What Is Prime Rate

The Prime Rate is the interest rate that banks use as a basis to set rates for different types of loans and lines of credit, with the exception of mortgage rates. Each bank sets its own Prime Rate, although for consumer products most banks will use the U.S. Prime Rate published in The Wall Street Journal in its column called “Money Rates,” and this is the rate shown above. The U.S. Prime Rate is not always the lowest, the best or the favored rate of interest. Banks use different methods to determine what Prime Rate is applicable for each product and when adjustments will be made. Please see your Commerce Banker for more information.

We’ve Answered The Most Frequently Asked Questions When It Comes To Fees

What types of fees do banks charge?

Some of the more common fees that could be associated with your Scotiabank account are outlined below. We recommend reviewing the summary of account fees page for details specific to your account.

ABM service fees

While its free to withdraw money from any Scotia ABM, you could be charged a small fee to withdraw from either chequing or savings account at another banks ABM in Canada. Certain accounts waive this fee. Cash advance fees from your Visa will also add a $3.50 fee.

Optional feature fees

Sending money to friends, family, or even yourself at a different account using Interac e-Transfers could mean paying an additional fee for each transfer. Many Scotiabank accounts do offer unlimited free Interac e-Transfers. Additionally, if you are someone who occasionally goes into overdraft, you could be charged $5 per month or per use depending on which overdraft protection plan you have on your account.

International transfer fees

If you need to send money internationally, you may be charged $1.99 per transfer depending on your account. As well, if you receive any incoming wire transfers, you will be charged $15 CAD/USD per transfer. The fee will depend on the currency of the account.

Paper statement fees

Is there a fee to close a Scotiabank account?

If I have multiple savings accounts, do I pay more than one fee?

How much is the monthly account fee?

Quick Answer: What Is Canadas Prime Rate Right Now

Prime Rates in Canada The Prime rate in Canada is currently 2.45%. The Prime rate is the interest rate that banks and lenders use to determine the interest rates for many types of loans and lines of credit. These can include credit cards, HELOCs, variable-rate mortgages, car and auto loans, and much more.

You May Like: Open An Llc In Ny

What Is The Current Prime Rate

The prime lending rate is a key interest rate that affects many other rates. See why it matters to you.

The prime rate is the best interest rate major banks offer to their borrowers with the best credit. In other words, the least risky ones.

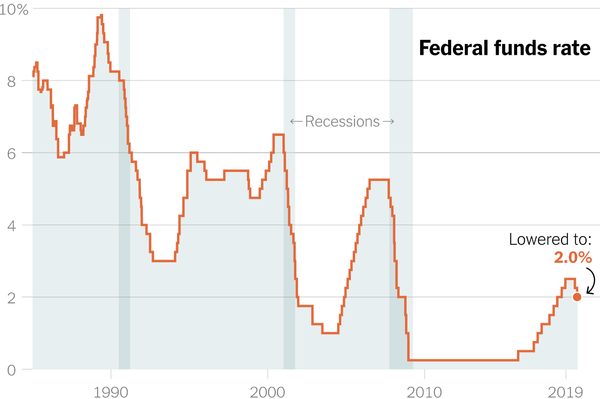

The prime rate rose this week for the second time this year, after the Federal Reserve increased its key benchmark rate by a half-point to try to quell inflation.

The two rates move together, and the increase means higher borrowing costs for car loans, home equity lines of credit and credit cards.

How Does The Prime Rate Affect You

While the interest rate on most financial products is dependent on the prime rate, the actual rate you receive is rarely the same exact amount. Typically, your interest rate is above the prime rate, but the amount can be greater depending on the lender. For instance, the average credit card APR on accounts assessed interest is currently 15.78% the prime rate plus 12.53%.

Of course, most credit cards set variable ranges for interest rates, meaning you can receive an APR anywhere on a preset scale, such as 12% to 24%. Consumers with excellent credit will likely qualify for rates as low as 12%, whereas someone with good credit may receive rates closer to 24%.

When prime rate changes , your credit card APR also fluctuates. The change follows the same pattern as the prime rate meaning a decrease in the prime rate results in a decrease in your card’s APR. The exact change in your interest rate depends on how much the prime rate changes take for instance, the two recent adjustments that resulted in .50% and 1% APR reductions. A 1% decrease means a 14.99% variable APR would decrease to 13.99%. This change often takes one to two billing cycles.

Fixed-rate financial products, such as many personal loans and auto loans, won’t fluctuate since you lock in your interest rate when you open the loan.

You May Like: Registering A Vehicle In New York

Who Sets The Prime Rate

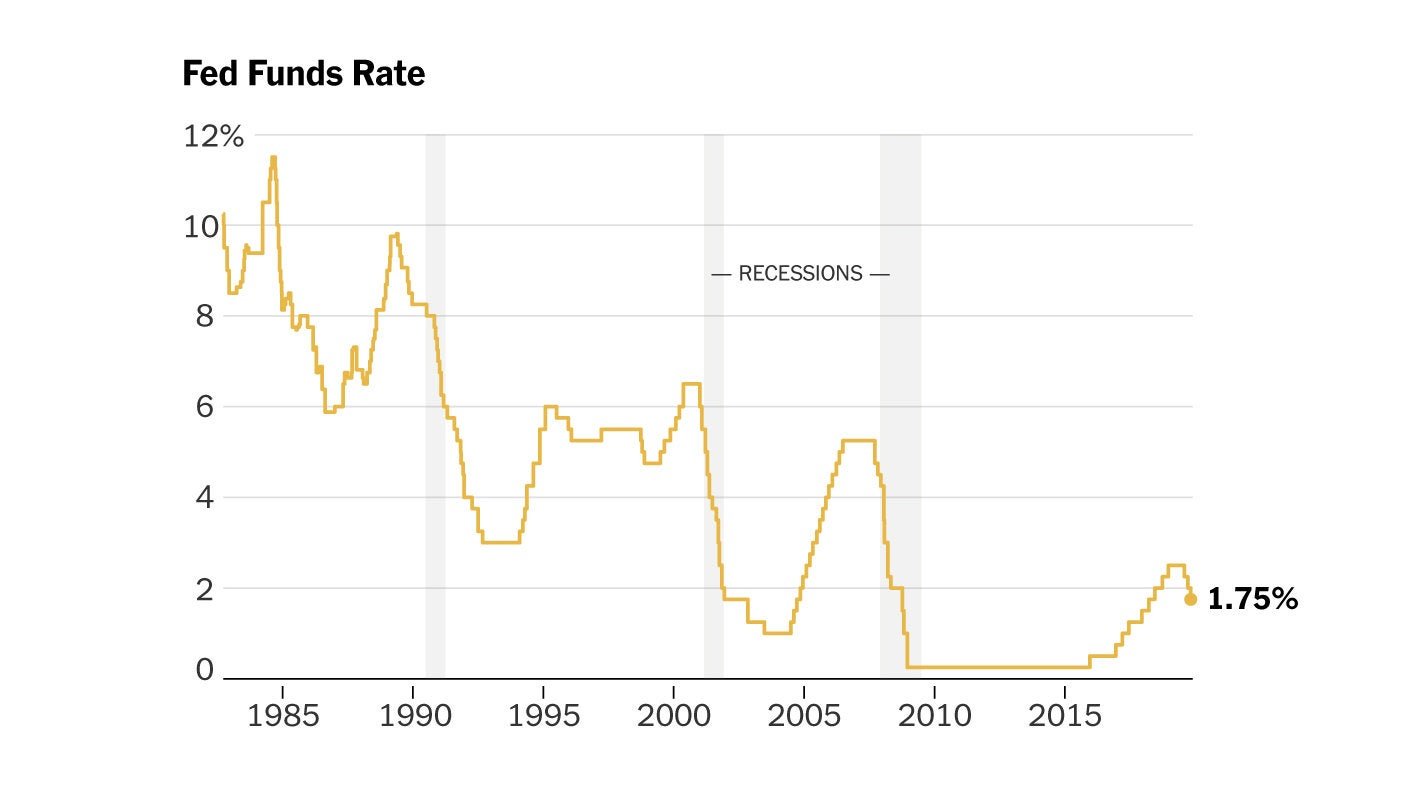

The prime rate piggybacks off the federal funds rate, which is the interest rate that’s one of the Federal Reserve’s primary tools for nudging the economy. Banks typically take that rate and add 3 percentage points to get their prime rate.

The prime rate is used to set interest rates for credit cards and also can influence personal loans and certain mortgages.

When banks’ prime rates are low, there is more lending, borrowing and spending activity in the market. That activity tends to slow when prime rates are higher, which in turn tempers the economy and inflation.

The federal funds rate is the interest rate banks charge each other for overnight loans so they can meet their reserve requirements. Those are the amounts of money the Fed requires banks to have on hand at the end of each business day, partly to guard against bank failures.

The central bank doesn’t exactly set the federal funds rate it’s ultimately decided by market supply-and-demand forces. But the Fed’s policymaking panel called the Federal Open Market Committee, or FOMC establishes a target for the federal funds rate.

The rate throughout the pandemic matched an all-time low established during the 2008-2009 financial crisis and Great Recession.

Whats A Good Mortgage Rate

Mortgage rates can change drastically and oftenor stay the same for many weeks. The important thing for borrowers to know is the current average rate. You can check Forbes Advisors mortgage rate tables to get the latest information.

The lower the rate, the less youll pay on a mortgage. Todays rate environment is considered extremely well-priced for borrowers. However, depending on your financial situation, the rate youre offered might be higher than what lenders advertise or what you see on rate tables.

If youre hoping to get the most competitive rate your lender offers, talk to them about what you can do to improve your chances of getting a better rate. This might entail improving your credit score, paying down debt or waiting a little longer to strengthen your financial profile.

Also Check: Wax Museum In New York

How Does The Federal Funds Rate Impact The Prime Rate

The federal funds rate is an interest range set by the Federal Reserve. The fed funds rate is the Feds recommendation for what banks should charge when they lend money to each other overnight to meet reserve requirements.

There is a rule of thumb that the prime rate is fed funds plus 3, says Garretty. When the Fed funds rate changes, one bank will usually take the lead and announce a change in that banks prime rate that same day.

The prime rate moves only when the federal funds rate moves. This is unlike other rates , which move daily/weekly according to short term financial market conditions, says Garretty.

Once a bank changes its prime rate based on the new federal funds rate, it will then start adjusting rates for many of its other lending products in the same direction. And when the federal funds rate and prime rate go down, other rates fall too, making it less expensive to borrow.

Note that certain lending products, like fixed rate mortgages and some student loans, are based on measures like SOFR and are less tied to the movement of the prime rate.

Understanding The Prime Rate

The prime rate is the interest rate that commercial banks charge their most creditworthy customers, generally large corporations. The prime interest rate, or prime lending rate, is largely determined by the federal funds rate, which is the overnight rate that banks use to lend to one another. Prime forms the basis of or starting point for most other interest ratesincluding rates for mortgages, small business loans, or personal loanseven though prime might not be specifically cited as a component of the rate ultimately charged.

Interest rates provide a way to cover costs associated with lending and they act as compensation for the risk assumed by the lender based on the borrowers credit history and other financial details.

Primeplus a percentageforms the underlying base of almost all other interest rates.

Read Also: Nys Dmv New Registration

Determining The Prime Rate

Default risk is the main determiner of the interest rate that a bank charges a borrower. Because a bank’s best customers have little chance of defaulting, the bank can charge them a rate that is lower than the rate they charge a customer who has a greater likelihood of defaulting on a loan.

Each bank sets its own interest rate, so there is no single prime rate. Any quoted prime rate is usually an average of the largest banks’ prime rates. The most important and most used prime rate is the one that the Wall Street Journal publishes daily. Although other U.S. financial services institutions regularly note any changes that the Federal Reserve makes to its prime rate, and may use them to justify changes to their own prime rates, institutions are not required to raise their prime rates in accordance with the Fed’s.

How Is The Prime Rate Determined

The prime rate isn’t determined by the Fed, but instead by individual banks. However, the prime rate is influenced by something called the federal funds rate, which is set by the Federal Open Market Committee consisting of twelve Fed members.

The federal funds rate is the rate banks charge each other for short-term loans. It is currently 0% to .25%. Banks use this rate as a starting point to set the prime rate for consumers. The prime rate is often roughly 3% higher than the federal funds rate .

The Fed meets roughly eight times a year to discuss potential adjustments to the federal funds rate, based on the economy’s current conditions. For instance, the Fed announced two emergency rate cuts in March to help combat the negative economic impact of the coronavirus. These rate cuts resulted in a decrease in the federal funds rate, which in change lowered the prime rate and the interest rate for many consumer financial products.

Recommended Reading: How Much Are The Tolls To Nyc

Youre Leaving Mufg Americas

The information that this private business collects and maintains as a result of your visit to its Web site, and the manner in which it does so, may differ from the information that MUFG Americas collects and maintains. . If you provide the business with information, its use of that information will be subject to that business’s privacy policy. We recommend you review their information collection policy, or terms and conditions to fully understand what that business collects. We are not responsible for the information collection practices of the other Web sites that you visit and urge you to review their privacy policies before you provide them with any personal information.

If you wish to continue to the destination link, press Continue.

The Prime Rate And Variable

If you have credit cards or a home equity line of credit, you feel the movements in the U.S. prime rate most closely.

Interest rates on those products change in sync with the prime rate. The adjustable rate on a HELOC might be advertised as “prime plus 1%” or “prime plus one,” for example.

The interest rate on that hypothetical home equity line will go up from 4.5% to 5% now that the benchmark rate is increasing. Again, the current prime rate is 4%.

In similar fashion, a credit card might have an annual percentage rate, or APR], described as “prime plus 11.49%” or “prime plus 9.99%.”

Also Check: Pay My Car Ticket Online

Whats The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing money whereas the APR is the yearly cost of borrowing as well as the lender fees and other expenses associated with getting a mortgage.

The APR is the total cost of your loan, which is the best number to look at when youre comparing rate quotes. Some lenders might offer a lower interest rate but their fees are higher than other lenders , so youll want to compare APR, not just the interest rate. In some cases, the fees can be high enough to cancel out the savings of a low rate.

Who Gets The Prime Rate

Banks usually only charge the prime rate to large, corporate customers with lots of financial resources. Thats because they have more money and assets to pay the loans back. Since individual consumers do not have the same resources, banks typically charge them the prime rate plus a surcharge based on the product type they want. A credit card rate might be the prime rate plus 10%, for instance.

On the other end of the spectrum, a banks very best borrowers may be able to negotiate lower than the prime interest rate. This kind of negotiation happened more frequently in the 1980s, Garretty notes, when interest rates were much higher. Lenders would try to attract blue chip borrowers by offering interest rates lower than the prime rates.

Recommended Reading: Plateman Staten Island Ny

Is It Smart To Refinance A House Right Now

If your current mortgage rate is above 3.88%, now is a good time to refinance. If your finances have improved and you can afford higher monthly payments you can refinance your 30-year loan into a 15-year fixed-rate mortgage, which will allow you to pay the loan off faster and also pay less interest.

Examples Of New York Prime Interest Rate In A Sentence

-

A. Bankers Trust Company and Morgan Guaranty Trust Company of New York, as their respective Prime Rate provided that if less than three of such banks have the same rate in effect, the median of the five rates shall be the New York Prime Interest Rate.

-

Tenant shall pay to Landlord at once, upon notice by Landlord, any sum paid by Landlord to remove such liens, together with interest at the New York Prime Interest Rate from the date of such payment by Landlord.

-

All sums so paid by Landlord and all necessary incidental costs together with interest thereon at the New York Prime Interest Rate, from the date of such payment by Landlord, shall be payable to Landlord on demand.

-

For the purposes of computing interest hereunder, the New York Prime Interest Rate in effect on the last day of a month shall be deemed to be such rate in effect throughout the succeeding month.

Also Check: Pay Traffic Tickets Online Nyc

The Prime Rate And Other Types Of Loans

Interest rates on auto loans are often tied to the U.S. prime rate too, and many adjustable-rate mortgages, or ARMs, adjust in tune with the prime rate.

The interest on ARMs is fixed for the first several years, then it moves up or down along with a benchmark interest rate often the prime rate. A common adjustable-rate mortgage is the 5/1 ARM, with an interest rate that’s fixed for five years and can adjust every one year after that.

The interest rates on personal loans and popular fixed-rate mortgages do not dovetail with the prime rate and the federal funds rate, but there is an indirect effect on what borrowers pay.

After the Fed cut its federal funds rate to near zero last year and created a climate for very low interest rates, mortgage rates dropped to historic lows. Rates on personal loans fell too.

But long-term mortgage rates don’t always move in the same direction as the prime. For example, 30-year mortgage rates fell from December 2016 to December 2017 even as the prime rate rose from 3.75% to 4.5%

Sponsored

Secured Overnight Financing Rate Data

The Secured Overnight Financing Rate is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities. The SOFR includes all trades in the Broad General Collateral Rate plus bilateral Treasury repurchase agreement transactions cleared through the Delivery-versus-Payment service offered by the Fixed Income Clearing Corporation , which is filtered to remove a portion of transactions considered specials. Note that specials are repos for specific-issue collateral, which take place at cash-lending rates below those for general collateral repos because cash providers are willing to accept a lesser return on their cash in order to obtain a particular security.

The SOFR is calculated as a volume-weighted median of transaction-level tri-party repo data collected from the Bank of New York Mellon as well as GCF Repo transaction data and data on bilateral Treasury repo transactions cleared through FICC’s DVP service, which are obtained from the U.S. Department of the Treasurys Office of Financial Research . Each business day, the New York Fed publishes the SOFR on the New York Fed website at approximately 8:00 a.m. ET.

Recommended Reading: Toll Calculator Baltimore To Nyc

How Do I Calculate Mortgage Payments

For much of the population, buying a home means working with a mortgage lender to get a mortgage. It can be difficult to figure out how much you can afford and what youre paying for.

Using a mortgage calculator can help you estimate your monthly mortgage payment based on your interest rate, purchase price, down payment and other expenses.

To calculate your monthly mortgage payment, heres what youll need:

- The home price