New York Proposes Capital Gains Business Tax Surcharges

Revised budget proposals from each of the New York State Assembly and the New York State Senate would include a one percent surcharge on the capital gains of certain individuals for tax years beginning on or after January 1, 2021. The capital gain surcharge would be imposed in addition to individual income tax. Further, both proposals call for a surcharge to be imposed on corporations for tax years beginning on or after January 1, 20201. While both surcharges are structured differently, in either case the tax would apply to corporations with income or receipts above a designated threshold. The Assembly proposal calls for an 18 percent surcharge, while the Senate proposal would permanently raise the corporate franchise tax rate from 6.5% to 9.5%. Lastly, the Assembly version of the Bill would reinstate the 0.15 percent capital base tax that had previously been repealed for tax years beginning in 2021.

New York Releases Details Of Pending Marijuana Law

New York state lawmakers released details of the new law legalizing recreational marijuana, which recently passed the state Senate. The legislation provides licensing requirements for marijuana producers, distributors, and retailers. It creates a social and economic equity program to assist individuals disproportionately impacted by cannabis enforcement that want to participate in the industry. The law provides for a 9% state excise tax and 4% local excise tax rate on the retail sales price of marijuana. Dispensaries may be allowed to open as early as 2022.

Distributors will be required to collect an excise tax based on the potency of the amount of THC, the active ingredient in cannabis. The law plans to tax raw flowers at 0.5 cents per milligram of THC, cannabis concentrate at 0.8 cents per milligram, and edibles at 3 cents per milligram.

The bill establishes the Office of Cannabis Management to put in place a framework that would cover medical, adult-use, and cannabinoid hemp. The tax revenue generated will be used to operate the state cannabis program and related social programs.

Dying With A Will In New York

For decedents who die with a will in New York, matters are pretty uncomplicated, with most wills being executed exactly as the decedent specified they should be. Just how this situation will be handled, though, is completely dependent upon the value of the estate and other factors. In every case where theres a will and real property in the estate, the testate will must be submitted to the court for probate.

The probate process in New York begins with a judge reviewing the will of the deceased, ensuring that its accurate and has all the information necessary for it to be considered valid. Be sure you signed your will in front of two witnesses, and that they sign as well. Following this, the executor listed on the will is formally named, and he or she begins distributing the property listed on the will to the intended beneficiaries. This person is also responsible for settling any liabilities that the estate may still have pending, according to New York inheritance laws.

When you file for probate, be sure to include a copy of the will, the death certificate, the probate petition and any other relevant documentation. Some counties may allow you to file online, though its recommended that you seek the assistance of a lawyer.

However, if there is a will, but the value of the decedents personal property is less than $30,000 and he or she either owned real property jointly or not at all, then you should file a small estate proceeding, according to New York inheritance laws.

Recommended Reading: New York Times Poetry

Nyc May Abate Ubt Late Filing/late Payment Penalties But Interest Still Accrues

The New York City Department of Finance, upon request, will waive late filing and late payment penalties for individual unincorporated business tax taxpayers, if such taxpayers complete filing payment on or before May 17, 2021. However, interest will accrue at the underpayment rate for the late payments. UBT taxpayers can request a penalty abatement by using the Departments portal, sending an email, filing a paper return and writing 21 at the top of the page, or request an abatement in writing.

New York Property Tax

Property taxes are assessed exclusively by counties and cities in New York State, which means that rates vary significantly from one place to the next. Effective rates – taxes as a percentage of actual value as opposed to assessed value – run from less than 0.7% to about 3.5%.

Surprisingly, the city with the lowest effective property tax rate is New York City, where property taxes paid total an average of just 0.88% of property value. The reason for that relatively low rate is that the taxable value of most residential property in New York City is equal to just 6% of the market value. That is, if your home is worth $500,000, you will only be charged taxes on $30,000 of that amount. Outside of New York City, however, rates are generally between 2% and 3%.

Regardless of city, if you are looking to refinance or purchase a property in New York with a mortgage, check out our guide to mortgages in New York. Weve got details on average mortgage rates and other information about getting a mortgage in the Empire State. You can also use our New York property tax calculator to find out what you would pay in property taxes in New York.

Recommended Reading: Opening A Llc In Ny

Instructions For Responding To A Bill Or Notice

We created step-by-step instructions to help you successfully respond to a bill or notice online. Whether you agree with our notice or bill, need to provide additional information, or want to challenge a Tax Department decision, responding online is the fastest, easiest way to resolve an issue.

New York Income Taxes

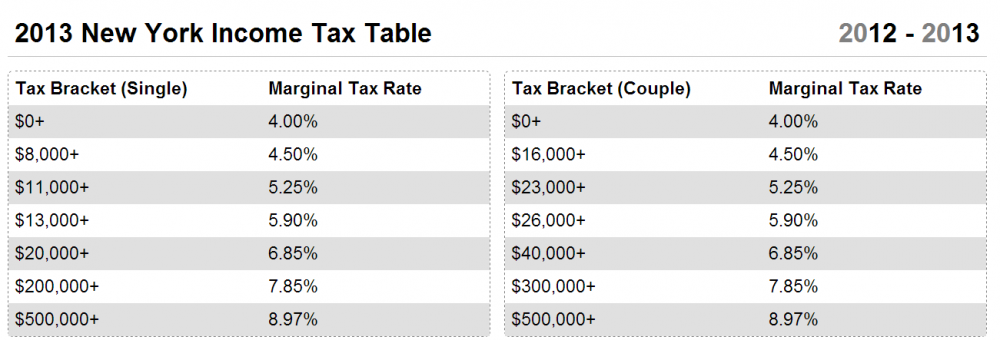

New York States top marginal income tax rate of 8.82% is one of the highest in the country, but very few taxpayers pay that amount. The state applies taxes progressively , with higher earners paying higher rates. For your 2020 taxes , only individuals making more than $1,077,550 pay the top rate, and earners in the next bracket pay nearly 2% less. Joint filers face the same rates, with brackets approximately double those of single filers. For example, the upper limit of the first bracket goes up from $8,500 to to $17,150 if youre married and filing jointly.

Don’t Miss: How Much Is Registration In Ny

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

New York Temporarily Suspends Hotel Occupancy Tax

New York City Mayor Bill de Blasio has issued an executive order suspending the 5.875% hotel occupancy tax imposed by NYC Administrative Code Section 11-2502 from June 1, 2021 through August 31, 2021. The daily hotel room tax under NYC Administrative Code § 11-2502 remains in effect. For additional information, please see the executive order released on May 18, 2021.

May 13, 2021

Also Check: How Much Does A New York Pass Cost

New York Provides Updates For Housing Development Fund Projects Covid

Effective April 16, 2021, New York exempts certain housing development fund projects from sales and use tax, and provides for a COVID-19 debt relief credit against corporate income tax. For specific details, please see L. 2021, A3006 . Further, New York has extended certain Brownfield credit periods for two years for specified taxpayers that failed to meet credit requirements due to COVID-19 pandemic restrictions. For information pertaining to the Brownfield credit extension, please see L. 2021, S2508 .

Whats Taxed And What Isnt

The majority of retail sales are subject to sales and use tax in New York. Some things, like cars and other motor vehicles, are taxed on the residence of the buyer and not the place where you actually buy the vehicle.

There are also a number of things that are exempt from sales tax. Some common examples are groceries, newspapers, laundering and dry cleaning, prescription drugs and feminine hygiene products. Clothing and footwear are not taxable if they are less than $110. If they are over $110, they are subject to regular sales tax rates. Any water delivered through mains and pipes is not taxable. However, public utilities like gas, electricity and telephone service are subject to sales tax.

Renting a car gets expensive in New York. If you rent a passenger car, New York state charges a sales tax of 6%. There is also a 5% supplemental tax if you rent the car within the metropolitan commuter transportation district . If you pay for any parking services , you will pay the New York sales tax of 4% plus any local sales taxes.

You can find a more complete breakdown of taxable goods and services with New York States Quick Reference Guide for Taxable and Exempt Property and Services.

Don’t Miss: Ship Alcohol To New York

What Is Exempt From New York Sales Tax

Like most states, New York sales tax doesnt extend to everything. Plenty of basic necessities like food thats not prepackaged or served at a restaurant and utilities are not subject to sales tax, whereas most other products you buy at the store would be. Some services are specifically subject to New York City sales tax as well, most of which include beauty or spa treatments like massages, electrolysis, manicures and pedicures, tanning and health salons.

Check Out: Tax-Free Weekends in Every State

How To File Taxes In New York

When tax time rolls around in New York, whether itâs monthly or annually, you must do three things:

New York requires that any seller with a sales tax permit file a sales tax return on your due date, even if you donât have any sales tax to report or pay. Even if you didnât make a single sale in New York during the reporting period, you should must do a âzero tax filing.â

Recommended Reading: Pay New York Ticket

Nys And Yonkers Withholding Tax Changes Effective January 1 2022

We revised the 2022 New York State personal income tax rate schedules to reflect certain income tax rate reductions enacted under the Tax Law. We also updated the New York State and Yonkers resident withholding tax tables and methods for 2022. These changes apply to payrolls made on or after January 1, 2022.

- Calculate 2022 New York State withholding tax amounts using Publication NYS-50-T-NYS , New York State Withholding Tax Tables and Methods.

- Calculate 2022 Yonkers resident and nonresident withholding tax amounts using Publication NYS-50-T-Y , Yonkers Withholding Tax Tables and Methods.

- NOTE: There were no changes to the New York City resident wage bracket tables and exact calculation methods. Please continue to use Publication NYS-50-T-NYC , New York City Withholding Tax Tables and Methods.

Other New York Fuel Excise Tax Rates

The primary excise taxes on fuel in New York are on gasoline, though most states also tax other types of fuel.

New York Aviation Fuel Tax

In New York, Aviation Fuel is subject to a state excise tax of 7.1 cents per gallon

Point of Taxation: first import into or production in the State

New York Jet Fuel Tax

In New York, Jet Fuel is subject to a state excise tax of 7.1 cents per gallon

Point of Taxation: Generally taxed on fuel burned on take-off from a NYS airport

Also Check: Price To Register A Car In Ny

Wise Is The Cheaper Faster Way To Send Money Abroad

Exporting or importing goods from abroad to sell in the US? Want to pay your sales tax via direct debit?

With Wise for Business, you can get a better deal for paying supplier invoices and buying goods overseas. Well always give you the same rate you see on Google, combined with our low, upfront fee so youll never have to worry about getting an unfair exchange rate.

That means you spend less on currency conversion, and have more to invest in growing your business.

Set up recurring direct debits from your Wise account, where payments will be automatically taken out on schedule. So it’s not only money you’ll be saving with Wise, but time as well.

Publication 831 Collection And Reporting Instructions For Printers And Mailers

Publication 831 provides information necessary for printers, mailers, or printer-mailers to collect and report the correct amount of New York State and local sales tax due on printing and mailing charges. The information includes a detailed sales distribution breakdown by jurisdiction for use when electing the alternative rate computation method. The Tax Department revises this publication whenever a tax or distribution rate change occurs.

Recommended Reading: Police Clearance Certificate Nyc

Save With Wise When Invoicing Clients Abroad

If you’re invoicing clients abroad, you could get a better deal on your international business transfers with a Wise Business account. We give you the same exchange rate you see on Google, no hidden markup fees. Link your Wise account to PayPal to receive and withdraw funds in different currencies to save on fees and set up direct debits for all your recurring payment needs.

Does New York Have An Inheritance Tax

Does New York have an inheritance tax? Not on most estates, but yes on very large estates. And you also have to be mindful of the federal inheritance tax, which applies to estates all over the country.

To understand New York inheritance tax, we will discuss some rules of the federal inheritance tax first. This will provide the context of understanding how New York inheritance tax rules work.

On December 22, 2017, the Tax Cuts and Jobs Act implemented substantial cuts to the inheritance tax and raised the lifetime estate exclusion amount, which resulted in many estates not being taxed at all. The main change, effective 2018, doubled the lifetime estate exclusion amount, which IRS clarified to be $11,180,000. In 2020, the inheritance tax exclusion amount will be adjusted for inflation and slightly higher. The New York inheritance tax exemption is very different.

New York is one of a handful of states that still taxes inheritance. In 2014, Gov. Cuomo led an estate tax reform in New York. With the idea of eventually matching Federal tax rates, the state legislature fixed inheritance tax rates through 2018 and thought to match the federal rates as of 2019. Alas, it was not to be. In 2020, the NYS inheritance tax exemption amount is set at $5.85 Million, adjusted for inflation. Thus, without the New York legislature intervention, there is a large taxation discrepancy between New York inheritance tax rates and Federal inheritance tax rates.

Recommended Reading: How To Register A Vehicle In Ny

Extended Filing And Payment Due Dates For New Yorkers Impacted By Post

If you were affected by Post-Tropical Depression Ida, we may have extended your due date. For more information, view N-21-5, Announcement Regarding Extension of Certain October 15 Deadlines for Taxpayers Affected by Post-Tropical Depression Ida.

If you applied for an extension of time to file your personal income tax or New York C corporation tax return but were not affected by Post-Tropical Depression Ida, your return is still due October 15, 2021.

New York State Budget Bill Highlights

New Yorks budget bill decouples from the CARES Acts increase to the limitation on the business interest deduction, according to IRC § 163 . Also, any references in New Yorks personal income tax laws to the IRC will not include changes made to the IRC after March 1, 2020, for taxable years beginning before 2022. Highlights of the bill include the following:

Personal income taxFor New York City, the current personal income tax rates are extended through 2022, thereby delaying the income tax changes to taxable years beginning after 2023.

Sales and Use taxApproximately 40 or so counties and three cities are allowed to impose additional sales and use taxes until November 2023.

The law extends the sales and use tax exemption to November 30, 2016, for certain purchases and services associated with the World Trade Center and Battery Park areas.

Real property taxFor the fiscal year 2021, special assessing units, which are cities, cannot increase the current base proportion of more than 5%. For special assessing units, which are not cities, cannot increase the current base proportion in the 2020 assessment roll to more than 1%.

For additional information, refer here.

You May Like: Nys Legal Name Change