The Services And Knowledge You Need To Incorporate

You’re not alone. One of the hardest parts of launching a US business is learning what you need to do and when. We’ll guide you through it and process the paperwork.âââHere’s our simple process â

Choose your state and entity type

Our business plan includes everything you need to launch, maintain and grow your US business: business formation, a registered agent, a free tax consultation, a US mailing address, digital document access, annual compliance filings, US IRS tax filings and more. Later on if you need things like a US Phone Line or ITIN, we can help!

The State forms your Company

We move fast and form your Company with the State. The timeline for this stage depends on the State’s internal timeline. The State creates your Company, and we’ll deliver all of your documents to you in a custom dashboard for digital access from anywhere.

We get your Employer Identification Number from the IRS

An EIN is required to apply for and open a US Bank Account, and we’ll take care of this for you. We’ll prepare and fill your EIN application and send it to the IRS. The timeline for this stage depends on the IRS’ internal processing timelines.

We help you open your US Bank Account and Payment Gateway

We keep you compliant with the State and the IRS

New York Business Name Search

Next, search the New York Department of State Corporation and Business Entity Database. This is an important step in the process because your filing will be denied if you try to file for a name already in use.

Search requirements can vary depending on your business needs. For example, a unique and available name is required to:

- File for formal business structures like LLCs and corporations.

- File a DBA name for any business structure.

A state-level name search isnt required for informal business structures like sole proprietorships or general partnerships in New York. But, if you decide to register an assumed name or DBA name, youll need to search the database to see if your desired name is unique and available.

How Do I Manage Ongoing Dba Name Compliance In New York

The date on the receipt issued by the New York State Department of State is proof that the certificate has been registered. Once your DBA name has been registered, the date on the receipt is the same date you can begin trading. Check your receipt to ensure all details are correct.

You do not need to renew your DBA name to remain compliant with state laws, but you may want to make other changes at some point. Specifically, a Certificate of Amendment of Certificate of Assumed Name may need to be completed and filed for $25. County fees will also apply to corporations.

Or you may want to file a Certificate of Discontinuance of Assumed Name for $25 with the Secretary of State should your business circumstances alter. Altered circumstances can include the sale or transfer of the company. Many reasons exist for amendments or the discontinued use of a DBA name. When changes take place, the DBA name must be officially maintained.

How we can help

Our team of experts is here to help you with every leg of the journey of running your business. If your New York small business is still in the formation stage, our LLC Formation Services or Corporation Formation Services can help you get started.

The content on this page is for informational purposes only, and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

Also Check: How Much Is A Helicopter Ride Around New York City

How To Apply For An Ein

The easiest and fastest way to apply for an EIN is to visit the Internal Revenue Service website, between the hours of 7 am 10 pm EST, Monday Friday.

The online application process only takes about 5 minutes to file the EIN online, and the number will be ready in seconds. If applying online isnt an option, you can also complete an EIN application by mail or fax by sending Form SS-4 to the IRS fax number 855-641-6935.

You can even get an EIN over the phone if the company was formed outside the U.S. by calling 267-941-1099. If filing by phone, note that it isnt a toll-free number.

There is no cost to apply for an EIN.

See how to register an EIN in this video:

Apply For A Federal Tax Id

All employers are required to obtain a federal tax ID, also called an Employer ID Number or EIN. DBAs arent required to file for an EIN, but its recommended to keep business and personal matters separate. You EIN is like a social security number for your business. If you dont have one, youll have to use your personal social security number on business legal and tax documents. Using an EIN can help prevent identity theft. To apply for your EIN, apply online with the IRS or via IRS Form SS-4. We can also apply for you with any business startup package.

NOTE: International applicants must .

Don’t Miss: How Much Is Daycare In New York City

Ongoing Requirements For Your Company

DBA : New York DBAs or Assumed Names should be valid for 5 years. If you change your business name, you will have to apply for a new certificate with the updated name.

LLC: New York LLCs must file biennial reports during the month of organization. So if you registered your LLC in May, biennial reports are due in May every 2 years. You must pay a filing fee to submit the report.

Corporation: New York corporations must keep complete accounting and business records at the principal business address. The records must include minutes of all shareholder, executive, and director meetings, list the names and addresses of all shareholders, the number and shares of each, and the date each became a shareholder.

Corporations must file biennial reports in New York. Reports are due the month you originally formed your Corporation. So if you incorporated in January, your biennial filings are due in January every 2 years. A filing fee is charged when a report is submitted.

Franchise Taxes: New York businesses are required to pay an annual franchise tax based on several categories, outlined here.

MyCompanyWorks Premium service can automate most ongoing compliance tasks.

Registering Your Business In New York State

Before applying for any type of license the legal entity of your business should be established. I have listed the key steps down below that will help you understand the process of registering your business in NY.

- Choose a unique name for your business.

- Determine your business structure. Your business can be an LLC, corporation, partnership, etc.

- Appoint a registered agent. Every business forming in the state should have a registered agent who will receive legal paperwork on behalf of your company.

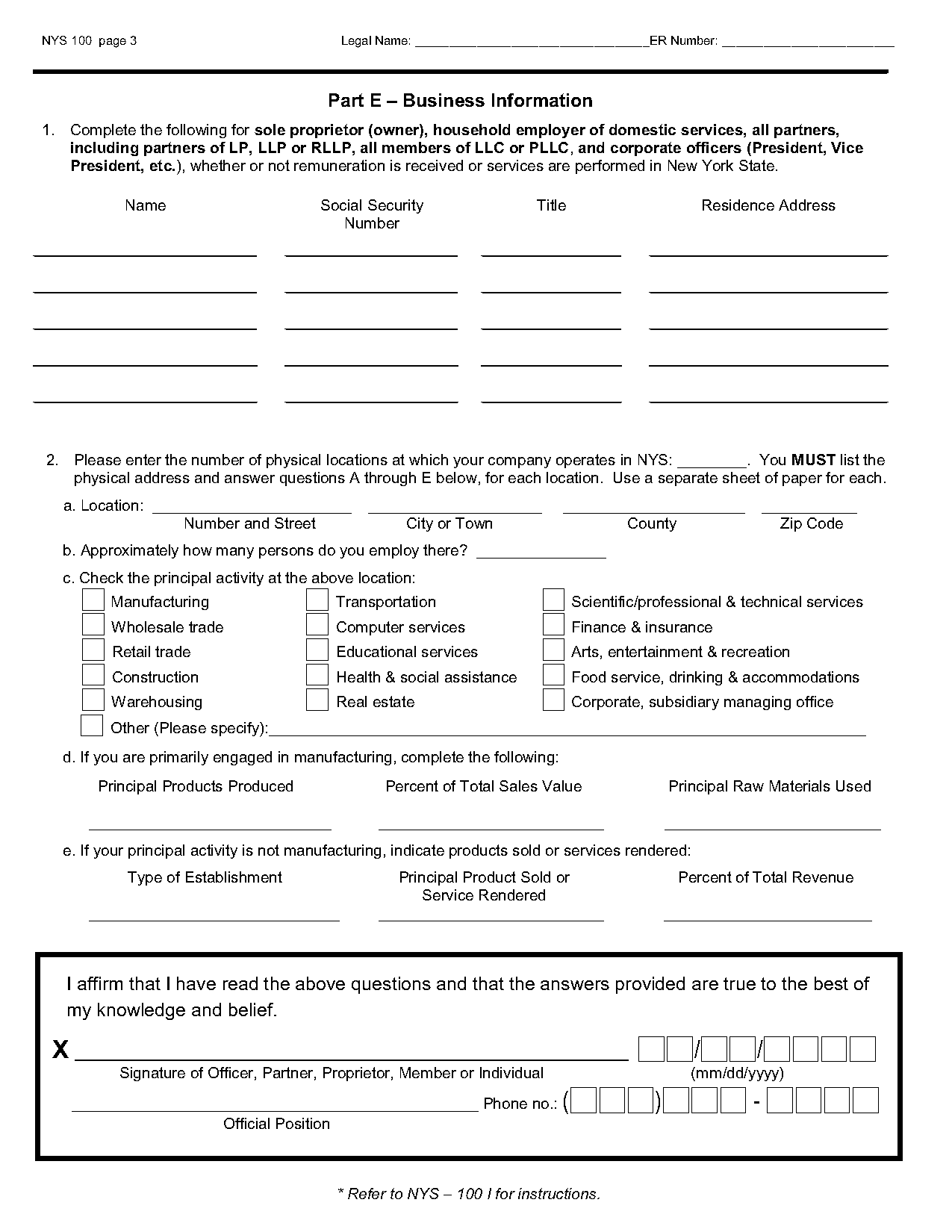

- File the documents to form your business structure. If your business is going to be an LLC you should file the Articles of Organization with the Department of State. To form a corporation in NY, you will need to file the Certificate of Incorporation. The filing fee prices for forming a corporation start from $125 while the LLC business costs $200.

- Obtain federal EIN from IRS. A nine-digit employer identification number is assigned to identify your business for tax purposes.

- Purchase insurance policy. Depending on the location and the nature of your business you may also need to purchase general liability insurance and workers compensation .

- Register for sales tax Certificate of Authority. If your business will sell products or provide taxable services you should register for this certificate with the State Department of Taxation and Finance.

Recommended Reading: Can You Take Drivers Ed Online In New York

Get A Dba Name For Your New York Business Today

If youre an entrepreneur in New York, you may not wish to use your businesss full legal name for all of your companys activities. If so, a doing business as name could be a helpful branding tool, allowing you to conduct your small business under a different title.

Doing business as names are an excellent alternative to using legal personal names or business names. They afford levels of flexibility for business owners that are not otherwise possible. New York business owners can file for DBA names, or assumed names as they are known in the state, to enhance brand personality or augment business operations in other areas.

Businesses that conduct business under a name that is not their legal name in New York need a Certificate of Assumed Name. This certificate is also called the doing business as certificate. Businesses must file the certificate with the New York State Department of State or local county clerk.

Read on to learn about New York DBA names, including how to choose, register, and maintain one, as well as how we can help make the process easier.

Get A Business Bank Account And Business Credit Card

You know the old saying, Dont mix business with pleasure? Turns out, it applies to your finances, too. The next step in starting a business in New York is to open a business bank account and credit card.

Separating your business and personal finances is crucial for two key reasons: Itll protect your personal assets in the unlikely event that your business is sued, and itll make your bookkeeping much easier to organize. Opening a business bank account and signing up for a dedicated business credit card are the first two important steps in establishing this separation. Luckily, theyre both easy to do.

If youre happy with the bank youre using for your personal finances, you may decide to open your business bank account with them, too. Keeping both sets of finances with the same institution is logistically easier, and as banks tend to reward loyalty, they may offer you incentives on your business bank account, like forgoing the monthly maintenance fee or allowing you to open your account online. Otherwise, take a look at our guide to the best business bank accounts for small businesses. Theyre all excellent options. Keep in mind that when youre starting out, you can get away with opening just a checking account for easy access to your cash. You can open a business savings account when you start growing.

Read Also: Is The New Yorker A Public Or Private Entity

New York Business Registration: Everything You Need To Know

New York business registration involves selecting your company name and registering it with the New York Secretary of State. The state can be very strict when it comes to accepting your company’s name and might reject new filings for reasons that seem trivial to the filer.3 min read

New York business registration involves selecting your company name and registering it with the New York Secretary of State. The state can be very strict when it comes to accepting your company’s name and might reject new filings for reasons that seem trivial to the filer. Some of the reasons the state might reject your name include:

- Not getting consent to use certain common words in your company’s name.

- Using an inconsistent spelling of the name when filing your documents.

- Using a foreign word without including the translation.

You can form several types of corporate entities in New York, including:

- Business corporation

- Registered limited liability partnership

After You Obtain A New York Business License

Once you obtain the appropriate New York business licenses for your industry, there should be little difficulty in keeping them current. Some licenses, however, might require additional training of you or your staff. This is to ensure that all employees within your business have the right level of education to competently perform their duties.

If your New York State business license lapses, you may be subject to fines from the city or state. You will also need to reapply for your license rather than renew it. This can take weeks or months, especially if you need to pass an inspection before getting the license.

incorporate.com can help make sure that all permits and licenses for your business are kept current so that you never have to worry about unnecessary fines and delays at a crucial moment.

Too busy to research your licensing requirements? We can help.

You May Like: When Did Mike Bloomberg Serve As Mayor Of New York

Choose A Business Structure

The type of business structure you choose to form will determine how you register the business with the state. Use our how to choose a business structure guide to help choose which business structure is best for you, whether its sole proprietorships, general partnerships, limited liability companies , and corporations.

The factors you should consider when choosing a business structure will depend on your needs and wants for personal liability protection, tax liabilities, and paperwork to keep the company in compliance.

Recommended: We typically recommend forming an LLC for most entrepreneurs because this structure comes with personal asset protection, has no double taxation, and is pretty easy to maintain.

If you would like to use a service, read our guide on the best LLC formation services.

Perform A Name Search

Youll first need to determine if your desired fictitious name is available. Perform a public inquiry at the states official website. If in the area, you can also visit the New York County courthouse basement at 60 Centre Street in Manhattan.

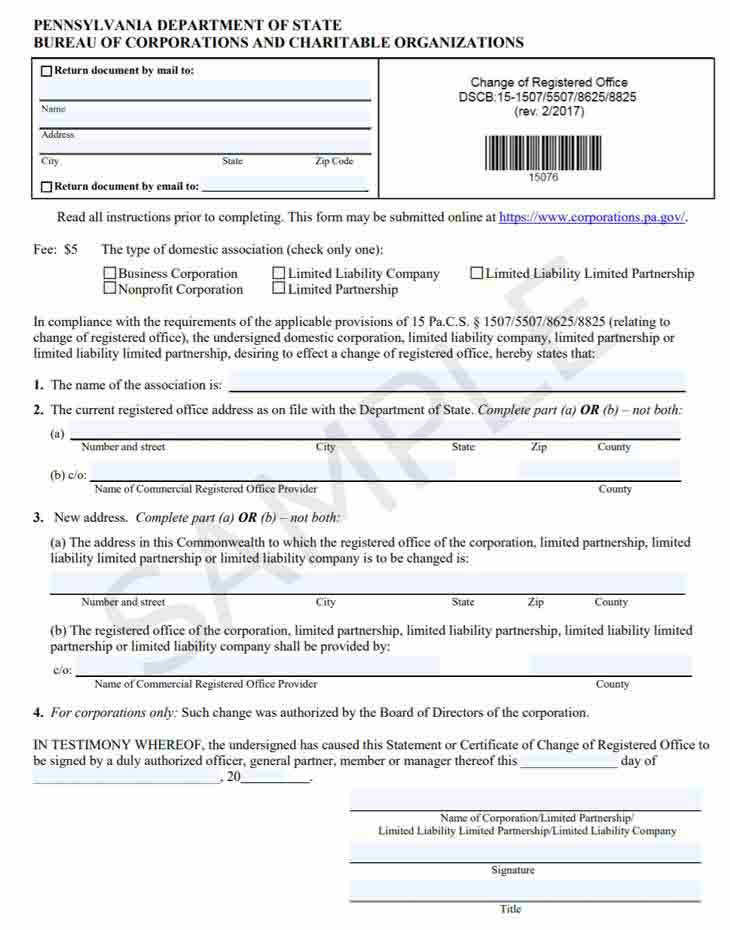

Out-of-state corporations and LLCs that are planning to register to do business in New York can reserve a fictitious name for up to 60 days by filing an Application for Reservation of Name. The filing fee is $20 and is made payable to the Department of State. If you need more time, you have the option to file a Request for Extension of Reservation of Name form. The extension costs an additional $20 and will let you hold the name for an extra 60 days.

Read Also: How Do I Cancel My New York Times Subscription

Register A Dba In New York

You may do business under a name different from your corporation’s legal name. While many states refer to this as a trade name, fictitious name or “doing business as” , it’s an assumed name in New York. You may decide to use an assumed name for a variety of reasons.For example, your primary business may be called Upstate Hospitality, Inc., and you have a chain called Hudson Valley Tours. You could register an assumed name just for that brand. You’d do that by filing a form for a Certificate of Assumed Name, or you can have Incfile do it on your behalf with our DBA service.In order to keep your business names unique, you can also use the New York business entity search. You can perform a New York assumed name search to find out whether any other companies are already using the assumed name you want. We can also help you with this via our DBA name service.Note: A trade name is not the same as a trademark. Learn more about trademark vs. DBA.

New York Incorporation Faqs

How to incorporate in New York?

incorporate.com will complete several steps to help facilitate your organization’s New York incorporation. In most cases, the steps are as follows:

Why incorporate in New York?

There are numerous reasons to incorporate in New York. Many businesses and nonprofit organizations choose to incorporate in New York because it affords easy access to a large population of consumers.

Ready to create your company?

A business must complete paperwork, secure unregistered names, and pay appropriate fees before it can become a limited liability company in New York.

Recommended Reading: Can You Sports Bet In New York

How To Get A Business License In Nyc: Everything To Know

When opening a business in New York City, the type of business you are starting will dictate the permits, licenses, or other forms of authorization you need. 4 min read

When you want to open a business in New York City, the type of business you are starting will dictate the permits, licenses or other forms of authorization you will need. Some types of businesses will require more than one license.

Delaware Llcs & Corporations

Since 1981, more than 300,000 limited liability companies and corporations have incorporated in Delaware with Harvard Business Services, Inc.

In addition to Delaware LLC formation and incorporation, we can also provide other forms of assistance throughout the life of your company. These custom business services are the most popular with our Delaware clients:

Our Learning Center possesses dozens of informational articles to help you along the way as you form an LLC, incorporate in Delaware, and so much more. Find all the Delaware incorporation information you need to know before, during and after forming your company with us.

The HBS Blog offers insight on Delaware LLCs and corporations as well as information about entrepreneurship, startups and other business topics.

Top 5 Reasons to use Harvard Business Services, Inc.Over 40 years of lightning-fast filings, unparalleled customer service and the lowest fees in the industry make us the smart choice. Learn more about why we’re the best choice to help you incorporate in Delaware.

You May Like: How Much Is Rent In New York