Correcting Business Information Where A Nominee Was Used

In the event a nominee was used to obtain an EIN you are required to correct the information. Otherwise, information regarding an entity could be disclosed to someone who is not authorized to receive such information. The IRS is considering several ways to identify the responsible parties of entities. However, by updating the information itself, an entity can establish that it is a reliable partner of the IRS in complying with the Federal tax laws.

To update the information, complete Form 8822-B, Change of Address or Responsible Party Business, and send to the address shown below that applies to you.

| If your old business address was in: |

Send Form 8822-B to: |

|---|---|

| Connecticut, Delaware, District of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia or Wisconsin | Internal Revenue Service |

How To Do An Ein Lookup Online

You can locate a lost or misplaced EIN by the following

If you are trying to find the EIN of business other than yours there are a few options.

Paid Method of Finding an EIN For a Business

Try purchasing a business credit report from any of the major credit agency.

How To Change Or Cancel An Ein

Once you obtain an EIN for your business, that tax ID remains with your business for its entire lifespan. However, there are some situations where you might need a new business tax ID number.

Here’s when you’ll need to apply for a new EIN:

-

You incorporate for the first time or change your business entity

-

You buy an existing business or inherit a business

-

Your business becomes a subsidiary of another company

-

You are a sole proprietor and are subject to a bankruptcy proceeding

-

You are a sole proprietor and establish a retirement, profit sharing, or pension plan

-

You receive a new charter from your state’s Secretary of State

-

There are changes to your ownership structure

The IRS has a detailed list of situations where you need a new EIN. A new EIN replaces your old EIN, so once you get the new tax ID, you would use that on tax returns and other business paperwork moving forward.

Note that more common changes, such as changes to your business name or address, generally don’t require a new EIN. But you should still report a business name change or location change to the IRS.

Don’t Miss: How To Pay A Ticket Online New York

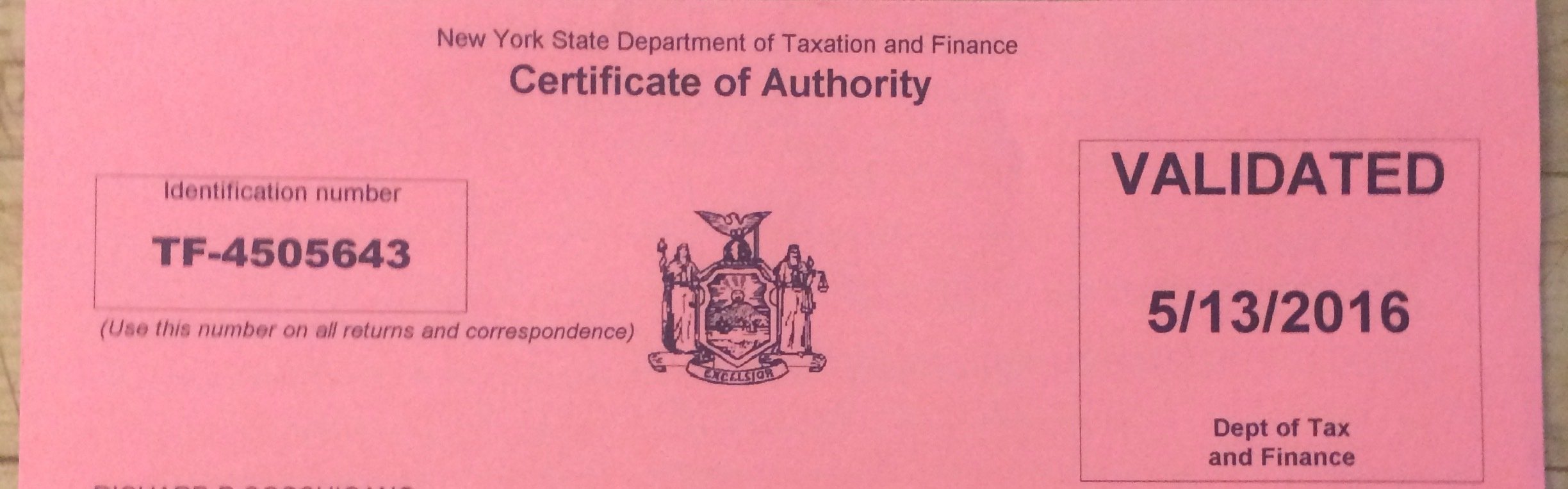

Who Needs A Sales Tax Certificate Of Authority In New York

A business must register as a vendor in New York when:

- A business has sales tax nexus. Nexus means having a physical presence in the state, such as having a physical location like a retail store or office or using a warehouse or fulfillment center to store inventory.

- Maintaining a place of business in the state , such as a store, office, or warehouse, and sell the taxable, tangible personal property or services to persons within the state or

- Soliciting business in New York State through employees, independent contractors, agents, or other representatives that sell tangible personal property or services in New York State or

- Soliciting business through catalogs or other advertising material that market tangible personal property or services and have some additional connection with the state or

- Selling taxable products or certain services within New York State

- A remote seller or an out-of-state business selling to New York residents and one of the following:

- Making total annual sales of tangible personal property to New York residents of $500,000 or more and

- Shipping 100 or more transactions to New York residents annually.

If you arent sure if you need to register, see the publication Do I Need to Register for Sales Tax?.

Get An Ein/tax Id Number

Once your Articles of Organization have been filed, you will need to obtain a Tax ID number, also known as an Employer Identification Number , through the IRS. Any LLC that has more than one member or any single-member LLC that wants to either hire employees or be taxed as a corporation is required to receive an EIN the application is completely free of charge.

You will need to use your EIN to identify your business to the IRS on all tax documents and necessary government filings the number acts much like a social security number for your LLC. If you want to hire employees, file federal taxes, open business bank or credit accounts or apply for business funding, you will need an EIN.

You can file the EIN application either online or by mailing it in. Keep in mind that if you are a foreign filer or do not have a social security number, you will need to file for your EIN through the mail.

Online

The quickest and easiest way to apply for your EIN is online you will receive your number once your application is completed. Visit the IRSwebsite to apply for your EIN for free.

You will need to fill out thisform when applying for your LLC by mail. If you are a foreign filer or do not have a social security number, leave section 7b blank. Mail the completed form to the address below. You can follow up on any questions with the IRS at 941-1099.

Internal Revenue ServiceCincinnati, OH 45999

Don’t Miss: How Much Are Tolls From Virginia To New York

The Benefits Of An Ein Number

An employer identification number offers many benefits for business owners. It allows you to:

- Preserve your limited liability since your business is a separate entity

- Open a bank account and obtain financing for your business

- Hire employees and have them follow instructions for Form 1040

New York Small businesses are often prone to identity theft, especially if you have to use your SSN. Separating your business from your own personal identity is essential to protecting your privacy and finances. Having an EIN also helps reduce the risk of identity theft because you can use your EIN instead of your social security number when dealing with suppliers or lenders.

What Is Required To Open A Bank Account In The Us

To open a US bank account, you will need two forms of a valid photo identification. You must submit a passport and a secondary ID, such as a student picture ID, state ID, or drivers license. You also need to provide immigration paperwork, including your visit or work visa. An EIN or Employer Identification Number should be included as well. This number is required to open a bank account in the US, or a US-based business. You should first obtain an International Taxpayer Identification Number before obtaining the EIN. The ITIN is needed for tax reporting if you are not a resident and do not possess a social security number . Most banks will require a US-based address and an initial deposit of $10 to $100. If you dont have a US address, you can solve this dilemma by obtaining a virtual street address. This address often comes with mail forwarding services. You can also receive mail through major US carriers, such as the US Post Office, UPS, and FedEx.

Also Check: How To Change Your Name In New York State

Filing Your Certificate Of Assumed Name Ny

If your business is incorporated, you are required to set up your DBA with the New York Department of State.

First, print a copy of the certificate of assumed name form. The application will ask for your new DBA name and information about your business, such as:

- Line 2: Your business entity type, ie. corporation, LLC, a general partnership.

- Line 4: Number and street of your principal New York business location or out of state address for foreign entities.

- Line 5: All counties where you do business or intend to do business.

- Line 6: Number and street of all of your New York business locations where you transact business.

A DBA does not offer any protection for your personal assets in the event that your business is sued. For more information on setting up an LLC , visit our How to Form an LLC page and select your state.

Submit Your Certificate of Assumed Name Form

Walk In

New York State Department of StateDivision of Corporations

474-1418

Include the and your written request for a certified copy, if required.

Payment and Fees

- $25 for the Certificate of Assumed Name

- $10 Certified Copy of Certificate of Assumed Name

- $150 2-hour processing, $75 Same day, $25 within 24 hours

Additional Fees For Corporations Only

- $100 for each NYC county where the business is or will be conducted within New York City

- $25 for each county where the business is or will be conducted outside New York City

- $1,950 to include every New York State county and the Certificate of Assumed Name combined

Why Does An Llc Need An Ein In New York State

Not every company needs this number. However, it comes with many benefits and its a good idea to apply for one. After all, you can get an EIN for free from the IRS!

This number is necessary if you have employees as you will need to generate a payroll for them. Please note that this also applies to a company with more than one member. Even if your company does not fall into these categories, getting this number helps you in:

- Opening a bank account: most institutions will require you to provide this number. Given that you must separate your finances and have an account to exude professionalism, it is in your best interests to have this ID. Plus, having such an account makes it easier for you to obtain loans by building a relationship with the financing institution. You also appear more credible to investors and other stakeholders who want to see that you are properly tracking your expenses and revenues.

- Hiring people: while you may not expect to hire people in the beginning, you may have to as the business grows. The government requires that employees file separate taxes and you must have this ID to generate a payroll for them. Plus, you cannot register for taxes if you do not have this ID. Instead of waiting for payday to get things in order, generate your number as soon as you get your company approved.

- Protecting your assets: by having this number, you will reinforce your limited liability protection. Plus, it makes it easier to ward off identity theft.

Don’t Miss: Where To Watch Kourtney And Kim Take New York

If I Dont Need An Ein Why Should I Get One

Even if your business, organization or entity is not required to obtain an EIN, it is highly recommended that you obtain one when starting or forming your business/organization for many reasons:

- Use your EIN instead of your SSN on business applications and licenses to protect your personal information

- Many state and local permits require that you have an EIN

- An EIN is required to open a business bank account

- EINs help to establish business credit history

- Minimize delays when you decide to hire employees

Frequently Asked Questions: Ein Number Lookup

Do I need an EIN if Im self-employed?

You dont need an EIN if youre self-employed you can simply use your Social Security number. Some people who are self-employed choose to apply for an EIN instead of using their Social Security number to reduce the risk of identity theft its less likely for someone to break into your accounts when you keep business finances and personal finances separate.

I have a sole proprietorship with a DBA . Do I Need an EIN?

Having a DBA doesnt impact whether or not you are required to have an EIN for your sole proprietorship. The same rules apply to a sole proprietorship with a DBA as apply to a sole proprietorship without a DBA.

Per the IRS, A sole proprietor without employees and who doesnt file any excise or pension plan tax returns doesnt need an EIN. Once you hire employees or file excise or pension plan tax returns, you will immediately require an EIN.

Is there a difference between an EIN and a TIN?

No, there isn’t a difference between an Employer Identification Number and a Taxpayer Identification Number . Both refer to the nine-digit number issued by the IRS to identify your business.

Is there a difference between an EIN and a FEIN?

No, there is not a difference between an EIN and a Federal Employer Identification Number . A FEIN can also be referred to as a Federal Tax Identification Number.

Also Check: Jack Spade Surprise Sale

Dont Have Your New York Payroll Account Numbers

To hire employees in New York, you must first register your business online. Online registration registers your business with both the New York Department of Labor and the New York Department of Taxation and Finance.

Upon completing registration, you will receive your eight-digit New York Employer Registration Number. Enter this number in the New York Employer Registration Number field.

If you only have seven of your full eight-digit Employer Registration Number, you can confirm the eighth digit by logging into your DOL Employer Home Page. From here, type in your FEIN and the seven digits of your Employer Registration Number you currently have and it will show you your full eight digit account number.

Your New York Withholding Identification Number will match your nine digit Federal Employment Identification Number . This information will auto-populate in the New York Withholding Identification Number field when you enter your EIN. If your business was assigned a branch code by the New York Department of Taxation and Finance, enter it in the second field. Otherwise, enter 00.

Note: Your New York Withholding Identification Number is only valid if you have registered with the New York Department of Labor and the New York Department of Taxation and Finance.

Sole Proprietor/individual Tax Id

Let IRS-EIN-TAX-ID government assist agents help you navigate through the complex process of obtaining your EIN number. It can be challenging to apply for a federal tax ID number because of the many forms that you need. Some sole proprietors and individual business owners dont even know which government offices to send their EIN paperwork to. IRS-EIN-TAX-ID takes the struggles and guesswork out of applying for an EIN number.

You May Like: Toll Cost From Baltimore To Nyc

What Our Clients Say About Us

We ask some of our clients what they think about the experience working with us. Here is what they think

-

“Thank you and all of the FilingsUSA.com team for your help in making starting my company easy.”

Alfredo DelacruzCEO –

-

“I commend you on the excellent customer service and the effective system you …Thanks, It is amazing!”

Dana MoralesPresident-

-

This is my second time ordering from FilingsUSA.com and I must say that the speed of action and support is AMAZING!!!

Alex Collins

Option : Check Other Places Your Ein Could Be Recorded

If you’ve misplaced your EIN confirmation letter, then you’ll need to get a little more creative to find your business tax ID number. Fortunately, once you get an EIN, your tax ID typically won’t change for the entire lifespan of your business. That makes locating the EIN easier.

These are some additional places where you can locate your EIN:

1. Old federal tax returns

2. Official tax notices from the IRS

3. Business licenses and permits and relevant applications

4. Business bank account statements or online account profile

5. Old business loan applications

6. Your business credit report

7. Payroll paperwork

Note that your EIN generally will not appear on business formation paperwork, such as articles of incorporation, articles of organization, or a fictitious business name document. These documents establish your business’s legal setup but don’t contain your business’s tax ID number.

Recommended Reading: Ny Tickets Online

New York State Tax Id

Outside of obtaining your Federal Tax ID in New York you will also likely need a New York State Tax ID. This ID is needed to pay business taxes, state income tax and/or sales tax on items you sell. Generally the State Tax ID is used for the follow:

- Sales and Use Tax

- Excise Taxes for items like Alcohol, Tobacco, Firearms, Oil & Gas, heavy machinery, etc.

For specific detail refer to the New York State Website at https://www.tax.ny.gov/pubs_and_bulls/tg_bulletins/st/how_to_register_for_nys_sales_tax.htm

Our Top Pick: Zenbusiness

Rating: 5/5

ZenBusiness is a well-rounded company that provides companies with several LLC services. This company makes it easy to create an LLC in New York and charges below-average prices. The cost for state LLC fees is $205 and the cost for State Corp Fees is $125. ZenBusiness also offers registered agent services, templates for operating agreements, and boasts impressive customer support.

Read Also: Average Cost Of Funeral In Nyc