Silver Plans: Best For Moderate Medical Care

Silver plans offer moderate monthly premiums and moderate costs when you need care. The deductibles are typically lower than bronze plans and are a good choice if you qualify for âextra savingsâ such as cost-sharing reductions. These are also a good choice if you are willing to pay a higher monthly premium than a Bronze plan for more routine services covered. With Silver plans, the insurance company typically pays 70 percent of the memberâs medical expenses while the member pays 30 percent.

How Does Medicaid Coverage Work In New York

If you apply for Medicaid in New York, you will be asked to select a health plan managed by an insurance carrier, such as UnitedHealthcare or Empire BlueCross BlueShield. These insurance companies also sell individual health insurance policies and small-business coverage, and the plans themselves operate similarly.

Each Medicaid plan will come with a network of doctors and health care providers that accept the insurance.

However, health plans offered as part of the Medicaid program may have a different network of doctors when compared to other plans offered by the same insurance carrier. If you have a physician you prefer, its important to make sure they are covered in the new network.

Average Cost Of Health Insurance

The average monthly cost of health insurance in the United States is $541.

Find Cheap Health Insurance Quotes in Your Area

Health insurance premiums have risen dramatically over the past decade. In previous years, insurers would price your health insurance based on a multitude of factors. However, the number of variables have decreased significantly with the Affordable Care Act.

In 2022, the average cost of individual health insurance for a 40-year-old on a silver plan is $541. This represents an increase of nearly 1% from the 2021 plan year.

You May Like: When Is The Primary Election In New York

American Health Insurance Vs International Cover: Whats The Cost Difference

International health insurance is a product designed to offer cross-border coverage. Many Americans are surprised by how affordable health coverage can be when they spend time overseas so how does this product compare to domestic cover?

At William Russell, our most comprehensive international health plans provide standard coverage in every country except the USA. Weve published a full guide on how we calculate premiums for health insurance. By comparing our typical premiums to U.S. averages, its possible to get an idea of the cost difference between health insurance in the USA and other nations.

| Typical US health insurance costs in 2020 | The average William Russell international health insurance premium in 2020* |

|---|---|

| Individual cover | |

| $8,419.90 |

*Based on William Russell premiums in Thailand and Vietnam

Recommended Reading: Does Health Insurance Cover Vision

Compare Pet Insurance Providers In New York

|

Provider |

||

|---|---|---|

|

2 days for accidents 14 days for illnesses |

||

|

14 days for all conditions |

||

|

14 days for all conditions |

||

|

15 days for accidents and illnesses |

None |

|

|

2 days for accidents 14 days for illnesses |

||

|

15 days for accidents and illnesses |

None |

|

|

5 days for accidents 14 days for illnesses |

||

|

14 days for all conditions |

None |

You May Like: How To Revoke A Power Of Attorney In New York

Small Business As Owners

If you are a small business owner in New York and would like to offer health insurance to your employees, there are many benefits to doing so.

You may qualify for the Small Business Health Care Tax Credit that would cover up to 50% of the cost the employer pays for their employees insurance premiums. The eligibility requirements are:

- Your business has 25 or fewer full-time or full-time equivalent employees.

- Your business pays an average annual salary of less than $53,000 a year per worker .

- Your business is contributing at a minimum of 50 percent toward the cost of employee premiums.

- Your business offers a Small Business Health Options Program plan coverage for all full-time employees.

It should be noted that eligibility is based on the number of full-time employees, rather than the number of total employees businesses with part-time workers may also qualify for the credit even if more than 25 workers are under their employ. Further information on this can be found in New York Small Business Health Insurance.

If you are a NY small business owner with fewer than 10 full-time employers with an average annual salary of $25,000 or less, you may still be entitled to the full tax credit. For those companies with a higher number of full-time workers and higher salaries, the amount of credit is reduced.

Four Types Of New York Small Business Health Insurance Plans

Whether youre looking at individual health insurance or group health insurance, there are several different types of health plans available. The four you should absolutely know are:

PPO Health Insurance Plans,

HSA-Qualified Health Insurance Plans, and

Indemnity Health Insurance Plans.

The plan type that is best for you and your employees depends on what you and your employees want, and how much you are willing to spend. Heres a brief review of the four popular types of health insurance plans:

Read Also: Where To Buy New York City Pass

Healthcare Costs Based On Age And State

Healthcare costs vary based on your age and the state you live in. As you might expect, younger, healthier adults pay the least for healthcare coverage, but even for younger adults, the cost of coverage varies greatly based on location.

In 2021, the average cost of a monthly health insurance premium in the U.S. is $495 per month. The average annual deductible is $5,940. In some places, the cost varies greatly from the national average. In West Virginia, the average premium is $712 with a deductible of $8,540 in next-door Maryland, the average is only $344 with a $4,122 deductible.

Age is another big factor when it comes to the costs of health insurance. Take a look at this breakdown by age for the average monthly healthcare premium without subsidies:

- 18 and under: $236

- 55-64 years: $784

Is Employer Coverage Cheaper

Many people assume that employer coverage is the best or cheapest option. In 2020 an estimated 157 million people opted for their employer-based health care plan.4

But is it? Should you always choose your employers health coverage or should you opt for individual health insurance?

Employer plans can sometimes be less expensive since the company chips in part of the costs. Your employer can also sometimes get a better rate because theyre buying a large block of insurance packages. But not always. It can sometimes be cheaper to get health insurance on your own. While it might take a little more work on your end, if youre looking to save money on your health insurance costs, you might want to pass on the employer coverage and shop for an individual plan.

You May Like: How Much Is A Po Box In New York City

How Do I Find Affordable Health Insurance

Group plans are generally cheaper than individual plans. So if you are eligible for onethrough your employer, your union, or some other associationthat’s your best bet, in terms of coverage for the money. If that’s not an option, the public health marketplaces established by the Affordable Care Act offer affordable health insurance for individuals. In most of the U.S., you can sign up for a plan offered through the federal government via the HealthCare.gov site. However, 12 states run their own marketplaces, and residents sign up via their sites.

Allowing Dependent Coverage Through Age 29

Under the Affordable Care Act, young adults can be covered under their parents health insurance plans up to the age of 27. Because of the way insurance is priced in New York, it is preferable for young adults to stay on their parents plans until the legal age limit since the additional cost for a dependent is cheaper.

New York also allows health insurance companies to offer an age 29 coverage option. Parents pay a little more for their health insurance in exchange for having their children stay on the family plan until the age of 29.

For example, say your young adult child has passed the age of 27 but does not have a job or sustainable income to pay for their own insurance. In this case, you could pay a small extra premium along with your normal health insurance rate that would allow your coverage to support your son or daughter. To qualify, the young adult must:

- Be unmarried

- Not be insured or eligible for insurance through their employer

- Live, work or reside in New York state or the insurance carriers coverage area

You May Like: Where To Go On Vacation In Upstate New York

The Average Cost Of Health Insurance By Plan Types

There are four types of health plans you can choose on the Marketplace, with varying degrees of flexibility and cost:

- Health Maintenance Organization : HMOs tend to have lower premiums but require you to use a specific set of providers and get referrals to specialists for covered services, except in emergencies. Silver HMOs average $473 per month.

- Exclusive Provider Organization : Somewhere between an HMO and a PPO, EPOs typically require that you use the health plans in-network providers, but you dont always need referrals to see specialists. EPO Silver plans average $508 per month.

- Preferred Provider Organization : PPOs tend to be more expensive than HMOs but typically offer a broader range of providers. You usually dont need to get a referral to see specialists for covered services. On the Marketplace, Silver PPO plans have an average premium of $517.

- Point of Service : POS plans tend to be the most flexible at an increased financial cost. You can usually get care outside of the health plans provider network, though youll likely pay more for those services. POS Silver plans have an average monthly premium of $534.

Average Health Insurance Premiums by Plan Type Silver Plans

Scroll for more

Dont Miss: Substitute Teacher Health Insurance

How To Choose The Right Pet Insurance Provider In New York

Before landing on the best pet insurance provider for you and your pet, consider the following factors:

- Plan type: If youre just looking for accident-only coverage, your options will be limited to providers that offer those plans, including Prudent Pet, ASPCA Pet Health Insurance and Spot. If you need accident and illness coverage, you can purchase from any of the providers in this review.

- Coverage limits: Your policys annual coverage limit is the total amount your provider agrees to pay for vet bills in a single year. If you need unlimited coverage, you can narrow your search down to providers that offer that, such asTrupanion.

- Wellness coverage: Looking to add coverage for wellness and preventive care can help you narrow down your search, since some providers dont offer that option.

- Policy customization: You can customize your policy by choosing lower annual coverage limits, a higher deductible and a lower reimbursement rate this is the best way to get the cheapest premium. For instance, Embrace quoted us $70.53 per month for a policy with a $30,000 annual limit, a $200 deductible and a 90% reimbursement rate to cover a mixed dog. However, it cost only $18.15 per month when customizing those options to $5,000 of annual coverage, a $1,000 deductible and a 70% reimbursement rate.

Also Check: How To Get Ein Number In New York

New Yorks Medicaid Cancer Treatment Program

New Yorks MCTP services are available to low-income residents with breast, cervical, colorectal, or prostate cancer. Generally, residents must be under 65, meet citizenship requirements, and not be enrolled in qualified coverage at the time of application. The states Department of Health Cancer Services Program oversees the application process.

Income limits vary. For example, the threshold for colorectal and prostate cancer is 250% of the FPL or up to $32,200 for a single adult in 2020.12

Those who qualify get full Medicaid coverage for a specific amount of time tied to the type of cancer. Enrollees must recertify each year if treatment is still needed.

Do You Need Insurance In Malaysia

If youre single and dont have anyone who is financially reliant on you, you may not require life insurance coverage. However, if you provide financial assistance to your parents, siblings, or other relatives, you may be required to get insurance. If you are caring for elderly relatives, it is crucial to consider the rising expense of medical care.

Don’t Miss: How Is The Weather In New York

The Importance Of Subsidies

The good news is that many who purchase marketplace plans will pay lower premiums through what the government calls advanced premium tax credits, otherwise known as subsidies. In 2019, 88% of people who enrolled at HealthCare.gov were eligible for advanced premium tax credits.

What are these subsidies? They are credits the government applies to your health insurance premiums each month to make them affordable. Essentially, the government pays part of your premium directly to your health insurance company, and you’re responsible for the rest.

As part of the American Rescue Plan Act passed in March 2021, subsidies have increased for lower-income Americans and extended to those with higher incomes. The ARPA expanded marketplace subsidies above 400% of the poverty level and increased subsidies for those making between 100% and 400% of the poverty level.

You can take your advance premium tax credit in one of three ways: equal amounts each month more in some months and less in others, which is helpful if your income is irregular or as a credit against your income tax liability when you file your annual tax return, which could mean you owe less tax or get a bigger refund. The tax credit is designed to make premiums affordable based on your household size and income.

What Is The Least Expensive Health Insurance

As you can see from the factors listed above, theres a lot that goes into determining the price of insurance. There isnt a single healthcare plan thats right for everyone. But finding the right plan for your needs can be easy with HealthMarkets. You can shop online, compare healthcare plans, and apply in minutes. You can also call 986-2752 to speak with a licensed insurance agent.

46698-HM-0222

Read Also: What Is The Best Hotel In Niagara Falls New York

How To Find Your Best Health Insurance Coverage In California

The best health insurance coverage for you will depend on the availability of plans in your county, as well as your medical and financial situation. For example, California has approved expanded Medicaid coverage under the Affordable Care Act . Therefore, anyone with a household income equal to or below 138% of the federal poverty level would likely be better served by Medicaid.

When evaluating plans and your needs, you should carefully review the premiums and deductibles for private health insurance to determine whatâs affordable. Typically, if you expect moderate to high medical costs, choosing a higher metal tier plan with more expensive premiums but better cost-sharing benefits would make more financial sense.

Gold and Platinum: Best if you expect high medical costs

Platinum and Gold are the highest tiers offered by the Covered California exchange, with health plans covering about 80% to 90% of your health care costs. These policies have the highest monthly premiums but come with the best benefits, including lower deductibles and out-of-pocket maximums. Because of this, Gold and Platinum plans can be the most cost-effective for those with higher medical bills, as you would reach the deductible quickly and then have access to coinsurance through your provider.

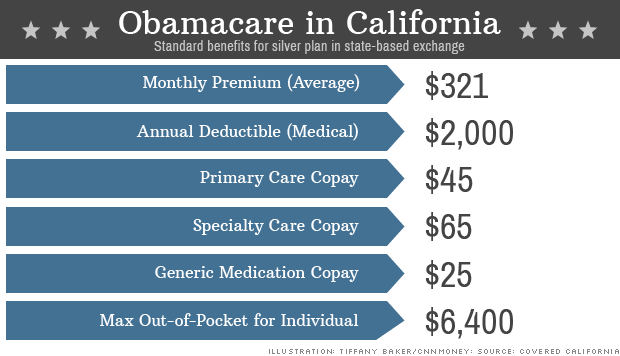

Silver: Best for people with low incomes or average medical costs

We recommend a Silver plan for most people because these plans balance cost-sharing benefits with affordable monthly costs.

Private Health Insurance Plans

Private health insurance plans are sold both on and off of the Health Insurance Marketplace. If you qualify for subsidies from the government, you can use them towards the monthly premium of on-exchange plans.

Off of the Marketplace, private health insurance plans can be purchased from a private insurance company or broker. There are usually more options off of the exchange, but they can be more expensive. For unsubsidized, private health insurance plans, individuals aged 55 to 64 pay $799 per month on average.

Recommended Reading: Are There Cruises From New York To Europe

Concierge Medical Plans: Best For Primary Care Savings

New York City offers a wide array of concierge medical plans, a model in which a patient pays a monthly, bi-annual, or annual fee to their physicians to create affordable health options for small businesses, self-employed. With these models, patients may pay a copayment but no charge for a specialist in the event of a referral. These facilities typically offer shorter wait times, and patients can normally reach a doctor quickly by phone or text and make an appointment the same day. Some concierge medical practices even make house calls.

How Cobra Affects Your Taxes

BURSAHAGA.COM” alt=”New York Life Insurance Quote > BURSAHAGA.COM”>

BURSAHAGA.COM” alt=”New York Life Insurance Quote > BURSAHAGA.COM”> If you decide to continue your current health insurance with COBRA, there is another expense you may not be aware of: higher taxes.

While youre employed, your insurance premium is deducted from your paycheck before taxes along with other pretax deductions such as your 401 retirement plan and group term life insurance. These deductions make your net income look smaller and, by doing so, lower your income tax.

When you lose job-based health coverage and switch to COBRA, you have to pay your COBRA premiums with after-tax money. This means that you lose the tax-free benefit you enjoyed while being employed.

In some cases, you may be able to deduct part or all of your COBRA premiums from your taxes. But not everybody is eligible for this deduction. Speak with an accountant or tax advisor.

You May Like: Umr Insurance Arizona

Also Check: How Much Is The New York New York Roller Coaster