Sole Proprietorship Dba Ny

Having a sole proprietorship DBA NY is a business owner who has control over every part of the company in New York.3 min read

Having a sole proprietorship DBA NY is a business owner who has control over every part of the company in New York. Forming a sole proprietorship is easy, as you can begin working under your name and pay your taxes by using your social security number. Sole proprietors are considered the same as their business, as the owner and business are considered to be the same thing. Sole proprietors are in charge of any liabilities and debts that occur while the business is operating. The Department of State has regulations and rules to follow when starting your own business.

How Do I Change My Dba In New York

To make changes to your certificate of assumed name, you must complete and submit the Certificate of Amendment of Certificate of Assumed Name form.

For most changes, visit the County Clerks office to complete an amendment form and pay a filing fee. Contact your county clerk for county-specific instructions for changing your DBA at the county level.

When Do You Need A Dba

New York law requires that a company use its true legal name to conduct business.

Thus, companies seeking to use a name other than their true legal name must file for a DBA.

DBAs can be useful for a number of reasons. They allow a business to open a bank account and process transactions under a different name.They also allow the business to build local brand equity in a name other than the legal name of the business itself.

Recommended Reading: Ny Times Submission Guidelines

Get A Dba Name For Your New York Business Today

If youre an entrepreneur in New York, you may not wish to use your businesss full legal name for all of your companys activities. If so, a doing business as name could be a helpful branding tool, allowing you to conduct your small business under a different title.

Doing business as names are an excellent alternative to using legal personal names or business names. They afford levels of flexibility for business owners that are not otherwise possible. New York business owners can file for DBA names, or assumed names as they are known in the state, to enhance brand personality or augment business operations in other areas.

New York requires all general partnerships to file for a DBA name, even if they plan to carry on business using their legal names. Further, any individual or legal business owner who trades under a name other than their legally recognized name must file for an assumed name.

Our guide provides insight into New York DBA names, including how to choose a name, registering it, and keeping in compliance.

Annual Federal Returns For Tax

A. Annual Federal Returns

Most tax-exempt nonprofit organizations are required to file an annual return with the IRS .

The annual gross receipt amounts for an organization determine which form should be used to file the annual federal return.

Gross receipt is defined by the IRS as the total amounts the organization received from all sources during its annual accounting period, without subtracting any costs or expenses

For gross receipts $50,000 — File 990-NGross receipts < $200,000 and total assets < $500,000 — File 990- EZGross receipts > $200,000 or Total assets > $500,000 — File 990

For any questions, contact the IRS at

- 829-3676

- 829-1040

Q: When is form 990 due? A: Form 990 is due on the 15th day of the 5th month after the taxable year of the organization comes to an end.

E.g. If the taxable year ends on Dec 31st, form 990 is due on May 15th.

NOTE: If an organization fails to file form 990 for 3 consecutive years, it will automatically lose tax-exempt status.

B. Unrelated Business Income

If an organization has a gross income of $1000 from a trade or business that is not related to the stated purpose of the organization, then it must file Form 990-T to pay tax on that income.

If your organization expects to pay $500 or more for the year in taxes on unrelated business income, your organization must pay a quarterly estimated tax on the unrelated business income using Form 990-W.

You May Like: The Wax Museum Nyc

After Filing Your New York Dba

If filing a DBA marks the beginning of your business journey, then there are a few more steps that you should take before getting started:

- Create your Businesss Website – Every business needs a website. Luckily, drag-and-drop builders like GoDaddy and Wix make the job quick and easy. Check out our Best Website Builder article to find the tool thats best for you.

- Get your Business Finances in Order – Youll need to separate your business finances from your personal ones. This is accomplished by opening a business bank account. If your business has long lead times or other cash flow irregularities, you can also look into a business credit card.

- Protect Your Business – While an LLC will help to protect your personal assets in the case of a lawsuit, your businesss assets also need protection. Having the right business insurance will ensure that youre covered if the worst happens. Most businesses start with general liability insurance as their base coverage.

How To Get A Dba In New York

Filing a New York DBA , also known as an assumed name, is a simple process and its done at the county level or with the New York Department of State depending on your business structure.

A DBA won’t protect your personal assets. Forming an LLC is the best choice for most small businesses. Learn more in our DBA vs LLC guide.

Learn How to Get a DBA in New York yourself. Choose your business structure to get started:

Don’t Miss: Parking Near Madame Tussauds New York

Get Business Insurance For Your New York Llc

You protect your home, car, and other investments with various insurance policies. Your business is no different. Make sure you get the right coverage before the worst happens. Here are some common types of insurance policies you will want to consider:

- General liability insurance: Youll need this if there’s an injury on your property. It pays for damages and a lawyer if you need one.

- Commercial automobile insurance: This works like your own car insurance. It covers drivers and cars for your business.

- Workers compensation insurance:New York laws require workers compensation coverage for all employees, even part-time employees. If your business is owned by one person and you have no employees, you may not have to purchase coverage.

- Commercial property insurance: This protects your property in the event of damage. Keep in mind that flood insurance is often a separate policy.

- Professional liability insurance: Lawyers, doctors, architects, and other professionals need this insurance. It provides coverage and legal defense in the event of a malpractice case.

- Business income insurance: If you have to close for some time, business income insurance can pay back the loss of income. Policies vary, though. Make sure that you know exactly what kinds of losses will be covered.

Comply With Public Inspection Rules

To comply with federal regulations regarding 501 charities, you will need to release the following documents to any member of the public that requests them:

- Your organizations annual returns for up to 3 years after the listed due date

- Any supporting documents and attachments for the above 990 forms. However, you only need to include the nature of the contribution and the amount contributed for Schedule B.

- Official IRS paperwork showing your organization is considered to be tax-exempt.

- Your organizations application for exemption and all supporting documents submitted with your application .

Your organization does NOT need to share the following documents and information with members of the public:

- Any portion of Form 990/990-EZs Schedule B that identify who contributors are.

- Anything considered to be an unfavorable ruling, which can include previous denials of tax-exempt status.

- Any additional information permitted to be withheld by the IRS, including things such as trade secrets, patents, etc.

Recommended: Inform your employees about their rights and stay compliant by posting labor law posters in your workplace.

Q: Can I charge members of the public for copies?A: Yes, you are permitted to request a reasonable amount to procure copies of requested documents.

Q: Do I actually need to provide physical copies of the requested documents? A: If a member of the public as for copies of documents, whether in writing or in person, you are required to make them available.

Don’t Miss: Wax Museum Times Square Nyc

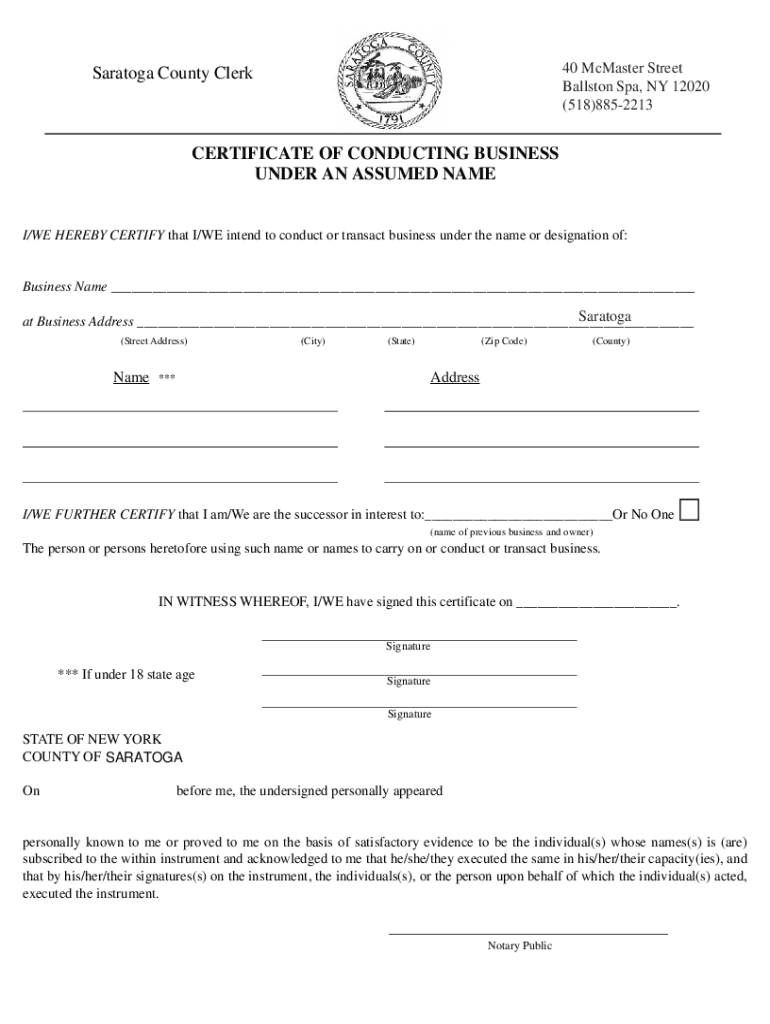

Doing Business As Filings

In accordance with New York State General Business Law , the County Clerk accepts and files certificates of persons conducting business under an assumed business name. These transactions are commonly referred to as DBA filings.

The General Business Law requires that individuals or partners conducting commercial activity under a name that is not their real name must file DBA certificates with the County Clerk. Filing a DBA protects the business name from use by others in the county where it is filed.

Please note that the law requires that DBA certificates contain specific language. Forms for DBA filings, amendments and discontinuances may be obtained at the Monroe County Clerks Office or downloaded using the links below. Forms are also available at some stores which carry legal stationery or business supplies. A filer may also consult with an attorney to draw-up the appropriate forms, particularly if filing a partnership.

Please note that if your business is located in the City of Rochester, there are often additional business permit requirements. The City’s website has information and contacts related to the business permit process. You can also get information by visiting a city Neighborhood Service Center for locations and hours.

Hiring A Registered Agent Can Save Money On Formation Costs

The financial reasons for designating an agent are unique to New York. Shortly after you form your LLC, Section 206 of the Limited Liability Company Law requires you to publish notices of the formation. Those notices must be in newspapers where your LLCs office is.

But, if you retain a registered agent company, you can use that companys address for your notices. That means that if your New York City LLC has an agent in upstate New York, youll end up paying a lot less for those notices than you would in one of the NYC boroughs.

If your business is located in New York City, you could save between $1000 and $1500 on the newspaper notices. That kind of money would more than pay for the costs of hiring a registered agent for several years.

Also Check: New Yorker Poetry Submission Guidelines

How To File A Dba

The process of filing a DBA tends to vary from state-to-state, even county-to-county. Here is a brief overview of DBA proceedings by state along with official resources to help you get started.

Can I file for a DBA online? Yes, in many states you can do so online easily, but this varies state by state.

Important: Always check the official sources as we are not not legal experts and regulations:

How Much Does It Cost To Start A Dba In New York

There are a few fees to keep in mind if you apply for the Certificate of Assumed Name:

- Filing fee: $25

- Youll pay a second county filing fee of $25, based on the county or counties your business does business or will do business.

- The second county filing fee in Bronx, Kings, New York, Queens, and Richmond counties is $100.

- In the state of New York, theres no county fee for limited liability companies or limited partnerships .

If you want certified copies of your business, youll pay a $10 fee.

You May Like: Nyc Pay Traffic Ticket Online

Applying For Trademark Protection

How Much Does An Assumed Name Cost In New York

Sole Proprietorships & PartnershipsThe filing fee for the Assumed Name Certificate varies by county but typically varies between $25 and $35.

Corporations & LLCs$25 for LLCs and limited partnerships. Corporation fees are $25 + $100 for each county within New York City and $25 for each county outside of New York City.

Recommended Reading: How To Register A Car In Ny From Out Of State

Submit Business Certificate Or Certificate Of Assumed Name

Finally, youll submit your business certificate or certificate of assumed name. After filing your Certificate of Assumed Name, youll receive an official filing receipt. It will contain:

- Assumed name

- Date of when you filed your Certificate of Assumed Name

- Fees paid

- Name of corporation or other business entity

The receipt will serve as proof of your filing, which is important because the Department of State wont issue duplicates.

Why Start Your Business In New York

The state of New York is home to more than 1.5 million small businesses, which employ an estimated 4 million people across the state. Small businesses in New York employ over 50% of the state’s workforce, making startups and small businesses critical to the state’s economic health. Thanks to its diverse and well-educated population, New York offers small businesses an excellent source of skilled talent to tap into to create a successful business. Some of the world’s largest companies have their roots in New York, including NBC, J.P. Morgan Chase, Time Warner, HBO, and AOL, among many others.

New York also offer ample opportunities to seek outside business investors. With a robust business climate and highly skilled workforce, the promise of prosperity creates incentives for investment in New York businesses.

Helpful New York Resources

New York Secretary of StateOne Commerce Plaza, 99 Washington Ave,Albany, NY 12231-0001

You May Like: Register A Car In Ny

Hiring A Registered Agent Is A Smart Business Decision

Maybe your LLC isnt based in New York City, and you still are not convinced that you need to hire an agent. Youve already shelled out a lot of money to start your business. You may be wondering why you should incur this cost.

You may be tempted to be your own registered agent because:

- Its cheap: Youre not paying someone for something you can do yourself.

- Its simple: The only address and contact information you have to keep current is your own.

- Its reliable: You will receive all important papers personally.

Before you make that call, though, think about some of the consequences of being your own New York registered agent:

- No privacy: Your name and address will be published on the Division of Corporations website.

- You will get a ton of junk mail in addition to a small amount of real mail and any service of process.

- No breaks: Agents must be open for service during all business hours. They dont get time off.

- Business interruptions: If your agency address is the same as your business address, your clients may be interrupted by people serving lawsuits. That could be embarrassing or hurt your reputation.

- Its your fault if you miss something: You always have to make sure your agency address is correct and up to date. If you make a mistake or miss something, thats on you.

Registered agents are not something that you will use every day, but when you need them, they must be reliable. Spending the money to hire a company is just a good business decision.

How To File A Dba In New York

Filing a DBA allows you to operate and receive payments under a name that is different from your legal business name. This helps you create an identity for your business that presents it in a professional light to customers and vendors, while allowing customers to write you checks and make payments directly to the business name you have chosen. Follow our step by step guide or let us handle the paperwork on your behalf, ensuring your business is filed quickly and accurately.

File a New York DBA for just $129 + state fees

Read Also: Pay New York Ticket

New York Llc Processing Time

The Department of State website says that the average processing time for articles of organization is seven business days. If you need your articles processed more quickly, the Department of State offers three tiers of expedited processing.

The expedited processing speeds, along with their costs, are:

- Within 24 hours: $25

- 2 hours: $150