Pay The New York Llc Tax

You know what they say death and taxes, etc.

New York LLCs also have to pay an annual filing fee to the Department of Taxation and Finance . The rate changes based on the gross income of your LLC. For LLCs making less than $100,000 a year, the rate is $25.

To pay, youll file Form IT-204-LL with the DTF by the 15th of the third month following the end of your tax year. So if your tax year ends December 30th, youll need to pay your annual fee by March 15th.

Choose A Unique Business Name And Complete A New York Business Search

You’ll need a distinctive and original name for your New York LLC thats not being used by any other business in the state. Our Business Name Generator can help you brainstorm names if you’re having trouble coming up with a good one. First, read up on the state’s naming rules in the New York Business Names section of this guide.Once you’ve chosen a name, make sure it’s available in the state by using our free tool to do a New York entity search. You can also perform a search on the NYS Department of State website.

How Can I Keep My Personal Information Off The Public Record

Once your address is posted somewhere online , theres no taking it back. Marketers will find your information and sell it. Its what they do.

The best way to keep your personal information private is to keep it off this filing altogether. How do you do that? Hire a registered agent who will allow you to use their business address on this form .

Read Also: New York State Toll Calculator

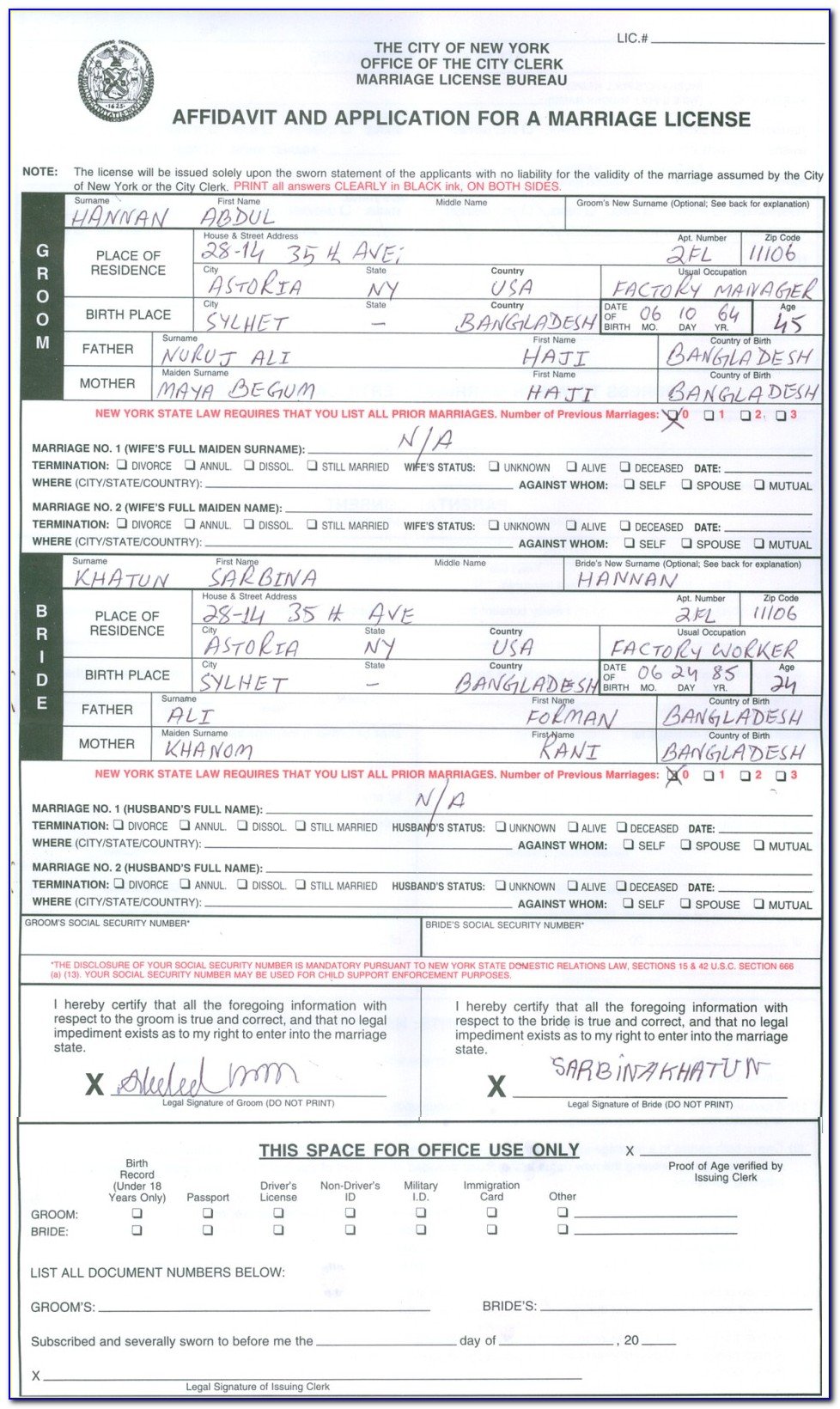

What Are The Ny Requirements For Domestic Partnership

A couple can register a domestic partnership in New York if they meet the following requirements:

- The partners have a close and committed personal relationship and have been living together continuously

- Both partners are New York City residents, or at least one person is employed by the City on the date of registration. The partners must sign a domestic partnership affidavit at the clerk’s office to swear to their residency

- Both people are 18 years of age or older

- Neither partner is currently married

- Neither person is currently in a domestic partnership nor has been in another domestic partnership within the last 6 months

- The partners are not related to each other by blood in a way that would prevent marriage in New York State

If you meet all of the above requirements, you can get an Affidavit of Domestic Partnership Form at any of the 5 City Clerk offices without making an appointment. From there, you must complete, sign, and notarize the form to legally register the domestic partnership. Keep in mind that the registration fee is $35 and can be paid by credit card or a money order made payable to the City Clerk.

When you apply for a domestic partnership in New York, you need to bring a valid, unexpired ID with you. Acceptable types of identification include:

- Driver’s license

- Nondriver’s identification card

- Original Birth Certificate

- A valid passport from any country

- Official School Record

- IDNYC

Get Inspired With List Of Business Names

To help inspire you I have written lists of catchy business names for lots of types of companies and different industries. Check out these unique business name ideas that are not taken and available!

To check to see if your business name is available in New York, you should first do a business name search, a domain name search, and a federal trademark search. Heres how

You May Like: Can I Register A Car Online

Other Filings Required At Time Of Incorporation

Some states require additional filings or steps at the time of incorporation, such as a county level filing, publishing notice of the LLC formation in a local newspaper or an initial report filing. New York requires the following:

- Publication requirement.New York requires LLCs to publish notice of the incorporation for six consecutive weeks in two newspapers as assigned by the County Clerk in the county of the LLCs legal address. A Certificate of Publication should then be filed with the Department of State upon completion of the publication requirement.

Step : Time To Name Your New York Llc

Choosing a company name is the first and most important step in starting an LLC in New York. Be sure to choose a name that complies with New York naming requirements and is easily searchable by potential clients.

1. Follow the New York LLC naming guidelines:

- Your name must include the phrase limited liability company, or one of its abbreviations .

- Your name cannot include words that could confuse your LLC with a government agency .

- Restricted words may require additional paperwork and a licensed individual, such as a doctor or lawyer, to be part of your LLC.

- Your name must be distinguishable from any other New York limited liability company, limited partnership, or corporation.

- Learn more about NY LLC naming guidelines on Business Enitity Search Department of States website.

2. Is my name available in New York? Make sure the business name you want isnt already taken by doing a name search on the State of New York website.

3. URL available? Online is bigger than ever these days, so check and see if your business name is available as a web domain. If so you may want to buy the domain in order to prevent others from doing so.

FAQ: Naming a New York LLC

What is an LLC?An LLC is a hybrid of a corporation and a sole proprietorship. Like a corporation, owners of an LLC will not be held personally responsible for liabilities, but the company will not live on if an owner dies or the business declares bankruptcy. Best explained in greater detail here on Wikipedia

Recommended Reading: Wax Museum New York Tickets

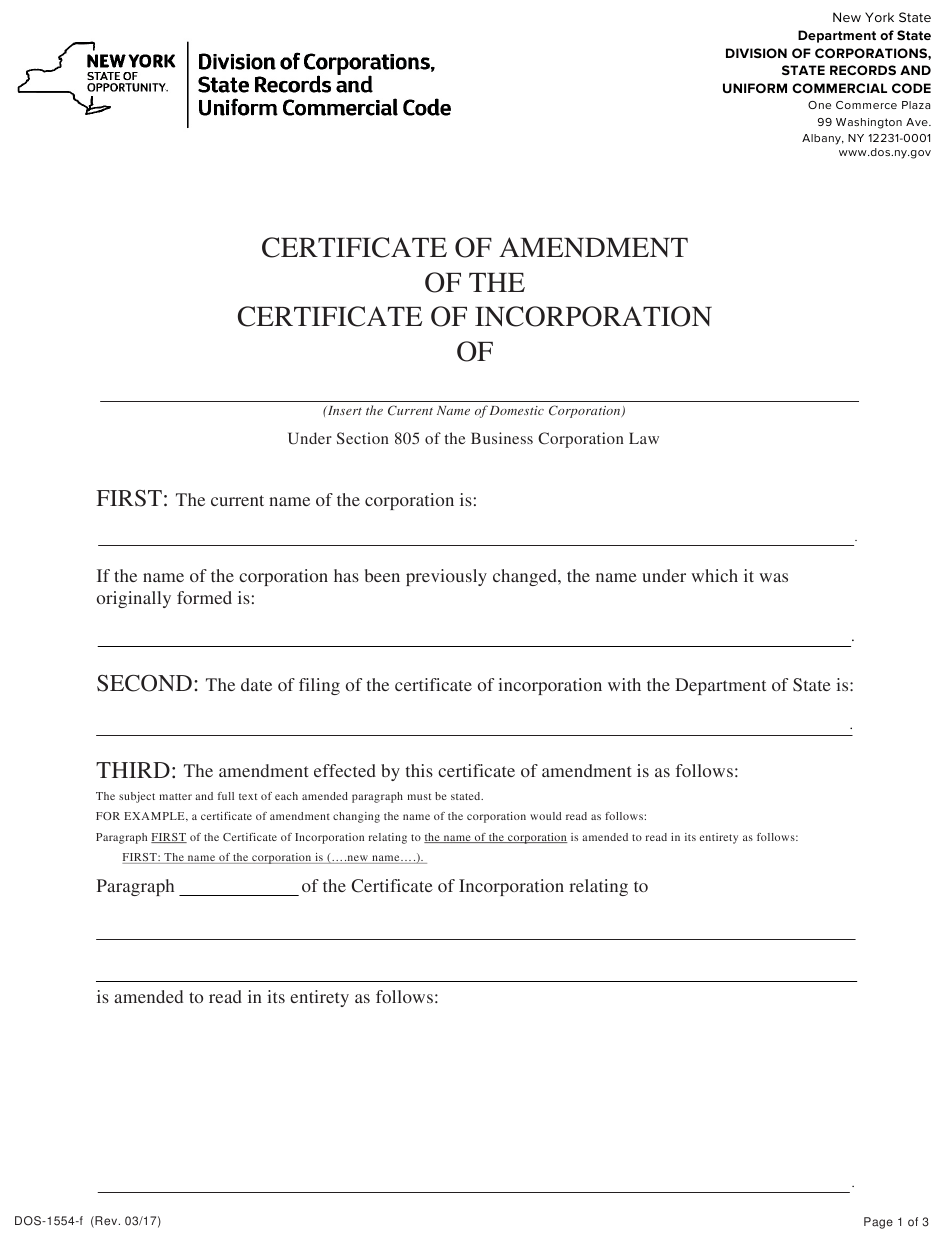

Amendment Of The Filing

An LLC needs to contact the Department of State if it wants to amend the LLC’s filing. An LLC filing may be amended to change the business name or to edit other important details. To make amendments, submit the completed Certificate of Amendment to Articles of Organization form to the New York Department of State, along with the $60 filing fee.

How To Apply For Nonprofit Status In New York State

If an organization obtains nonprofit status in New York state, they are eligible for federal and state tax exemptions. Most nonprofits form as a 501 organization, which include religious, charitable, scientific, literary, or educational. Nonprofits in New York cannot be formed for profit or other financial gain. In addition, no corporate members, directors, or officers can obtain corporate assets, income, or profit unless permitted by state law.

Also Check: Do I Need Insurance To Register A Car In Ny

How Do I Publish My Llc In Ny

Publishing your LLC in New York isnt that different from advertising a garage sale in the classifieds. Essentially, youre buying an inch or so of newspaper space to announce the formation of your LLC to the public. Youll need to hire two newspapers in the county where your business address is located to publish notice for six consecutive weeks. That notice should include:

- Your LLCs name, address, and county.

- The date you filed your Articles of Organization.

- Your registered agents information.

- A short description of your business activity.

- Your LLCs end date .

Dont Want To Form An Llc By Yourself

Let IncFile or IncAuthority guide you through the LLC formation process, so you know everything was done right. Only pay state fees!

Quick Reference

The Limited Liability Company is a popular entity structure for businesses starting in New York. The LLC provides personal liability protection and has the potential to save money on taxes. With our guide, you can learn how to form an LLC in New York without an attorney.

Unlike a sole proprietorship or partnership where the small business owner can be held personally liable for lawsuits against the business, the LLC is a separate legal structure, protecting the business owners personal assets.

Besides the liability protection, the Limited Liability Company provides several other benefits over the sole proprietorship, partnership, and corporation because of the multiple tax options, ease of administration, and management flexibility.

You May Like: New York State Public Arrest Records

Whats The Difference Between A Member

In a member-managed LLC, members handle the LLCs day-to-day operations. This includes opening business bank accounts, entering into contracts, and hiring employees, among other tasks. In a manager-managed LLC, the members appoint or hire managers to run the business.

For help with deciding which management structure will work for you, see our page on LLC Member Vs Manager.

How To Get A Dba In New York

Filing a New York DBA , also known as an assumed name, is a simple process and its done at the county level or with the New York Department of State depending on your business structure.

A DBA won’t protect your personal assets. Forming an LLC is the best choice for most small businesses. Learn more in our DBA vs LLC guide.

Learn How to Get a DBA in New York yourself. Choose your business structure to get started:

Or, use a professional DBA service:

Read Also: Disability Application Nyc

How To Apply For An Ein

The easiest and fastest way to apply for an EIN is to visit the Internal Revenue Service website, between the hours of 7 am 10 pm EST, Monday Friday.

The online application process only takes about 5 minutes to file the EIN online, and the number will be ready in seconds. If applying online isnt an option, you can also complete an EIN application by mail or fax by sending Form SS-4 to the IRS fax number 855-641-6935.

You can even get an EIN over the phone if the company was formed outside the U.S. by calling 267-941-1099. If filing by phone, note that it isnt a toll-free number.

There is no cost to apply for an EIN.

See how to register an EIN in this video:

Obtain A Copy Of The Certificate Of Publication

Aside from the affidavits, you should also get the Certificate of Publication, which you will file with the New York Division of Corporations, State Records, and Uniform Commercial Code. You will need to download this form to proceed.

Once you have received the Certificate of Publication and the affidavits, you will need to submit both the certificate and the affidavits to the New York Department of State. It is the same address where you sent the LLC organization form.

Also Check: Can You Register A Car With A Permit In Ny

Get Business Insurance Policy

Running a business is risky. Injury, natural disaster, or lawsuit can force you out of business and leave your family without income! Business insurance protects against these unforeseen risks to keep things running smoothly so the company doesnt have to close its doors due to an accident or major incident.

Think about it. If your business gets sued, you will lose money that could have easily been prevented by purchasing the right insurance policy!

Insurance Regulations: Federal IRS, State, and City

The protections you get from choosing a business structure like an LLC or corporation typically only protect your personal property and even that protection is limited.

In todays world, it is impossible to protect everything. Even with the most comprehensive coverage in place, there are still many gaps that can leave your business exposed if you dont have adequate insurance protection for both personal and business assets as well!

There are a number of aspects to consider when determining the right type and level of business insurance. For example, you will need different coverage if your company employs other people than just yourself or is within certain industries.

To navigate the complex world of business insurance needs I recommend the Coverwallet easy-to-use tool here that will quickly tell you exactly what insurance policies you need and provide competitive price quotes from top insurers.

Test Your Business Idea

Now that you have researched your idea, it is time to test its viability. Its important not to invest in an idea until we know for sure whether or not it will be profitable!

Serial entrepreneurs should always test their ideas before investing too much time and money.

As a serial entrepreneur, I have done tons of business idea testing. Some ideas passed, but lots failed. But I am sure glad that the ones who didnt were only small investments while my newfound confidence in myself was more valuable than anything else!

Below are the best ways I have found to test new product ideas. Get the full list of my 10 best ways to field test your business ideas here.

- Visit Trade Shows with Your New Products

- Ask Others for Constructive Feedback

- Run A Short Testing Ad Campaign

- Stage a Focus Group Session

You May Like: Ny Arrest Records

Ny State Filing Fees And Expedited Options

Currently, the state filing fee starts at $200. There are some counties that charge a filing fee of $205 to $250. However, you can receive the New York LLC approval in as soon as five days included in the filing fee.

You can always expedite the process and get the approval in just one day. The rush filing fee will depend on where you are located in New York. It is typically around an additional $25 for 24-hour turnaround time. Faster filing can take up to two hours only but is more expensive as it can go for an additional $150 or more.

Filing A Dba In Ny For Sole Proprietors And General Partnerships

Sole proprietors and partnerships are required to file their NYS DBA with the County Clerk where their business is located. Estates and real estate investment companies are also required to file with the county.

A sole proprietorship is a business owned by a single individual that isn’t formally organized. If you run a business and file taxes under your own name, you are a sole proprietor.

A DBA doesn’t offer any protection for your personal assets in the event that your business is sued. For more information on setting up an LLC , visit our How to Form an LLC page and select your state.

SKIP AHEAD

If you need to create a DBA for an LLC or Corporation, you can .

Recommended Reading: Ny Tolls Calculator

Women In Business Tools And Resources

If you have a woman-owned business, many resources are available to help you concentrate on your businesss growth:

Our information and tools will provide educational sources, allow you to connect with other women entrepreneurs, and help you manage your business with ease.

The Benefits Of An Llc

As stated above, a key benefit of an LLC is thelimited liability for obligations that the owners of the LLC enjoy ,unlike sole proprietors and general partners who face unlimited personalliability for company obligations, even if another partners actions caused theliability.

In addition, members of an LLC can enjoy a more favorable tax treatment than they otherwise would, which can include the passing-through of business profits if they so choose. Members also have the flexibility to choose among a variety of tax treatments, including S-Corp taxation, C-Corp taxation , or taxation as a partnership or sole proprietorship. LLCs which only have one member are not required to file a formal partnership tax return , although those with more than one member must do so.

LLCs in New York also enjoy more flexibility thanS-Corps in how they apportion profits and losses and distributions. LLC membersare free to agree via an operating agreement to uneven distribution of profitsand losses . Similarly, LLCmembers are free to agree to make distributions as they see fit.

This flexibility extends to the ability of LLCsto have as many members as they would like, which can include foreigninvestors, and they may create different classes of members who have differentrights and obligations with regard to the LLC. Finally, an LLC can easilyconvert to a corporation should its members decide to do so.

You May Like: Register Car Online Ny

Choose A Name For Your Llc

In New York, your LLC’s name must contain the words “Limited Liability Company” or the abbreviations “LLC,” or “L.L.C.”

Your LLC’s name must be distinguishable from the names of other business entities already on file with the New York Secretary of State. Names may be checked for availability at the New York Department of State Division of Corporations business name database.

You may reserve a name for 60 days by filing an Application for Reservation of of Name with the New York Department of State Division of Corporations. The application must be filed by mail. The filing fee is $20.

Using an Assumed NameYou don’t have to use your LLC’s official legal name registered in your Articles of Organization when you do business out in the real world. Instead, you can use an assumed name, also called a fictitious buisness name, “DBA” , or trade name. To do so in New York, you must register your assumed name with the New York Department of State. You register by filing by postal mail a Certificate of Assumed Name. The filing fee is $25. For more on registering business names, see Nolo’s article How to Register a Business Name.

How Much Does A Dba Cost In Ny

DBA filing fees vary depending on the location of the business and the business type.

Sole proprietor and partnership DBA fees are assessed by the county where the business is located. You must access your county directly for specific fee information. You can do this online or by calling the county clerk. You can find your counties’ contact information on the NYSAC.org website.

Fees for incorporated businesses like LLCs and corporations are as follows:

$25 for the Certificate of Assumed Name$10 Certified Copy of Certificate of Assumed Name$150 2-hour processing, $75 Same day, $25 within 24 hours

Additional Fees For Corporations Only

$100 for each NYC county where the business is or will be conducted within New York City $25 for each county where the business is or will be conducted outside New York City$1,950 to include every New York State county and the Certificate of Assumed Name combined

Don’t Miss: Changing Your Name In New York State