Reserving A Name For Your Llc

If you’re not quite ready to start your business, you can reserve a name for 30 days with the Secretary of State by filing an Application for Reservation of Name and paying a fee of $20. First, conduct a New York business search and learn the state’s business naming rules to ensure you choose a name that meets legal requirements.

What Is Llc Membership Interest

Membership interest is your percentage of ownership in the LLC. Typically, your membership interest determined by your initial investment. For example, if four members each invest $10,000 in an LLC and the fifth member invests $60,000, the first four members will each hold 10% membership interest and the fifth will hold 60%. Membership interest is often directly related to voting power.

How To Obtain A Certificate Of Good Standing In New York

A Certificate of Good Standing, known in New York as a Certificate of Status, verifies that your LLC was legally formed and has been properly maintained. Several instances where you might need to get one include:

- Seeking funding from banks or other lenders

- Forming your business as a foreign LLC in another state

- Obtaining or renewing specific business licenses or permits

You can order a New York LLC Certificate of Status by mail, by fax, or in person.

Request a Certificate by Mail, by fax, or In Person From the New York Department of State

Note: Fax filings must include a form.

Read Also: Sabbath Candle Lighting Nyc

Publish Your Articles Of Organization In Two Newspapers

The LLC must publish in two newspapers a copy of the articles of organization or a notice related to the formation of the LLC. This requirement must be fulfilled within 120 days after the LLC’s articles of organization become effective.

LLC’s are required to publish in newspapers designated by the county clerk in which the office of the LLC is located. Once published, the newspaper will provide an affidavit of publication. . The Certificate of Publication, with the affidavits of publication of the newspapers attached, should be submitted to the New York Department of State.

Tax Treatment Of Llcs And Llps

- The New York personal income tax and the corporate franchise tax conform to the federal income tax classification of LLCs and LLPs.

- An LLC or LLP that is treated as a partnership for federal income tax purposes will be treated as a partnership for New York tax purposes.

- An LLC or LLP that is treated as a corporation, including an S corporation, for federal income tax purposes will be treated as a corporation for New York tax purposes or as a New York S corporation if the New York S election is made .

- A single-member LLC that is treated as a disregarded entity for federal income tax purposes will be treated as a disregarded entity for New York tax purposes.

- If the SMLLC is disregarded and the single member is an individual, the SMLLC will be treated as a sole proprietorship for New York tax purposes.

- If the SMLLC is disregarded and the single member is a corporation, including an S corporation, the SMLLC will be considered a division of the corporation for New York tax purposes.

- If the SMLLC is disregarded and the single member is a partnership, the SMLLC will be considered a division of the partnership.

- For information regarding the tax treatment of an LLC or LLP for purposes of the New York City Business Corporation Tax, New York City General Corporation Tax , and the New York City Unincorporated Business Tax , please visit the New York City Department of Finance Business webpage.

You May Like: Wax Museums New York

New York Franchise Tax

Some small business transition to C corporations after expanding. While a corporation franchise tax is standard in most states, New York’s franchise tax is more complex. The state wants to close loopholes that allow businesses to minimize their taxes, which is why the state imposes four different ways of calculating tax. Each method is calculated in a different way, and you must calculate taxes using each method and pay the highest amount of the four results. These four amounts are:

- The company’s entire net income

- The company’s minimum taxable income

- The company’s business and investment capital

- A fixed dollar minimum tax

The easiest method is calculating tax based on net income, which equals the federal taxable income. A company’s investment capital may also be taxed. Another method is the minimum taxable income, calculated from net income plus some federal adjustments. Finally, the fixed dollar minimum method taxes companies on gross receipts, and charges set tiers a flat dollar amount.

New York corporate income tax is sometimes called a franchise tax. The state’s corporation franchise tax applies to both types of corporations and a filing fee tax which applies to LLCs, partnerships, and limited liability partnerships . If you receive income from your business, that income is also taxed on your individual New York tax return.

Foreign corporations are not subject to New York tax if they only engage in interstate commerce.

Get Business Insurance For Your Llc

Business insurance helps you manage risks and focus on growing your business. The most common types of business insurance are:

- General Liability Insurance: A broad insurance policy that protects your business from lawsuits. Most small businesses get general liability insurance.

- Professional Liability Insurance: A business insurance for professional service providers that covers claims of malpractice and other business errors.

- Workers’ Compensation Insurance: A type of insurance that provides coverage for employees job-related illnesses, injuries, or deaths. In Alabama, businesses with five or more employees are required by law to have workers’ compensation insurance. Note that officers and LLC members are counted as employees.

Find out how much it will cost to keep your business protected.

Read our review of the best small business insurance companies.

Don’t Miss: Wax Museums In Ny

How Do I Search For A New York Registered Agent

- Perform a New York business name search with the Department of State, Division of Corporations.

- Type in the name of the company youre searching for.

- Find the registered agents name and registered office street address in the search results.

If you want to legally notify a business through their New York registered agent service, just send a certified letter directly to the registered agent at their registered office address.

How Much Does It Cost To Publish An Llc In New York

It depends. Publication fees can vary widely among newspapers, and you need to publish in the county where your principal office address is located. In New York City, publication fees can cost upwards of $1,000. In Albany, where our office is located, publication fees are closer to $100. Hiring us can save you a lot of money on the publication requirement.

Read Also: Poetry Submissions The New Yorker

Selecting A State To Form Your Llc Is An Important Choice

The law and policies of your state will figure out whether you must develop the LLC in your own state or in another state. Normally, people who wish to start an organization in their own state will set up an LLC in their house state. You should think about the benefits and disadvantages of each choice and choose the one that is right for you.

When youre ready to start a limited liability business, you should pay taxes. For an LLC, the federal government will require a tax filing charge, which is a little percentage of the companys overall revenue. For a not-for-profit, this charge is minimal, and the majority of them dont have any employees or consumers. As a result, forming an LLC can be a pricey procedure. In addition to the cost of filing, there are lots of advantages.

Depending upon your company requirements, you can develop an LLC for your service. As soon as your LLC is produced, you can note the present members and managers of the company. You will also need to decide on the type of LLC you wish to form. Despite the function of your service, you will require to choose the place of your operations. You can start including your business. Youll require a signed up representative and an Operating Agreement.

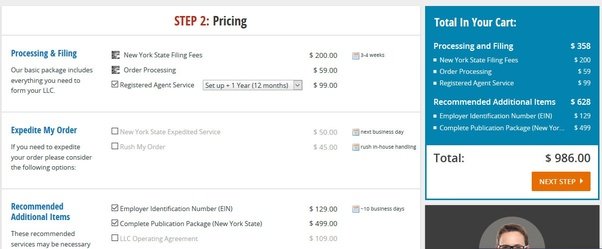

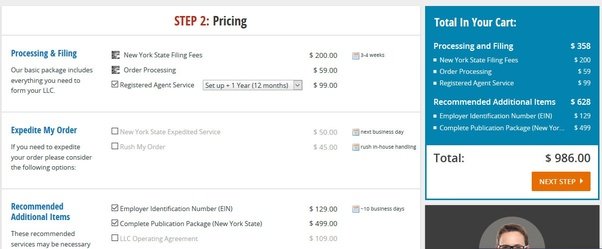

State Llc Filing Fees

To form an LLC, you will need a to file an Articles of Organization with the Secretary of State.

Every state has its filing fee for forming an LLC. So the filing fee for filing the Articles of Organization or Articles of Incorporation will depend on which state you will be incorporating in.

Typically, state filing fees for forming an LLC are between $50 and $800, depending on which state you will be forming your LLC in.

You can find a list of state filing fees here.

You May Like: How To Delete A New York Times Account

Submit Llc Articles Of Organization

To make your LLC official, youll need to complete a form called Articles of Organization. Once youve completed the form, youll submit it to the New York Division of Corporations, State Records and Uniform Commercial Code by mail, fax, online, or in person with the $200 filing fee.

Note: All of the information on this form will become part of the public record.

To fill out the paper form, youll need to provide the following information about your LLC:

- Company name. Include an indicator like LLC.

- County. This is the county where youll need to meet the publication requirement.

- Registered office. The name and New York address of someone who will accept your LLCs legal mail.

- Organizer name and address. Anyone you authorize to sign and submit this form to the state.

If you file online, you can also provide the following optional information:

- Purpose. Tick this box to include a general business purpose in your articles.

- Management structure. Indicate whether your LLC will be managed by members or managers.

- Effective date. Add a date to delay the start of your LLC for up to 60 days or skip.

- Dissolution date: Add an end date to your LLC if you want it to dissolve on a certain day or choose perpetual existence for your LLC to last indefinitely.

- Liability statement. Add a clause stating that the LLC will compensate members or managers for expenses connected to proceedings against the LLC or skip.

B Hire Us To Publish For You

You can spend hours of your precious time on earth calling around to dozens of newspapers to compare publication costs. Or you can just hire us to complete the entire process for you for $375.

Well run your ads with the local paper, acquire the Affidavit of Publication, and file your Certificate of Publication form with the New York Division of Corporations for you for $375 total, and thats expedited.Just select the publication service at checkout.

| Our Filing Fee |

| $375 |

*We dont even bother with standard processing because the New York Secretary of State is notoriously slow. Hire us and its automatically expedited.

Don’t Miss: Submissions Poetry To The New Yorker

Articles Of Organization Fees

When starting a new business, there are many initial steps to take to get your company off the ground. One of these steps is filing for articles of organization with the state. This document is what officially creates your company and sets out its basic structure and bylaws.

The cost of filing for articles of organization varies from state to state. In New York, the filing fee is $200 for a limited liability company and $750 for a corporation.

After your articles of organization have been approved by the state, you will want to make sure that they are correctly formatted to avoid any issues with the Internal revenue service when you file your first tax return.

If you’re not familiar with the process of filing for articles of organization, it’s best to consult with an attorney or accountant who can help you through the process. This is an essential step in starting your business, so don’t hesitate to get the help you need.

How Do New York Registered Agents Get Served

Serving a registered agent is legal proof that you were notified. Regardless of whether you receive the documents your New York registered agent signs for on your business behalf, once they accept the documents, youve been notified. You need a New York registered agent you can trust. Here is what happens when we are served with a lawsuit in NY:

- A process server, sheriff, or third party will walk into our Albany office and hand us the documents , which we sign for.

- We scan the document to your online account, immediately triggering our notification system.

- The process server then gives an affidavit to the court as confirmation that they served us.

Also Check: Pay Your Ticket Online Ny

Why Hire Corporate Filing Solutions To Form Your New York Llc

Starting your LLC in New York shouldnt be a hassle or a time consumer. Thats why we offer Filings Made Easy to make starting an LLC in New York super easy.

Hire us and relax while our filing experts form your new New York LLC. Our staff will process orders the same business day as they are received. To make things even easier, we bundle the first year of Registered Agent service and ensure your New York LLC comes fully equipped and ready to do its job.

Start your LLC in New York and get Registered Agent service for as low as $55 a year.

What Legal Documents Do I Need To Form An Llc

Now that you know how much does it cost to create an LLC in each of the different states, the next step is to ensure you have all legal documents to form an LLC.

Depending on the state you want to set up your business in, youll be required to follow a specific set of guidelines to form an LLC. They adhere to general principles that are more likely the same. However, regardless of which state your LLC has been formed, youre required to prepare two legal documents to provide legal recognition to your business:

Also Check: Parking Ticket Lawyer Nyc

When Is Filing A Dba Required In New York

A DBA is required whenever a business is operating under a name other than its legal name. In the case of a sole proprietorship, you will need a DBA if you are operating under a name other than your own personal name. Partnerships in NY must always file a DBA in all counties where they transact business.

New York Llc Publication Requirement Faqs

Yes. Its bonkers and way outdated, but Section 206 of the New York Limited Liability Company Law requires both New York LLCs and foreign LLCs doing business in New York to publish notice in two newspapers in the county where the LLC was formed. Dont throw your money away on publishing in NYChire us and save hundreds by publishing in Albany instead.

It really depends on where youre doing business. If your business address is in NYC, you could be looking at over $1,000 to publish. If your business address is in Albany its closer to $150

If you live in NYC and want to save money on the LLC publication requirement, you can hire us to publish and file your Certificate of Publication for you. Well use our address on your documents which both protects your privacy and gets you in on those low publication fees. Otherwise, youll be looking at paying over $1000 to fulfill an arcane requirement.

Our New York LLC Publishing Service: $375

- $150our filing fee

- your LLCs future dissolution date

- a brief description of your business activity

Remember when your mom paid to advertise the family yard sale in the classifieds? This is that, except for legal notices. The smaller the ad, the cheaper, but it can be hard to squeeze all that legally required information into a small space. Plenty of people overspend by being too wordy. We have a super-short template thats been approved by the New York Division of Corporationspart of how we keep our publication service fee so low.

You May Like: New York Times Short Story Submission

Whats The Difference Between My Llcs Name And An Assumed Business Name

Your LLCs name is its official namethe one listed on your Articles of Organization. An assumed business name , is any name other than your LLCs name or your own legal name under which you do business. New York requires anyone using an assumed business name to register with the Department of State by filing a Certificate of Assumed Name. For an LLC, registering an assumed business name costs $25.

Start With A New York Assumed Name Search

If you haven’t already, head over to the New York Department of State website to make sure your name isn’t taken by or too similar to another registered New York business.

TIP: Our business name generator tool is a great resource for entrepreneurs who are still working to create the perfect business name or website address. You can also use our free logo generator tool to make a logo yourself! No design experience necessary!

Next, make sure your name complies with New York naming rules:

- Your name cannot include words that could confuse your business with a government agency

- Restricted words may require additional paperwork and a licensed individual, such as a doctor or lawyer, to be part of your business.

Next, a quick online search of the U.S. Trademark Electronic Search System will tell you whether someone else has already trademarked your name.

Now would be the perfect time to get a web domain for your DBA.

Powered by GoDaddy.com

After registering a domain name for your DBA, consider using a business phone service to improve customer satisfaction and further establish credibility. Our top pick is Nextiva because of its affordable pricing and useful features. Start calling with Nextiva.

Read Also: New York Tolls Map