Nyc Real Estate Market Trends In September 2022

Let us now look at the most recent trends in the New York City real estate market. New York has also been one of the hardest hit by the COVID-19 pandemic, with the highest job losses among the country’s major metropolitan areas. It has been recovering from the economic effects of the pandemic. Inventory shortages and strong buyer demand continued to drive up home prices, with multiple offers on a limited number of homes being a common occurrence in the majority of market segments.

Data by Redfin shows that the median sales price of homes in New York was $800,000 last month, up 0.1% since last year.

- In September 2022, New York home prices were up .0% compared to last year, selling for a median price of $800K.

- On average, homes in New York sell after 54 days on the market compared to 58 days last year.

- There were 3,185 homes sold in September this year, down from 3,815 last year.

- The average sale price per square foot in New York is $617, down 4.8% since last year.

New York Migration & Relocation Trends

The current market dynamics point to a slowdown in New York City housing market as well. According to StreetEasy data, the cancellation rate listings under contract that have returned to the market without closing, as a percentage of all in-contract listings increased to 1.7% by September, the highest level since the pandemic began.

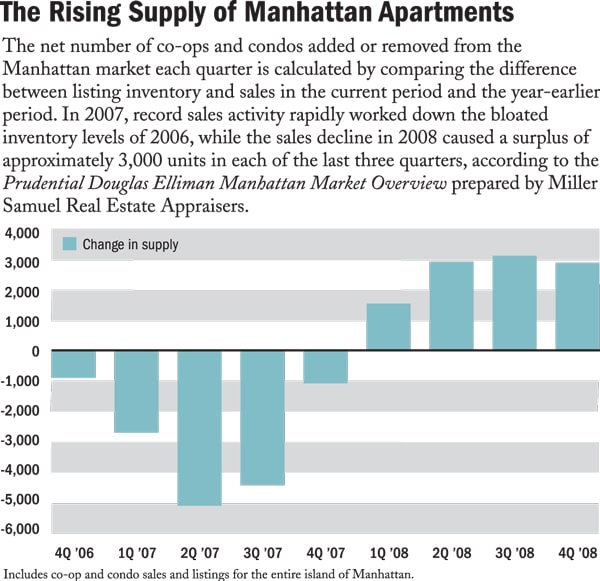

Manhattan Inventory Supply Saves The Day

The saving grace in this story is the lack of supply on the market. In comparison to the end of 2020, which had inventory levels over 8,100, todays supply is at a low of 5,858. There are many reasons for this, as I discussed back in August and summarized below.

The limited amount of supply should put a floor under potential price declines as we go into 2023. And, we dont see any inventory coming on the market any time soon either because of the following reasons:

- Golden handcuff mortgages

- 80% of New Yorkers with mortgages have rates less than 5%.

- This will result in owners staying in their current homes indefinitely.

- No one is going to trade their 3% mortgage for a 6% mortgage any time soon.

New Development Deals Remain

There are still New Development bargains to be had, as prices have been reduced significantly for projects introduced 3 years ago. Recently launched projects, however, have been priced to current market, so not a lot of discounts there. While some of the discounts are showing up in lower prices, many of the discounts are concealed in closing cost concessions. These dont show up in the price per square figures. The magnitude of discounts on new development vary widely, as they are dependent on factors such as when the project was launched, sale velocity to-date, the number of remaining units available in a particular line, the equity partners in the capital stack, and most importantly lenders’ minimum release prices .

To get the best deal in New Development, you need to have an open mind and not get set on something that isn’t going to garner the highest discounts. For instance, developers are neither offering large discounts on apartments with outdoor space nor on lines that are almost sold out.

This chart below shows how new development pricing has regained some of its footing from its lows a few months ago.

Recommended Reading: Who Is The Best Neurosurgeon In New York

What Are The Most Popular Neighborhoods In Manhattan

The most popular neighborhood in Manhattan is East Village, where there are 25 listings with an average rent of $4,299. Next up is Greenwich Village, where apartments go for $4,402/month, followed by Harlem with $3,291 If youre looking to rent in Manhattans most popular neighborhoods, make sure to also check out Yorkville, where renters pay $4,466 on average, and Lenox Hill, where the average monthly rent is $4,206.

How Will President Trump Affect Us Real Estate

Never before has America had a New York City property developer and real estate broker sitting in the White House. While many of us may not agree with Trumps behavior and policy positions, one thing for sure is that Trump will be pro-property and pro-real estate.

While some postulated that a Trump presidency would be a black swan event, rather than plunging, both the US dollar and stock market rose today!

If you are wondering how the policies of President Trump affect US Real Estate, here are insights as to how Trump will likely operate once in office.

Will he use real estate to kickstart the economy?

Trump is a property developer and real estate broker. He has used real estate himself as an investment all his life and has said that hes interested in boosting homeownership. Given that his family business is real estate, either through his own company, the Trump Organization, or his son-in-laws, Kushner Properties, we expect Trump to continue his love affair with property.

What will happen to mortgage rates?

Will he lower taxes for real estate investors?

Republicans retained control over the House and Senate. As a result, the republicans have unfettered control over the future of tax policy, meaning there will some big changes that will affect taxes for real estate investors. Trump has proposed to:

- Lower tax rates, with capital gains tax at a top rate of 20%.

- Eliminate the estate or death tax

- Reduce corporate taxes from 35% to 15%

Could it become easier to borrow money?

Read Also: What Is In Manhattan New York

Manhattan Market Bounces Back In Q4 2020

With headline news talking about people fleeing big cities, its no wonder why my clients are surprised to hear that signed contract activity in Manhattan has been robust over the last couple of months. Signed contracts per month in October and November 2020 averaged 855, with December 2020 on track to exceed December 2019 signed contracts of 717. Signed contract activity for the quarter thru mid-December has already surpassed the same quarter last year.

Confidence in the vaccine and the capitulation by sellers to price discounts have brought buyers back into the market. Most of this contract activity has been in the $3 Million-and-under segment, with the luxury sector still lackluster, but improving.

As you can see below, the number of contracts signed above $5 million continues to grow and this is the segment where we are seeing the largest discounts.

Manhattan Blows Past The Market Bottom As Contract Activity Explodes

The second quarter of 2021 was a blockbuster quarter, proving everyone wrong that city living was dead. Manhattan has rebounded to the best spring selling season in 6 years and has had the highest sales activity since 2007.

Pent-up demand, reasonable pricing, low-interest rates, a desire to upgrade to large spaces , increased personal wealth, and a larger pool of buyers have driven up sales volume. In sum, the city is booming, thanks to science and, in turn, a renewed optimism.

Note: for this update, I compare Q2 2021 to Q2 2019, which is much more appropriate that Q2 2020, when NYC was locked down.

Don’t Miss: How To File For New York State Disability

It’s A Buyers’ Market In New York City

Today, we feel that the current Manhattan housing market is a once-in-a-decade or possibly a once-in-a-generation investment opportunity. In Q4 2018, Manhattan evolved into a pronounced buyers market, as inventory rose, sales slowed and median asking prices declined. There is significant new supply coming online this year at a time when there are still unsold new development units from the past 2 years. The market has been weak and sellers are highly negotiable. At the same time, New York City’s economy is robust. We believe the combination of these factors make it a great time to make a long-term investment – setting up 2019 as the perfect time to buy.

This is a very rare occasion. Over the last 20+ years, Manhattan has been in a buyers market only two other times: in 2001 right after 9/11, which lasted just six months, and in 2008-2009 after Lehman Brothers collapsed triggering a credit crisis that lasted one year. The current buyers market began in late 2015, but only in the ultra-luxury segment, a small sliver of the market. Since then, however, the buyers market has widened. First to the luxury segment in 2016 and 2017 and now to all inventory segments, especially in 2018 after the new unfavorable federal tax law was enacted which pushed many buyers to the sidelines.

As you can see from the chart below from Compound, if you buy Manhattan real estate at the right time , the rewards can be plentiful:

As for details on how the 4th Quarter of 2018 performed:

How Are Resale Inventory Levels In The Manhattan Real Estate Market

“BuyersA price correction already occurred, and over the last year or so the broader market has shown signs of stabilization and normalization. If you have a real need to buy and you find the right property, utilize this slow period for any leverage you can get in negotiationsyou never know when a seller has had enough, and is ready to hit that bid.”

Read the full article at: medium.com

We agree with Urban Digs. The Manhattan RE market has already corrected, especially in the luxury segment, and buyers have more leverage now than they did than from 2014 – 2016. We expect this leverage to continue in 2018, as confusion about new tax changes takes place. We have found, however, that resale inventory supply is still low.

We have looked at resale inventory supply levels in four prime neighborhoods that are popular with our primary home buyers and investors: Tribeca, Chelsea, Upper East Side and Upper West Side. We looked at the $5 – $10 million segment, $2 – $5 million segment and $1 – $2 million segment.

Of all Manhattan real estate for sale in the $5 – 10 million segment, there were only 17 resale units for sale in Tribeca, 8 resale units for sale in Chelsea, 5 resale units for sale in the Upper East Side, and 4 resale units for sale in the Upper West Side. That’s a total of 34 resale units in these four neighborhoods, which cover a lot of the island of Manhattan.

https://belamorena.com.br

You May Like: How Do You Dissolve A Corporation In New York

Wow Home Prices Are High Wow Home Prices Are Low

High or low home prices don’t mean much in a vacuum – and that includes measures that include things such as “multiple of income”.

There’s no requirement to buy a home in any market, nor do you need to refinance if rates move against you . Homeownership rates also count people who bought a home already and currently live in it.

I prefer to look at home affordability instead. That shows how home prices, incomes, and prevailing mortgage rates interact. That gives you a better idea than using prices alone about how accessible it is for people to move into a new home in current conditions.

Sellers Are Happy But Not Too Happy

Sellers in 2021 have been very happy, especially after a dearth of sales in 2020. Buyers are out there, so demand is very strong, especially in the luxury segment where you will find the larger apartments.

Although activity has been significantly heightened for most of the year, fear is not gone yet, so prices are not rising beyond those of pre-covid. The covid discount of 6-9% , has disappeared, but we have not seen price increases over 2019 levels yet.

With all this activity, one would think prices are ready to rise again. Generally, price increases usually happen within 9 to 12 months after a marked improvement in sales activity. Check your calendars, as we will begin to enter into this phase in short order.

Read Also: When To Vote In New York

Nyc Home Prices Are Falling

According to the StreetEasy Price Index, NYC home prices are past their peak reached in July since the start of the pandemic. The index fell modestly by 0.7% month-over-month in September after staying essentially unchanged in August. The indices for Manhattan , Brooklyn , and Queens also declined modestly in September from the previous month, while still being higher than one year ago.

The citywide median asking price rose slightly to $995K in September from $975K in August, just slightly below the mansion tax threshold of $1M, due to a large influx of higher-priced listings mostly in Manhattan after the Labor Day holiday. In September, the citywide median asking price for new listings was $999K, with 25% priced above $2M.

In September, Manhattan accounted for half of all new listings, with a median asking price of $1.475M 48% higher than the citywide norm. As a result, Manhattan’s median asking price reached $1.5 million, the highest amount since the pandemic. The most expensive listing in September was on Billionaires’ Row, asking $250 million.

New York’s Recovery From The Pandemic

On a net basis, the total number of nonfarm jobs in the state increased by 15,600 over the month, while private sector jobs rose by 17,400,in September 2022. At the same time, the total number of nonfarm jobs in the nation increased by 263,000, while private sector jobs increased by 288,000.

Manhattan Housing Sales Q2

According to Douglas Elliman, the median sales price in Manhattan hit an all-time high, while the average sales price reached its third-highest level. The amount of second-quarter sales reached its greatest level since 2007. The market share of cash buyers increased to the third-highest level seen, a return from the low recorded five quarters ago.

The median sales price of co-ops reached an all-time high, marking the sixth consecutive year-over-year increase. The median sales price of condominiums also reached an all-time high, marking the third consecutive year-over-year increase. Condominium listing inventory saw its greatest first-to-second-quarter increase in at least eight years.

Indicators of the overall price trend for luxury goods continued to grow annually. The number of new development sales has more than doubled compared to the same period last year, while the number of new development listings has risen rapidly for the third consecutive quarter. The pricing trends in Manhattan continued to increase from the preceding year and pre-pandemic levels. The median sales price increased by 10.6 percent yearly to a record $1,250,000, surpassing the previous record established during the same time frame three years prior.

Recommended Reading: Must Visit Restaurants In New York

This May Be The Worst Time In My Living History For The Home Buyer Said One Analyst As Mortgage Rates And Prices Are At Their Highest In Years

New York is one of the most expensive cities in the US. According to Property Club NYC, the boroughs with the lowest median house price were the Bronx , Staten Island , and Queens . Brooklyn and Manhattan topped the list with a median sale price of $900,000 and $1.16 million, respectively. This compares to a median house price average of $454,900 for the whole nation.

However, it looks like these prices are set to drop as the nation deals with an overinflated market as well as high mortgage rates, at least in comparison to the last two decades.

Mortgage rates are sky high, prices are sky high, and theres no inventory, said Mark Zandi, the chief economist at Moodys Analytics. This may be the worst time in my living history for the home buyer it just doesnt make sense.

Mortgage rates are at their highest level for 20 years. The average 30-year fixed rate sits at 6.95%, more than double it was at the start of the year.

Affordability was the worst its ever been, and that was before 7 percent mortgage rates, said Rick Palacios Jr., John Burns Real Estate Consultings director of research.

Emphasising this, New York house prices have been rising every month for the last five years. However, after a surging in price between July 2020 and July 2022 have begun to decrease. This information is from the Case-Shiller Home Price Index.

New York has failed to build housing that matches the jobs we have created and the impact could be catastrophic.

Governor Kathy Hochul

Nyc Real Estate Market: Are Home Prices Dropping

The New York resale housing market slowed down in the third quarter of 2022 as increasing inflation and soaring mortgage interest rates finally caught up with most market players. Many buyers looking to purchase a home have lost eligibility for a mortgage or are unable to purchase a home in the present economic situation, resulting in a precipitous decline in buyer interest. The Housing Affordability Index in New York dropped by 25.6% QoQ to 93. A higher number means greater affordability. As borrowing costs continue to rise, many buyers and sellers are choosing to wait while the market resets before making their next move.

- Pending Sales in New York State were down 9.8 percent to 37,292.

- They are considered a forward-looking indicator of home sales based on contract signings

- Closed Sales decreased 10.9 percent to 38,743.

- Inventory shrunk 14.4 percent to 39,370 units.

- Prices gazed upward as the Median Sales Price was up 5 percent to $400,000.

- The average sales price was up 6.2 percent to $530,937.

- Sellers received, on average, 102.5% percent of their original list price at sale, a year-over-year improvement of 0.5 percent.

- Days on the Market decreased by 10.9 percent to 41 days.

- Months Supply of Inventory was down 8.3 percent to 3.3 months.

Don’t Miss: Does Southwest Airlines Fly To New York City

Bidding Wars Are Making A Comeback

The days of the Covid discounts and pandemic pricing in Manhattan are long gone, said Miller.

Manhattan saw a more modest price increase last year than red-hot housing markets like Austin or Boise, where median year-over-year prices were up 40% and 30%, respectively, according to Zillow.

Prices in Manhattan had been drifting lower or not seeing much appreciation from 2017 to 2020, according to the report. Heading into the pandemic, the upper end of the market had become soft.

Then we have this unexpected boom after a frozen market, he said. And now the upper end is way ahead of pre-pandmeic.