New York Llc Approval Times

Mail filings: In total, mail filing approvals for New York LLCs take 4 and a half months. This accounts for the 4 month processing time, plus the time your documents are in the mail.

Online filings: Online filings for New York LLCs are approved immediately if you file your documents during business hours. Since you can download your documents as soon as theyre approved, there is no extra transit time.

What is LLC approval time? This is the total turnaround time to get your LLC approved from start to finish. It includes the processing time plus any transit time to and from the state.

Forming An Llc In New York

Here is an outline of the steps you need to follow in order to form an LLC in New York. You should also read the general section on forming an LLC for information that is applicable in any state.

1. Choose a business name for the LLC and check for availability.

- Please see our section on choosing and checking the availability of a name for your small business, as well as our section on the trademark law aspects of choosing a name.

- New York law requires that an LLC name contain the words”Limited Liability Company” or the abbreviation “L.L.C.” or “LLC”.Additionally, your business name must be distinguishable from othernames on file with the Department of State. There are a large number ofwords that cannot be included in the name without prior approval. For afull list, see N.Y. Ltd. Liab. Co. Law § 204.

- You can search for the availability of your proposedname by writing to the Department of State, Division of Corporations,41 State Street, Albany, NY 12231. The written inquiry should statethat you wish to determine the availability of a corporate name and list the name to be searched. There is a $5 feefor each name, which must accompany the request. Searching theavailability of a corporate name does not reserve the name. You may also search the New York Corporation and Business Entity Database to help you identify names that have already been taken, but this database might not be complete.

2. Prepare and file articles of organization with the Department of State.

Forming A Limited Liability Company

New York recognizes many business forms including the limited liability company , corporation, limited partnership, sole proprietorship, general partnership and other less familiar forms. Each has its own advantages and disadvantages. For any particular venture, personal and business circumstances will dictate the business form of choice. The Department of State cannot offer advice about the choice of business form and strongly recommends consulting with legal and financial advisors before making the choice. Forming an LLC should only be done after careful analysis. The following information has been developed to answer your questions regarding formation of an LLC and to assist in the filing of the Articles of Organization. Department of State staff cannot provide legal advice, however, they are available to assist in answering questions about filing LLC documents. Please contact the Department of State, Division of Corporations, State Records and Uniform Commercial Code, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231 or a representative at 473-2492 or email us with any questions you may have.

Next Section

Recommended Reading: Registering Vehicle In Ny

Create A Name For Your New York Llc

Before you register your LLC, you’ll need to come up with a name. Your business name needs to be catchy for branding purposes and legitimate for legal purposes.

We go into depth on this topic in our LLC naming guide. Well go over the basics below.

Naming Your LLC

First, brainstorm some possibilities. Use our LLC name generator to get the ideas flowing.

Next, make sure your name meets New York guidelines:

- it contains the words limited liability company, limited company, LLC or L.L.C.

- it doesn’t contain words like academy, bank, lawyer, mortgage, university, or doctor

- it must be distinguishable from any other entity or trade name registered in New York

- full list of New York naming guidelines

Next, do a New York LLC name search with the Secretary of State to find out if your name is available in New York.

If your business name is available and meets guidelines, youll be able to register it when you file your New York Articles of Organization with the Secretary of State.

Is the URL available? Before you commit 100% to a name, check to see if theres a good web domain available.

We recommend buying your domain right away because even if launching a business website isnt on your radar right now, it will be soon.

Powered by GoDaddy.com

Is There An Annual Fee For An Llc In New York State

Even though most state are not subject to the federal or state income tax, they are still required to pay for an annual filing fee. An LLC in New York must file a form IT-204-LL every taxable year. The amount of the filing fee is calculated depending on the gross income of the LLC, and can vary from $25 to $4,500 . LLCs that do not have income, or are treated as a corporation, a partnership, or a disregarded entity will not need to pay for this type of annual filing fee.

Additionally, LLCs in New York state are also required to pay certain types of taxes and fees annually. They include State Employer Taxes, Sales and Use Taxes, and, for LLCs treated as a disregarded entity or partnership, State Business Taxes.

These payments are usually handled by LLCs registered agents in New York. An agent will help businesses comply with the state rules and regulations, as well as deal with administrative procedures. If you need a registered agent for your LLCs in New York, or anywhere else in the world, check out One IBCs corporate services. We are proud to have supported more than 10,000 clients worldwide in setting up new businesses successfully in more than 27 jurisdictions.

Also Check: Apply For Medicaid Nyc

Name Your New York Llc

You’ll need to choose a name to include in your articles before you can register your LLC.

Names must comply with New York naming requirements. The following are the most important requirements to keep in mind:

- Your business name must include the words Limited Liability Company, LLC, or L.L.C.

- Your name must be different from an existing business in the state. You can do a search on the Secretary of State’s website to determine if a particular business name is in use. For name availability in New York, check this link.

- The business name cannot contain words used to name a government agency

- Certain restricted words may require additional documentation and licensure paperwork.

See a complete listing of New York’s naming rules.

Faqs About New York Llc Formation

How much does it cost to form an LLC in New York?

There are several costs associated with forming an LLC in New York. For a start, to file your Articles of Organization, the New York Department of State Division of Corporations charges a $200 fee. Then, if you decide you would like to reserve your LLC name so that it doesnt get taken by anyone else, there is a $20, which has to be paid before filing your Articles of Organization. If you are going through the process yourself, these are the main fees you will have to pay, however, if you use an LLC formation service, you will have to pay them the cost of the package you choose. Another option is to hire a lawyer, although this is likely the most expensive option.

If I want to dissolve my LLC in New York, how would I go about this?

When the time comes and you want to shut down your LLC, it is advisable that you dissolve it properly. This will limit your liability for lawsuits and any government fees if your business was not shut down properly. There is plenty of information out there that will take you through the process.

How long will it take to form an LLC in New York?

Can I be my own registered agent in New York?

What is an LLC?

LLC stands for Limited Liability Company. It is a type of business structure that offers a lot of flexibility than other corporations. Despite this, it still has a lot of the same benefits.

Do I need a bank account for my LLC?

How do I know if I can use my chosen business name?

Read Also: Wax Museum In New York

Create An Operating Agreement

An operating agreement is a document that outlines the way your LLC will conduct business. New York City requires LLC members adopt an agreement within 90 days after filing the Articles of Organization.

There is no requirement to file the operating agreement, but it is an essential component of your business. Having a readily accessible, written operating agreement is helpful for various reasons, including settling disputes that may arise over financial agreements and other potential litigation. Without an agreement in place, the courts make determinations based on state law, not necessarily what is in the best interest of the LLC and its members.

The operating agreement can include, but is not limited to, the following:

- LLC’s name and principal address

- Duration of the LLC

- Name and address of the registered agent

- Information about the Articles of Organization

- Purpose of the business

- The way profits and losses will be divided

- Procedure for admitting new members, as well as outgoing members

- Management of the LLC

- Indemnification and liability clauses

Learn The Steps Required To Obtain A Business License In New York

By David M. Steingold, Contributing Author

Looking to start a small business in New York? You may need to obtain one or more state licenses or permits, or complete one or more kinds of state registration, as part of the start-up process. Here’s a quick look at some of the main informational resources available and a few of the steps you may need to take.

Don’t Miss: How Much Are The Tolls From Virginia To New York

Form An Llc In New York

A New York LLC is a business structure that combines the limited liability of a NY corporation with more flexible ownership, management structure, and taxation options.

Setting up an LLC in New York isnt easy, but you can do it. Well teach you everything we know. Why? We hate to see New Yorks movers and shakers slowed by bureaucracy. Youre an entrepreneur. You should be out there making your dream happen, not slogging through paperwork or worst of all, overpaying on publication fees.

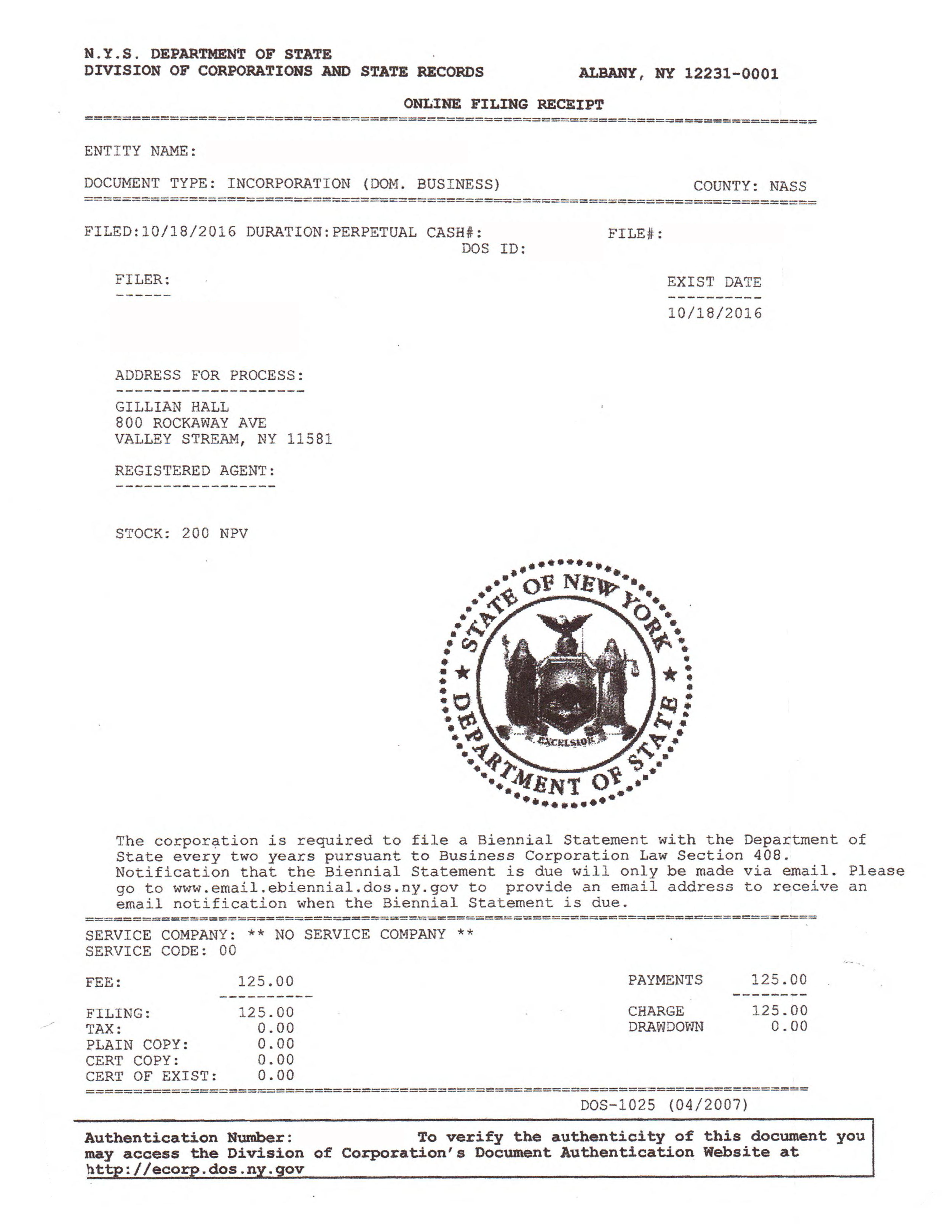

File Articles Of Organization In Ny

You can file online through the Department of States Division of Corporations website. Just type in your LLC name and get started. Some fields on the Articles of Organization are optional and some are required heres a quick rundown for how to fill it out. You can file online, by fax, in person, or by mail. However, the online form offers more options for shaping your LLC and makes it easier to add a registered agent.

This box should be checked if an organizer is completing the Articles of Organization. Anyone can be an organizer you, a fancy attorney, Jenny from the block, or a company like us.

Heres where you fill in your killer business name just make sure it isnt taken first. You can check the New York Department of States business database to make sure its available. Be careful not to use any of New Yorks restricted words . Youll also need to tack on either LLC, L.L.C., or Limited Liability Company to the end. If you have the perfect name but arent ready to pull the trigger on forming an LLC in NY, you can reserve the name for 60 days with the Application for Reservation of a Name .

You can check this box to include the purposes statement. The statement basically affirms that youre going to do business legally and that if you need a license or other permission, youll get it. Its an optional statement. Including it can be useful if youre planning on expanding into other states down the road.

Read Also: New Yorker Poem Submission

How To Form An Llc In Ny Yourself

Are you ready to make it official? To get your LLC on the books, you need to file Articles of Organization with the New York Department of State. If youve already registered in another state, you dont need to form another LLC. Instead, youll need to submit a Certificate of Authority for a New York foreign LLC. You can only file by paper, and you must attach a Certificate of Good Standing, Certificate of Existence, or Certificate of Status from your LLCs home state. The filing fee is $250.

To start a New York LLC, your first step is to file Articles of Organization.

Choose A New York Business Name

The first step is arguably the simplest, you have to decide on a name for your LLC. There are certain guidelines that are outlined by the state of New York that your business name will have to meet in order to be accepted, however, youll still want to make sure that it relates to your business.

Your business name must include the term Limited Liability Company, although this can be abbreviated to LLC or L.L.C. it must also not contain any restricted words or phrases. These are words that are usually set aside for certain sectors, such as a doctor, but it is advisable that you check the full list of restricted words before coming to a final decision. It must also be completely unique from all the other business names in the state.

To find a name that has not been used before, youll have to check the Corporation and Business Entity Database of the state of New York. This is free to do, but if you do not feel comfortable doing it yourself, there are companies that will complete the search for you. If you want to officially check if your required name is still available, youll have to send a written request to the Department of State, which comes with a $5 fee. If your name is not available, you will have to submit the request again, along with another fee. If you want to, once you have found a name that is available, you are able to pay $20 to have it reserved for up to 60 days.

You May Like: Cost Of Tolls From Nyc To Dc

Submit An Address To Which Legal Documents Can Be Forwarded And Choose Your Registered Agent

In New York, the “agent for service of process” for every LLC is the New York Department of State. If your LLC is sued, the New York Department of State will accept legal documents and forward it to the LLC. All LLC’s must give their name and address to the New York Department of State.

You can also appoint a registered agent as an additional agent to receive service of process for your New York LLC.

A registered agent is the person or entity authorized to receive service of process and other official legal documents and notices on behalf of your LLC.

A registered agent can be a person or an entity that offers a registered agent service. They must meet the following criteria:

- Entities must provide registered agent services.

- The agent must have an address in New York.

- The agent must be on-site and available to accept documents during regular business hours.

Open A Business Bank Account

After obtaining an EIN, you will then need to set up a business bank account for your NY LLC. It is important for LLCs to keep personal and business finances separate after forming an LLC. Opening up a bank account after completing the LLC formation protects NY LLC in the event of losses or a lawsuit. It also makes accounting and bookkeeping much easier for future investments and LLC taxes.

Read Also: The New Yorker Poetry Submission

Step : Create Your New York Llc Operating Agreement

All New York LLCs are required to have an operating agreement. This may be a verbal or written agreement. We would suggest a written agreement.

Explain an operating agreement? An operating agreement is a legal document outlining the ownership and operating procedures of an LLC. this agreement outlines the company structure and the responsibilities there in.

Are operating agreements important? A comprehensive operating agreement ensures that all business owners are on the same page and reduces the risk of future conflict.

For more information on operating agreements, read our New York LLC operating agreement guide.

Filing Your New York LLC Operating Agreement

What are the state requirements?

The State of New York requires every LLC to file an Operating Agreement, regardless of whether the company has one or multiple members. Your Operating Agreement LLC New York will outline the structure and purpose of your company as determined by your LLC members and will bind all the members of your LLC

File Your Articles Of Organization With The Nys Division Of Corporations

Once you’ve gathered all the information for your LLC, youll need to file your New York LLC Articles of Organization with the NYS Division of Corporations. This document formally creates your LLC.

Heres what is typically included:

- Your business name and address

- Details of your Registered Agent

- The county where your business is located

- Name and address of the organizer

Your Articles of Organization can be mailed, filed online via NYS Business Express or Incfile can do it on your behalf for free. The state charges a $200 filing fee for NYS LLC formation.

File by Mail:

Important:

Section 206 of the New York State Limited Liability Company Law requires that within 120 days after the effectiveness of the initial articles of organization, a limited liability company must publish in two newspapers a copy of the articles of organization or a notice related to the formation of the LLC. The newspapers must be designated by the county clerk of the county in which the office of the LLC is located, as stated in the articles of organization. After publication, the printer or publisher of each newspaper will provide you with an affidavit of publication. A Certificate of Publication, with the affidavits of publication of the newspapers attached, must be submitted to the New York Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231. The fee for filing the Certificate of Publication is $50.

Recommended Reading: Open An Llc In Ny