Study For And Pass The Cpa Exam

Studying for the CPA Exam is definitely the most challenging and time consuming part of the whole process, so you might as well get a jump start on studying as soon as your fees are submitted.

Not sure which exam section to take first? Check out my post where I break down the pros and cons of each route you can go so you can make the best possible decision: Which section of the CPA Exam should I take first?

By far the most important factor to success on the CPA Exam is sticking to a consistent study schedule and not letting too much time lapse between study sessions.

The CPA Exam is not a test you can just cram for so youll want to make sure you space out the material into manageable chunks in a way that fits your schedule.

As long as you schedule things out properly, you wont have to sacrifice your entire social life for the CPA Exam like some folks say!

Youll also need to purchase a CPA review course thats best suited for your study style and budget. Ive personally tested and examined all of the top review courses out there so you can find the best one for you.

If you still cant decide which course is best, send me an email and Ill personally help you!

Accounting Schools In New York

This overview of graduate-level accounting schools in New York offers important information about your options for earning an accounting degree and furthering your accounting career. New York has numerous colleges and universities with high-quality accounting degree programs designed to fit a variety of concentrations and interests. Several schools also offer alternatives to traditional on-campus programs, either through entirely online programs or hybrid programs. Keep reading to find out more about New York masters in accounting programs and how to become a Certified Public Accountant in the state.

Requirements To Obtain Your Ny Cpa License:

- Obtain a Masters in Accountancy degree from an AACSB accredited college, university or foreign equivalent

- Have at least 150 total semester hours from an accredited college, university or foreign equivalent with at least:

- 33 semester hours in accounting with one course in each of the following four areas:

- Financial accounting and reporting

| Total | $1,069.96 |

|---|

*New Yorks Notice to Schedule window is 6 months, so you should only register and pay for the exam section you intend to take within that time. In case you need to schedule or re-take any sections beyond the original nine-month NTS window, a $75 re-examination fee plus the associated exam section fees above will apply.

You May Like: How To Move From New York To California

Cpa Exam Requirements New York

New York CPA Exam Education Requirements

Minimum Degree: Baccalaureate

Additional Requirements: Must include courses in financial accounting, cost or managerial accounting, taxation, and auditing

New York Residency Requirements for the CPA Exam

Citizenship: U.S. Citizenship is not required

Minimum Age: 21

Additional Requirements: It is not necessary to be a resident, employee, or keep office in the state

Interview A Prospective Cpa

When you meet with a potential accountant, bring a copy of your most recent tax return. Reviewing your latest return is one of the best ways for the tax pro to evaluate your situation and give you an idea of how much they might charge.

Be prepared to let your potential accountant know about any significant life changes youve experienced in the past year, like if you got married , invested in rental property, or started a business.

Here are some key questions to ask during your meeting:

Read Also: How Much Is A Penthouse In New York

Identification Ny Cpa Requirements

Although you dont have to be a U.S. citizen in order to become a New York CPA, you must disclose your Social Security number to the state when you apply for licensure. For those who are not familiar with an SSN, it is ID the U.S. government only issues to U.S. citizens, residents, and individuals allowed to study or work in the U.S.

However, if you are not a U.S. citizen, you can still have the chance to become a CPA licensed in the state of New York. The state board will give you an automatically generated 9-digit number that they will use for state recordkeeping.

Cpa Examination Services States

For states that are a part of NASBAs CPAES jurisdiction, the application process is much more streamlined. States that do so to make the application process for candidates more simplified. Candidates applying through CPAES will find that there are no third-party companies/organizations used to help evaluate credentials or process their application. This means that CPA Exam costs have less variation from state to state. Initial application, individual CPA Exam sections, and registration/re-examination fees remain relatively the same.

For these states, candidates go directly through CPAES to learn more about what requirements they need to meet to be eligible to sit for the CPA Exam. CPAES works with the State Board of Accountancy to determine this. The only other time CPAES interacts with State Boards of Accountancy are when candidates are issued their actual CPA license.

Many international candidates apply to states under NASBAs CPAES jurisdiction since the application process can be more efficient and simpler, offering in house credential evaluation services as well as other resources that tailor to their unique circumstances.

Recommended Reading: When Are Flights To New York Cheapest

New York Cpa Requirements

Wondering how to become a CPA in New York? The first thing youll want to do is to check the New York CPA requirements, as the New York Board of Accountancy will ultimately license you. This page serves as a resource for New York state CPA requirements and is current as of August 2021. Always consult with New York’s Board of Accountancy for the most current information.

How To Become A Cpa In New York

To become a Certified Public Accountant in the state of New York, the regulations are steep to maintain professional integrity. With the correct preparation, any committed and detail-oriented person can easily earn their CPA license in the Empire State. After finishing a bachelor’s degree CPA wannabes must complete another 30 credit hours of accounting or business courses. Completing and passing the uniform CPA exam comes next. The applicant must score a 75% or better on each of the four sections. The final step is to work with the supervision of a licensed CPA for one year. After filling out the licensing paperwork the Certified Public Accountant license for the state of New York should be in the mail.

Read Also: What Can You See In New York

New York Cpa Exam & License Requirements 2021

Heres how you can earn CPA licensure in the state of New York.

There are accountants in nearly every industry in business and ecommerce. There are even accountants working for federal and state government, law enforcement and non-profit organizations. However, none can surpass the workand industry respectof the Certified Public Accountant . When you achieve this professional designation, you will be qualified to sign official financial statements, taxation documents and attest to the accuracy of all financial documents. New York State confers this responsibility on those who are able to meet its specific guidelines. Keep reading to learn how to become a CPA in New York.

New York Accounting Associations

- New York Society of CPAs : The NYSSCPA works as an advocate and resource for CPAs in New York by working to cultivate the values of integrity, professionalism, and ethics.

- Independent Association of Accountants of New York : The IAA of New York works to advocate for the field of accounting and accounting professionals in the state of New York through networking, professional education, and development opportunities.

You May Like: A Trip To New York Cost

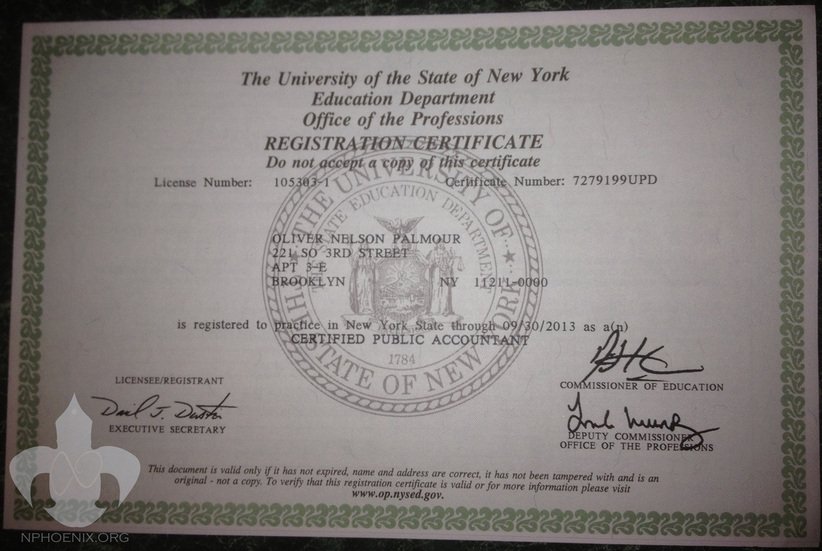

Receive A Cpa License

Once all application materials are reviewed and approved, the Board will issue candidates a license number. Candidates will be entitled to practice from the effective date of licensure. Candidates may find out if their license has been issued by going to the Boards online verification site and searching for their name. A license parchment and registration certificate will be mailed within two working days of the effective date of licensure.

Nasba Approved Qas Self

FurtherEd is registered with the National Association of State Boards of Accountancy as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website:www.nasbaregistry.org.

About

You May Like: How To Rent A Yacht In New York

Best Cities In State To Work As An Accountant

Content Source: BLS Data

The professional organization for accountants in New York State is called the New York State Society of CPAs. Their website has all sorts of helpful information for future and current CPAs. It is a go-to resource for anyone in the Empire state, from those accountants in New York who are just getting started and need help remiembering the paperwork they need to file, to seasoned accountants who are interested in an upcoming conference. The NYSSCPA has information on CPE requirements and information on CPE events that are specific to New York. The accountants who are affiliated with a membership also have more access to tax law changeg. These happen constantly and are enough of a pain in the butt without having to miss out on hearing about one. Professionals can also network with their collegues, which is never a bad thing.

Content Source: BLS Data

Cpa Licensure In State Steps Toward Eligibility

To be eligible for CPA licensure in State, candidates must meet these following qualifications:

Content Source: National Association of State Boards of Accountancy

Every state requires accountants to stay current in their knowledge of the tax and financial laws that pertain to their state. To remain licensed in the state of New York, where it is a great place to be an accountant, licensees must complete a minimum of 40 contact hours every year, and report this information annually or three years of acceptable formal continuing education in any of the recognized subject areas, or complete a minimum of 24 contact hours of acceptable formal continuing education concentrated in one subject area. The subjects approved by the state of New York are: accounting, attest, auditing, taxation, advisory services, specialized knowledge and applications related to specialized industries. Four of these hours must be in ethics of accounting courses. Providers offering ethics courses must register with the Board and/or have their content approved by the Board. Accountants in New York can report their CPE any day of the year. The required dates of license renewal are triennial based on the date of license issuance and the birth month of the licensee.

You May Like: How Do I Renew My Drivers License In New York

New York Cpa Work Requirements

Much like with many other states, you need one year of accounting work experience after youve met your education requirement. Keep in mind that your work experience only applies if its been verified by a CPA.

There are no limiting factors on where you can work to gain this experience. New York recognizes work from the private sector, public sector, or educational institutions just make sure theres a licensed public accountant who can verify the work you do!

Pass The Aicpa Ethics Exam

After you have to pass all four sections of the CPA exam, you will need to take a short ethics exam that is administered by the AICPA. This is more of a take home exam than a real exam.

Once you sign up for it, you will be mailed an ethics textbook that describes the ethical duties and obligations that CPAs are required to uphold. All you have to do is read the book and take the ethics exam online.

The CPA ethics exam isnt mandatory in all states, but its pretty common. You should check with your state board about this step, but most likely you will need to do it.

Read Also: How To Obtain Arrest Records In New York

How Much Does A Cpa Make In New York

The average income for a CPA in New York is $95,650 per year, with the average reaching as high as $102,090 in the New York City metro area.10 New York is the second-highest paying state in the nation for accountants and auditors.11 The New York City metro area is the top-paying metropolitan area for accountants in the country.11

Ask Friends Family And Co

Dan Henn, a C.P.A. in Rockledge, Florida, said most of his business comes from referrals.

Check with family, friends, business associates, co-workers, your attorney, financial adviser, or banker, Mr. Henn said. Find out who they use and if theyve had a positive experience.

C.P.A.s and accountants tend to focus on particular niches or specialties, such as small-business owners, high-net-worth individuals, or clients who work in certain industries. As a result, Mr. Henn recommends asking people you know with similar needs. For example, if youre a doctor, talk to other doctors and ask who they use, he said.

You May Like: Is New York Life Insurance A Good Company

Cpa Experience Requirements New York

In the state of New York, you need one year of full-time experience to meet the CPA experience requirements. This can be done two ways:

- 35-40 hours in a five-day work week

- Equivalent part-time work, with no fewer than 20 hours/week

To fulfill this requirement while only working part-time, every two weeks will count as one week of full-time work. This would take two years.

You will use specific forms, filled out by qualifying employers, to certify that you have met this requirement.

After your work experience is complete, you can apply for your CPA license. There is a $377 fee that must be paid in order to obtain a license to practice public accounting in the state of New York.

Get Your New York Cpa License

After passing the Uniform CPA Exam and fulfilling the experience requirement, you will be ready to submit your New York State CPA license application. Verify completion of all requirements for licensure in New York:

a. Checklist

- Earn a bachelors degree or higher by completing an accounting program that consists of at least 150 undergraduate semester hours.

- Take and pass all four sections of the Uniform CPA Exam.

- Complete one year of full-time work experience that requires use of your accounting skills, or the equivalent in part-time work, under the supervision of a CPA licensed in any U.S. jurisdiction.

b. Apply for your New York CPA license.

- Submit Form 1, Application for Licensure & First Registration along with the $377 licensure and application fee. Checks must be made payable to the New York State Education Department. Your signature on Form 1 must be notarized.

- Complete Form 4, Applicant Experience Record, and submit it to the New York State Department of Education, Office of Professions. Provide a copy of Form 4B, Certification of Employer, to the employer with whom you fulfilled your work experience requirement. Your employer will then complete Form 4B and submit it on your behalf to the Department of Education.

For international and out-of-state applicants:

Interstate/International Reciprocal License

Also Check: Where To Get Weed In New York

Cpa Mobility Is Increasing

It is becoming easier to transfer your CPA license from one state to another. This is especially true for individual mobility, but even firm mobility is making rapid strides.

As there are 55 jurisdictions, checking if your license and credentials are valid in a different state can be a complicated task. The best approach is to use CPAmobility.org, the mobility tool developed by NASBA and AICPA. If this does not help, it is a good idea to contact the accountancy board in the state in which you plan to work for additional information.

New York State Resources And Contact Information

Below are state resources in the areas of accountancy, government, study, and taxes. Click on the entity title to access the website, and the social media logo to access the entity account.Accountancy

We are the American Institute of CPAs, the worlds largest member association representing the accounting profession. Our history of serving the public interest stretches back to 1887. Today, you’ll find our 431,000+ members in 130 countries and territories, representing many areas of practice, including business and industry, public practice, government, education and consulting.

You May Like: How Much Does A Studio Apartment Cost In New York

The International Application Process For The Uniform Cpa Exam

The application to apply for the CPA exam as an international student is very similar to domestic candidates. The only real difference is in the educational requirements. Most US Colleges and Universities are accredited and approved by NASBA and the AICPA. Thus, US candidates dont tend to have problems with their education requirements. Before you apply, check the NASBA site to make sure your institution is recognized. After that is out of the way, your application process should be pretty easy.

1) Contact the appropriate board of accountancy to obtain an application.

2) Send in your application including the required recommendation letters, transcripts, photographs, and other documents. You should request your application several months in advance. Keep a copy of your completed application, and send your application by certified mail .

3) Use your ATT to obtain an NTS

4) Use your NTS to schedule your exam.

State boards are constantly changing their CPA exam requirements, so make sure to contact the state you plan to sit in before sending in your application.

Once you have passed the exam in one state you can transfer to another state if need be. You will have to meet the education and experience requirements of the new state, but normally you are given credit for having already passed the CPA exam.