IRS in the future

- If filed more than 3 years late, a refund will not be remitted by the IRS to the taxpayer

If you don’t file your tax forms with the IRS by the tax deadline, or need to correct a mistake, you may be able to submit an amended tax return or mail the necessary tax documents even after the deadline date. Consult with a tax professional for assistance if you need to adjust a previously filed tax return.

Read Also: How I Met My Wife New Yorker

Explore Our Financial Education Program

The Financial Education Program is a series of short modules and videos designed to take you through the benefits available to you and the responsibilities you have as a New York State taxpayer. You can start anywhere in the series or review all the modules. This is for youlet us know what you think!

How Do I Get Paper Tax Forms

Notice: Historical Content

Do I need form it-201?

You must file Form IT-201, Resident Income Tax Return, if you were a New York State resident for the entire year.

Is it-201 same as 1040?

The IT-201 is the main income tax form for New York State residents. It is analogous to the US Form 1040, but it is four pages long, instead of two pages. The first page of IT-201 is mostly a recap of information that flows directly from the federal tax forms.

Previous Post

Also Check: What Is New York Famous For

If You Had Us Income During 2021 You May Need To File A State Tax Return

State taxes may have different residency guidelines than US taxes. For a fee, you can use Sprintax to file your state taxes. There are two easy ways to access Sprintax:

You may need to file for every state you lived and/or worked in for 2021. Remember, you cannot electronically file your tax return if you’re using Sprintax and filing as a nonresident for US tax purposes.

NEW YORK STATE and CITY TAX

You must file a NY Tax Return if:

- You are a NY resident and you filed a US tax form for 2021 or

- You had NY income greater than $4,000 in 2021 or

- You want a refund of NY State or City taxes withheld from your paycheck in excess of what you actually owed.

NEW JERSEY STATE TAX

- International students, professors and scholars are considered non-residents for NJ state tax purposes unless they had a permanent home in NJ.

- Make sure to confirm your own tax residency to determine your tax filing status NJ state.

- Use the appropriate NJ tax form:

- Either NJ resident tax form NJ-1040

- or NJ nonresident tax form NJ-1040NR.

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Contact the IRS to get a free transcript . There are two ways you can get your transcript:

-

Online – To read, print, or download your transcript online, you’ll need to register at IRS.gov. To sign-up, create an account with a username and a password.

Also Check: Yorkies For Sale In Brooklyn

New York State Department Of Taxation And Finance

| Department of Taxation and Finance headquarters in Albany |

| Department overview |

|---|

| .gov |

The New York State Department of Taxation and Finance is the department of the New York state government responsible for taxation and revenue, including handling all tax forms and publications, and dispersing tax revenue to other agencies and counties within New York State. The Department also has a law enforcement division, the New York State Office of Tax Enforcement. Its regulations are compiled in title 20 of the New York Codes, Rules and Regulations.

It is headquartered in Building 8/8A at the W. Averell Harriman State Office Building Campus in Albany.

During the , the department had offices on the 86th and 87th floors of the World Trade Center’s South Tower. On the 86th floor, five of eight employees in the revenue crimes bureau died. On the 87th floor, the mediation services bureau lost six of seven employees. Of the estimated 20 people on the 87th floor, nine were lost, including two of three senior staff.

The tax department was formally created on January 1, 1927 but the first signs of the department date to 1859. The original intent was to find a way to distribute tax revenue to individual counties in New York State.

How To Order New York State Tax Forms

Contents

Also know, how do I get paper tax forms?

Also the question is, where can I pick up local tax forms? During the tax filing season, many libraries and post offices offer free tax forms to taxpayers. Some libraries also have copies of commonly requested publications. Many large grocery stores, copy centers and office supply stores have forms you can photocopy or print from a CD.

Considering this, can I download tax forms online? Yes, you can print the tax forms you download for free from the IRS website. You can also print forms from other sites that offer free downloads. If you use an online filing software, you can usually print the forms after you use the software to complete all the information.

Recommended Reading: Jobs In Brooklyn Hiring Immediately

Where Can I Get New York Tax Forms

Printable New York tax forms for 2021 are available for download below on this page. These are the official PDF files published by the New York State Department of Taxation and Finance, we do not alter them in any way. The PDF file format allows you to safely print, fill in, and mail in your 2021 New York tax forms.

To get started, download the forms and instructions files you need to prepare your 2021 New York income tax return. Then, open Adobe Acrobat Reader on your desktop or laptop computer. Do not attempt to fill in or print these files from your browser.

From Adobe Acrobat Reader use the Ctrl + O shortcut or select File / Open and navigate to your 2021 New York tax forms. Open the files to read the instructions, and, remember to save any fillable forms periodically while filling them in. Print all New York state tax forms at 100%, actual size, without any scaling.

- Social Security Number

- Form you filed

The requested information must match what was submitted on your 2021 New York Form IT-201. You can also look up prior year refunds if you have the requested information available. If not, you will need to contact the New York State Department of Taxation and Finance service center by phone or mail.

To contact the New York State Department of Taxation and Finance service center by phone or email, use the check your refund status link above. Alternatively, read or print the 2021 New York Form IT-201 instructions to obtain the proper phone number and mailing address.

Gather The Following Documents

You may not have or need some of these this is a list of all documents you might need:

- Exit and Entry Dates for all past US visits

- I-20, DS-2019, I-797, or other immigration documents

- Social Security Number

- Current US Address AND Permanent Foreign Address

- Name of Educational Institution or Sponsoring Organization

- All relevant tax form for taxable purposes:

- Form W-2, 1042-S, 1099

- Scholarship or Fellowship grant letters

Also Check: How Much Is A Carton Of Cigarettes In New York

Are The New 1040 Tax Forms Available

Forms 1040 and 1040-SR and the associated instructions are available now on IRS.gov and are being printed for taxpayers who need a hard copy. The IRS has not yet announced a start date for the 2021 filing season. IRS Free File will open in mid-January when participating providers begin accepting returns.

Processing New York State Payroll Tax Forms For Electronic Filing

Contacting Support

Were currently experiencing service issues for contacting Support. Please use the Help & How-To Center while we work through these issues.

Accounting CS offers the ability to electronically file the New York state Form NYS-45 and the NYS-1 payment voucher. Use the following steps to set up clients for NY e-filing and processing. .

Also Check: United States Postal Service Bronx Ny

Residency Status Information For New York Returns

Residents: A resident is an individual who is either domiciled in New York State or whose domicile is not New York State but they maintained a permanent place of abode in New York State for more than 11 months of the year and spent 184 days or more in New York State during the taxable year. There are exceptions to these rules, however. See “Nonresidents” below.

Part-year resident: You are a part-year resident if you meet the definition of resident or nonresident for only part of the year.

Nonresidents: A nonresident was not a resident of New York State for any part of the year. Additionally, an individual domiciled in New York State is not a resident if they meet all three of the conditions in either Group A or Group B as follows:

Group A

- They did not maintain any permanent place of abode in New York State during the taxable year and

- They maintained a permanent place of abode outside New York State during the entire taxable year and

- They spent 30 days or less in New York State during the taxable year.

Group B

New York City and Yonkers Residency – Residency in New York City and Yonkers is determined along the same lines as above. Thus, you can substitute “New York City” or “Yonkers” for “New York State” in the above descriptions.

Need To Request An Income Tax Extension

New York State personal and fiduciary income tax returns are due April 18. If you can’t file on time, request an automatic extension of time to file online or by paper .

The fastest way to obtain forms and instructions is to download them from our website. Current and prior-year forms are available as standard PDFs, and select forms are available as enhanced fill-in PDFs.

For detailed instructions on downloading our forms, see Forms-user instructions.

Don’t Miss: How To Visit New York On A Budget

Other Ways To Obtain Forms

You can order forms using our automated forms order telephone line: 518-457-5431. It’s compatible with TTY equipment through NY Relay and with Internet and mobile relay services .

Usually, you can also get the most commonly used income tax forms and instructions at your local library. Visit the New York State Education Department website to find libraries near you: Find Your Public Library in New York State by Public Library System.

Use Glacier Tax Prep To File Your Federal Tax Return

GTP will help you easily fulfill your tax obligations by first asking you a series of questions to determine your residency status for tax purposes, and if you are a non-resident for tax purposes, filling in all necessary forms for you. It will also inform you of any tax benefits that may apply to you.

1. Get access to GTP by logging in with your NYU net ID and password. GTP is available free of charge to NYU students and scholars. You must be logged into your NYU account on the web browser you are using in order for the GTP link to work.

You will need to create a user ID and a password with your NYU email address by first logging in with your NYU Net ID and password. Once you log into GTP follow the instructions in each step. If your NYU Net ID is not active, first visit . If you are having difficulty accessing GTP, visit our Tax FAQ for instructions.

If you were employed at NYU or received an NYU scholarship or fellowship you may have already logged into Glacier. GTP would populate the information from Glacier to expedite the process. Log in using the user ID and password you created when you first started an account on Glacier. If you have forgotten your user ID or password click on Forgot ID to reset your user ID or password.

Read Also: How To Get A New York State Security Guard License