New York Releases Advisory Opinion On Sales For Solar Energy Systems

The New York Department of Taxation and Finance issued an Advisory Opinion on the application of sales and use tax on the sale and installation of residential and commercial solar energy systems. Petitionerstwo partnerssold commercial and residential solar energy systems to customers primarily located in upstate New York. One partner procured and provided components required for the installation of the solar energy systems, and the other partner was responsible for the transportation and installation at customers sites. The Department concluded that retail sales and installations of both residential and commercial solar energy systems were exempt from sales tax but are exempt from local tax only if the locality has enacted the exemption. Please see New York Advisory Opinion No. TSB-A-20S for further discussion.

New York City Denies Corporate Tax Refund For Service

A New York City-based business provided a subscription service, which gave customers access to expert consultants in a variety of fields. As part of its service package to customers, the taxpayer employed salespeople, IT staff, and consulting managers but the expert consultants were compensated as independent contractors. The taxpayer sought a refund for a large portion of corporate income taxes it had paid during tax years 2003-2010. Alternative rationales were offered for differing methodologies, but ultimately the taxpayer settled on an allocation whereby only the locations and amounts paid to consultants and research managers who provided services directly to clients should be counted IT staff was excluded. The City contended that all of these persons contributed to the performance of the services provided to clients. The New York City Tax Appeals Tribunal found the taxpayer hadnt allocated income correctly because receipts had to include work done by both employees and consultants in New York City, not all of whom the company had included. The Appellate Court agreed , determining all these individuals were all part of the delivery of services for which clients paid an upfront flat subscription fee.

New York City Income Tax Rates

New York City has four tax brackets, ranging from 3.078% to 3.876%. Rates kick in at different income levels depending on your filing status.

The lowest rate applies to single and married taxpayers who file separate returns on incomes of up to $12,000 as of 2020. Those who are married and who file joint returns qualify for the lowest rate on incomes of up to $21,600.

The next tax brackets jump to 3.762%, then to 3.819%, then to 3.876%.

Also Check: Where Is The Wax Museum In New York

Other New York City Taxes

New York City charges a sales tax in addition to the state sales tax and the Metropolitan Commuter Transportation District surcharge. But food, prescription drugs, and non-prescription drugs are exempt, as well as inexpensive clothing and footwear.

There’s also a state and local tax on hotel rooms for inexpensive to moderately-priced rooms. This tax rate includes New York City and New York State sales taxes, as well as a hotel occupancy tax. Rooms renting for less expensive prices are subject to the same tax rates, but at lesser nightly dollar amount fees.

Medallion owners or their agents pay a tax for any cab ride that ends in New York City or starts in the city and ends in Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, or Westchester counties. This tax, known as the taxicab ride tax, is generally passed on to consumers. Medallion owners are those who are duly licensed with a medallion by the Taxi Limousine Commission of New York City.

New York Gasoline Tax

The Motor Fuel Excise Taxes on gasoline and diesel in New York are 8.05 cents per gallon and 8.00 cents per gallon, respectively. Furthermore, the Petroleum Business Tax is paid by petroleum businesses for certain types of fuel and paid at different points in the distribution chain. As of Jan. 1, 2020, the PBT is 17.4 cents per gallon.

You May Like: Watch Kourtney And Kim Take New York

New York Holds Purchase And Lease Of Picasso Painting Was Not A Sale For Resale

An LLC taxpayerowned by two family trustspurchased a one-half interest in a Picasso painting. The other 50-percent purchaser was the father of the two sons in whose name the trusts were established. Sales tax was paid on the transaction by both purchasers. A few years latersubsequent to a lease of the painting structured between the LLC and the fatherthe LLC sought a refund for the sales tax it paid on its original purchase of the painting on the grounds the purchase was a sale for resale. Retroactively going back and using the lease as a basis for sale for resale argument was not successful. New York reasoned that in order to be a sale for resale, the taxpayer would have needed to show its sole purpose for purchasing the painting was to lease it. Here, however, the additional purpose for purchasing the painting was because it was an investment and added to the taxpayers art collection.

May 2, 2020

Nys And Yonkers Withholding Tax Changes Effective On Or After July 1 2021

We revised the 2021 New York State personal income tax rate schedules to reflect certain income tax rate reductions enacted under the Tax Law. We also updated the New York State and Yonkers resident withholding tax tables and methods for 2021. These changes apply to payrolls made on or after July 1, 2021.

- Calculate 2021 New York State withholding tax amounts using Publication NYS-50-T-NYS , New York State Withholding Tax Tables and Methods.

- Calculate 2021 Yonkers resident withholding tax amounts using Publication NYS-50-T-Y , Yonkers Withholding Tax Tables and Methods.

- NOTE: There were no changes to the New York City resident wage bracket tables and exact calculation methods. Please continue to use Publication NYS-50-T-NYC , New York City Withholding Tax Tables and Methods.

Recommended Reading: Plateman Staten Island Ny

New York State Taxes: Everything You Need To Know

Taxes in the Empire State won’t make you feel like royalty. Taxes 101

New York state tax has the second-highest average tax rate in the country, with the typical New Yorker paying over a quarter of their income to state and federal governments. And thats just at the state level. For the 8.5 million-plus people living in New York City the least tax-friendly city in America additional city taxes mean theyre shelling out even more.

So, why are New Yorkers paying more in taxes than most of the rest of the country? Heres a closer look at all of the state taxes in New York state.

| New York State Taxes | |

| State Sales Tax Rate Range | 7% 8.875% |

| State Income Tax Rate Range | 4% 8.82% |

| 3.06% 16% |

Reality Check: Few Will Really Pay More Than 50%

New York’s income tax rate for annual earnings above $1 million will rise to 9.65%, from its current 8.82%, under the latest deal. It will also create new tax brackets for income above $5 million and $25 million a year, with even higher rates of 10.3% and 10.9%, respectively.

The increases combined with New York City’s own 3.9% tax on personal income, as well as federal income tax rates that range from 10% to 37%, will raise the top marginal personal tax rate for city residents to nearly 52%. That would push New York past California, which currently has the highest marginal personal tax rate of just over 50% on income over $1 million.

Few of Gotham’s wealthiest, however, will end up paying rates that high. Nearly 3 million New York City residents file taxes, according to state data from 2018, but just 30,000 reported making more than $1 million a year. And only about 4,000 of those people made more than $5 million. That’s about the population of Armonk, the wealthy New York City suburb that is home to IBM headquarters.

And remember: That 52% surcharge is a marginal rate paid on the income above $25 million. High-wage earners will still pay a lesser, combined all-in rate of 44% on income below $1 million.

Don’t Miss: Wax Museum Nyc Times Square

New York Issues Guidance On The Application Of Tax Credits On Combined Returns

New Jersey has indicated that with respect to combined returns, tax credits belong to the taxable member that earned them, unless a specific statute authorizes the tax credit to be earned or awarded at the group level. Any credit carryover available for future use belongs to the taxable member that originally earned the credit. If a member leaves the group, that member takes with them any tax credit/carryforward they generated. Any carryforward must be reduced by the amount that is used by the group and/or member. For specific details, please consult New Jersey Division of Taxation Technical Bulletin TB-90 .

Nys And Yonkers Withholding Tax Changes Effective January 1 2021 And Before July 1 2021

We revised the 2021 New York State personal income tax rate schedules to reflect certain income tax rate reductions enacted under the Tax Law. We also updated the New York State and Yonkers resident withholding tax tables and methods for 2021. These changes apply to payrolls made on or after January 1, 2021, and before July 1, 2021.

- Calculate 2021 New York State withholding tax amounts using Publication NYS-50-T-NYS , New York State Withholding Tax Tables and Methods.

- Calculate 2021 Yonkers resident withholding tax amounts using Publication NYS-50-T-Y , Yonkers Withholding Tax Tables and Methods.

- NOTE: There were no changes to the New York City resident wage bracket tables and exact calculation methods. Please continue to use Publication NYS-50-T-NYC , New York City Withholding Tax Tables and Methods.

Recommended Reading: Where Is The Wax Museum In New York

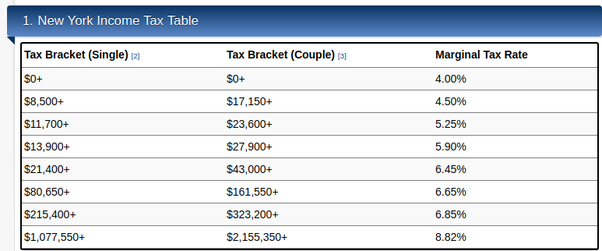

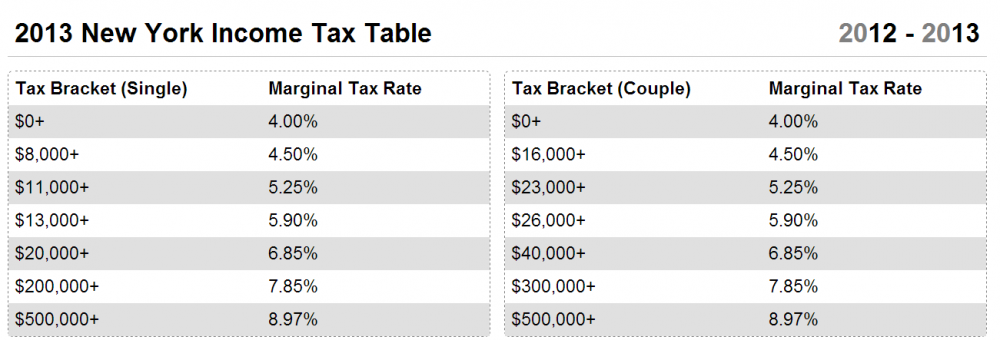

New York Income Tax Rate 2020

New York state income tax rate table for the 2020 – 2021 filing season has eight income tax brackets with NYtax rates of 4%, 4.5%, 5.25%, 5.9%, 6.09%, 6.41%, 6.85% and 8.82% for Single, Married Filing Jointly, Married Filing Separately, and Head of Household statuses.

The New York tax rate is mostly unchanged from last year. A couple of small changes were made to the middle bracket tax rates. The income tax bracket amounts are unchanged this year. New York income tax rate and tax brackets shown in the table below are based on income earned between January 1, 2020 through December 31, 2020.

| 8.82% |

Please reference the New York tax forms and instructions booklet published by the New York State Department of Taxation and Finance to determine if you owe state income tax or are due a state income tax refund. New York income tax forms are generally published at the end of each calendar year, which will include any last minute 2020 – 2021 legislative changes to the NY tax rate or tax brackets. The New York income tax rate tables and tax brackets shown on this web page are for illustration purposes only.

Imposed Sales Tax On Vapor Products

Effective December 1, 2019, a new 20% supplemental sales tax will apply to retail sales of vapor products in New York, which should be collected by a vapor products dealer. Any business that intends to sell vapor products must be registered as a vapor products dealer before making sales of vapor products. The Tax Department is developing an online registration process. In addition, if a taxpayer has debit blocks on their bank account, even if the taxpayer has already authorized sales tax payments to the Tax Department, the taxpayer must communicate with their bank to authorize their vapor products registration payment.

You May Like: Tolls From Baltimore To Nyc

New York Updates Estimated Tax Payment Instructions

The New York Department of Taxation and Finance has issued a bulletin alerting taxpayers of updated instructions for Forms IT-2105, Estimated Tax Payment Voucher for Individuals, and IT-2106, Estimated Tax Payment Voucher for Fiduciaries. The updates reflect recently enacted increased personal income tax rates for the following taxpayers: married taxpayers filing jointly with income over $2,155,350 single filers, married taxpayers filing single, and estates and trusts with income over $1,077,550 and heads of household with income over $1,616,450.

May 26, 2021

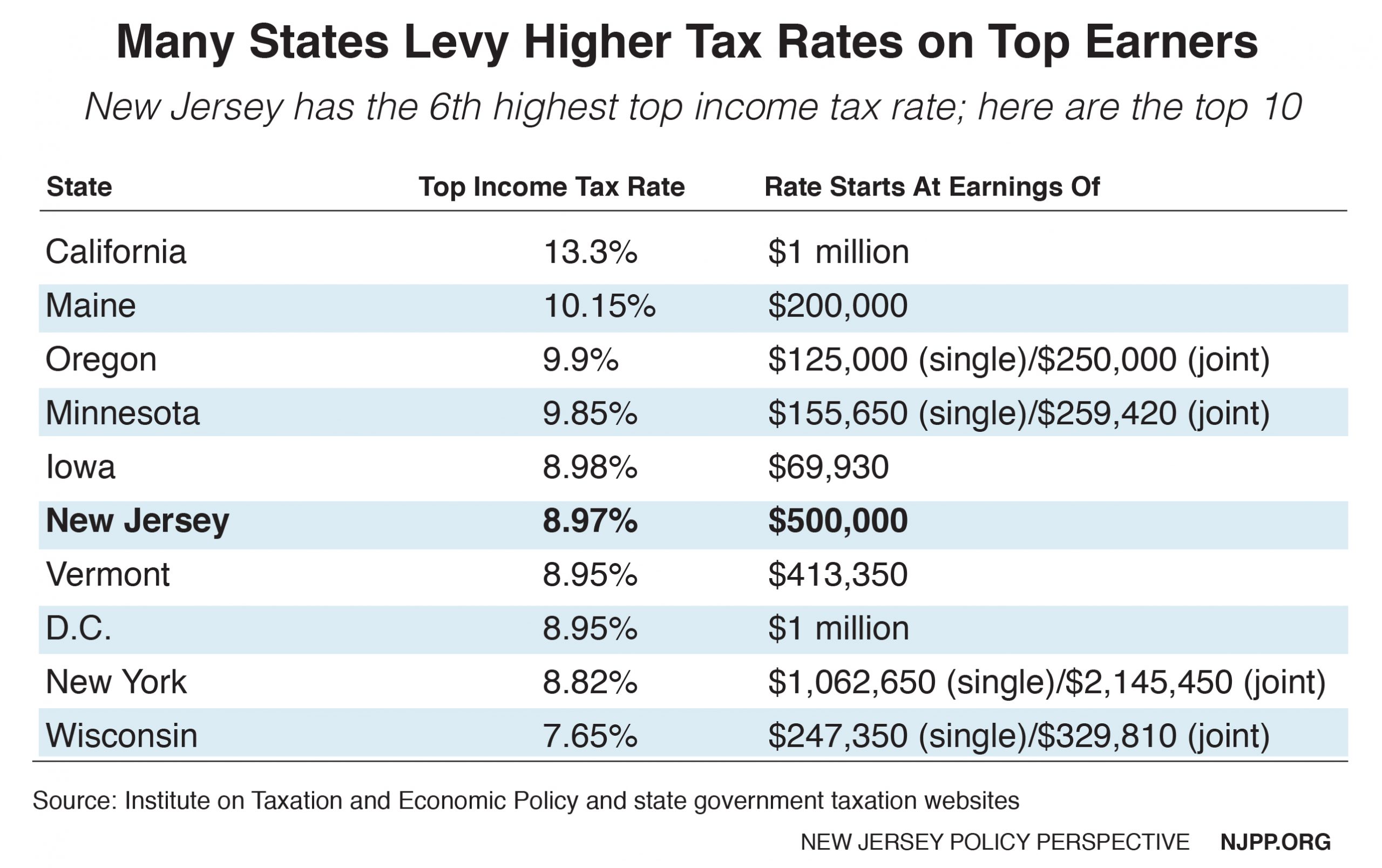

Top Income Tax Rates By State

California tops the list with the highest tax rates in the countryits highest tax rate is 13.30%, a full 2.3% more than Hawaii, the runner-up for the highest tax rate with 11.00%. California applies its highest tax rate to those who earn more than $1 million.

Rounding out the top-10 states with the highest tax rates are:

- Iowa: 8.53%

- Wisconsin: 7.65%

New York’s highest tax rate was changed with the passage of the 2021-2022 budget, from 8.82% to three graduated rates of 9.65%, 10.30%, and 10.90%. All of these rates apply to incomes over $2 million. In 2028, these rates are scheduled to revert to the pre-2021 rate.

Read Also: How To Submit Poetry To New York Times Magazine

The Nyc Enhanced Real Property Tax Credit

This credit is offered to renters and homeowners living in residences that weren’t totally exempted from real property taxes during the tax year. Your household income must be less than $200,000 as of 2020.

You must have resided within the city for the entire year and in the same residence for at least six months. You can’t be claimed as a dependent on anyone else’s federal tax return. This credit can be as much as $500.

How Your New York Paycheck Works

When you start a job in the Empire State, you have to fill out a Form W-4. Your new employer will use the information you provide on this form to determine how much to withhold from your paycheck in federal income taxes. How much you pay in federal income taxes depends on several factors like your marital status, salary and whether or not you have additional taxes withheld from your paycheck.

The 2020 W-4 includes notable revisions. The biggest change is that you won’t be able to claim allowances anymore. Instead, you’ll need to input annual dollar amounts for additional income and things like non-wage income, total annual taxable wages, income tax credits and itemized and other deductions. The form also utilizes a five-step process that asks you to enter personal information, claim dependents and indicate any extra income or jobs.

All employees hired as of Jan. 1, 2020 must complete the form. If you were hired before then, you don’t need to worry about filing a new W-4 unless you plan on changing your withholdings or getting a new job.

Also Check: Thrush Poetry Submissions

New York State Extends Income Tax Filing Deadline

New York states income tax filing deadline is being moved to July 15 to comply with the federal governments decision to push back the traditional filing date due to the coronavirus outbreak.

Disclaimer: Please note this is the information that is readily available at this time, it is subject to change so please consult your Withum tax advisor.

New York Auditing Income Tax Returns Of Certain Nonresident Remote Employees

New York tax authorities are focused on auditing 2020 income tax returns filed by nonresidents who work for New York employers. During the course of the Coronavirus Pandemic, the New York Department of Taxation and Finance directed nonresidents whose primary office is in New York to count telecommuting days as time working in the state. More specifically, TSB-M-06I, issued in 2006, provides that in order for any work days to be allocated outside of New York State, such services must be because the employers necessity and not the employees convenience. Applying this rule, unless telecommuting was because of necessity of the employer, employee services rendered remotely were to be considered New York work days. However, there may be legal challenges to that position because taxpayers are arguing telecommuting was a requirement and, in many cases, mandated rather than simply being based upon convenience. Moreover, the U.S. Supreme Court will rule on a similar issue as requested by New Hampshire, which is challenging Massachusetts taxation of residents working remotely.

You May Like: How Much Does It Cost In Tolls From Va To Ny

Overview Of New York Taxes

New York state has a progressive income tax system with rates ranging from 4% to 8.82% depending on taxpayers income level and filing status. Living in New York City adds more of a strain on your paycheck than living in the rest of the state, as the Big Apple imposes its own local income tax on top of the state one. New York Citys income tax system is also progressive and rates range from 3.078% to 3.876%.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

- Our Tax Expert

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

Corporation Tax Changes In 2019 Budget

This summary highlights the corporation tax changes that were part of the 2019- 2020 New York State budget. Most notably, several tax law provisions were amended, including the contributions to the capital of a corporation, entire net income for stock life insurance companies, and unrelated business taxable income. Additionally, electronic filing and payment mandates have been extended through December 31, 2024, and the tax shelter penalty and reporting requirements have been extended through July 1, 2024.

Don’t Miss: What Airlines Fly To Cabo San Lucas From New York