The Doctors Company Protects New York Doctors

The Doctors Company leads the industry on behalf of physicians and is the best choice for affiliated doctors of New Yorks leading hospitals. With The Doctors Company, doctors are members, not policyholdersand unlike commercial insurers that reward shareholders, we reward our members. Founded and led by physicians since 1976, The Doctors Company brings its long history in the medical malpractice market to New York doctorsand can offer access to the states excess coverage as well.

We are committed to providing you with the best imaginable service, plus unrivaled resources to reduce risk and avoid claimsincluding 24/7 support.

As a native New Yorker, I am proud that New York physicians have expanded access to the nations largest physician-owned medical malpractice insurerdriven by our mission to advance, protect, and reward the practice of good medicine.

Richard E. Anderson, MD, FACP, chairman and CEO of The Doctors Company

The Doctors Company is one of the only medical malpractice insurers in New York that is:

- Physician owned.

- National in scope.

- Rated A by A.M. Best Company and Fitch Ratings.*

With more than $6.5 billion in assets and $2.5 billion in member surplus, The Doctors Company has the financial strength to protect our 84,000 members today and for many years to come.

What If You Represent Yourself

Filing a medical malpractice case without a lawyer means not having to share a settlement or court award with anyone else. But besides the risks inherent in handling a complex case like this on your own, you’ll have to pay the costs of the lawsuit up front. It usually costs between $100 and $500 just to file the lawsuit in court, and you’ll almost certainly need to pay to acquire copies of all medical records that could be relevant to your case. And as touched on above, expert witness fees can reach into the tens of thousands of dollars.

It should be noted that a medical malpractice lawsuit is not like a car insurance claim after a fender-bender. A medical malpractice case typically hinges on incredibly complex medical and legal concepts, not to mention defendants and insurance carriers who are ready to fight you at every step. Before going it alone, it may be wise to at least discuss your situation with an experienced professional. You can use the tools right on this page to connect with a medical malpractice lawyer in your area, or learn more about finding the right medical malpractice lawyer for you and your case.

New York Legislators Introduce Bill To Require Liability Insurance For Police

Insurance companies would be liable for costs related to misconduct.

Doctors are required to have insurance if they want to practice medicine. Some states require attorneys have malpractice insurance if they want to practice law.

If New York State Legislature passes new legislation, cops will also have to take out insurance if they plan to wear a badge.

State Sen. Alessandra Biaggi introduced a bill last week that would mandate all officers in New York obtain liability insurance throughout their career. The local city and police agency would determine the base rate of the policy.

Read Also: How Much Does It Cost To Travel To New York

Shop Around To Compare Several Quotes

Last but not least, as in any insurance types, be sure to shop around with a few companies or with a broker or agency to compare several quotes to select the cheapest one for you. Different insurance companies have their own underwriting engine and will offer you different quotes and rates, do not settle on one policy until we see at least 3 quotes from three different companies. Many companies nowadays offer quotes online. It should take you less than 10 minutes to get a quote from a particular company.

When comparing several quotes, make sure you compare these quotes with the same deductibles and coverages.

Lpl Requirements In Indiana

Indiana does not require attorneys to carry legal malpractice insurance. Other requirements for Indiana attorneys are that they must be members of the Indiana Bar Association, submit annual registration fees, and maintain a good standing with the Bar association. The law firm is also required to have its status on file with the Bar association.

You May Like: New York Times Poetry

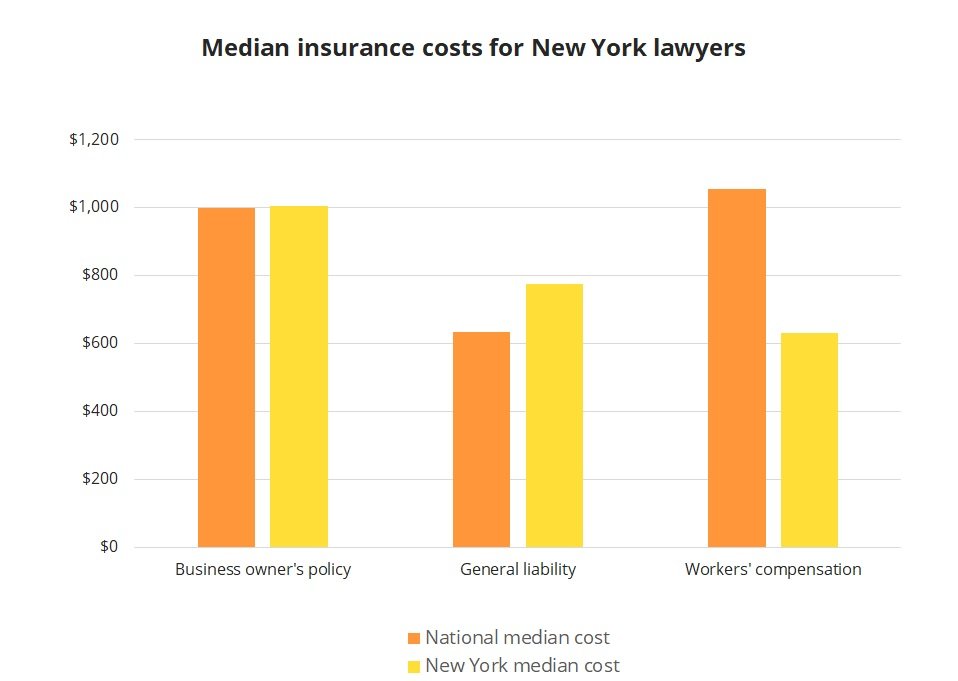

Save Time And Money With Insureon

Insureons industry-leading technology helps lawyers in New York save time and money shopping for insurance by comparing policies from top U.S. carriers. Start a free online application to review quotes for the policies that best fit your business. Our insurance agents are licensed in New York and can answer your questions as you consider coverage.

To make the application go quicker, have this information ready:

- Workforce details, such as the number and types of employees

- Current and projected revenue

- Insurance history and prior claims

- Commercial lease insurance requirements

Ib Legal Malpractice Insurance New York How Our Process Benefits You

Does your firm have the best possible terms on its malpractice insurance, i.e., the broadest coverage at the lowest price?

The only way to find out is to test the market.

Thatâs where we come in.

We submit each firmâs application to all viable insurers, based on its risk profile â typically 7 â 10 â and obtain proposals at the firmâs current terms, and at policy limits one or more levels higher. If the best proposals are close, we solicit another round of proposals from the âfinalistsâ.

This aggressive comparison shopping lets us consistently obtain much better coverage and pricing for firms than they currently have.

More than a dozen major insurers cover New York firms, and they compete fiercely for good risks. If your firm hasnât incurred a claim in five or more years, and hasnât shopped for competing quotes in two or more years, then one or more of those insurers will likely offer it much better terms than it currently has.

AXA, CNA, and Zurich usually offer the best terms to New York firms.

To obtain no-cost, no-obligation quotes from these and other âAâ-rated legal malpractice insurers, send us your most recent application, or complete our short application, either online or by it.

Weâll help you compare the competing quotes to your current terms, and make the best decision.

Thereâs no risk, and a potentially great reward.

Also Check: Can I Register A Car Without A Title In Ny

Coverwallet: Best For Comparing Quotes Online

CoverWallet is a national insurance brokerage firm specializing in small business insurance. They work with several leading business insurance companies such as Chubb, Hiscox, the Hartford, Liberty Mutual, etc. and can provide you with several quotes online from these firms so that you can compare and choose the best quote for you. The quoting flow is relatively simple and fast. Within 10 minutes, you will be able to compare quotes from at least 3 leading firms.

In some cases, they might not be able to provide you with online quotes. However, you can call their customer service staff to get quotes. Their customer service staff are licensed agent, so every knowledgeable and well-trained. If you are new to buying legal malpractice insurance for your own, you should definitely call them to get educated on several nuances of different policies.

Lpl Requirements In Delaware

Delaware does not require attorneys to carry malpractice insurance. Other requirements for Delaware attorneys are that they must be members of the State Bar Association, submit annual registration fees, and demonstrate good moral character. The law firm is also required to have its status on file with the Bar association.

You May Like: How Much Are Tolls Between Dc And Nyc

Who Pays For Malpractice Insurance

If you own your medical practice, you are solely responsible for paying your malpractice insurance. However. if you work as an employee of a hospital or healthcare network, your employer may cover the cost for you.

Your employment contract may include details about what type of insurance is necessary and who will pay for it. Always hire a contract review specialist to go over these details of your employment before signing a contract.

Related: Do Contract Reviews Work?

Lpl Requirements In Mississippi

Mississippi does not require attorneys to carry malpractice insurance. Other requirements for Mississippi attorneys are that they must be members of the State Bar Association, submit annual registration fees, and demonstrate good moral character. The law firm is also required to have its status on file with the Bar association.

Don’t Miss: Submit Poems To The New Yorker

Why Partner With Cunningham Group

Partnering with Cunningham Group will give you a full view of the New York marketplace. We can get you quotes from all the major insurance companies and help you choose the policy that best fits your needs and budget. Our company was founded in New York, and this is where our headquarters is located. We know New York better than any broker in the state. Our veteran insurance agents average 15+ years of industry experience. Let us help you secure medical malpractice insurance quotes from every major insurance company in New York.

Medical Malpractice Insurance Vs Legal Malpractice Insurance

The main difference between medical malpractice insurance and legal malpractice insurance is that medical malpractice insurance covers claims and associated costs against medical professionals for issues that result in harm or death of the patient, while legal malpractice insurance of course covers attorneys for malpractice claims against their practice of law.

However, there are more nuanced differences. First, while only one state requires malpractice insurance for lawyers, a majority of states mandate that physicians need to have malpractice insurance. Additionally, medical malpractice insurance is typically going to deal with more serious issues. While malpractice losing a case can be devastating, ultimately malpractice that causes a serious injury or death is more grave. Medical negligence is the third biggest cause of death in the US, leading to 250,000 deaths per year.

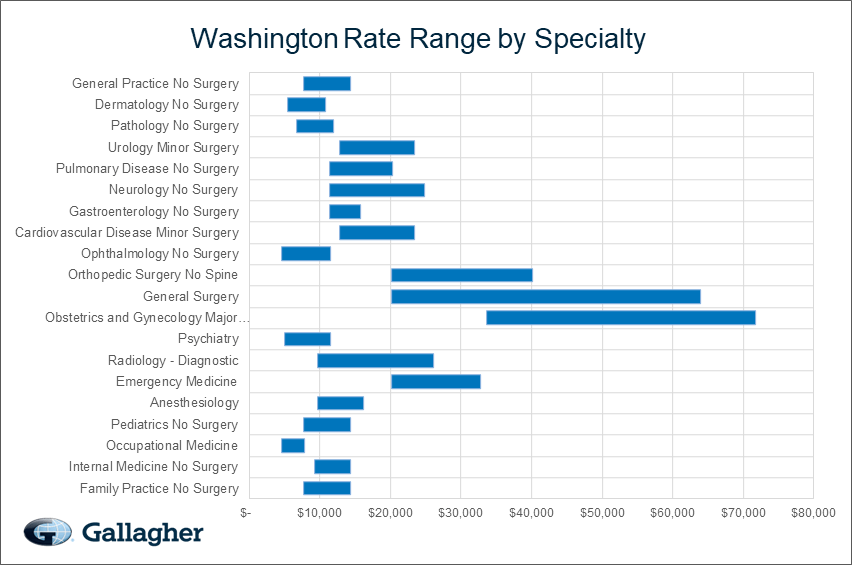

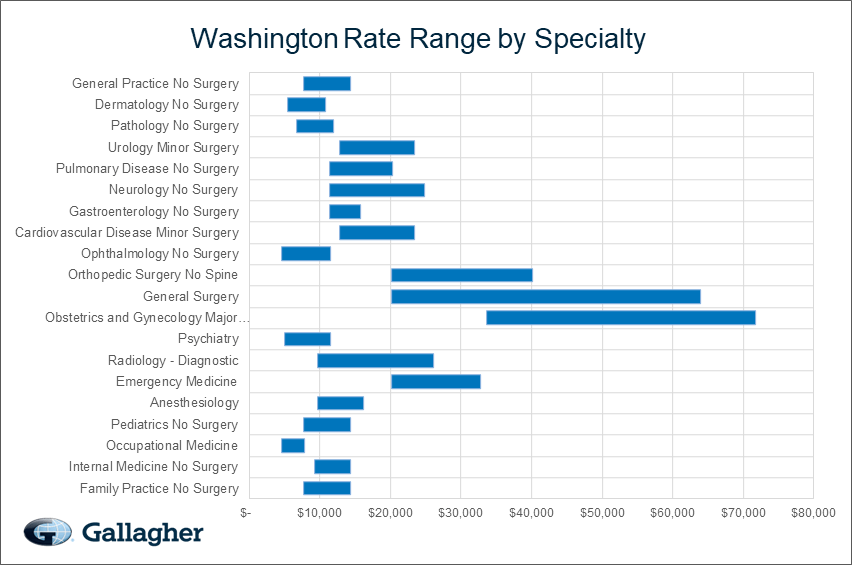

Additionally, medical malpractice insurance typically has a higher price tag. On average it costs $7,500 and can be as high as $50,000. Additionally, the average payout is over $300,000 and can total up to $4 billion per year for the medical industry.

While you are not likely to face many legal malpractice claims during your practice of law, even one claim could prove devastating to your career, largely because of the cost associated with malpractice claims. Having professional liability coverage can prevent a bad situation from becoming a nightmare.

Recommended Reading: How Much Does It Cost To Register A Car In Ny

How Much Does Professional Liability Insurance Cost

Pricing for attorneys malpractice insurance is somewhat counterintuitive. Insurance premiums are lowest for new attorneys, rises substantially in years 5-10, and levels off for experienced attorneys.

According to the American Bar Association, lawyers in private practice for less than 5 years report only 3.5% of malpractice claims, while lawyers who have been practicing for 11-20 years report 37% of claims. The explanation for this statistic is that new lawyers havent been in practice long enough for claims to be discovered and reported. Additionally, experienced lawyers handle more complicated cases, and also oversee other lawyers work.

The American Bar Association reports that premiums for new attorneys can start around $500, but can rise to $1,500-$3,000 for more experienced attorneys.

Additionally, areas of law practice with frequent claims such as plaintiffs personal injury, and real estate law have higher premiums. Practices with claims of high severity such as patent/trademark law, entertainment law, and securities law also face higher prices.

The 7 Best Malpractice Insurance Companies Of 2021

- Best for Dentists: Dentists Advantage

- Best for Social Workers: CoverWallet

- Best for Attorneys: 360 Coverage Pros

Proliability is one of the few companies that serves multiple industries and offers both low-cost options and higher tiers of coverage. With decades of experience and an excellent reputation, you can also qualify for discounts to further lower your premium and make your insurance policy more affordable. This company does malpractice insurance and nothing else they’re our top choice for multiple industries.

-

Available for a wide range of industries

-

Premium discounts if youre a member of professional associations

-

Coverage available to students

-

Coverage limits can go up to $5 million

-

Other business policies arent available

Available nationwide, Proliability has been serving clients since 1949. It provides professional liability insurance to a wide range of industries, including healthcare workers and business professionals. Whether youre a physician, dentist, pharmacist, therapist, or lawyer, you can get coverage through Proliability for your business. It offers group protection as well as individual coverage, so you can get coverage for legal entities, ancillary professionals, and other employees. Proliability is our overall choice because they can represent the most classes at competitive pricing.

The company even has coverage options for students. Students doing clinical work can get student malpractice insurance for as little as $30 per month.

Also Check: Dmv Tvb Office To Request To Reschedule The Hearing

How Much Does Legal Malpractice Insurance Cost

Home » How Much Does Legal Malpractice Insurance Cost?

Weve all heard of medical malpractice, and we all know its a situation in which a doctor or other healthcare professional makes an error during patient care. Did you know that other professional career fields also have malpractice rules? The legal field, for example, refers to malpractice as either professional liability or errors and omissions.

Regardless of the name, malpractice is still malpractice. Someone made a mistake, and it has affected someone else. In the case of an attorney, clients can sue them for malpractice. Unfortunately, in the last few years, it seems that clients are more likely to sue than ever.

If only there were something to protect professionals from these lawsuits, whether frivolous or founded. Luckily for those who have chosen law as a career path, there is. Its called malpractice or professional liability insurance.

Lpl Requirements In Georgia

Georgia does not require attorneys to carry malpractice insurance. Other requirements for Georgia attorneys are that they must be members of the State Bar, submit annual registration fees, and maintain a good standing with the Bar association. The law firm is also required to have its status on file with the Bar association.

Don’t Miss: New York Llc Name Change

Top 6 Providers Of Legal Malpractice Insurance

Below weve listed some of the top places to begin looking for malpractice insurance for attorneys. Because of the highly specialized nature of legal malpractice insurance, you may want to source it from companies that specialize in lawyer insurance. Finding a quote comparison site might be too general for an insurance type that is so tied into the type of law your practice handles.

- Coverwallet: Best for Comparing Quotes Online

- ALPS: Best for Variety of Products

- biBERK: Well-rated company

The Policy Will Cover Both The Firm Itself As Well As Individual Attorneys

The cost of legal malpractice insurance can vary greatly as it depends on a number of factors such as practice specialty, length of time currently insured, geographic location and previous claim history to name a few. Another policy may have $1m/$3m, meaning you have $1m per claim for the policy period. The average premium for most attorneys with a fully rated policy is between $1,200 and $2,500 per year, with minimal limits.

You May Like: How To Obtain Arrest Records In New York

Lpl Requirements In Arkansas

Arkansas attorneys are not required to carry malpractice insurance. Other requirements for Arkansas attorneys are that they must be members in good standing of the State Bar Association, submit annual registration fees, and maintain a good standing status with the Bar association. The law firm is also required to have its status on file with the Bar association.

Ways To Lower Your Legal Malpractice Insurance Cost

Legal malpractice insurance is necessary but since it is not required by laws, many attorneys wonder whether they should have it. With a few hundreds a month, they will have the peace of mind if any law suits incur. Buying insurance is a tricky issue since you may pay premiums for years without having any benefits from it. But when you do, it will be so relieved that you have it. Legal malpractice insurance isnt too expensive given that 5% of attorneys get used each year. There are ways for you to lower the legal malpractice insurance cost too.

Don’t Miss: Wax Museum Times Square Nyc

What Is The Data Used To Determine The Premium Rate For Lawyers

When underwriters seek to establish premium rates for lawyers professional liability insurance, its a data-led process that relies heavily on historical claims data that each insurer has collected over the course of many years and continues to collect. This claims data is analyzed according to two major principles, the frequency and the severity of losses.

What Isnt Covered By Malpractice Insurance

If attorneys are accused of criminal, malicious, or fraudulent acts it will not be covered by the malpractice insurance provider. Most malpractice insurers will also exclude coverage for cases between lawyers who work at the same firm. Lastly, if you were aware of the potential for a lawsuit before you obtained malpractice insurance, insurance companies will exclude that claim from coverage.

You May Like: New Yorker Submissions Poetry

The Facts On Malpractice Suits

According to data from the AMA, 34% of physicians will have a medical malpractice lawsuit filed against them during their careers. The longer you practice, the more likely that becomes. Almost half of all physicians over the age of 55 have been sued at least once.

A National Practitioner Data Bank 2018 report shows plaintiffs that sued for medical malpractice received over 4 billion dollars, with an average payout of $348,065 per claim.

Of all suits filed, approximately 50% go to trial, though only about 5% result in a jury verdict. In most cases, malpractice claims end in a settlement either before trial or during the trial proceedings.

Even if your suit ends in a jury verdict in your favor, you will still be forced to pay for legal services and defense fees. Unless you have malpractice insurance to cover those costs for you.