What Is The Highway Use Tax In Ny

How to get an IFTA Sticker ? The state of New York applies its own HUT for many different motor carriers. These are carriers that operate vehicles across New York State public highways. Every tax rate of a New York carrier is unique. The HUT tax rate gets based on how much a truck or vehicle weighs. Check out Driver Qualification Files .

Starting a Trucking Company Package . All motor carriers have to pay the New York Highway Use Tax. This applies to both intrastate and interstate carriers. These are trucking companies that operate motor vehicles on public highways. And this refers to only New York State public highways. The HUT tax gets based all miles traveled across public highways in New York. Carriers have to maintain records of miles traveled each day, for every vehicle. Contact us to get California DOT number .

When To File New Mexico Weight Distance Tax

you must have to pay the Weight distance tax return each Quarter on due date to avoid penalty if your commercial vehicle travel in the State of New Mexico and fall in the above listed requirements to pay New Mexico WDT which is due on each Quarter by

- January – March: Due Date

- April – June: Due Date

- July – September: Due Date

- October – December: Due Date

How Your Highway Use Tax Is Determined

The tax is based on mileage traveled on New York State public highways and is computed at a rate determined by the weight of the motor vehicle and the method that you choose to report the tax. When completing your first return for the calendar year, you must choose to use either the gross weight methodor the unloaded weight method to compute your tax. After you select a method, you:

- must use the same method to compute your tax for each return filed during the year,

- cannot change the selected method until the following year, and

- must use it for all your vehicles.

You should base your method on your particular operations. One method may be more economical or convenient for you. For additional information concerning methods of computing HUT, see Tax Bulletin Howto Determine Your Highway Use Tax .

Also Check: Where Is The Wax Museum In New York

Excluded And Exempt Vehicles

Certain vehicles are excluded from the highway use tax registration requirements if they are used for the purpose for which they were designed. Other vehicles may be exempt from the HUT registration requirements if used exclusively for an exempt activity. See Tax Bulletin Excluded and Exempt Vehicles – Highway Use Tax .

Fuel Use Tax Trip Permit

Instead of obtaining an IFTA license and decals and paying fuel use tax by filing a return, you may fulfill your fuel use tax obligations by obtaining a trip permit for each jurisdiction traveled.

For trips in New York State, you may use the New York State fuel use tax trip permit for any vehicle subject to the fuel use tax. A 72-hour trip permit can be ordered through a service bureau. New York State charges a fee of $25.00 for a trip permit. The service bureau may charge a fee in addition to the cost of the permit. You may not apply for more than ten trip permits during a single calendar year.

Also Check: How To Delete New York Times Account

Eligibility For New York Hut

The following vehicles are required to apply for New York Highway Use Tax:

Those vehicles have a gross vehicle weight of 18,000 lbs and more. Or if you are using the unloaded method to file your taxes, the trucks that weigh more than 8,000 pounds and trucks that weigh more than 4,000 pounds are required to register for New York Highway Use Tax.

And second, those semi-trailers, trucks, tractors that transport automotive fuel, are required to file for New York HUT along with an Automotive Fuel Carrier Certificate.

What Is The New York Highway Use Tax

New York State imposes a highway use tax for motor carriers operating certain motor vehicles on NYS public highways . The weight of the motor vehicle and the method you choose to report your taxes determines the tax rate you must pay.

In order to get a HUT permit, you must first obtain a certification of registration and decal for each vehicle in your fleet.

You May Like: How Much Does A Hotel Cost In New York City

What Is The Penalty And Interest Rate For Filing A Late Quarterly Fuel Tax Report In New York

New York charges a late penalty of $50 or 10% of the net tax due, whichever is greater. Interest is computed on overdue taxes in each jurisdiction at a rate of .4167% per month. Even if you are due a net refund, interest still applies to each jurisdiction for any underpayment of fuels use tax to that jurisdiction. This interest is calculated from the day after the IFTA quarterly due date for each month, or fraction of a month, until paid.

Beginning October 1 2021

Renew your credentials and pay your renewal fees online with One Stop Credentialing and Registration . Its fast, easy, and secure.

If you cannot renew electronically, call us to request Form TMT-1.2, Renewal Application for Highway Use Tax and Automotive Fuel Carrier Certificates of Registrations and Decals 24th Series.

Submit your renewal application by November 30, 2021, to ensure your decals arrive in time to place on your vehicles by January 1, 2022.

Don’t Miss: Rolling Loud New York Price

How Do I Apply For An Ifta License In New York

You will need to contact New York directly to receive your IFTA application Form IFTA-1, New York State International Fuel Tax Agreement License Application and mail the completed license application to:NYS TAX DEPARTMENT W A HARRIMAN CAMPUS ALBANY NY 12227-0163 On or before November 30 of each calendar year, NY will send you an application for renewal of your IFTA license and decals. If you do not receive your application, you can download the application from the NY Tax Web site at www.tax.ny.gov.

Trucking Jobs In 30 Seconds

Every month 400 people find a job with the help of TruckersReport.

Atlanticus trucking said:

do i need a NY HUT sticker? i have a ram 3500. the website says below. My truck weighs 9000lbs without the trailer / load. it mentions below about if the truck gross weight is over 18k lbs. does that 18k lbs include the loaded trailer? cause if so then id be over the 18k. if not then im below. can anybody clarify?

Atlanticus trucking said:

do i need a NY HUT sticker? i have a ram 3500. the website says below. My truck weighs 9000lbs without the trailer / load. it mentions below about if the truck gross weight is over 18k lbs. does that 18k lbs include the loaded trailer? cause if so then id be over the 18k. if not then im below. can anybody clarify?

You May Like: How To Pay A Ticket Online New York

Ifta & Ny Hut Permits

New York State is a participating member of the International Fuel Tax Agreement . IFTA, which is in effect in most states and Canadian provinces, simplifies the reporting of fuel use taxes by allowing a motor carrier to report to a single base jurisdiction all the fuel use taxes that it owes to the various IFTA member jurisdictions. Under IFTA, a carrier needs only a single IFTA license for all its qualified motor vehicles. In addition, the carrier must obtain two IFTA decals for each qualified motor vehicle. The carrier must obtain both the license and the decals from the carriers base jurisdiction. The license and decals will allow those vehicles to travel in all IFTA member jurisdictions.

New York State also imposes a highway use tax on motor carriers operating certain motor vehicles on New York State public highways . The tax is based on mileage traveled on NYS public highways and is computed at a rate determined by the weight of the motor vehicle and the method that you choose to report the tax.

Duplicate Certificate Of Registration

If a certificate of registration is lost, mutilated, or destroyed, you may:

- request a duplicate certificate online at OSCAR, or

- file Form TMT-334, Application for Duplicate and/or Replacement Highway Use Tax and/or Automotive Fuel Certificate of Registration and/or Decals.

There is a $1.50 fee for each duplicate certificate.

You May Like: How Much Does Artificial Insemination Cost In New York

Don’t Miss: Toll Calculator Dc To Nyc

New Mexico Weight Distance Tax

The registrants, owners and operators of commercial motor vehicles having a declared gross weight or actual gross vehicle weight over 26,000 pounds and who are using highways in New Mexico are subject to the weight distance tax for use of the highways. They must have to pay New Mexico Weight Distance Tax for each vehicle operated in New Mexico.

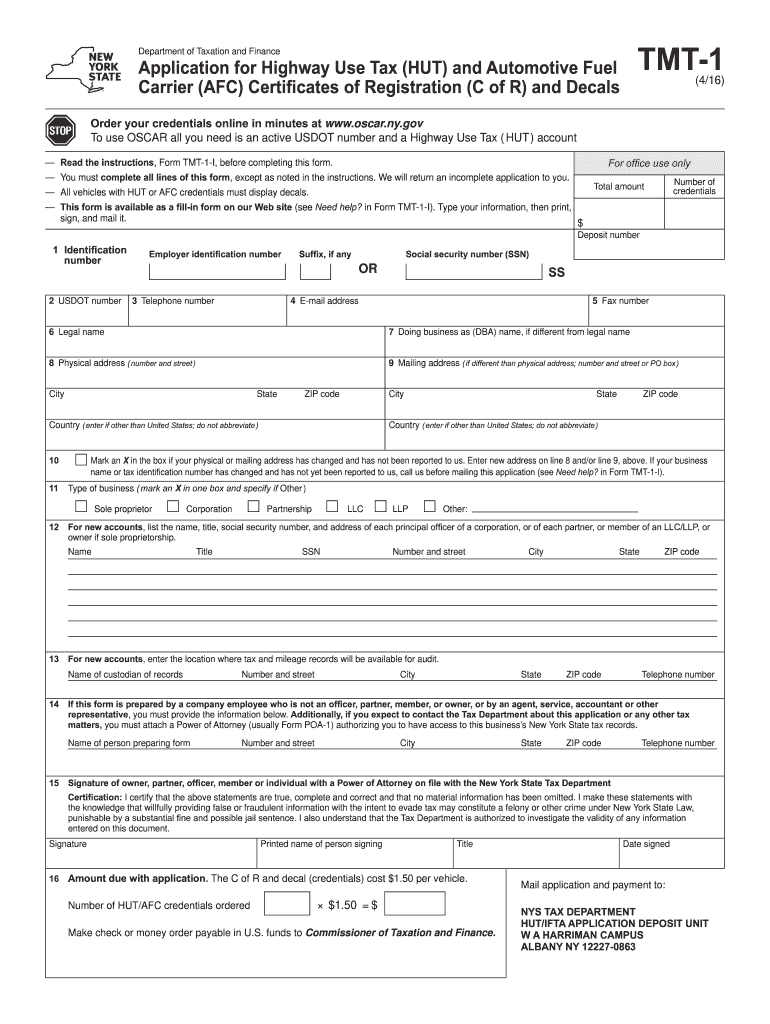

How To Apply For Your Hut And Afc Credentials

OSCAR New York State provides a single point of contact to apply for various operating credentials over the Internet. After you establish a HUT account, many services are available to you on OSCAR. Currently, within OSCAR you can:

- add a vehicle to your HUT fleet

- transfer license plates from an existing International Registration Plan vehicle to a new IRP vehicle

- convert a commercial vehicle license plate to an IRP plate

- revise HUT/AFC credentials or

- cancel HUT/AFC credentials.

To establish your account and request your credentials, file:

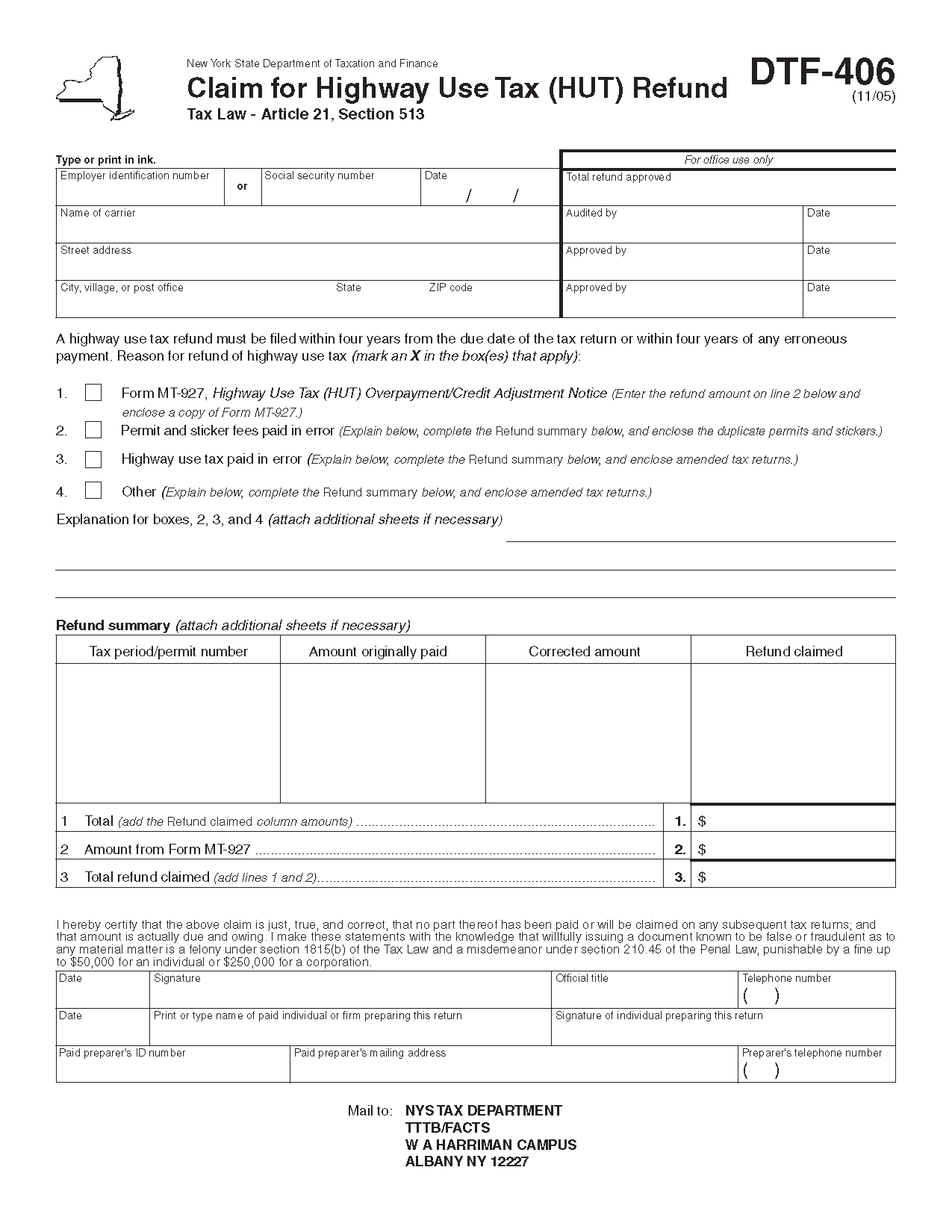

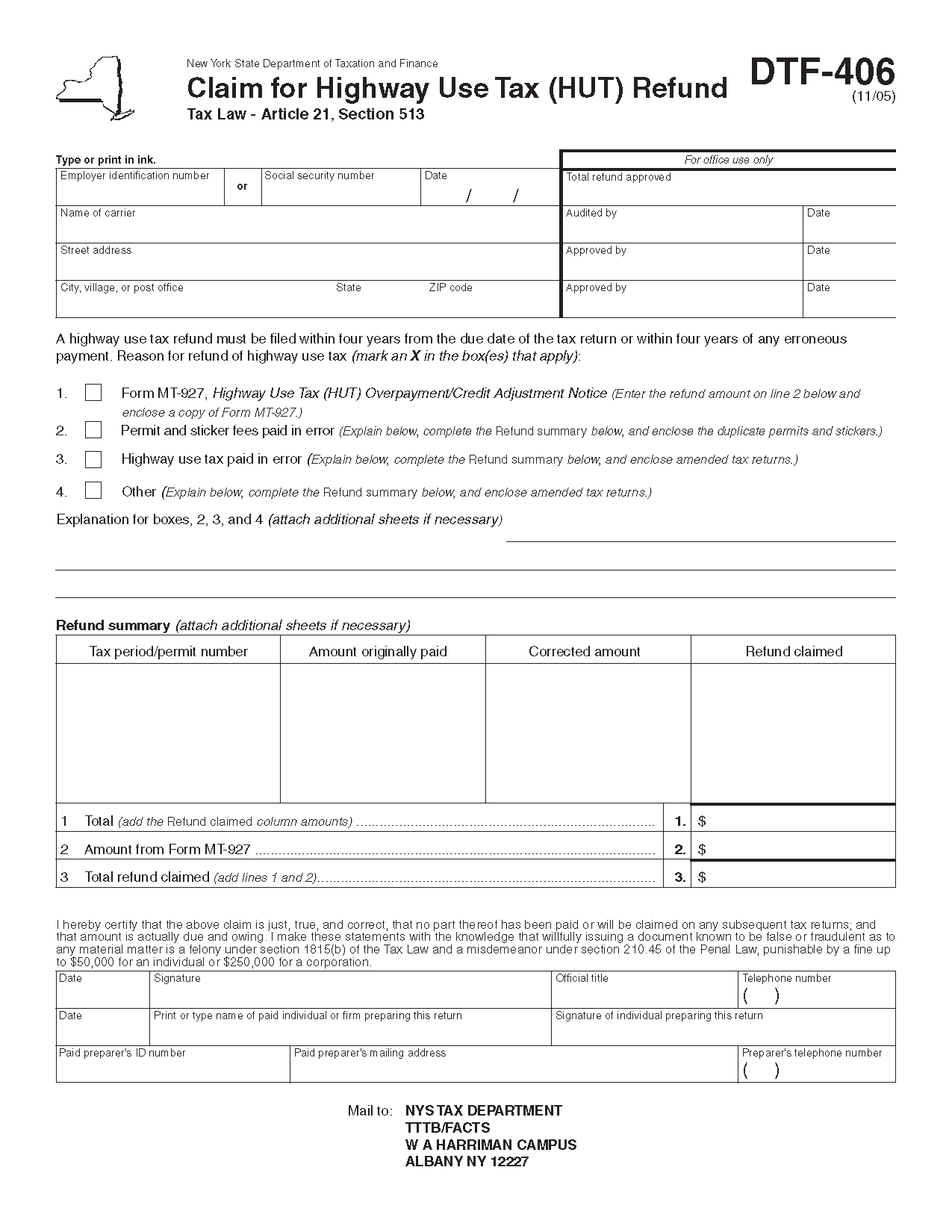

- Form TMT-39, New Account Application for Highway Use Tax and Automotive Fuel Carrier . If you plan to obtain your HUT credentials online, use OSCAR, or

- Form TMT-1, Application for Highway Use Tax and Automotive Fuel Carrier Certificates of Registration and Decals.

Recommended Reading: Do You Need A License To Register A Car In Ny

How To Get The New York Highway Use Tax Registration Certificate And Decals

DOT Filing can assist you with any type of paperwork regarding the IFTA license and fuel permits. We provide a full-range registration service for your business. Our agents process all documentation carefully and effectively. Using our services, you will receive the required permit, license and application as easy and soon as possible! Give us a call at 818-568-0644 and get your permit!

Temporary Credential Or Receipt Of Application

As a carrier, you may acquire HUT/AFC credentials to be used immediately if you:

- already have a HUT account and use OSCAR, or

- use a permit service company approved by the Tax Department. To obtain a list of approved permit service companies, call the Miscellaneous Business Tax Information Center.

Order your temporary HUT and AFC credentials online at OSCAR or through a permit service company approved by the Tax Department. Print Form TR-8, Temporary Credential or Receipt of Application, and carry it in the motor vehicle until the Tax Department issues a certificate of registration and decal.

Read Also: What Airlines Fly To Cabo San Lucas From New York

How To Apply For A New Divisible Load Overweight Permit

Step 1: If you do not have a Customer Account with us, complete the Account Maintenance Form to establish an Oversize/Overweight Permit Customer Account. There is no fee to establish an account. To submit the form, see Step 5.

If you are a commercial carrier, you must have a USDOT number. For USDOT number information, see the USDOT Information Page.

Existing customers who already have established an Oversize/Overweight Permit Customer Account may skip Step 1 unless they need to update any account level information.

Step 2: For each power unit to be permitted, complete an Application for a New Divisible Load Overweight Permit Perm 61.

If permitting a combination , there is only space on the application for one trailer information. Additional trailers will require the completion of one or more trailer attachment forms:

- Trailer Attachment Form Perm 93 is used if the additional trailers and all future trailers will have the same length, axle ratings, axle spacings, Gross Vehicle Weight Rating and/or Sum of Manufacturers Tire Ratings.

Step 3: Provide a copy of the current power unit registration or, if apportioned, the cab card showing New York State as an operating jurisdiction.

Step 4: Determine the correct fee for the permit type applied for and any trailers associated with the permitted power unit. Refer to Types of Divisible Load Overweight Permits Perm 69 for fee information.

Step 5: Submit the forms and any other requirements via email, fax or mail.

Applying For A Trip Permit

If you already have an Oversize/Overweight Permit Customer Account, follow these steps:

To apply yourself:

Step 2: Fill out the Special Hauling Permit Application Perm 39

If the vehicle/load is 14 high or over, 100 long or over, or 16 wide or over, a route survey form is required. Route surveys must be performed by NYS Certified Escorts .

Step 3:Mail completed form and all supporting documentation to the address listed at the top of the form. OR bring it to address listed or any one of our NYSDOT application sites.

Step 4: Make sure your account has sufficient funds. You can either send a check with the application or Prefund your account.

To apply via a Service Company:

Step 1: Choose from an .

Read Also: Submit To The New York Times

What Is The New York Highway Use Tax And Who Needs It

New York State imposes a highway use tax for motor carriers operating specific motor vehicles on NYS public highways . The weight of the motor vehicle and the method that you choose to report your taxes determines the tax rate that you must pay.

In order to receive a HUT, you must first obtain a certification of registration and decal for every vehicle in your fleet.

You May Like: Where To Stay In New York Tourist

Renewing Your New York Ifta License

Your IFTA license and decals expire each year on December 31st. However, your current license and decals may remain displayed during the IFTA sticker grace period that extends through February of the coming year. To avoid any delays or penalties, you should submit your IFTA license application before November 30th. If you are not compliant with all IFTA fuel use taxes, your application will not be approved.

IFTA New York allows you to file for your renewal license electronically and pay online using IFTA Web File if you prepare tax documents yourself, use a computer to prepare filings, and have broadband Internet access.

Recommended Reading: New York Times Paywall Smasher For Google Chrome

How To Apply For New York Hut

Qualified motor carriers should apply to the New York State Department of Taxation and Finance for a certificate of registration and decal. After approval, the decal must be affixed near the license plate of the motor carrier. The application can be done under the following categories.

HUT Certificate of Registration

This registration is for motor carriers and other private vehicles with a Gross Weight of 18,000 pounds and more.

Automotive Fuel Carrier Certificate of Registration

This registration is for motor carriers transporting automotive fuel.

Temporary New York HUT Permits

This registration is for motor carriers that occasionally travel across New York. They have the option to purchase a trip certificate of registration that allows them to operate in New York without having to register, obtain a decal, or file HUT tax returns. Motor carriers are allowed to apply for the temporary permit ten times in a calendar year.

What Is The New York Hut Mileage/highway Use Tax

WHAT IS THE NEW YORK HUT MILEAGE/HIGHWAY USE TAX

New York Highway use tax at a glance

What is the highway use tax?

The highway use tax is imposed on motor carriers operating motor vehicles on New York State public highways . The tax is based on mileage traveled on New York State public highways and is computed at a rate determined by the weight of the motor vehicle and the method that you choose to report the tax.

In general, the gross weight method is used to compute your tax and determine your registration requirements. However, you may elect to use the unloaded weight method to compute your tax and determine your registration requirements. You must use the same method for all your motor vehicles.

What vehicles are subject to the highway use tax?

The following motor vehicles are subject to tax depending on whether the gross weight method or unloaded weight method is used. Any truck, tractor, or other self-propelled vehicle with a gross weight of more than 18,000 pounds.

Gross weight method

Certificate of Registration

Before operating in New York State, you must obtain a certificate of registration for each motor vehicle subject to the tax. Certificates of registration, a HUT certificate of registration and an automotive fuel carrier

Beginning January 1, 2013, you must affix a decal to each vehicle that is required to have a certificate of registration.

WHAT IS THE NEW MEXICO MILEAGE/HIGHWAY USE TAX

New Mexico Highway use tax at a glance

Don’t Miss: Wax Museum Nyc Times Square