Factors To Consider When Calculating Ny Car Sales Tax

The following are factors to consider when calculating how much sales tax you will pay for a vehicle in New York:

- Manufacturer or dealership cash incentives

- Manufacturer rebates

- Whether the vehicle is sold below fair market value

If you receive incentives or rebates when purchasing your car, the sales tax you will pay will be based on the price of the car after the incentives or rebates are subtracted. Additionally, when buying a car from a private party, you must submit a DTF-802 form with details of the transaction in the event that the car is bought for less than the market value.

Paper Carryout Bag Reduction Fee

The New York State Bag Waste Reduction Act authorizes counties and cities to impose a five-cent paper carryout bag reduction fee on paper carryout bags that sales tax vendors of tangible personal property provide to customers. Sales tax vendors that sell tangible personal property in a locality that imposes the paper bag fee must charge the fee for each paper carryout bag provided to a customer, even if the vendor does not sell any tangible personal property or a service to the customer. For a current listing of the localities that enacted the fee, see Publication 718-B, Paper Carryout Bag Reduction Fee. The fee is reported on Schedule E, Paper Carryout Bag Reduction Fee.

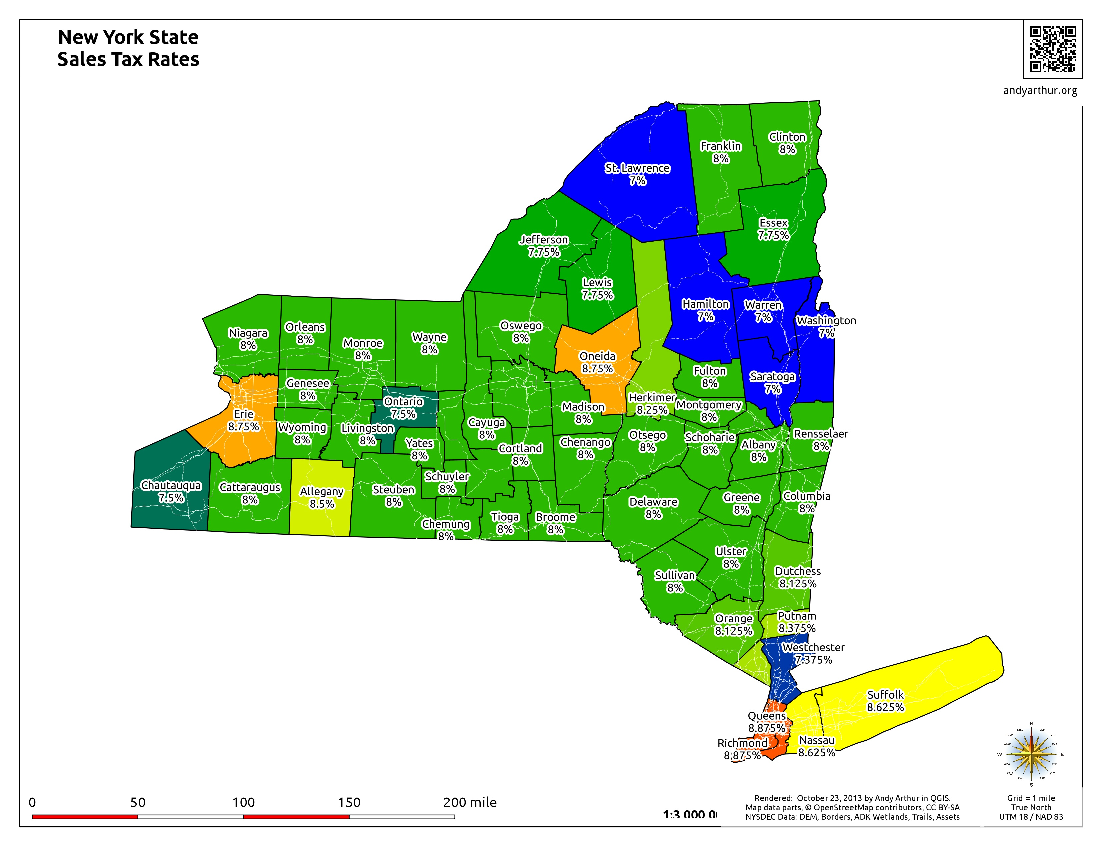

County City Taxes Mean New York State Sales Tax Rates Will Vary

Throughout the rest of the state, sales and use tax rates will vary depending on the county and city youre in. And New York counties typically add an additional 4 percent or more to your taxes every time you make a qualifying purchase. The highest rates are in the five counties that make up New York City, but Oneida and Erie county each have a 4.75 percent rate in addition to New Yorks 4 percent. The counties with the lowest additional sales tax rate are Saratoga County, Warren County and Washington County, only adding another 3 percent to every purchase.

Everything You Need to Know: New York State Taxes

Heres a look at each county in New York and its prevailing sales tax rate:

| 8% |

Don’t Miss: How To Delete New York Times Account

What State Has Lowest Sales Tax

Lowest and highest sales tax states It calculates Alaskas sales tax at 1.76 percent, still well below the national average of 7.12 percent. The lowest state and local sales taxes after Alaskas are in Hawaii , Wyoming , Wisconsin and Maine .

New York Sales Tax Rates

New York State sales tax varies by location. There is a state sales tax as well as by city, county or school district rates. New York Sales Tax Rate: 4% plus any local tax rate imposed by city, county or school district, typically between 3-5%.

New York Sales Tax Rate: 4%Maximum rate for local municipalities: 8.875%

New York Sales Tax varies by county, but a given county may have more than one rate due to local taxes. Therefore, a retailer cannot determine the tax rate simply by knowing the county. Likewise, New York sales tax also cannot be accurately determined by zipcode alone.

New York collects destination based sales tax, that is, local sales tax based on the destination of shipment or delivery within the state by businesses. There is no sales tax charge for deliveries outside the state. Learn more details at their website.

Don’t Miss: Tolls From Washington Dc To New York City

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

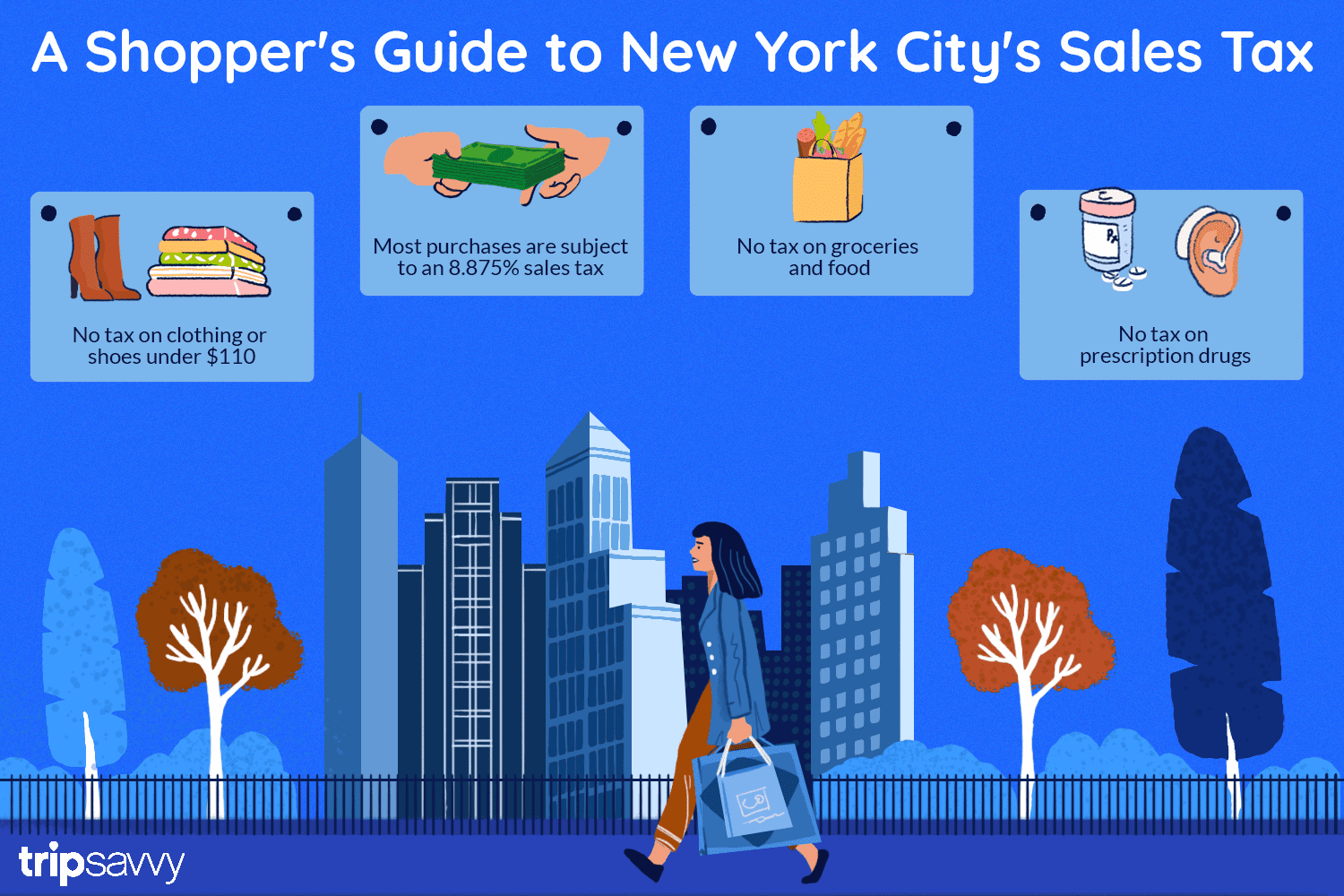

Other New York City Taxes

New York City charges a sales tax in addition to the state sales tax and the Metropolitan Commuter Transportation District surcharge. But food, prescription drugs, and non-prescription drugs are exempt, as well as inexpensive clothing and footwear.

There’s also a state and local tax on hotel rooms for inexpensive to moderately-priced rooms. This tax rate includes New York City and New York State sales taxes, as well as a hotel occupancy tax. Rooms renting for less expensive prices are subject to the same tax rates, but at lesser nightly dollar amount fees.

Medallion owners or their agents pay a tax for any cab ride that ends in New York City or starts in the city and ends in Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, or Westchester counties. This tax, known as the taxicab ride tax, is generally passed on to consumers. Medallion owners are those who are duly licensed with a medallion by the Taxi Limousine Commission of New York City.

You May Like: Plateman Staten Island Ny

Deferring Taxes In Sumdeferring Taxes In Sum

The above was a simple example. However, it would help if you also considered your mortgage. For example, if you had a $500,000 mortgage, the new mortgage loan is $400,000, that $100,000 is regarded as a profit. To avoid this, buy an apartment worth at least as much as your old home carry the same or higher mortgage.

There are also reverse exchanges where you buy the replacement property before selling yours. However, these are not practical since you buy the property with all-cash, but banks may be reluctant to lend.

Sales Taxes In The United States

Sales taxes in the United States are taxes placed on the sale or lease of goods and services in the United States. Sales tax is governed at the state level and no national general sales tax exists. 45 states, the District of Columbia, the territories of Puerto Rico, and Guam impose general sales taxes that apply to the sale or lease of most goods and some services, and states also may levy selective sales taxes on the sale or lease of particular goods or services. States may grant local governments the authority to impose additional general or selective sales taxes.

As of 2017, 5 states do not levy a statewide sales tax.California has the highest base sales tax rate, 7.25%. Including county and city sales taxes, the highest total sales tax is in Arab, Alabama, 13.50%.

Sales tax is calculated by multiplying the purchase price by the applicable tax rate. The seller collects it at the time of the sale. Use tax is self-assessed by a buyer who has not paid sales tax on a taxable purchase. Unlike the value added tax, a sales tax is imposed only at the retail level. In cases where items are sold at retail more than once, such as used cars, the sales tax can be charged on the same item indefinitely.

Read Also: Toll Calculator New York

The Nyc Child And Dependent Care Credit

Full-year and part-year New York City residents who paid child care expenses for children under the age of four might be eligible to claim the Child and Dependent Care Credit.

Your household federal adjusted gross income must be no more than $30,000 as of 2020. The credit amount can be as much as 75% of your New York State dependent care credit, depending on your income.

You can claim both the city and state credit if you qualify. This is a refundable credit.

What Is The Tax Rate For New York City Nyc

The City Sales Tax rate is 4.5%, NY State Sales and Use Tax is 4% and the Metropolitan Commuter Transportation District surcharge of 0.375% for a total Sales and Use Tax of 8.875 percent.

You can use this link to find precise NY locations sales tax rates by address for all other locations in NY state

You can use this link to get a more accurate sales tax rate for all other states, locality by zip code:

I hope this was helpful?

Recommended Reading: How To Pay A Ticket Online New York

Where Does New York Sales Tax Go

For the last full fiscal year, the state of New York collected $15.2 billion in sales taxes, which comprised about a fifth of its total tax revenue but just a third of what was collected from state income taxes. That money goes toward covering the nearly $100 billion in State Operating Funds spent each year.

In the city of New York, sales taxes also pay for a smaller but important share of the citys total budget. The 8.66 percent of the citys income coming from sales tax is the fifth-largest source of funding behind federal grants , income tax , state grants and property taxes . Thats all a part of the approximately $82 billion in tax revenue collected by the city against expenditures of just over $85 billion.

More on Money and Taxes

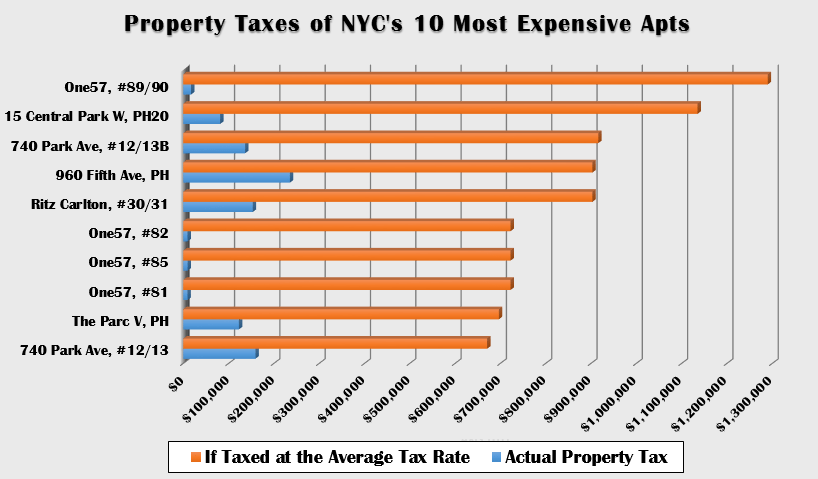

What Is Tax Abatement In Nyc

A tax abatement is a tax break on property or business taxes. In NYC, owners of co-ops and condos who meet certain requirements can qualify to have their property taxes reduced. The requirements include using the co-op or condo as a primary residence, not owning more than three residential units in any one development , and not being part of the Urban Development Action Area Program.

You May Like: How To Submit Poetry To New York Times Magazine

How Much Is The Car Sales Tax In New York

When buying a car in New York, you will pay a 4% sales tax rate for your new vehicle, according to Sales Tax States. This statewide tax does not include any county or city sales taxes that may also apply. Sales taxes for a city or county in New York can be as high as 4.75%, meaning you could potentially pay a total of 8.75% sales tax for a vehicle in the state.

The lowest city tax rate in New York is found in Pleasantville, which has a rate of 4%. The highest possible tax rate is found in New York City, which has a tax rate of 8.88%. The average total car sales tax paid in New York state is 7.915%. New York is one of the five states with the highest rate of local vehicle sales taxes.

Who Must Pay New York City Income Tax

Every income-earning individual, estate, and trust residing or located in New York City must pay the city’s personal income tax. Taxpayers who live in NYC for only part of the year can calculate their tax based on the number of days they resided there.

New York City government employees who were hired on or after Jan. 4, 1973, must pay the tax even if they don’t live in the city. They must pay a city income tax equal to what they would have paid had they resided in the city.

The city tax is in addition to any income tax you might owe the state of New York.

Recommended Reading: Renew Italian Passport Nyc

Is There A Tool That I Can Use To Calculate Ny Car Sales Tax

To calculate the sales tax you may pay for a vehicle in New York, you can use the tool provided by the New York State Department of Taxation and Finance website. This tool enables individuals to input their zip code and address to get an estimate of the total state and local taxes they may be subjected to pay for a vehicle. You will then multiply the sales price of your vehicle by the tax rate provided for your address in New York.

Services Subject To Tax In New York City

New York City collects sales tax on certain services that the state doesnt tax. Examples include beautician services, barbering, tanning and massage services. The city also charges sales tax at health and fitness clubs, gymnasiums, saunas and similar facilities. If youre trying to improve your credit, keep in mind that New York City charges sales tax on most credit reporting services.

Read Also: When Is Rolling Loud New York

How Much Are Ny Documentation Fees

Dealerships often charge buyers something known as documentation or doc fees in addition to taxes. These fees account for the costs incurred by the dealership when preparing and filing the necessary documentation for the purchase of a vehicle. The average documentation fee is $75 in the state of New York.

Everything You Need To Know About Sales Tax Tips And Extra Fees In Nyc

Youre on vacation in New York and I guess you do not want to talk about sales tax, expenses I understand perfectly! However, you must know that in the United States and especially in New York, prices appear without taxes. To avoid bad surprises when you get to the cashier, Ill give you some advice.

You May Like: Toll Calculator Ny

What Is Not Taxed In New York

The Tax Law exempts purchases for resale most sales to or by the federal and New York State governments, charitable organizations, and certain other exempt organizations sales of most food for home consumption and sales of prescription and nonprescription medicines. Sales tax also does not apply to most services.

How To Identify The Rate And Compute Sales Tax

Example: Taxpayer A lives in Saratoga County and travels to a mall located in Albany County to purchase a new television. The sales tax due is based on the combined state and local rate in effect in Albany County because that is where Taxpayer A took ownership and possession of the television, even though the television will be used in Taxpayer A’s home in Saratoga County.Example: Taxpayer B lives in Dutchess County but works in White Plains in Westchester County. At lunchtime, they bring their car to a shop near work to have the oil changed. Sales tax will be collected at the combined state, Westchester County, City of White Plains, and MCTD rates because those are the combined rates in effect where they took possession of the car on which the maintenance service was performed. If the repair shop delivered the car to them in Dutchess County, then the Dutchess County rate would have applied instead of the Westchester County and White Plains rates. The MCTD rate would still apply since Dutchess County is in the MCTD. Example: Taxpayer C shops online and orders a new tea pot from an Internet retailer. The tea pot will be delivered to their home in Erie County. Taxpayer Cs purchase will be subject to sales tax at the combined state and Erie County rate since the tea pot is being delivered to them there.

You can use two resources to find the correct combined state and local sales tax rates:

Recommended Reading: Watch Kourtney And Kim Take New York

New York City Property Tax

The New York City Department of Finance values residential and commercial properties. A tentative value value assessment is sent out to property owners on May 1 each year for most communities. A final assessment is then sent out if there aren’t any changes.

New York City assessments are based on percentages of market value, and those percentages can vary based on the type of property. You have a right to appeal if you don’t agree with your assessment.

Property tax rates are set each year by the mayor and by city council, and they can vary depending on the type of property. They’re applied to property values to help determine each homeowner’s annual tax liability. Property taxes are due either in two semi-annual payments for homes with assessed values of more than $250,000, or four quarterly payments for homes with assessed values of $250,000 or less.

New York City offers several exemptions and property tax reductions, including exemptions for senior citizens, veterans, and the disabled. The New York State STAR exemption for owner-occupied housing is also available, as well as property tax abatements or reductions for certain individuals.

The 2021-2022 New York State budget also gives homeowners a break in the form of a tax credit for any portion of real property taxes that exceeds 6% of their qualified adjusted gross incomes if their QAGI is less than $250,000.

What Is Nyc Sales Tax

NYC sales tax varies depending on the item being purchased. Clothing and footwear under $110 are exempt from NYC sales tax. Sales tax on most other items and services is 4.5%. The city charges a 10.375% tax and an additional 8% surtax on parking, garaging, and storing vehicles for a total tax of 18.375%. There is a Manhattan Resident Parking Tax exemption from the 8% surtax.

Don’t Miss: Madame Tussauds New York Parking