The Caveat: Average Mortgage Payments Don’t Really Matter

Its important to keep in mind that statistics are just broad, overall trends. The truth is, every mortgage payment is unique. Two homebuyers with identical properties can have very different payments, whether theyre across the country from each other or just down the street.

Thats because mortgage payments are based on a whole slew of factors that vary from one buyer to another. Here are just a few of the things that can make one homeowners mortgage payment different than the next:

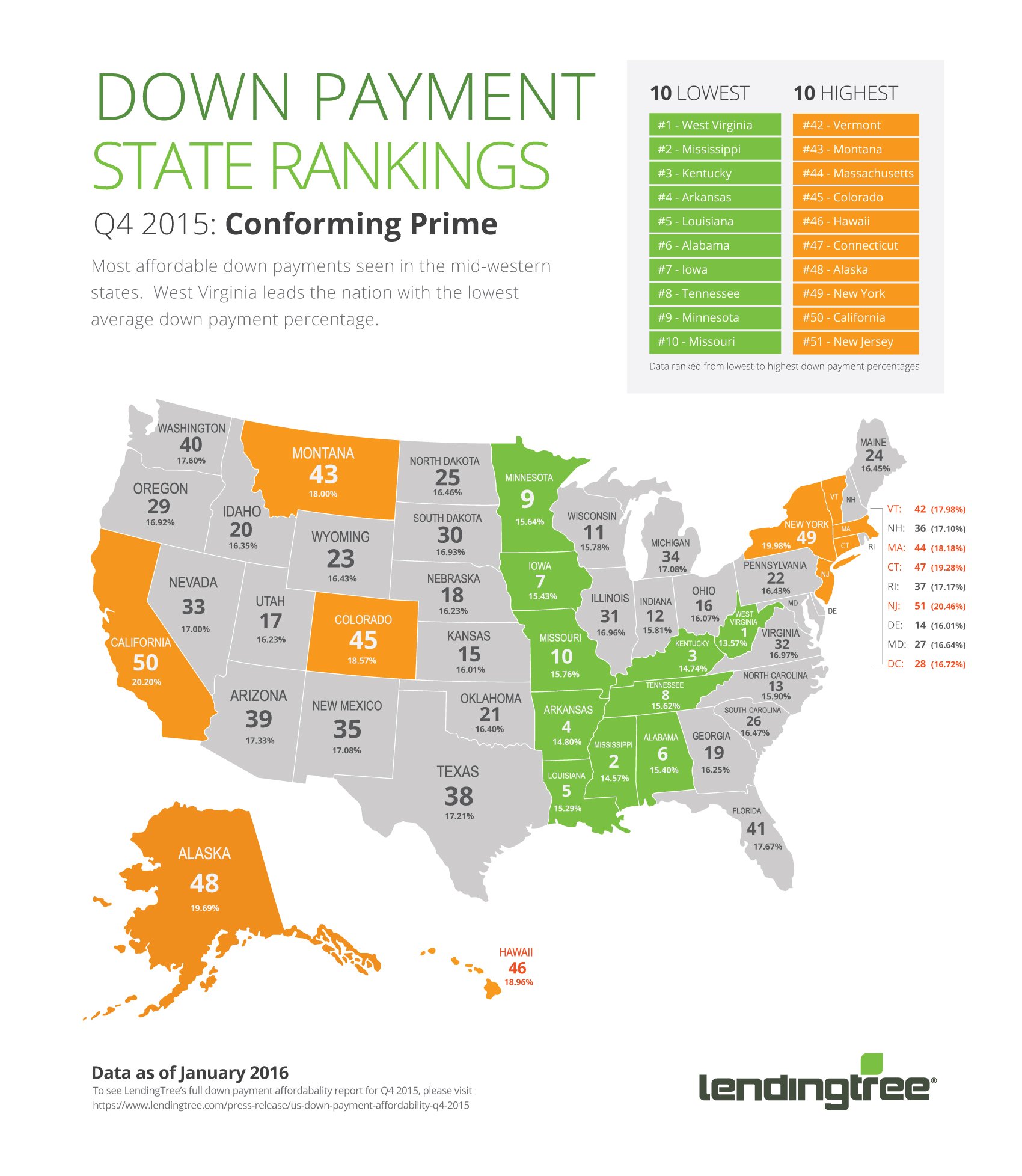

- Down payment size

| $1,100 | $1,450 |

In this scenario, Buyer A has a stellar credit score of 760. She qualifies for a 3.75% interest rate as a result. And she makes a 20% down payment of $60,000. Not including property taxes and home insurance, shed see a monthly mortgage payment of $1,111.

On the other hand, Buyer B has notsogreat credit . He qualifies for a 4.25% interest rate and puts down just 10% . His mortgage payment would come out to $1,443 .

Thats a difference of $332 per month or $3,984 per year. Buyer B would also see significantly more paid in interest over the life of the loan.

Why Is It So Expensive

The fact that New York City is so damn expensive isnt a recent phenomenonthe city has remained a bastion of wealth for over a century now, despite the ebbs and flows in the marker over the decades, according to real estate guru Jonathan Miller.

The most recent push in pricey real estate occurred following the financial crisis in 2008, as the markets began to recover, Miller says. Capital poured in from across the world that prompted developers to go on a building spree. With the limited amount of space available in the city, the high cost of construction, and the expensive land values, developers choose to build luxury developmentslike the developments on Billionaires Rowand in turn drove up prices citywide.

New York City has always been affordability-challenged, but this most recent housing boom has only exaggerated it further, says Miller.

Being the cultural capital of the world also holds a certain amount of cache, says Corcorans Geller. There is a premium for that, he explains, and historically, people have been willing to pay the price.

Other Refinancing Costs Borrowers Should Consider

Every loan will have closing costs of some kind to pay the brokers, underwriters, and others involved. Most no-closing-cost promotions will roll the closing costs and fees into the loan itself. Another method is the yield spread premium where a lender pays the broker costs in exchange for a higher-rate mortgage. Options like these can be an advantage for cash-strapped homeowners. However, the borrower paying costs upfront will not have to pay interest on those fees for the next 15 to 30 years.

Its well-known that borrowers with bad credit scores usually receive higher interest rates. Those with the best credit ratings will qualify for the lowest rates and the best products. Have you taken appropriate measures you straighten your credit out before beginning the refinancing process?

Recommended Reading: Ez Pass Toll Calculator Ny

Frequently Asked Questions About A Mortgage Underwriter Salaries

The average salary for a Mortgage Underwriter is $86,195 per year in New York City, NY Area. Salaries estimates are based on 68 salaries submitted anonymously to Glassdoor by a Mortgage Underwriter employees in New York City, NY Area.

The highest salary for a Mortgage Underwriter in New York City, NY Area is $121,735 per year.

The lowest salary for a Mortgage Underwriter in New York City, NY Area is $61,031 per year.

Average Closing Costs In New York

Across the state, the average home sale price is between $400,000 and $500,000. If you buy a home in that price range, the average closing costs before taxes are $5,571.32. These fees pay for processing, appraisal and recording fees, plus title insurance, municipal searches and more.

New York is also notorious for its taxes, and real estate is no exception. If you live in the city, you face property taxes and the New York City mortgage tax which can be anywhere from 1.80% to 2.80% of your purchase price resulting in about $13,261.67 in closing costs after taxes.

New York Citys Mansion Tax

If youre buying a home for $1 million or more in the Big Apple, your purchase is subject to the New York City mansion tax. Its a mere 1% of your purchase price, but it ends up being no small tax. And youll end up paying it within 15 days of your closing.

Sellers dont get away scot-free, either. If youre the home seller, you pay fees as well as a New York State or New York City transfer tax.

Rocket Mortgage

- Miscellaneous co-op fees: Varies

You May Like: Delete New York Times Account

Todays Mortgage Rates In New York

Whether youre ready to buy or refinance, youve come to the right place. Compare New York mortgage rates for the loan options below.

Compare current refinance rates today.

The rates below assume a few basic things:

- You have very good credit

- Your loan is for a single-family home as your primary residence

Costs Included In A Monthly Mortgage Payment

In the Census Bureau’s American Community Survey’s data, the monthly mortgage payment includes things like insurance and taxes. In part, it’s because that’s how mortgages actually work oftentimes, you pay for more than just the loan’s principal and interest in your monthly payment.

If your mortgage includes an escrow account, you’ll pay for two costs each month in your monthly mortgage payment:

- Property taxes: You’ll pay tax on your home to your state and local government, if necessary. This cost is included in your monthly payment if your mortgage includes escrow.

- Home insurance: To keep your home covered, you’ll need to purchase a homeowner’s insurance policy. The average cost of homeowners insurance is about $1,200 per year.

In addition, mortgage payments can also change based on several factors. Two different people could face very different homeownership costs for the same house, even. There are two big factors that change your monthly payment:

Another monthly cost to consider should be how much you’ll need to save for repairs. In general, the older your home is, the more you should keep on hand for repairs. Utilities like internet, garbage removal, and electricity will also add to your monthly costs of homeownership.

Also Check: Ny State Mug Shots

Frequently Asked Mortgage Questions

We recommend you seek mortgage pre-approval with your chosen lender before making an offer on a property in New York City. Once your offer is accepted and the contract is signed, its time to complete your mortgage application package and choose the right home financing product. These questions will help you make an informed decision about your mortgage.

The Cost Of Living In New Jersey

New Jersey has some of the highest taxes in the U.S. It also has some very high home prices, driven in part by its proximity to New York City and its population density . Despite this, the Garden State has a lot to offer: New Jerseys economy is consistently strong, and its schools are among the best in the Northeast. There are many other factors that go into its cost of living calculations, though.

Read Also: How To Register A Car In Ny

Mortgage Loan Processor Isalary In New York Ny

How much does a Mortgage Loan Processor I make in New York, NY? The average Mortgage Loan Processor I salary in New York, NY is $49,241 as of November 29, 2021, but the range typically falls between $44,556 and $55,513. Salary ranges can vary widely depending on many important factors, including education, certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary.com helps you determine your exact pay target.

| Percentile | |

| 10th Percentile Mortgage Loan Processor I Salary | $40,291 |

| 25th Percentile Mortgage Loan Processor I Salary | $44,556 |

| 50th Percentile Mortgage Loan Processor I Salary | $49,241 |

| 75th Percentile Mortgage Loan Processor I Salary | $55,513 |

| 90th Percentile Mortgage Loan Processor I Salary | $61,222 |

Nyc Mortgage Recording Tax

By Prevu Team onDecember 31, 2020

The NYC mortgage recording tax is one of the largest closing costs NYC homebuyers pay when using a mortgage to finance a large portion of their property purchase. You are probably thinking, “Oh great, more taxes.” Not to worry! Weve outlined below some helpful information to better understand how much you will pay, when the tax is applicable, and how you can offset the mortgage recording tax with the savings of a commission rebate.

You May Like: Application For Nys Disability

If Refinancing Is For You What Are Your Options

Borrowers can refinance at a variety of different loan lengths. 15, 20, and 30-year fixed rates in New York are popular products. 20-year refinance options are a happy balance of benefits between each of these options. With 20-year terms, you can pay the loan off quickly, like you would with a 15-year loan, but also receive lower rates than that of a 30-year mortgage.

A fixed-rate mortgage will generally come at a higher rate than a variable product. Even if a variable loan has lower interest now, a market change could cause problems down the road for variable rate loans. Market volatility can leave homeowners with Adjustable Rate Mortgages paying excessive interest payments. The Fair Housing Act , part of Housing and Urban Development , has a variety of options for homeowners. While most FHA loans service new home purchases, the department offers a few programs for refinancing as well.

If youre nearing the end of your loan, plan to sell your home soon, or anticipate a windfall of cash, you might opt to go for an adjustable rate mortgage. The low initial interest can save you money, just remember the potential spike of interest after the fixed period of time associated with the loan.

Current Market Forecast In New York

Many housing markets werent fully affected by the U.S. financial crisis until 2012, but New York experienced immediate deterioration. In 2008, the lowest point for New York states housing market, the median home value was $455,000, according to Zillow. Luckily, the market turned around quickly. In 2017, the median home value skyrocketed to $640,000. By 2018 the median home price is expected to reach $666,000.

These two predictions will mean different things for different borrowers.

Are you trying to refinance for the lowest rate possible? Or can you get more out of a higher valuation of your home? If you secured a loan pre-2012 its likely your mortgage rate is higher than current refinancing rates in NY. If you can secure a new interest rate one percent or less than your current mortgage rate, you could save a great deal of money over the life of your loan.

Seeing as the market is set to rise, if you dont need to refinance immediately, waiting to receive an appraisal in 2018 might enhance the refinancing products youre eligible for. A higher valuation may also allow you to rid yourself of PMI if youre currently paying insurance.

Recommended Reading: How To Become A Teacher In New York State

Mortgage Recording Tax Nyc

- Purchase Price: $2,000,000

- NY State Mortgage Recording Tax: $8,000

- NYC Mortgage Recording Tax: $22,800

- Total Mortgage Tax: $30,800

PREVU SMART TIP

Did you know you can save thousands on your NYC condo with a commission rebate? Buying with Prevu youll receive a rebate of two-thirds of the commission paid to the buyers broker at closing.

What Kind Of Homes Can I Buy In Nyc

There are several types of homes available for potential NYC buyers:

Condo: When you buy a condo, you have full ownership of the apartment, and some part of the buildings common areas . Though the condo building will have a board, it wont be as involved as a co-op board, and owners can easily rent or sell their home when they chose to. Condos are usually a good option for those who arent looking for a long-term investment. On the flip side, theyre typically more expensive than a co-opowners can be asked to pay more common charges depending on the amenities in the buildingand in NYC, they are quicker to fly off the market, says Geller.

Co-op: These are ideal for people looking to make a long-term investment in a home. In a co-op building, owners get a share in the co-op association, and all the shareholders together own the building and its units. Co-op boards play a big role, and can determine whether you can rent out your unit or make major changes to the apartment. Co-op boards also play a large role in determining who gets to own in their buildings, so it can sometimes be hard to snag an apartment even if you have the means. NYCs co-ops are generally older compared to condos, and somelike the Upper West Sides San Remo and Dakotahave celeb owners, which means you can expect a much stricter application process. However, co-ops are more plentiful in the city, and can often cost less than condos.

Don’t Miss: Delete Nytimes Account

Average Monthly Mortgage Payments By Age Group

Until the 45 to 54 age group, borrower age had a positive correlation with the median size of mortgage payments in 2015. Median payments increased for each successive working-age group, reaching their peak among people between 35 and 44 and declining for age groups with more retirees.

| Age | |

|---|---|

| $27,122 | $71,000 |

Borrowers of working age, in the 25 to 64 year old range, made monthly mortgage payments of close to $1,000. Consumers under 25 are likely able to afford a less expensive home than older professionals, and make a median monthly mortgage payment of under $800. Mortgage holders over 64 are likely retired and have either paid down their mortgage or are spending on a less expensive home, leading to a lower median payment for this group.

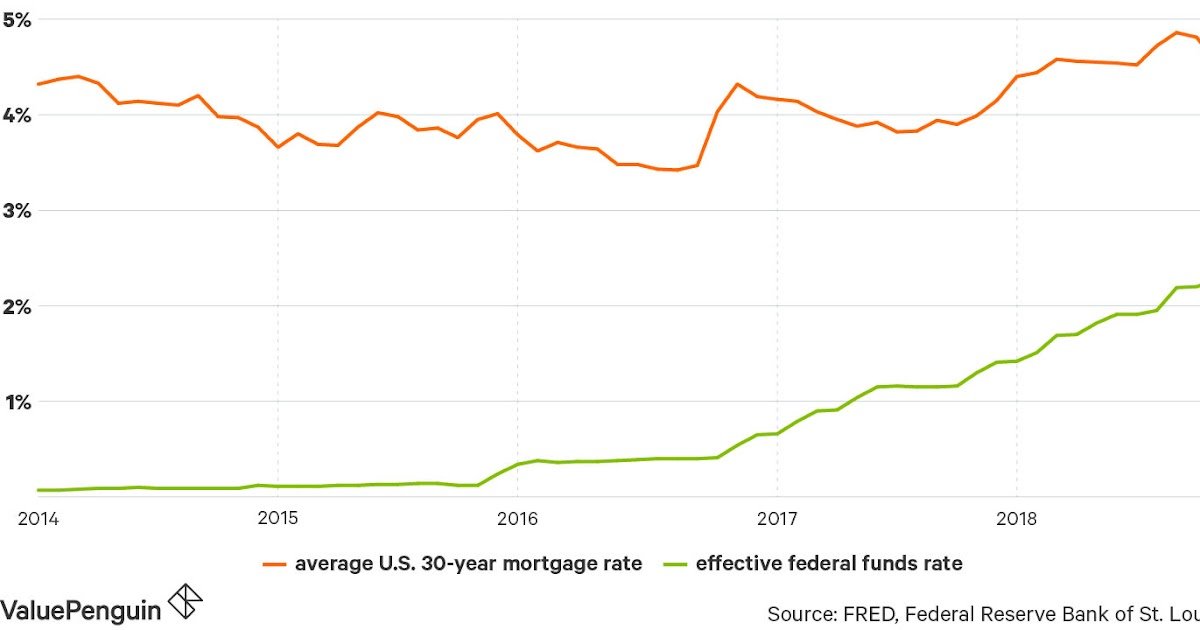

Why The Average Mortgage Payment Is Declining

According to property data firm CoreLogic,the typical mortgage payment is down nearly 3% over May 2018, despite rising home prices.

Thats thanks to predicted low interest rates, which have hovered around threeyear lows for some time.

According to CoreLogics findings, rates should average about 0.7 percentage points lower on 30year, fixedrate loans compared to last year.

That should lead to even steeper declines in average mortgage payments moving forward.

Read Also: Airfares To Cabo San Lucas

Mortgage Options In New York

Loan programs and rates can vary by state. To set yourself up for success and help you figure out how much you can afford, get pre-qualified by a licensed New Yorklender before you start your home search. Also check New York rates daily before acquiring a loan to ensure youre getting the lowest possible rate.

If you already have a mortgage and are considering a refinance, get customized rates for your unique circumstances. The APRs on this page are for purchasing mortgages, which are typically similar to refinance rates. Though, refinance rates can be higher.

A lot of lenders will require an appraisal during the mortgage process to determine thefair market value of a property. This ensures youre not paying more for a home than its worth on a purchase transaction and verifies the amount of equity available on a refinance transaction. Home values are constantly changing depending on buyer demand and the local market. Typically, home values increase over time.Contact a New York lender to learn more about local requirements for mortgages.

How Does Your Mortgage Stack Up

Whether youre a long-time homeowner, or someone looking to buy your first home, knowing the average monthly mortgage payment can help you put your next home purchase in context. However, knowing the average monthly mortgage payment isnt nearly as important as knowing how much you can afford. Before buying your next house, use a home affordability calculator to decide how much you can afford to put towards your monthly mortgage payment.

Methodology: LendingTree data from used the U.S. Census Bureaus Population Estimates Program to estimate monthly mortgage payments. The Census Bureaus data estimates were based on the 2016 American Community Survey Data.

To estimate monthly mortgage costs, we subtracted median selected housing costs from houses without a mortgage from median selected housing costs from houses with a mortgage.

Estimates of monthly income are based on the median monthly income of homeowners with mortgages in each state. Monthly mortgage payments as a percentage of income is calculated as the estimated monthly mortgage costs divided by the median monthly income of homeowners with mortgages in each state.

Recommended Reading: Wax Figures Museum New York

Average Mortgage Interest Rates

When it comes to mortgages, as with any loan, the interest rate is one of the most important factors. Unlike most other loans though, mortgages are very big often theyll be the biggest loan youll ever take out in your life.

There are also different types of mortgage, which makes getting the average mortgage interest rate a little tricky.

Statista has a useful graph showing the most up to date mortgage rates depending on if you are going for a fixed or variable mortgage.

Loan to value is the relationship between the current value of the property that the mortgage is paying for, and the actual amount the mortgage is. The mortgage value divided by the property value = LTV. Dont be scared of the maths, pull out your phone or use the Which? LTV calculator.

You also need to think about mortgage fees, which can be anything from £500 to £2,000 or more. Some mortgage providers will let you add the fees to the mortgage itself. This means you dont need to shell out the money when you first get the mortgage.

The con of doing this though is that the interest then applies to the fee, so you end up paying more overall, as well as more per month. Our advice: pay the fees upfront.