What Benefits Are Provided

New York State disability benefits provide 50 percent of a claimants average weekly wage up to a maximum of $170 per week, whichever is less. The average weekly wage is based upon the claimants last eight weeks of employment. Benefits are paid for a maximum of 26 weeks during a period of 52 consecutive weeks.

What Are The Penalties For Not Providing Disability Benefits Insurance In Nys

Failure to provide disability benefits insurance is a misdemeanor in New York State, punishable by a fine of not less than $100 nor more than $500 or imprisonment for up to one year or both for a first violation.

A second violation of the law within five years may result in a fine of not less than $250 nor more than $1,250. A third violation within five years may result in a fine of up to $2,500.

Answer A Few Questions To Check Your Eligibility

New York is one of the few states that has a temporary disability insurance program, which requires employers to provide short-term disability insurance for their employees. Employers are required to provide partial wage replacement, for up to 26 weeks, to employees who are temporarily unable to work due to disability. Pregnancy and childbirth are covered under the law.

In 2018, New York will start phasing in its new paid family leave program, which will provide up to 12 weeks of paid benefits to employees who need time off to care for a new child .

You May Like: How To Open A Liquor Store In New York State

Who Qualifies For Disability In Ny

To qualify for disability in New York, the applicant must fulfill certain conditions:

â The employer and one or more employees becomes âcoveredâ four weeks after the 30th day of their employment.

â An employer decides to provide benefits by filing an Application for Voluntary coverage. Employees are then covered for disability.

â Recent or current employees who work for an employer who is âcoveredâ and who have worked for at least 4 consecutive weeks qualify for disability.

â Employees who have changed from one job where they were âcoveredâ to another job where they are âcoveredâ, receive disability benefits protection starting on the first day of their new job. Eligible employees donât lose protection during the first 26 weeks of unemployment as long as the employee is eligible to claim unemployment insurance benefits.

â Personal or domestic employees who work for 40 or more hours weekly for one employer qualify for disability benefits.

Why New York Life

There for you when you need us most

At New York Life, we honor our commitments. In fact, we have the highest financial ratings of all four major ratings agencies.6 So, when it comes to protecting what really matterslike your lifestyle and your futureyou know youll have coverage when you need it most.

A legacy of stability

Our greatest legacy is helping others protect their legacies for generationsNew York Life has been serving policy owners for over 175 years, in good times and bad.

Human guidance

Our financial professionals can help address your financial needs. But most of all, they can provide one-on-one guidance with flexible strategies that evolve as your life changes.

In it together

As a mutual insurance company, were fully committed to younot outside investors. Since we answer solely to our policy owners, we have your long-term interests at heart.

Dividend-eligible

New York Lifes MyIncome Protector is one of very few individual disability insurance plans on the market that offers the potential for dividends7 to its policyholders.

Read Also: How To Pay New York Tolls

What If Disability Happens While Between Jobs

If disability occurs within 4 weeks after termination of employment, benefits are payable beginning with the 8th consecutive day of disability, by the former employers insurer.

Unemployed workers who become disabled more than 4 weeks, but within 26 weeks after termination of employment, and are either eligible for or receiving unemployment benefits, are paid benefits from the first day of total disability upon termination of unemployment benefits. The former employers account is not charged.

Employer/insurance Carrier Requests Examination By A Health Care Provider

- Your employer/insurance carrier may designate a health care provider to examine you. You must submit to requested examinations under the following conditions:

- Exams may occur at intervals, but not more than once a week.

- You do not pay for the exams.

- Exams occur at a reasonable time and place.

Also Check: Must See Places In New York State

What Employers Need To Know About Nys Mandatory Disability Benefits Law

NYS requires all employers to provide Mandatory Disability Insurance Benefits to their employees. Failing to provide coverage is a misdemeanor and carries a $500 fine or up to one year in jail.

Employers may comply with this mandate to make short term disability insurance coverage available to their employees in one of two ways:

1. Purchase disability insurance from a state approved insurance company for the benefit of his/her employees or,

2. Establish a Private, self-insured disability benefits law plan

Can You Go On Disability For Depression

It is possible to go on disability for depression, but an individual with this disorder must meet certain criteria to be eligible to receive benefits. The specific criteria are listed in Social Securityâs listing manual. In some cases, applicants may be granted disability on the basis of a medical-vocational allowance if the depressive symptoms are severe and other factors are present in the applicantâs work history, age, and level of education.

Depression is listed as Social Securityâs impairment listing 12.04, Depressive, Bipolar, and Related. To qualify for Social Security disability benefits for depression, you must demonstrate that you have a severe form of the disease by manifesting at least five of the following symptoms:

â Depressed mood

â Diminished interest in all or almost all activities

â Poor appetite or overeating that results in a demonstrable change in weight

â Sleep disturbances

â Inability to concentrate or think clearly

â Feelings of guilt or worthlessness

â Thoughts of suicide or death

â Slow physical movement or reaction time

â Slowed speech and physical agitation such as hand wringing or pacing

Additionally, you must meet certain functional criteria that show that your ability to work has been impaired as a result of the depressive disorder. An extreme or âmarkedâ limitation in two of the following areas is necessary to receive disability benefits for depression:

Read Also: How To Be A Cna In New York

How Do I File A Claim For Short

It is very important to note that if you become disabled and qualify for short-term disability insurance, you must file your claim within 30 days of becoming disabled.

If you are working — or are unemployed and have been collecting unemployment benefits for less than four weeks — at the time your disability began, you will file a DB-450 form. These forms can be obtained through your employer. Completed DB-450 forms should be sent to: NYSIF Disability Benefits Claims 15 Computer Drive West Albany, NY 12205.

If NYSIF is not your employer’s insurance provider, contact the Worker’s Compensation Board.

If you are unemployed and have been collecting unemployment benefits for longer than four weeks at the time you become disabled, you will file a DB-300 form. These forms can be obtained on the NYSIF website, from your local Workers’ Compensation Board, or by calling 800-353-3092. Completed DB-300 forms should be sent to: NYS Workers’ Compensation Board â Disability Benefits 100 Broadway Menands/Albany, NY 12241.

Both forms require you to fill out a section about your disability, as well as a section to be filled out by your treating physician regarding your disability. Medical evidence regarding your disability may be required for the entire period you are requesting benefits.

For those who are employed or unemployed for less than four weeks, there is an additional section that must be filled out by your employer.

It Pays To Have Income Protection

Portable

Whether you work for yourself or an employer, you can take your coverage wherever you go. If you choose to change jobs, youre still protected with coverage that stays with you.

Customizable

Everyones needs are different. With individual disability insurance from New York Life, you can count on coverage thats customizable to fit your individual needs and circumstances.

Dependable safety net

Most of all, its a reliable way to replace a portion of your income and help maintain your lifestyle. You can breathe easy knowing youll be covered when you need it most.

You May Like: Where To Stay In The Finger Lakes New York

Who Is Not Eligible For Benefits

- Minor children of an employer.

- Government, Railroad, or Maritime employees.

- Ministers, Priests, Rabbis, members of a Religious Order, sextons, or Christian Science readers.

- Persons engaged in a professional or teaching capacity for a non-profit religious, charitable, or educational institution.

- Persons receiving rehabilitation in a sheltered workshop or under a certificate issued by the Department of Labor.

- Persons receiving aid from religious, charitable, or educational institutions, who perform services in exchange for such aid.

- Daytime elementary or high school students who work part-time during the school year or during vacation periods.

- Independent contractors.

- Employees during the first 45 days of extra employment.

- These are persons not normally in the labor market who are hired to do work for a limited special period of time.

- Employees in casual employment. An employee who normally works in a different occupation, who is hired for a day or less.

- Corporate Directors, acting only as such, and not as employees.

- Partners and Proprietors are not required to be covered. They must, however, cover any eligible employees.

- Executive Officers of an incorporated non-profit, religious, charitable, or educational institution .

- An employer may elect to provide voluntary benefits to an excluded class of employees by filing an application for voluntary coverage with the Workers Compensation Board.

Social Security Disability Ny

New York State also co-manages the Social Security Disability Insurance program with the Federal Government. Two Social Security policies provide income replacement for people with long-term disabilities .

SSI and SSDI have vastly different benefits amounts and application steps.

Recommended Reading: Va Toll Calculator

Also Check: How To Make Money In New York

New York State Short Term Disability Insurance

Are you overpaying for your New York Short Term Disability Insurance? There is a good chance you are and dont expect your broker to tell you.

Why?

Most employers buy a short term disability insurance policy, stick it in the drawer and forget about it. Over time, short term disability prices increase ever so slightly but few employers rarely take the time to compare their rates.

QUICK TIP: Complete the GREEN form on this page to compare short term disability rates. Most applications approved within 48 hours.

You Can Apply For The Supplemental Nutrition Assistance Program:

Online:myBenefits.ny.gov

In person: To help stop the spread of COVID-19, many and SNAP Centers locations are consolidating their hours until further notice. We are asking New Yorkers to do everything they can through myBenefits.ny.gov. Please call your local district or visit their website to check their operating hours.

Also Check: H& r Block Manhattan Ks

How To Apply For Ssdi In New York

You can apply for Social Security Disability in one of three ways: online, over the phone, or in person. To apply online, submit your application by creating an account on SSA.gov. You can also call the Social Security office directly at 800-772-1213 and a representative will walk you through the application process.

If you prefer to make your application in person, contact your closest New York field office to set up an appointment.

It will speed up the process to gather any relevant information and documents ahead of time. Below is a general list of requirements, but you may be asked to provide more or less based on your specific case:

- Personal information: birth certificate or permanent resident card, marriage or divorce records, military records, vital details about any minor children

- Current employment or self-employment information

- Bank account information for direct deposit

- Personal or professional references like a doctor or family member who can certify your conditions

- Medical history about your disability like records of physical and mental health, tests, and names of doctors

- Job and education history for at least the last two years

Submit A Disability Claim Online

Please follow the steps below and provide as much information as possible. In Step 10, youll be able to review your answers before submitting your claim. A case manager may call you to confirm the information youve provided or to request additional details.

This service is offered by New York Life Group Benefit Solutions to employers and employees who wish to file a disability claim.

The information requested is required for us to begin reviewing your claim. Its important that you provide us with complete and accurate information to avoid a delay in the processing of your claim.

You can submit your claim in one of two ways:

It may be necessary for us to obtain additional information or clarification from your employer and your health-care provider. If you have not done so, please complete a Disability Disclosure Authorization Form. This form grants us access to the information necessary to process your claim.

Have a question? Call us at 800-362-4462 between 7:00 a.m. and 7:00 p.m. Central Time

Also Check: How To Transfer A Dba In New York

What Is A Covered Employer

The definition of covered employer generally includes all employers who have one or more employees. Some exclusions to this definition include government workers, religious leaders, those providing work in return for charity care, and high school students who work part-time or only during vacations.

Is Short Term Disability Mandatory In New York

Yes and just because its mandatory, it doesnt mean you have to overpay for it. Short term disability insurance is required if you operate a business in NY and have at least one employee.

But, many employers just pay the bill and never bother to look to see if their rates have increased or if they can get a better deal.

Recommended Reading: 2022 Bmw X3 M40i Brooklyn Grey

Which Employers Must Provide Insurance

New York law requires employers to provide coverage, either by purchasing insurance or by self-insuring. These employers must provide coverage:

- An employer that has had at least one employee in each of 30 days in a calendar year. Once the employer hits the 30-day mark, the employer must provide coverage four weeks later.

- Those who employ domestic or personal employees , if those employees work at least 40 hours a week for the same employer.

- An employer that is a successor to a covered employer. These employers must immediately provide benefits.

An employer may also elect to provide coverage, even if it isn’t legally required to, by filing an Application for Voluntary Coverage.

Employers may collect a small amount from employees to help fund their insurance obligation however, this amount may not exceed 60 cents per week. Employers don’t have to require employee contributions.

Disability Benefits Guide For Ny Residents

Approximately 37.5% of the worldâs population has a disability, but some disabilities donât impair a personâs ability to do work. For disabled individuals who arenât able to work or pay for private disability insurance, Social Security benefits offer an important source of income. Benefits are paid monthly through this program which allows disabled individuals to continue on with their lives, but qualifying for Social Security disability benefits is notoriously difficult.

Further, the payout is calculated off the number of years the beneficiary worked before becoming disabled. So that means that younger disabled individuals are likely to receive lower benefits than people who are older when they become disabled.

Understanding the challenges ahead in applying for and receiving Social Security disability benefits can help applicants prepare for the steps involved to ensure that the process goes smoothly.

Before we delve into disability benefits, letâs take a look at disabilities in general.

Recommended Reading: Is There A Rooms To Go In New York

What Agency Handles Short

The New York State Workers’ Compensation Board, under the New York State Department of Labor, oversees short-term disability benefits. New York State law requires that every covered employer provides insurance to cover short-term disability benefits for their employees. Under the Workers’ Compensation Board, the New York State Insurance Fund provides insurance to a vast majority of employers in New York State.

The New York State Workers’ Compensation Board can be contacted regarding short-term disability insurance for employees who are disabled due to non-work-related illnesses or injuries at 462-8881 or 353-3092. NYSIF may be contacted directly if the insurance fund is your employer’s insurer.

Another option that is available to employers is the ability to apply to the Board for an exemption that allows them to self-insure, meaning they would pay short-term disability benefits themselves instead of paying for insurance to do so. If your company self-insures, contact them directly to coordinate disability payments.

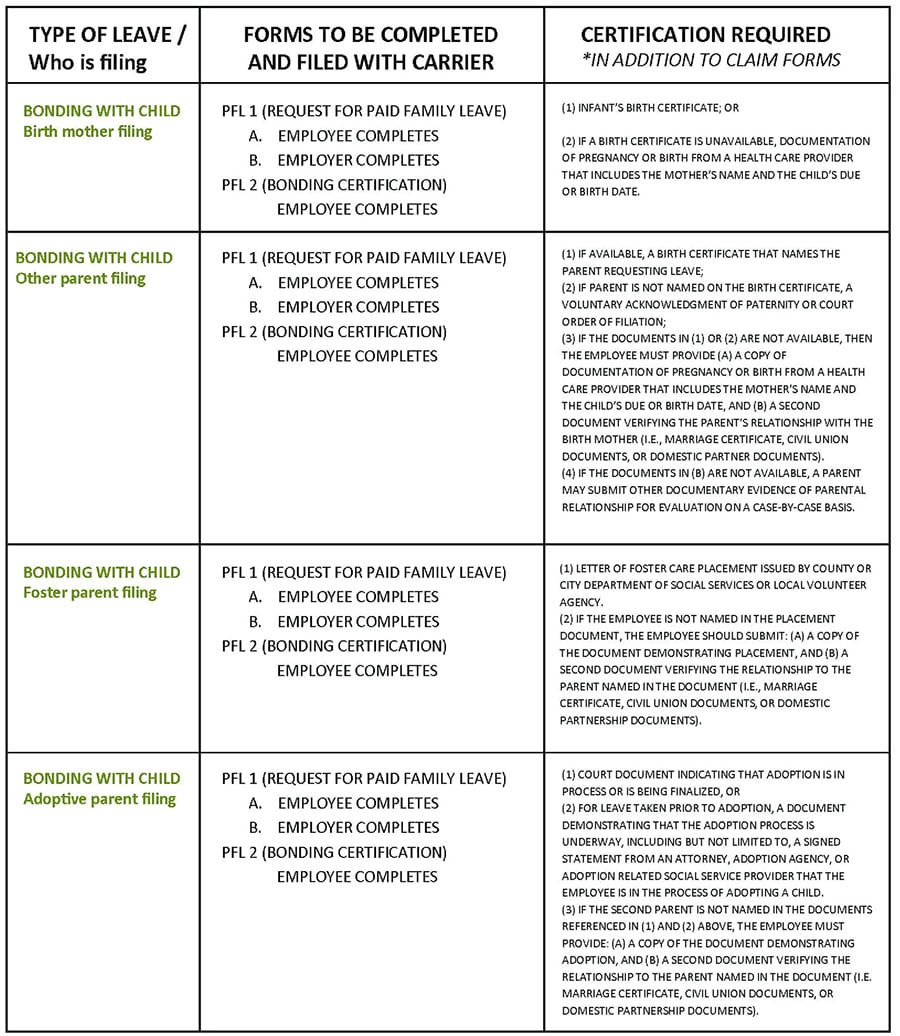

Differences Between Disability Benefits And Paid Family Leave

- Only the birth mother is eligible for disability benefits for the period immediately after the birth of a child.

- Paid Family Leave begins after the birth and is not available for prenatal conditions.

- A parent may take Paid Family Leave during the first 12 months following the birth, adoption, or fostering of a child.

- You cannot collect disability benefits and Paid Family Leave benefits at the same time.

- There is a limited exception to this for employees who may be eligible for both disability benefits and Paid Family Leave when subject to an order of quarantine due to COVID-19. See PaidFamilyLeave.ny.gov/COVID19 for details.

Also Check: Where To Go In Brooklyn