Medicare Costs In New York In 2022

Original Medicare costs in New York are the same nationwide.

The Medicare Part A premium can cost you $0, $274, or $499, depending on how long you or your spouse worked and paid Medicare taxes. For Part A hospital inpatient deductibles and coinsurance, you pay:

- A $1,556 deductible for each benefit period

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $389 coinsurance per day of each benefit period

- Days 91 and beyond: $778 coinsurance per each lifetime reserve day after day 90 for each benefit period

- Beyond lifetime reserve days: all costs

Premium-free Part A coverage is available if you or your spouse paid Medicare taxes for a certain amount of time while working. You can receive this at 65 if:

- You already get benefits from Social Security or Railroad Retirement Board.

- Youre eligible for Social Security or Railroad benefits but havent filed yet.

- You or your spouse has Medicare-covered government employment.

If youre under 65, you get premium-free Part A if:

- You have Social Security or Railroad Retirement Board disability benefits for 24 months.

- You have End-Stage Renal Disease and meet certain requirements.

The standard monthly Medicare Part B premium is $170.10 in 2022, and the Part B deductible is $233. Once the deductible is met, you usually pay 20% of the Medicare-approved amount for most doctor services , outpatient therapy, and durable medical equipment.

Aged Blind And Disabled

Our Facilitated Enrollment for the Aged, Blind, and Disabled program helps individuals who are age 65 and older, or certified blind, or living with disabilities to apply for Medicaid and the Medicare Savings Program through the New York City Human Resources Administration. We also help you renew your existing Medicaid coverage.

We have multi-lingual facilitated enrollers who will help you enroll in public health insurance, step by step. They are trained to walk you through the entire sign-up process, from helping you determine eligibility, to helping you enroll in a health plan. We are located in the Bronx, Brooklyn, Manhattan, Queens, and Staten Island.

How To Apply For Medicare Part B

When you apply for Medicare, youâll be asked if you want to enroll in Medicare Part B. You donât have to enroll in Medicare Part B . Part B covers outpatient care, like doctorsâ office visits and preventive care.

If youâre 65 and still working, you might have a group health plan through a current employer or spouseâs employer. If thatâs the case, you might not need Part B coverage or want to pay the premiums you can delay enrolling in this part of Medicare. When you decide to leave work and lose your employer-sponsored health coverage, you might qualify for a special enrollment period â which will allow you to sign up for Medicare Part B without a penalty.

If you donât qualify for a special enrollment period and didnât sign up for Part B when you were first eligible, youâll pay a late enrollment penalty. Youâll also have to wait until general enrollment period to sign up.

Learn more about Medicare Part B.

You May Like: New Yorker Op-ed Submission

Quick Review: Whats Medicaid

Medicaid is a federal assistance program that provides health insurance for low-income and vulnerable Americans. The program is partially funded by the states and each state can set its own eligibility requirements. Qualifying for Medicaid benefits depends largely on your income, but also on your age, disability status, pregnancy, household size, and your household role.

See if you qualify with our state-by-state guide to Medicaid.

Medicaid is a separate program from Medicare. Both programs provide health insurance, but Medicare coverage is primarily for seniors while Medicaid eligibility depends largely on your income. Itâs possible to take part in both programs at the same time. Learn more about the difference between Medicaid and Medicare.

You do not need to have Medicaid to apply for MSPs. In fact, you donât qualify for the QI program if you have Medicaid.

How Does Medicaid Provide Financial Assistance To Medicare Beneficiaries In New York

Many Medicare beneficiaries receive financial assistance through Medicaid with the cost of Medicare premiums and services Medicare doesnt cover such as long-term care.

Our guide to financial assistance for Medicare enrollees in New York includes overviews of these programs, including Medicare Savings Programs, long-term care coverage, and eligibility guidelines for assistance.

Also Check: How Do I Apply For Disability In New York State

New York’s Medigap Regulations Are Among The Strongest In The Country With Community Rating And Year

- Health insurance & health reform authority

- More than 3.7 million residents are enrolled in Medicare in New York.

- Nearly 47% of New York Medicare beneficiaries are enrolled in Medicare Advantage plans, and the state has a robust market with many Medicare plans from which consumers can choose.

- New Yorks Medigap consumer protections are among the strongest in the nation, and 12 insurers provide Medigap plans in New York.

- New York residents can select from among 19 stand-alone Part D prescription plans in 2022, with premiums that range from about $7 to $101 per month.

What Are The Top Medigap Plans In New York

The Best Medigap plan in New York is Plan N. But, if youre not newly eligible for Medicare, Plan C could prove beneficial. Since excess charges arent allowable in New York, comparing the cost of Plan F and Plan C could save you money. Further, comparing the cost of Plan G and Plan N could be beneficial. Again, since excess charges arent allowable, choosing a plan that doesnt cover excess charges gives New Yorkers a chance to save money on premiums without worry about an extra fee. Of course, if you travel out of the state for care, you may be responsible for paying those excess charges.

You May Like: Forms Needed To Register A Car In Ny

Helpful Resources For New York Medicare Beneficiaries And Their Caregivers

Need help with your Medicare application in New York, or have questions about Medicare eligibility in New York? These resources provide free assistance and information.

- Contact HIICAP, New Yorks Health Insurance Information Counseling and Assistance program.

- Visit the Medicare Rights Center. This website provides helpful information geared to Medicare beneficiaries, caregivers, and professionals.

- Access the New York State Department of Financial Services for helpful information about Medicare.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

About our health insurance quote forms and phone lines

We do not sell insurance products, but this form will connect you with partners of healthinsurance.org who do sell insurance products. You may submit your information through this form, or callto speak directly with licensed enrollers who will provide advice specific to your situation. Read aboutyour data and privacy.

If you have questions or comments on this service, pleasecontact us.

Medicare Savings Programs Qualified Medicare Beneficiary Program

The Qualified Medicare Beneficiary is a Medicare Savings Program that pays for the Medicare Part A premium and the Medicare Part B premium. The program also pays Medicare cost-sharing expenses, including deductibles, coinsurance, and copayments.

If you qualify for QMB, you automatically qualify for the Extra Help prescription drug program to save on out-of-pocket expenses for your medications.

You must be eligible for or currently enrolled in Medicare Part A to apply for the QMB Medicare Savings Program.

This program uses the low-income subsidy asset test to determine eligibility. This amount may change each year. For the most up-to-date requirements, contact Medicare for more information at 1-800-MEDICARE , 24 hours a day, seven days a week for TTY assistance, call 1-877-486-2048.

Liquid assets that are taken into consideration include checking and savings accounts, stocks, and bonds. Items that arent counted when determining eligibility include your home, one car, personal items, and up to $1,500 in burial expenses . .

Read Also: Nys Car Registration

Income Limits And Rules

Each of the three MSP programs has different income eligibility requirements and provides different benefits. The income limits are tied to the Federal Poverty Level .

2021 FPL levels were released by NYS DOH in GIS 21 MA/06 – 2021 Federal Poverty Levels Attachment II

NOTE: There is usually a lag in time of several weeks, or even months, from January 1st of each year until the new FPLs are release, and then before the new MSP income limits are officially implemented. During this lag period, local Medicaid offices should continue to use the previous year’s FPLs AND count the person’s Social Security benefit amount from the previous year – do NOT factor in the Social Security COLA . Once the updated guidelines are released, districts will use the new FPLs and go ahead and factor in any COLA.

See 2021 Fact Sheet on MSP in NYS by Medicare Rights Center ENGLISH SPANISH

What Is The Medicare Extra Help Program

MSPs can help pay the out-of-pocket expenses associated with Medicare Part A and Medicare Part B. They do not cover prescription drug costs. However, Medicare recipients who qualify for an MSP are also automatically eligible for Medicare Extra Help, which helps pay for a Medicare Part D prescription drug plan. Extra Help eliminates your premiums and deductibles. It also reduces your copays for generic and brand-name medications.

Don’t Miss: Registering A Car In New York State

Types Of Medicare Savings Programs

There are seven kinds of MSPs. Each type of MSP is tailored to different needs and circumstances.

- Qualified Medicare Beneficiary Programs pay most out-of-pocket costs for Medicare, protecting beneficiaries from cost-sharing. These programs offer full coverage of Part B premiums. Your Part A premium will also receive coverage if you havent worked 40 quarters. Deductibles, copays, and coinsurance receive coverage contingent on the state in which the beneficiary resides. Those who qualify for the QMB program are also automatically eligible for the Extra Help program for prescription drugs.

- QMB Plus refers to those who receive full Medicaid benefits, as well as all the cost-sharing coverage QMB programs offer.

Medicaid Buy In Program For Working People With Disabilities And Medicare Savings Programs

The Medicaid Buy-In Program for Working People with Disabilities provides Medicaid coverage for people ages 16-64 who have a disability and are engaged in a work activity for which they are paid. In order to be considered for this program, the individual must be determined disabled as defined by the Social Security Administration. The persons net income must be at or below 250% of the federal poverty level.

You May Like: Tolls From Dc To Ny

Medicaid And Qi Together

An individual cannot have Medicaid and a QI plan at the same time. Although the Medicaid agency administers both types of programs, there are differences between them.

Medicaid pays for a range of healthcare services for those with low income and resources, not just the monthly premium.

Each state offers Medicaid programs with varying eligibility criteria and benefits.

For example, in New York, to qualify for the QI program, an individual cannot exceed a gross monthly income of $1,456. For a person to be eligible for Medicaid, the total monthly income limit is $895.

A person may find help to pay for medical expenses through the following resources:

Apply Through The Dutchess County Department Of Community & Family Services If You Are:

- Age 65 and older

- Enrolled in Medicaid Buy-In for Working People with Disabilities enrollees

- Former foster care youth

- Resident of adult homes and nursing homes

- Resident of treatment center/community residences operated by the Office of Mental Health

- Applying for AIDS Health Insurance Program or Medicaid Cancer Treatment Program

- Applying for Medicare Savings Program

- Your eligibility is based on being blind or disabled or you request coverage for community based long term care services including those individuals with an immediate need for Personal Care Services or Consumer Directed Personal Assistance Services

Also Check: Wax Museum In Manhattan

What Counts Toward Your Resource Limit

Your resource limit includes money you have in all types of savings accounts, checking accounts, and retirement accounts. It also includes all of your investments in stocks or bonds. If you own multiple properties, the value of everything except your primary residence may count toward your resource limit.

The resource limit does not consider your primary home, a car, a burial plot, furniture, or any other personal items. You can also exclude $1,500 per person to account for burial expenses. A life insurance policy doesnât count, and neither do any advance tax credits or money you received for housing assistance.

Enrolling In An Msp For People Who Have Free Medicare Part A

Some clients will be automatically enrolled in an MSP by the New York State Department of Health shortly after attaining eligibility for Medicare. Others need to apply. The 2010 “MIPPA” law introduced some improvements to increase MSP enrollment. See 3rd bullet below. Also, some people who had Medicaid through the Affordable Care Act before they became eligible for Medicare have .

But if a Medicaid recipient does not have MSP, contact the Local Medicaid office and request that they be enrolled.

-

In NYC – Use Form 751W and check the box on page 2 requesting evaluation for Medicare Savings Program. Fax it to the Undercare Division at 1-917-639-0837 or email it to . Use by secure email. If enrolling in the MSP will cause a Spenddown

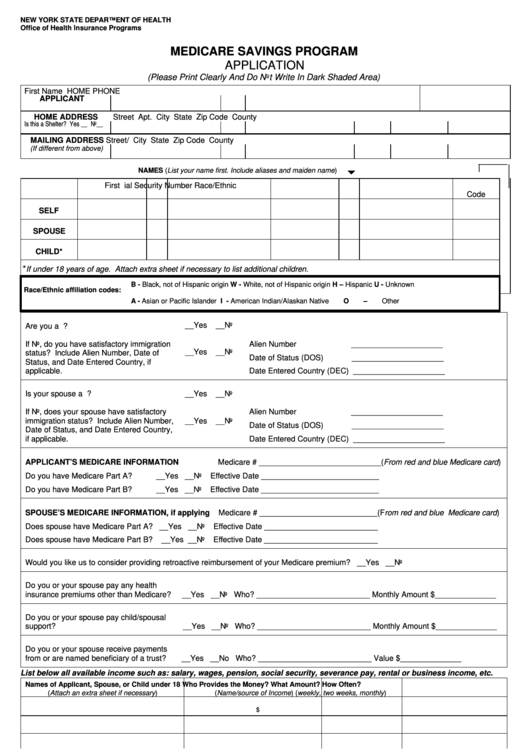

If do not have Medicaid — must apply for an MSP through their local social services district. , you can use the simplified MSP application form . Either application form can be mailed in — there is no interview requirement anymore for MSP or Medicaid. See 10 ADM-04.

Applicants will need to submit proof of income, a copy of their Medicare card , and proof of residency/address. See the application form for other instructions.

Don’t Miss: New York Times Poetry Contest

When To Sign Up For Medicare In New York

Medicare Annual Election Period is October 15 to December 7 each year. Beneficiaries who are already enrolled in Medicare should review their healthcare needs for the upcoming year and determine if changes to their current coverage are necessary. The Medicare Plan Finder allows users to compare pricing between Original Medicare, Medicare plans with prescription drug coverage, Medicare Advantage plans, and Medicare Supplement Insurance policies.

How To Apply For Medicare Part C

Medicare Part C plans, more commonly known as Medicare Advantage plans, are offered by federally approved private insurers as alternatives to Original Medicare .

In order to get a Part C plan, you must first enroll â and stay enrolled â in Original Medicare. You can compare Medicare Advantage plans on the Medicare website and then purchase one directly from the insurer. You can do this during your initial enrollment, special enrollment, and open enrollment period in the fall.

If you decide you want to return to Original Medicare coverage, you can drop Part C during Medicare Advantage disenrollment, which runs January 1 to February 14 ever year.

Learn more about Medicare Part C.

Read Also: Can I Register A Car With A Permit In Ny

Local Resources For Medicare Beneficiaries In Nebraska

- Medicare Savings Programs in Nebraska: Low-income beneficiaries in Nebraska may be eligible for programs that offer help with out-of-pocket expenses like premiums and coinsurance. Even if youre not sure youll qualify, you can apply for a Medicare Savings Program to see if youre eligible for financial assistance.

- Nebraska State Health Insurance Counseling and Assistance Program : The Nebraska Senior Health Insurance Information Program is a free counseling service that offers beneficiaries educational information about Medicare.

The Three Medicare Savings Programs

1. Qualified Medicare Beneficiary . The QMB program provides the most comprehensive benefits. Available to those with incomes at or below 100% of the Federal Poverty Level , the QMB program covers virtually all Medicare cost-sharing obligations: Part B premiums, Part A premiums, if there are any, and any and all deductibles and co-insurance. QMB coverage is not retroactive. The programs benefits will begin the month after the month in which your client is found eligible.

** See NYC HRA QMB Recertification form

** Even if you do not have Part A automatically, because you did not have enough wages, you may be able to enroll in the Part A Buy-In Program, in which people eligible for QMB who do not otherwise have Medicare Part A may enroll, with Medicaid paying the Part A premium .

2. Specifiedl Low-Income Medicare Beneficiary . For those with incomes between 100% and 120% FPL, the SLMB program will cover Part B premiums only. SLMB is retroactive, however, providing coverage for three months prior to the month of application, as long as your client was eligible during those months.

Q-I-1 recipients would be eligible for Medicaid with a spend-down, but if they want the Part B premium paid, they must choose between enrolling in QI-1 or Medicaid. They cannot be in both. It is their choice. DOH MRG p. 19. In contrast, one may receive Medicaid and either QMB or SLIMB.

Read Also: New York Car Registration