Cost To Form A New York Llc

At BizFilings, we clearly outline our fees and the New York state fees. When you view our pricing to form an LLC you plainly see:

- BizFilings package prices.BizFilings offers three incorporation service packages from which you can choose.

- State fee for standard turn-around.Our pricing clearly shows the state fee to incorporate in New York with standard turn-around.

- Expedited turn-around.You will see the BizFilings and state fee, if any, for expedited turn-around.

- 24-hour turn-around.New York has a 24-hour filing option, which is outlined in our pricing.

- Certified copy.Our pricing also clearly displays the BizFilings and state fee, if any, for issuing a Certified Copy of the Articles of Organization.

Llc Name Requirements In The State Of New York

- There should not be any existing businesses with the same name as yours.

- When forming an LLC in New York, the name needs to be registered with a designator, such as Limited Liability Company in the end. As an alternative, you can choose from LLC or L.L.C.

- It is also not recommended to use LLC in place of another word. For instance, you like New Business but a New Business Co already exists. You cannot use this name and simply replace CO with LLC.

- And and & are considered the same. Therefore, you cannot replace the name of an existing business and make it yours. If Salon and Spa already exists, you cannot use Salon & Spa.

- You cannot use names from a government agency, such as the FBI or Department of State as it may mislead customers or clients.

Assign A York Registered Agent

Someone who receives official correspondence and is responsible for filing reports with the New York Secretary of State is known as a Registered Agent. If you have an LLC, New York requires you to have a Registered Agent. You’ll appoint your Registered Agent when you file the Articles of Organization to create your business.You can fill this position, assign another manager in your business or use a Registered Agent service. If your New York Registered Agent is a person, they must have a physical street address in New York and must be present during business hours to receive important documents on behalf of your company.All of Incfiles business formation packages include Registered Agent service. Its free for the first year and just $119 per year after that. You’ll also have access to a digital dashboard to view any document we’ve received on your behalf.

Read Also: Can You Register A Car Without A License In Ny

How To Register A Delaware Company In New York

Would you like to register a Delaware company in New York so you can start doing business in New York with your Delaware LLC or corporation?

If you own a Delaware company and would like to start operating in the state of New York, your first step is to register as a foreign entity. This process permits a company to transact business in a state other than where it was formed. Failing to adhere to local compliance issues may put your company’s assets at risk. However, if you file for foreign qualification for a Delaware LLC that will be operating in the state of New York, you can ensure your Delaware LLC is both legal and compliant in the state of New York.

If you’re interested in registering a Delaware company in New York, you’re probably wondering, “What does New York require in order to register my Delaware LLC as a foreign entity?”

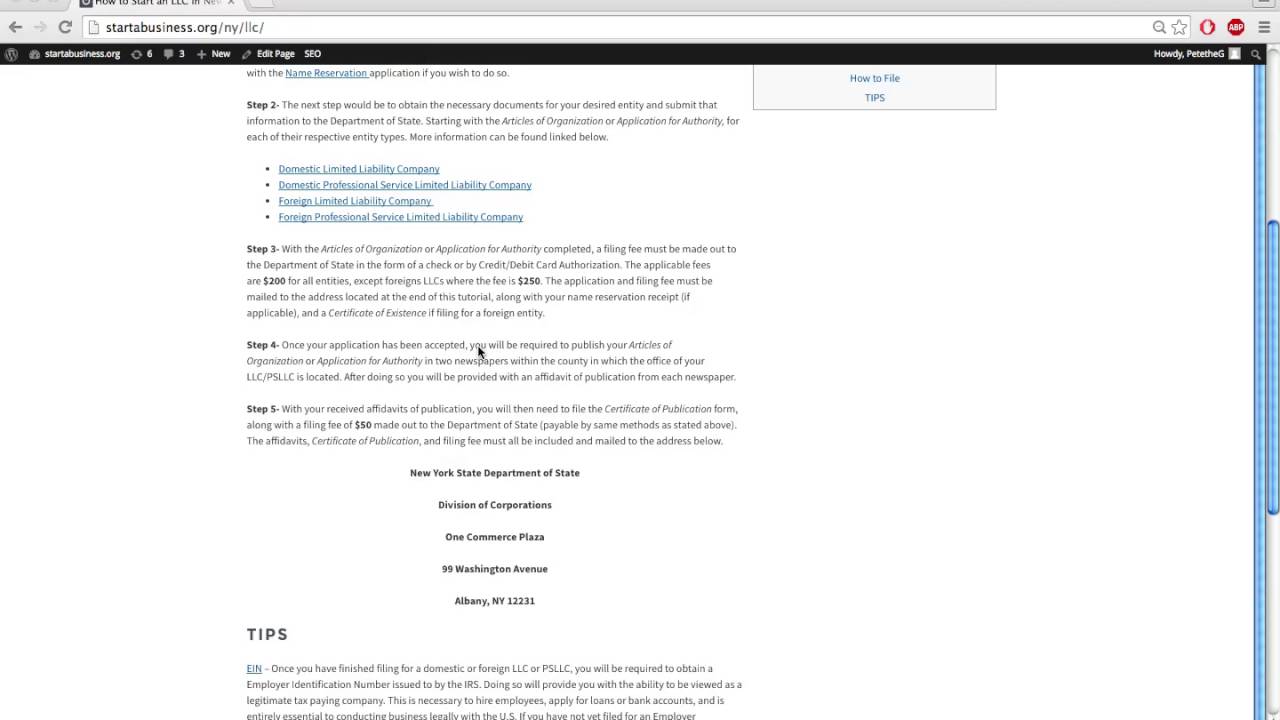

S After Forming An Llc

After forming your LLC, it’s important to:

- Open a business bank account. A business bank account legally separates personal finances from business finances. This separation is required to maintain your LLC’s corporate veil .

- Get a business credit card. A business credit card will help separate personal and business expenses while building your companys credit history. A strong credit history will be useful for raising capital in the form of small business loans.

- Hire a business accountant. A business accountant will help you save on taxes and avoid penalties and fines. An accountant makes bookkeeping and payroll easier. Find out how much you could be saving with a consultation with a business accountant.

- Get business insurance. Business insurance helps manage risk. The most common forms of business insurance are general liability, professional liability, and workers compensation.

Don’t Miss: Ny Wax Museum

Open An Llc Bank Account

Opening a bank account for your LLC is important for liability protection as the account separates the businesss funds from the members personal funds.

Several documents will be needed to open a business bank account, such as:

- A banking resolution is a document that authorizes the members to open a business bank account on behalf of the LLC.

- Copies of the original formation paperwork from the state showing the creation of the LLC.

- Drivers licenses of the members.

- Occasionally, the bank will request a New York Certificate of Good Standing to prove the LLC is active and in good standing with the state.

Related: How to Open a Business Bank Account for your LLC

Create A New York Llc Operating Agreement

Creating a New York LLC operating agreement is the only way to legally lock down your LLCs management and ownership structure. Having this document in place will give you something to return to if a dispute or lawsuit arises.

Even single-member LLCs benefit from having an operating agreement.

Your operating agreement should outline the following:

- Each members responsibilities

- How new members will be admitted

- How existing members may transfer or terminate their membership

- How profits and dividends will be distributed

You can add as many provisions as you want, as long as they don’t conflict with New York business law. Take a look at our What is an Operating Agreement guide to learn more.

Download a template or create a custom Free Operating Agreement using our tool.

You May Like: Thrush Poetry Journal Submissions

Tax Treatment Of Llcs And Llps

- The New York personal income tax and the corporate franchise tax conform to the federal income tax classification of LLCs and LLPs.

- An LLC or LLP that is treated as a partnership for federal income tax purposes will be treated as a partnership for New York tax purposes.

- An LLC or LLP that is treated as a corporation, including an S corporation, for federal income tax purposes will be treated as a corporation for New York tax purposes or as a New York S corporation if the New York S election is made .

- A single-member LLC that is treated as a disregarded entity for federal income tax purposes will be treated as a disregarded entity for New York tax purposes.

- If the SMLLC is disregarded and the single member is an individual, the SMLLC will be treated as a sole proprietorship for New York tax purposes.

- If the SMLLC is disregarded and the single member is a corporation, including an S corporation, the SMLLC will be considered a division of the corporation for New York tax purposes.

- If the SMLLC is disregarded and the single member is a partnership, the SMLLC will be considered a division of the partnership.

- For information regarding the tax treatment of an LLC or LLP for purposes of the New York City Business Corporation Tax, New York City General Corporation Tax , and the New York City Unincorporated Business Tax , please visit the New York City Department of Finance Business webpage.

How Can I Withdraw My Nys Dba

Contact your county clerk for county-specific instructions for withdrawing your DBA for your unincorporated business.

For incorporated businesses, you will need to file for discontinuance of your assumed name with the NY Department of State. You can find the Certificate of Discontinuance of Assumed Name form here.

You May Like: New York Times Delete Account

New York Llc Tax Filing Requirements

Depending on the nature of your business, you may be required to register for one or more forms of state tax. This can be done online through the NY.gov portal.

New York Sales Tax

If you are selling a physical product, you’ll typically need to register for a seller’s permit, known as a Sales Tax Certificate of Authority, with the New York Department of Taxation and Finance.

This certificate allows a business to collect sales tax on taxable sales.

Sales tax, also called “Sales and Use Tax,” is a tax levied by states, counties, and municipalities on business transactions involving the exchange of certain taxable goods or services.

Read our New York sales tax guide to find out more.

New York Employer Taxes

If you have employees in New York, you will need to register for Unemployment Insurance Tax with the New York Department of Labor and Employee Withholding Tax with the New York Department of Taxation and Finance.

Industry Specific Taxes

If your business falls within a specific industry, additional state taxes may apply.

Register for New York State Taxes

You can register your New York LLC for all of your business taxes through the New York Business Express Portal.

Annual Fee

There is an annual filing fee for each LLC formed in New York which varies depending upon your LLCs income.

Appoint A Registered Agent In New York

A registered agent is a person or entity that receives tax notifications, compliance information, and service of process on behalf of your LLC.

In New York, the NY Secretary of State acts as the registered agent for every New York LLC. This is required by state law. However, you can list an additional registered agent on your Articles of Organization, a document that youll learn more about in the next step.

Hire a Additional Registered Agent

You can appoint yourself as the companys additional agent, but this may not be the best move. It can be time-consuming to keep up with all the legal paperwork and stay organized while trying to launch and run a new business. Hiring an outside registered agent service like ours comes with many benefits. For example, an agent acting on your behalf can:

- Ensure you meet all New York state requirements for an LLC

- Offer consistent availability to receive documents during regular business hours

- Provide discretion by receiving legal documents away from your place of business

You may also be able to save money on publishing notices to fulfill the publication requirement, as detailed in step six. The amount of savings depends on the county in which your registered agent resides since advertising costs are much cheaper in some counties.

Also Check: Registering A Vehicle In Ny

Obtain Business Insurance For Your New York Llc

General Liability Insurance gives you protection against lawsuits relating to your New York LLC. Small LLCs are advised to have this type of coverage for the protection of their business.

Professional Liability Insurance will serve as protection for consultants, accountants, and other professional service providers. You will need this coverage to secure your company against claims of business errors, including malpractice.

Workers Compensation Insurance is helpful in covering job-related accidents, injuries, and illnesses of your employees. It can also cover death expenses in case a worker dies while on duty. All LLCs in New York with at least one employee is required by the New York Department of State to have this type of insurance.

If you need help with choosing the best types of insurance for your New York LLC, contact the team at LLC Formations. We can connect you with professionals who can help you organize the safety nets for your business.

Ny State Filing Fees And Expedited Options

Currently, the state filing fee starts at $200. There are some counties that charge a filing fee of $205 to $250. However, you can receive the New York LLC approval in as soon as five days included in the filing fee.

You can always expedite the process and get the approval in just one day. The rush filing fee will depend on where you are located in New York. It is typically around an additional $25 for 24-hour turnaround time. Faster filing can take up to two hours only but is more expensive as it can go for an additional $150 or more.

Don’t Miss: Celebrity Wax Museum Nyc

Open Your New York Llc Bank Account

Put on your lucky shoes. Its time to open a business account for your LLC. Youll need to bring the bank the following:

- your New York LLCs EIN

- a copy of your Articles of Organization

- a copy of your Operating Agreement

- your business license

You need an LLC bank account to keep your business finances separate from your personal finances.

One of the biggest upsides of an LLC is that it creates a legal separation between you and your business. This separation is valuable, especially when it comes to liability.

Letting your personal and business finances intermingle erodes that separation. To keep it intact, you need to open and use an LLC bank account.

Yes. If your LLC intends to accept credit card payments, youll need a bank account for depositing funds after the payments are cleared and settled. This is a basic requirement of any payment processor, and youll need the bank account in advance of applying for your merchant account.

When Is Filing A Dba Required In New York

A DBA is required whenever a business is operating under a name other than its legal name. In the case of a sole proprietorship, you will need a DBA if you are operating under a name other than your own personal name. Partnerships in NY must always file a DBA in all counties where they transact business.

You May Like: Cost To Register A Car In Ny

Start With A New York Assumed Name Search

If you haven’t already, head over to the New York Department of State website to make sure your name isn’t taken by or too similar to another registered New York business.

TIP: Our business name generator tool is a great resource for entrepreneurs who are still working to create the perfect business name or website address. You can also use our free logo generator tool to make a logo yourself! No design experience necessary!

Next, make sure your name complies with New York naming rules:

- Your name cannot include words that could confuse your business with a government agency

- Restricted words may require additional paperwork and a licensed individual, such as a doctor or lawyer, to be part of your business.

Next, a quick online search of the U.S. Trademark Electronic Search System will tell you whether someone else has already trademarked your name.

Now would be the perfect time to get a web domain for your DBA.

Powered by GoDaddy.com

After registering a domain name for your DBA, consider using a business phone service to improve customer satisfaction and further establish credibility. Our top pick is Nextiva because of its affordable pricing and useful features. Start calling with Nextiva.

Reserve Your Llc Name For Future Use

When naming your New York LLC, you can choose to have the name reserved in case you cannot submit the name right away. In this situation, you will need to pay $20 to the Department of State. You will have the ability to reserve the name for two months or 60 days. You will also have to file an application for reservation of name.

Also Check: Name Change Ny State

Filing A Dba In Ny With The County Clerk

If your business is a sole proprietorship or partnership, then you are required to file a business certificate with the appropriate county clerks office in order to operate under a DBA.

Knowing which county to file in is simple: you must file in any county where your business conducts or transacts business.

In New York State, ALL PARTNERSHIPS, whether operating under an assumed name or not, must register a Business Certificate for Partnerships with the appropriate county clerks office. Continue reading this section for instructions on completing this step.

We will give you step-by-step directions to get a New York County DBA . If you need to register your DBA in a different county than New York County, youll need to get in touch with the county clerk for the registration requirements.

You can find your counties’ contact information here.

Filing aDBA in NYC Contact Information:

Kings County– 404-9750New York County– 386-5955

How to File a New York County DBA

At this point, you shouldve already chosen a name for your business and completed the name searches in Step 1 above.

New York County suggests searching their assumed name records before you start the DBA filing process. Those records can be found at the New York County courthouse basement at 60 Centre Street in Manhattan.

Forms

- X-74 Business Certificate form for Partnerships

- X-201 Business Certificate form for Sole Proprietorships

You Must Submit Your Business Certificate In Person

Walk In Location

Payment

Fast Reliable Incorporation Services With No Hidden Fees For New York

Use BlumbergExcelsior Corporate Services, Inc. to prepare and file the documents in New York to incorporate or to start an LLC, new nonprofit corporation, professional corporation , limited partnership , LLP or professional association . Our fast, reliable incorporation and LLC formation services for New York include a corporate kit or LLC kit, which ships free, with minutes/bylaws or LLC operating agreement. To start a New York LLC or corporation, call or add the item to cart and fill out the new corporation or LLC order form.

Blumberg’s registered agent service is only $125 for the first year when we do the NY corporate or LLC filing and then $139/year. You may order registered agent service on the order form.

Readers of the New York Law Journal voted us the Best Business Formation ServicesProvider, the Best Legal Notice and Advertising Services and the Best Corporate Kits Provider in 2015, 2017 and 2018.

Don’t Miss: How To Delete A New York Times Account