Reserving A Name For Your Llc

If you’re not quite ready to start your business, you can reserve a name for 30 days with the Secretary of State by filing an Application for Reservation of Name and paying a fee of $20. First, conduct a New York business search and learn the state’s business naming rules to ensure you choose a name that meets legal requirements.

What Is The Llc Tax Rate In New York

Businesses are generally are taxed on the income the derived from the state in which they were formed. Generally, this is referred to as a corporate income tax.

You may be wondering what is the LLC tax rate? Or how is an LLC taxed? In New York, corporate income tax can vary greatly depending on the entity type, tax elections made, and other financial considerations. Understanding the New York corporate tax structure can be difficult, but it is important for understanding how these taxes apply to your business and for ensuring your business is paying the appropriate amount of taxes to the state.

In New York, corporate income tax appears in the form of a corporation franchise tax when applied to New York C-corporations and New York S-corporations. For New York limited liability companies, limited liability partnerships, and general partnerships, corporate income tax is referred to simply as a filing fee.

Registering A Corporation In New York

Becoming a corporation can be complicated. Many small business owners decide to hire a lawyer to get through the process. In order to incorporate, owners must:

- File a Certificate of Incorporation with the Department of State.

- Create bylaws.

- Report taxes and other employee information.

- Request a Federal Employer Identification Number from the Internal Revenue Service .

- Apply for business permits and licenses.

- Submit your entity’s first report.

- Pay all incorporation fees.

Recommended Reading: Who Owns Resorts World Casino New York

Pay The New York Llc Tax

You know what they say death and taxes, etc.

New York LLCs also have to pay an annual filing fee to the Department of Taxation and Finance . The rate changes based on the gross income of your LLC. For LLCs making less than $100,000 a year, the rate is $25.

To pay, youll file Form IT-204-LL with the DTF by the 15th of the third month following the end of your tax year. So if your tax year ends December 30th, youll need to pay your annual fee by March 15th.

Registering With The State

In New York, businesses can handle nearly all of their state tax obligations online once they have a business online services account. You can create an online services account on the state website and start receiving and paying bills on that same platform.

New York requires businesses that have the capacity to file and pay taxes online. Once registered, then you can use your business account online to handle estimated tax withholding for employees, annual tax returns, sales tax, and more.

Also Check: How To Submit Poetry To New York Times Magazine

What Is The Main Tax Benefit Of An Llc

The key concept associated with the taxation of an LLC is pass-through. This describes the way the LLCs earnings can be passed straight through to the owner or owners, without having to pay corporate federal income taxes first. Sole proprietorships and partnerships also pay taxes as pass-through entities. These businesses pay no federal income taxes themselves. Instead, their earnings are passed directly to their owners, who pay taxes on them at their individual income tax rates.

This is different from standard C corporations, which are subject to double taxation. More specifically, the corporation must pay taxes on its income. Then, any distributions to its owners are also taxed as individual income. Clearly, avoiding double taxation can save significant money in the long run. Thats one of the main tax benefits of an LLC.

Getting A Certificate Of Good Standing In New York

Some organizations may request that you prove your LLCs compliance with laws and tax requirements. In many states, this proof is provided with a Certificate of Good Standing. Rather than a New York Certificate of Good Standing, the state calls this proof a New York Certificate of Existence or a New York Certificate of Status. To get one, you’ll need to submit a written request to the Department of State and include a $25 fee.

You May Like: Where Is Woodstock New York

What Are The Tax Benefits Of An Llc

One of the most popular ways to organize a business is as a limited liability company, otherwise known as an LLC. LLCs require less paperwork than C corporations and S corporations, while giving owners some of the same protections against being held personally liable for any actions of the business. But the true advantage of this title comes in the form of tax benefits. LLCs give business owners significantly greater federal income tax flexibility than a sole proprietorship, partnership and other popular forms of business organization.

Make sure you have a financial plan in place for your small business. Talk to a financial advisor today.

How To Dissolve A New York Corporation

A certificate of dissolution must be filed with the New York Department of State in order to dissolve a New York corporation. It must be accompanied with a written consent form from the New York State Department of Taxation and Finance. In cases where the corporation has worked with and incurred tax liability with the City of New York, a Consent of the New York City Commissioner of Finance form must also be attached.

Don’t Miss: Is Online Betting Legal In New York

Capital Gains Taxes In New York

The most important tax issue to be aware of when buying or selling a home in New York is capital gains. Capital gains are defined as the profits you make as a result of a real estate or property purchase. You can think of it as the difference between the selling price and the purchase price.

The amount of capital gains tax on your sale depends on various numbers and conditions. They include everything from the condition of the property to whether or not the buyer is a legal resident of the United States. Each different adjusts the percentage. There are also plenty of deductions available, including the fees paid for the origination of the loan application, closing costs, and points paid back on a loan to get a lower rate on the mortgage.

Generally speaking, capital gains taxes are around 15 percent for U.S. residents living in the State of New York. If the hose is located within New York City, you have to account for another 10% in NYC taxes. However, its possible that you qualify for an exemption.

If the house was the sellers primary residence for at least two years within the last five years, capital gains are limited to $250,000 for an individual and $500,000 for a married couple.

One of the key takeaways from all of this is that it benefits the owner to live in the residence for at least two years before deciding to sell the house. If you do, you will have more time to reinvest the capital gain from the sale of the house.

How Do Llc Taxes Work

An LLC is typically treated as a pass-through entity for federal income tax purposes. This means that the LLC itself doesnt pay taxes on business income. The members of the LLC pay taxes on their share of the LLCs profits. State or local governments might levy additional LLC taxes. Members can choose for the LLC to be taxed as a corporation instead of a pass-through entity.

There are several types of LLC taxes. The federal government, as well as state and local governments, levy these taxes. All LLC members are responsible for paying income tax on any income they earn from the LLC as well as self-employment taxes. Depending on what you sell and whether you employ anyone, you might also be responsible for paying payroll taxes and sales taxes. To complicate things even more, an LLC can opt to be taxed as a different business entity.

In this guide, well cover the entire range of LLC taxes, what youll be responsible for, and options for reducing your tax bill. Understanding your tax burden in advance can help you make smarter financial decisions.

Read Also: How To Set Up An Irrevocable Trust In New York

Bare Minimum Cost To Open An Llc In New York

Navigation

To register LLC in New York, be fully prepared to invest your personal time and money. But how much does an LLC cost? For an effective budget outline, you should first learn about the basic steps involved in formation.

There are two main types of New York LLC formation costs: mandatory and optional. The key required costs are:

- $200 for New York LLC filing

- $50 for the certificate of publication.

Other common costs that are optional in nature include:

- $20 for name reservation

- $49+ formation company fees, with the lowest rates belonging to ZenBusiness.

How Long Does It Take To Form An Llc

You can form an LLC within 24 hours. However, you normally have to wait a couple of days to receive the necessary documents in the mail to prove that your LLC has been formed. This may be necessary for opening a bank account. Again, if you form online, it will be much faster.

Some banks may require you to show an operating agreement before they will open an account for your LLC.

The publication requirement has to be completed within 120 days of formation. Notwithstanding, you can start doing business with your LLC as soon as it is born. If you fail to fulfill the publication requirement, your business loses the authority to conduct business in New York with the expiration of the 120 day period. This is not as bad as it sound, as explained here.

Don’t Miss: How Long Is The Lemon Law In New York State

Does An Llc Pay Taxes

A one-member LLC is treated as a disregarded entity. The only member reports income, losses, and deductions of her LLC on her personal federal and state income tax return like a sole proprietor.

A multi- member LLC is normally treated as a partnership for tax purposes. Just like a partnership, the LLC does not pay taxes, but files an informational return

Members report their share of the LLCs income, loss, and deductions on their individual state and federal tax return. For this reason, an LLC is also known as a pass-through entity.

Federal Taxes For Your Llc

Federal taxes are filed with the IRS.

Most LLCs in New Jersey with default tax elections are tax-reporting entities with the IRS and not tax-paying entities. Meaning, the LLC doesnt file its own tax return with the IRS, but rather the profits and losses flow-through to the owners and the owners are responsible for filing them on their personal income return.

A New Jersey LLC with 1 Member is taxed as a Disregarded Entity:

- If the LLC owner is an individual, the LLC is taxed like a Sole Proprietorship

- If the LLC owner is another company, the LLC is taxed like a branch/division of the parent company

In LLC/Sole Proprietorship taxation, the LLC doesnt file its own federal return, but rather, the LLC owner reports and pays the taxes via their personal income tax return . The profits and losses from the business will likely be reported on a Schedule C. You may also need to include additional Schedules and Forms, depending on how the income is derived.

A New Jersey LLC with 2 or more Members is taxed as Partnership.

In LLC/Partnership taxation, the LLC is a tax-reporting entity and has to file its own federal information return and issue K-1s to each Member . The K-1 is then attached to the owners personal income tax return .

Besides the default tax elections, you can request that the IRS tax your LLC like a Corporation instead.

There are two types of corporate taxation for LLCs:

- LLC taxed as C-Corp

- LLC taxed as S-Corp

Don’t Miss: How To Order My Birth Certificate From New York

Sole Proprietorship Taxes In New York

With a sole proprietorship as your business entity in New York, you dont need to worry about any specific New York state taxes on your business. As the lone owner of your business, all of your business income counts as personal income for your tax return, and you will pay taxes according to your personal rate.

The personal income tax rate in New York uses tax brackets based on the level of income, just like the federal system. The tax rate starts at 4% for income up to $17,150, and the rate will go as high as 8.82% for income starting at $2,155,350.

What Is An S Corporation

An S corporation is a business corporation that elected a special tax treatment with the federal tax authorities and/or the New York State tax authorities.

Otherwise, an S corporations characteristics are just like a regular business corporation, which means that it is a legal entity that can be formed by one or more persons. Once a corporation is formed, the S corporation will enter into all contracts, issue all invoices and undertake all business activities.

Note: Professionals can only form a professional corporation.

Also Check: Is The New York Stock Exchange Open

Corporation Vs Llc In New York State

As you gear up to start a business in the Empire State, you are still deciding between a limited liability company and a corporation. While the LLC is the more popular choice, you should choose the model best suited for your particular business.

Under New York state law, you can incorporate your business as either a C corporation or an S corporation. If you operate a professional service business, you can only form a professional corporation.

This article provides an overview of the LLC and corporate models and how they compare with one another.

Limited Liability Companies And Taxes

A single member LLC has a default classification as a disregarded entity. Because of this, the owner of the LLC is not considered an employee. Therefore, any income received from the company is not a salary.

Instead, the Internal Revenue Service considers the single member to be self-employed. Any income received is considered earnings from self-employment.

An advantage of an LLC by someone who has a day job and starts a side business is that the losses from the LLC can offset the salaried income.

In general terms, profit and loss are calculated by deducting the business expenses of the LLC from its revenue. A business expense is one that is considered to be ordinary and necessary and one that a reasonable business would use. For example, a home-based courier business would not be allowed to deduct the payments for a leased Ferrari because it’s not ordinary nor is it reasonable that you would drive a Ferrari to deliver items.

A necessary item is something the business needs to operate. It does not mean the item must be indispensable, but it does need to be helpful and appropriate for the enterprise.

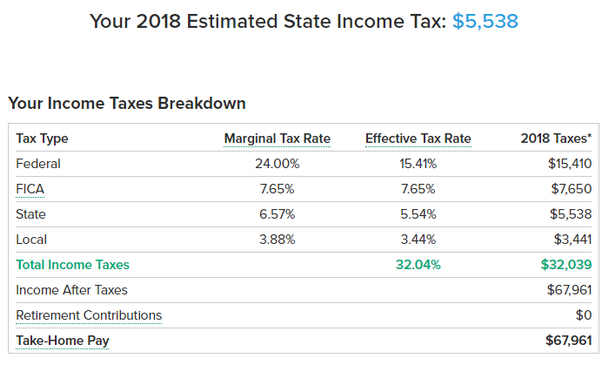

The federal government taxes 92.35 percent of the net earnings from self-employment. Up to a specified threshold, self-employment income is taxed at a rate of 15.3 percent. This breaks down to 12.4 percent for Social Security and 2.9 percent for Medicare. For self-employment earnings above the annual ceiling amount, only the 2.9 percent Medicare tax is used.

Read Also: Where Is The Wax Museum In New York

New York Llc Name Reservation Fee

Name reservation is not required for opening an LLC in New York, but it could be quite handy for those planning a late launch.

If you already have a perfect LLC name but dont want to register your business quite yet, you can reserve your option for up to 60 days and renew it 2 more times. Each renewal requires a new submission of the Application for Reservation of Name along with its $20 fee.

Name reservations costs can be avoided if you register immediately by getting your Articles of Organization approved and thus legitimizing your company.

Women In Business Tools And Resources

If you have a woman-owned business, many resources are available to help you concentrate on your businesss growth:

Our information and tools will provide educational sources, allow you to connect with other women entrepreneurs, and help you manage your business with ease.

Also Check: How Many Nursing Homes In New York State

Know Tax Exemptions For New York Home Buyers & Sellers

You are going to want to be aware of the many tax exemptions that exist when buying or selling homes in New York. First, if you own a house as a primary residence for at least two years and you have to sell it due to unavoidable circumstances that require relocation , you can receive a tax exemption. When it comes to health reasons, youll need to make sure you have a letter from a physician that describes the issue in detail, just in case there is an audit at a later date.

You can also qualify for a real estate tax exemption for unforeseen circumstances. What does that mean, exactly? Well, the IRS defines it as the occurrence of an event that you could not reasonably have anticipated before buying and occupying your main home. Some of the examples include natural disasters, divorce, death, multiple births from one pregnancy, terrorism, or a change in employment status. Its quite a wide set of parameters to choose from. Youll want to consult IRS Publication 523 to get an even clearer idea of what qualifies as unforeseen circumstances.

Going back to capital gains, there is a provision in the tax code that allows those enlisted in the Army, Navy, or National Guard do not need to have lived in the house for at least two years in order to receive the exemption. Also, instead of five years, you have to have used it as a primary residence within the last ten years, accounting for the fact that some military members are away on active duty.