How A Jumbo Loan Works

If you have your sights set on a home that costs close to half a million dollars or moreand you don’t have that much sitting in a bank accountyou’re probably going to need a jumbo mortgage. And if youre trying to land one, youll face much more rigorous credit requirements than homeowners applying for a conventional loan. Thats because jumbo loans carry more credit risk for the lender since there is no guarantee by Fannie Mae or Freddie Mac. There’s also more risk because more money is involved.

Just like traditional mortgages, minimum requirements for a jumbo have become increasingly stringent since 2008. To get approved, youll need a stellar credit score700 or aboveand a very low debt-to-income ratio. The DTI should be under 43% and preferably closer to 36%. Although they are nonconforming mortgages, jumbos still must fall within the guidelines of what the Consumer Financial Protection Bureau considers a qualified mortgagea lending system with standardized terms and rules, such as the 43% DTI.

What Is A 30

A jumbo mortgage is a home loan that exceeds the typical lending limits of the Federal Home Loan Mortgage Corporation , Federal National Mortgage Association , the Federal Housing Administration or the Veterans Administration.

Loans sold to Fannie Mae or Freddie Mac are referred to as conventional loans or conforming loans since the mortgage amount “conforms” to these firms’ underwriting standards and lending limits.

Each year, Congress establishes jumbo loan limits.

Most counties in the United States have standard lending limits.There are a few counties that are exempt.Jumbo loans are those that exceed the following lending limitations.

- 1-unit homes: $548,250

- 4-unit homes: $1,054,500

Mortgage Rates New York State

Inquire with a loan consultant about jumbo financing in expensive neighborhoods in NYC such as SoHo, Tribeca, Midtown, Chelsea, Boerum Hill, Flatiron district, as well as Ossining, Northport on Long Island, Long Beach, Somers, New Rochelle, Yorktown Heights, Setauket, Brooklyn, Dix Hills and Manorville to secure financing for these neighborhoods with home values that average have a starting price tag of $778,000.

Loan amount and terms of 5, 7 & 10 Year Jumbo ARMs are available as well as 30-year and 15-year program. Rates and terms may vary from lender to lender.2020 Maximum Conforming Loan Limits for high cost areas in the Empire State are:Bronx, New York, Queens, Westchester, Kings, Nassau, and other high cost Counties1 Unit – $625,500 3 Unit – $967,950 4 Unit – $1,202,925

Once again multi-million dollar financing is available for luxury homes and magnificent estates in New York:

Many can be found in this article from the Business Insider that have median sales prices of $2 million

Also Check: Www.nyc.gov/parkingservices

Local Loan Limits New York County Ny

FHA and conventional Loan limits vary based on the number of living-units on the property. FHA loans are only allowed on 1 to 4 living-unit properties.These 1 to 4 unit properties can be purchased with an FHA loan as long as the owner occupies one of the unit.Properties with over 4 units are considered commercial and do not quality for FHA or conventional loans.

How Much Can I Borrow With A Jumbo Loan

Some lenders are more comfortable lending large sums than others. So, if you wish to borrow several million dollars, you may have to shop around more carefully than someone borrowing less than $1 million.

But multimillion-dollar jumbo loans are quite common in high-cost areas. So it shouldnt be too hard to find what you need.

Many lenders, including Bank of America and Quicken Loans, routinely lend up to $2 million. And some go higher. But note that many lenders are shy about detailing their jumbo loan offerings online. So youll likely have to call and chat with a loan officer to learn whats available.

If you want to know how much you can actually borrow with a jumbo loan, get pre-approved by a mortgage lender.

The pre-approval process looks at your income, assets, credit, and down payment to determine how much you can borrow. This is the only real way to know how much house you can afford.

You May Like: Plateman Staten Island Ny

Jumbo Vs Conventional Loans: The Bottom Line

The bottom line is that theres usually no contest between jumbo vs. conventional loans. If youre borrowing within local loan limits, you can get a conventional/conforming loan. And if your loan amount exceeds that limit, youll get a jumbo loan.

Yes, jumbo loan rates can sometimes be higher than conventional loan rates. But thats not always the case.

As with any mortgage, you can find the best deal by shopping around between lenders. And with todays mortgage rates at historic lows, there are good deals to be had for conventional and jumbo loan borrowers alike.

Ready to get started?

Popular Articles

Resources

Conforming Loan Limits By County

This website provides 2021 conforming loan limits by county, as well as FHA limits. In 2021, the baseline loan limit for most counties across the U.S. will be $548,250, an increase from the 2020 cap of $510,400.

More expensive markets, such as New York City and San Francisco, have conforming loan limits as high as $822,375. Anything above these maximum amounts would be considered a jumbo mortgage.

The PDF and Excel spreadsheet files above were obtained from FHFA.gov. They are offered here as a convenience to our visitors. You can download them to your computer, in either format, and refer to them as needed.

Read Also: How Much Are Tolls From Virginia To New York

Is A Jumbo Loan A Bad Idea

A jumbo loan is not a bad idea if you can comfortably afford the monthly mortgage payments. As with any home loan, that depends on your income and your current debt load.

You can use a mortgage calculator to estimate your future monthly payment and find to whether a jumbo loan might make sense for you.

Of course, nobody likes being in debt. And if you have alternatives a bigger down payment, perhaps, or a smaller home youll want to consider those.

But most people see mortgages as good debt. And a bigger loan can even offer benefits down the line, like more home equity and a bigger profit when you sell. So weigh the risks and rewards of your loan options, as you would for any major financial decision.

Conventional Loan Limits Faqs

Will conventional loan limits increase in 2022?

Most likely. Conforming loan limits are set annually based on national home prices, which skyrocketed in 2021. Usually, the Federal Housing Finance Agency releases the coming years limits in November or December. The FHFA compares home prices reported in its House Price Index during the third quarter versus the third quarter of the previous year. In 2020, home prices had increased more than 7% compared to 2019, which lifted conforming limits by $37,850. There could be an even larger dollar increase for 2022, due to rapid home appreciation in 2021.

Did 2022 conventional loan limits increase to $625,000?

No. Many lenders started offering conforming loans up to $625,000 starting in late-2021 in anticipation of a large increase for 2022. The official limit is still $548,250 in most areas. However, homebuyers and refinancing homeowners can get a bigger loan now by applying with lenders that offer increased limits, including Fairway Independent Mortgage Corporation, which owns Home.com. Lenders plan to hold these loans on their books until January when they can most likely sell them to Fannie Mae or Freddie Mac, assuming the agencies increase their limits to at least $625,000.

What is a conforming loan?What is a conforming high-balance loan?What is the jumbo loan limit for 2021?

Technically there is no jumbo loan limit. Lenders can set their own jumbo loan limit, which can be upward of several million dollars.

You May Like: Tolls From Baltimore To Nyc

Jumbo Mortgage On A Home Purchase

If youre buying a one-unit primary property with a loan amount of up to $2 million, youll need to have a minimum median FICO®Score of 680 and a minimum down payment of 10.01%.

The maximum debt-to-income ratio must be no higher than 45%.

If the primary residence has more than one unit or the loan amount is higher than $2 million, you may have slightly different credit score requirements, and youll need to make a higher down payment up to 25%, depending on the loan amount and type of occupancy.

You May Have To Undergo A Second Appraisal

To prove your home is actually worth the amount of money youre borrowing, lenders may require a second appraisal of the property before closing. A home appraisal is a formal evaluation of the homes market value by looking at the property size, exterior, and interior condition and any home improvements and renovations.

Stay in the know with our latest home stories, mortgage rates and refinance tips.

In your inbox every Thursday

- A valid email address is required.

- You must check the box to agree to the terms and conditions.

Thanks for signing up!

Read Also: When Is Rolling Loud New York

Where To Find A Jumbo Loan

Many private lenders, traditional banks, and online lenders offer jumbo loans.

Banks often like jumbo loans because of their high credit quality, short duration, and wider spread than other loans and securities, Bardos said. In other words, they tend to be lucrative and lower-risk.

Additionally, dont be surprised if you see jumbo loan rates lower than standard conforming loan rates. Thats because banks like to lure high-net-worth individuals with attractive jumbo loan terms in order to gain their business for other financial products.

But thats not always the case. Many lenders will require higher rates and down payments. If youre interested in a jumbo loan but are wary of putting down 10%, shop around. Lenders can set their own criteria for jumbo loans, and they may have programs that allow you to put down less particularly if youre in a medical profession.

Some physician loan programs allow recent medical school graduates, residents, surgeons, and a number of other physician types to buy high-value homes with less than 10% down.

Jumbo Loans Vs Conforming Loans: Which Is Better

If you dont need a big, expensive home with unconventional terms attached to the loan, a conventional loan with rules set by the federal government is likely to be far more in your favor as a homebuyer, Solomon said.

Opting for a conforming loan gives you access to loans with as little as 3% down that allow you to use gift funds toward your down payment, reducing the amount of money you need upfront.

It may also be harder to qualify for a jumbo loan than a conforming loan.

Common criteria

| 45% | 45% |

Again, lenders can set their own criteria. While one company might allow a jumbo loan down payment of less than 10%, another might not approve jumbo borrowers unless their credit scores are above 700 and they can show substantial cash reserves to cover the mortgage payment.

If you have significant savings, high income, and good credit, a jumbo loan can certainly expand your homebuying possibilities. Youll have access to a greater number of properties, likely in very desirable areas, and a better shot at getting a home with all of your desired amenities.

But just because you can qualify for a jumbo loan doesnt mean you should take the maximum amount offered.

Just be careful when planning your home purchase, Solomon cautioned. While you want to have a house thats big enough to last through your plans, you dont want one so big and fancy that you are wasting money.

As a bankruptcy attorney, he said he often observes clients getting in over their heads.

Read Also: Madame Tussauds New York Parking

How To Qualify For An Fha Loan In Nassau County New York

The minimum loan amount in Nassau County is $5,000 dollars and may go up to $1,581,750depending on home size and loan type.In order to qualify for an FHA loan, you must be planning to live in the home.Although a loan can include some renovation costs,FHA loans cannot be used for real estate investments in Nassau County.

Additionally, your loan amount cannot exceed the value of home you are purchasing. Learn more about FHA Loan Requirements.

Local Loan Limits Nassau County Ny

FHA and conventional Loan limits vary based on the number of living-units on the property. FHA loans are only allowed on 1 to 4 living-unit properties.These 1 to 4 unit properties can be purchased with an FHA loan as long as the owner occupies one of the unit.Properties with over 4 units are considered commercial and do not quality for FHA or conventional loans.

Don’t Miss: Nyc To Cabo

How Much Money Will I Need For The Down Payment And Closing Costs

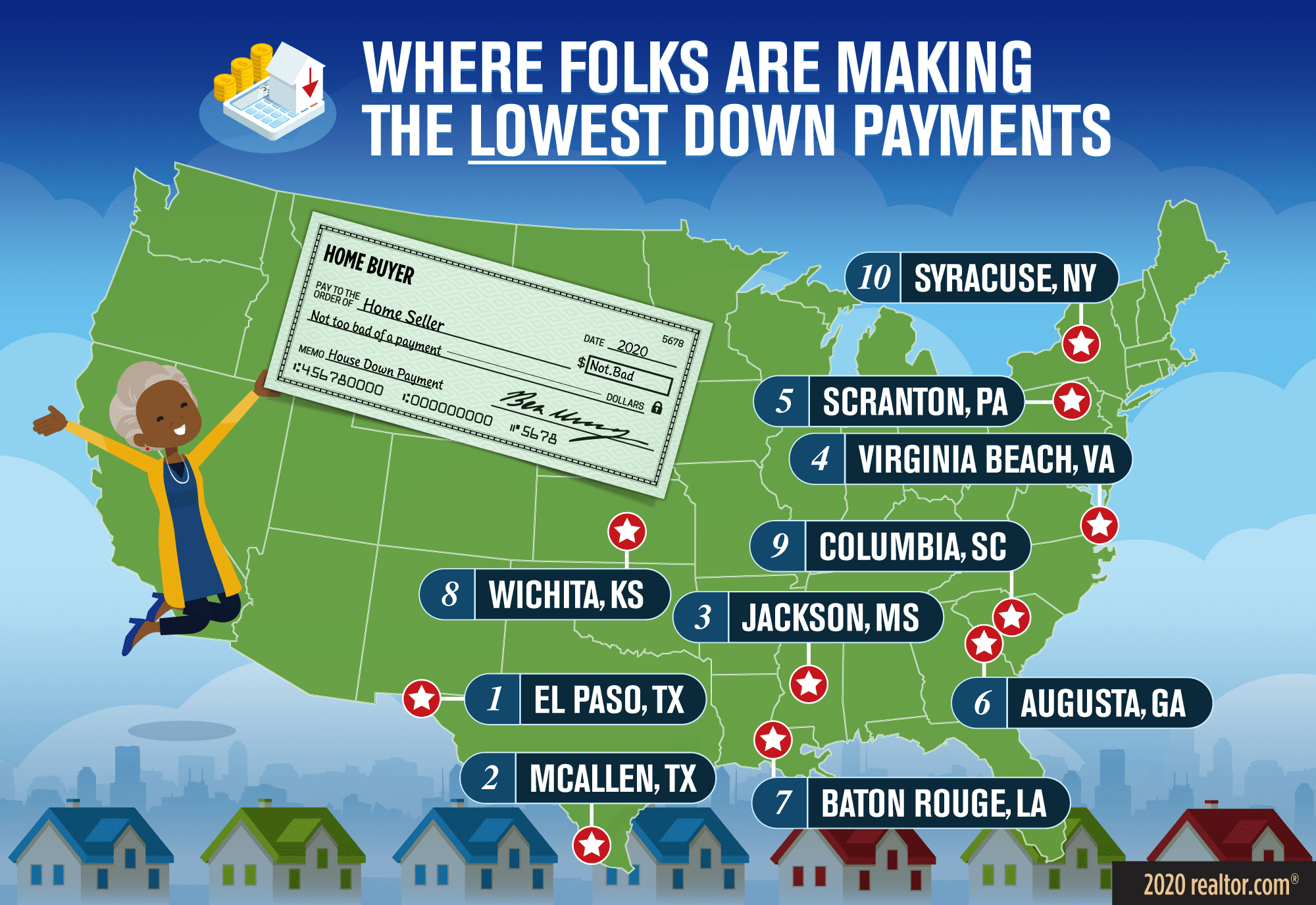

Conventional home loans require the home buyer to invest between 3% and 20% of the sales price towards the down payment and closing costs. If the sales price is $100,000 for example, the mortgage applicant must invest at least $3,000 $20,000 to meet conventional mortgage down payment requirements, depending on the program.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Recommended Reading: How Much Are Tolls From Virginia To New York

Who Should Take Out A Jumbo Loan

How much you can ultimately borrow depends, of course, on your assets, your credit score, and the value of the property you’re interested in buying. These mortgages are considered most appropriate for a segment of high-income earners who make between $250,000 and $500,000 a year. This segment is known as HENRY, an acronym for high earners, not rich yet. Basically, these are people who generally make a lot of money but don’t have millions in extra cash or other assets accumulatedyet.

While an individual in the HENRY segment may not have amassed the wealth to purchase an expensive new home with cash, such high-income individuals do usually have better credit scores and more extensively established than the average homebuyer seeking a conventional mortgage loan for a lower amount. They also tend to have more solidly established retirement accounts. They often have been contributing for a longer period of time than lower-income earners.

Don’t expect a big tax break on a jumbo loan. The cap on the mortgage interest deduction is limited to $750,000 for new mortgage debt.

These are just the sorts of individuals that institutions love to sign up for long-term products, partly because they often need additional wealth management services. Plus, it’s more practical for a bank to administer a single $2 million mortgage than 10 loans valued at $200,000 apiece.

Jumbo Mortgage Requirements How To Qualify For A Jumbo Mortgage

Typically, a borrower must meet the following criteria to be eligible for a jumbo loan:

Lower Debt-to-Income RatioSince jumbo loans have more associated risk, the lender may require the borrower to have a lower debt-to-income ratio. Monthly mortgage payments may be larger than that of a conforming loan, so having less monthly debt obligations can help a lender determine your ability to repay the loan.

Higher Down PaymentIt is common for the down payment requirement to be higher than that of a conforming loan to mitigate the lenders risk. If you have more invested in the property, you may be less likely to default on the loan.

Higher Credit ScoreLenders may prefer that you have a higher credit score. A higher credit score may show a history of a strong ability to repay monthly debts on time and in full.

Higher Reserves & AssetsIt is common for lenders to require higher than usual reserves and assets for borrowers applying for a jumbo loan. The lender will review your reserves and assets to understand the strength of your financial profile overall.

Second AppraisalA jumbo loan may require a second appraisal on the subject property to evaluate the homes actual value and make sure it aligns with the anticipated loan-to-value.

Don’t Miss: How Much Are Tolls From Virginia To New York

Tips For Finding The Right Lender

- Before you sign off on any loan, its important that you understand your current financial situation and future financial plans. SmartAssets free financial advisor matching tool will help you find a financial advisor in your area who can help you with that. Find a local advisor and get started today.

- If youre interested in taking out a large loan, its important that you do your research. SmartAsset has compiled its list of the best jumbo mortgage loan lenders to get you started.

- If youre a first-time homebuyer, youll want to make sure youre not missing any important information. Check out SmartAssets guide to the best mortgage lenders for first-time homebuyers to learn more.