Do I Need A License To Operate My Business In New York

Whether your business needs a license depends on the type of business you are running. For example, all businesses that are involved in the sale of goods will need to get a certificate of authority to collect sales tax. Certain occupations must also be licensed by the state, and depending on the services offered, your business may need more than one license. New York has an Online Permit Assistance and Licensing system that can tell you what state licenses your business may need.

Where Can I Register A Business Name And Obtain A Master Business Licence

Ontario.ca provides access to the governments electronic services that simplify and streamline registration, renewal and reporting processes for Ontario businesses. New entrepreneurs and existing corporations can electronically complete the most important applications to register their business at one location, including applications for Business Name Registration, Retail Sales Tax Vendor Permit, Employer Health Tax and Workplace Safety and Insurance Board. When registering via Business Registration Online and some provincial governments including Ontario), you may apply for the above programs as well as for a Federal Business Number and other CRA programs.

Business names can be searched and registered through ServiceOntario via the following channels:

Note: you must enter the business information yourself when using BRO and the ServiceOntario website. For more information about fees and processing times or to obtain ServiceOntario applications, please visit the ServiceOntario website or call:

Toronto: 416-314-9151

TTY toll-free: 1-800-268-7095

How Do I Write Bylaws

Creating bylaws can be overwhelmingwhere do you start? Northwest can help. We give you free corporate bylaws when you hire us to form your New York corporation. We know what kinds of topics and questions corporations need to address, and weve spent years refining and improving our forms. We offer many other free corporate forms as well, including templates for resolutions and meeting minutes.

Read Also: How Much Does It Cost To Register A Car In Ny

Choose A Business Name

Your business name is arguably among the most important aspects of your business it indicates to your customers who you are, what you offer, what you value, and how your customers will feel when they patronize your business. This isnt a task to take lightly, but its also one of the most creative aspects of starting a business. Take a look at our guide on how to come up with a business name to get started on this crucial step.

Once youve landed on a business name, youll need to make sure its available for use across a few platforms. Most importantly, search the New York Business Entity Database and do a business entity name search through the New York Secretary of State to make sure the name isnt already in use by another New York business. If it is, you wont be able to move onto registering your business, so youll have to go back to the drawing board. We recommend running your name through a trademark search on the U.S. Patent and Trademark website, too.

Then, run a Google search to ensure that a competing business isnt using your dream name, or a similar name, either in New York or elsewhere. Finally, check that your web domain name is available, and if it is, buy it ASAP. That way, you can build your business website and start garnering traffic immediately.

Once youve cleared all these hurdles, youre ready to register your business with the state of New York.

Meet Licensing And Tax Requirements

Depending on the nature of your business, you may need to meet state and local licensing requirements. The State of New York does not require a license to operate a sole proprietorship, however, some professions require state licensing. These include legal, insurance, and banking businesses, for example.

Some cities in the state require a license to operate. Check with your city to make sure your business is in compliance.

Depending on the nature of your business, your sole proprietorship may need to collect state sales taxes. Apply for a Certificate of Authority to collect sales and use tax if appropriate. Check for other local, state, and federal tax requirements for your business. In New York, it’s easy to launch a new business on a whim as a sole proprietor. Before you get going, you should make sure you’ve followed all state and local requirements.

This portion of the site is for informational purposes only. The content is not legal advice. The statements and opinions are the expression of author, not LegalZoom, and have not been evaluated by LegalZoom for accuracy, completeness, or changes in the law.

Ready to incorporate your business?

Don’t Miss: Motzei Shabbat New York

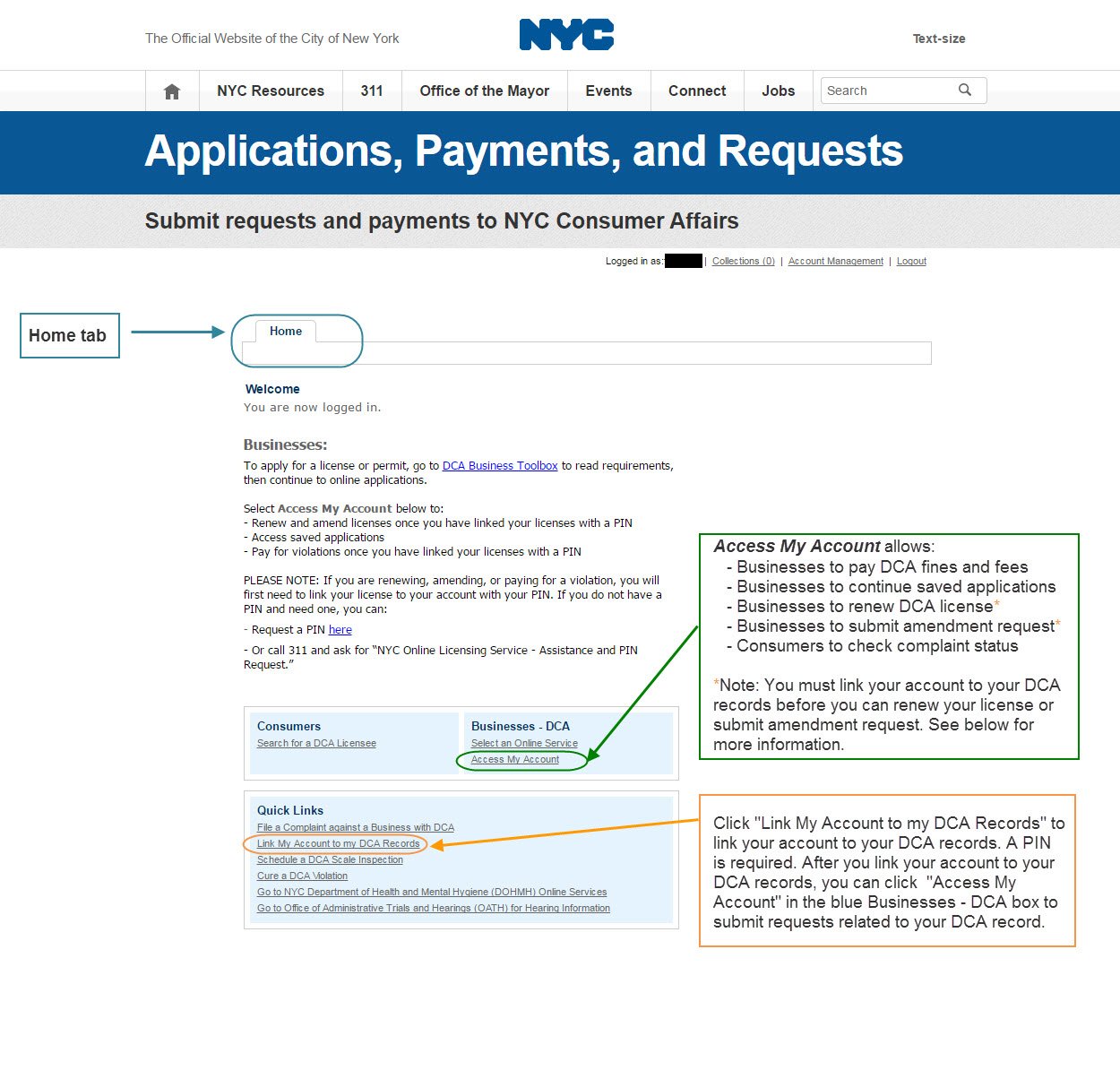

Obtain Licensing And Permits

Depending on the type of industry in which you operate, along with whether or not you plan on hiring employees, you might need to obtain additional licensing and permits. For example, if you plan on operating a restaurant, you will need to obtain a license in order to serve food. If you hire employees, you will need to register for withholding taxes, unemployment insurance, and workers compensation.

If you operate in the transportation industry, then your employees will need to obtain commercial drivers licenses. Some other industries that require additional licensing and permits include the mining, trash removal, and construction industries. Be sure to check out the New York Secretary of State website to find out what is required of you before you start doing business.

Those entities operating in New York City will need a specific business license, regardless of what type of business or industry you are operating in. Some other cities in the state of New York also require local permits and licenses, simply for being geographically located in that area.

If you need help with learning more about registering your New York business, you can post your legal need on UpCounsels marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Content Approved

Get A Business Bank Account And Business Credit Card

You know the old saying, Dont mix business with pleasure? Turns out, it applies to your finances, too. The next step in starting a business in New York is to open a business bank account and credit card.

Separating your business and personal finances is crucial for two key reasons: Itll protect your personal assets in the unlikely event that your business is sued, and itll make your bookkeeping much easier to organize. Opening a business bank account and signing up for a dedicated business credit card are the first two important steps in establishing this separation. Luckily, theyre both easy to do.

If youre happy with the bank youre using for your personal finances, you may decide to open your business bank account with them, too. Keeping both sets of finances with the same institution is logistically easier, and as banks tend to reward loyalty, they may offer you incentives on your business bank account, like forgoing the monthly maintenance fee or allowing you to open your account online. Otherwise, take a look at our guide to the best business bank accounts for small businesses. Theyre all excellent options. Keep in mind that when youre starting out, you can get away with opening just a checking account for easy access to your cash. You can open a business savings account when you start growing.

Recommended Reading: How Much Are The Tolls To Nyc

When To Register To Collect Sales Tax In Ny

Every state has a sales tax nexus. You can think of the nexus as a special version of that stateâs border if you perform certain business activities within that border, you fall into the stateâs sales tax nexus, and youâre required to register for and collect state sales tax.

Typically, these actions take the form of buying and selling goods and services.

Until 2018, selling or buying non-physical goodsâlike subscriptions to streaming services, SaaS memberships, etc.âdid not, generally speaking, qualify you for sales tax nexus. After an important court ruling in 2018, that changed. Now, if you buy or sell non-physical goods or services in a state, you may fall within its sales tax nexus.

What Do I Need From My Home State

A certificate of existence is required. If no such certificate is issued by the jurisdiction of formation, a certified copy of the articles of organization of the limited liability company and all subsequent amendments therefore, or if no articles of organization have been filed, a certified copy of the certificate filed as its organizational base and all amendments thereto is required.

Does it need to be an original copy?

Yes, if filing by mail or in person.

How current does the certificate need to be?

It must be current within one year of filing.

Also Check: What Do I Need To Bring To Apply For Medicaid

Start With A New York Assumed Name Search

If you haven’t already, head over to the New York Department of State website to make sure your name isn’t taken by or too similar to another registered New York business.

TIP: Our business name generator tool is a great resource for entrepreneurs who are still working to create the perfect business name or website address. You can also use our free logo generator tool to make a logo yourself! No design experience necessary!

Next, make sure your name complies with New York naming rules:

- Your name cannot include words that could confuse your business with a government agency

- Restricted words may require additional paperwork and a licensed individual, such as a doctor or lawyer, to be part of your business.

Next, a quick online search of the U.S. Trademark Electronic Search System will tell you whether someone else has already trademarked your name.

Now would be the perfect time to get a web domain for your DBA.

Powered by GoDaddy.com

After registering a domain name for your DBA, consider using a business phone service to improve customer satisfaction and further establish credibility. Our top pick is Nextiva because of its affordable pricing and useful features. Start calling with Nextiva.

New York Incorporation Faqs

How to incorporate in New York?

incorporate.com will complete several steps to help facilitate your organization’s New York incorporation. In most cases, the steps are as follows:

Why incorporate in New York?

There are numerous reasons to incorporate in New York. Many businesses and nonprofit organizations choose to incorporate in New York because it affords easy access to a large population of consumers.

Ready to create your company?

A business must complete paperwork, secure unregistered names, and pay appropriate fees before it can become a limited liability company in New York.

Don’t Miss: What You Need To Register A Car In Ny

Transacting Business In New York

According to New York’s LLC Act, you are required to register your foreign company with the state of New York if you are “transacting business” or “doing business” in New York. What does this mean? Well, like most states, New York’s LLC Act does not specifically define either “transacting business” or “doing business” in relation to foreign registrations.

However, state laws governing when foreign companies must collect state sales tax in their state provide some guidance on the issue. Under these laws, a business must have a physical presence inor nexus withthe state in order to be required to collect state sales tax on sales to that state’s residents. Generally speaking, physical presence and nexus are synonymous, and mean having:

- a warehouse in the state

- a store in the state

- an office in the state, or

- a sales representative in the state.

Certain exceptions may apply and the rules get more complicated with things like Internet sales. Nevertheless, in general, if you have an office, a store, a warehouse, or employees in another state, you will need to qualify your LLC as a foreign company in that state. For more details, including some possible distinctions between physical presence and nexus, check Nolo’s articles on Internet Sales Tax: A 50-State Guide to State Laws.

How To Start A Business In New York:

There is support for new small businesses and entrepreneurship in New York. In 2016, New York lending institutions issued 417,765 loans under $100,000. The state offers many business development programs like START-UP NY, a program that offers eligible businesses the opportunity to operate tax-free for ten years when partnered with academic institutions, and the Empire State Developments Small Business Division, which offers guidance to businesses with fewer than 100 employees through a range of programs and initiatives.

Review New York State formation options.

New York State offers 4 ways of forming your business. Review these closely and pick the one that fits your business best.

Name your business.

When you have a business name in mind, you should search the name in the DOS Business Entity Database to see if it has already been registered.

You should also check the trademark database to see if the name you have in mind has been trademarked.

If you need help finding a business name, be sure to check out NameSnack’s free business name generator.

Get an Employer Identification Number.

Nearly all businesses will need to register for federal taxes by applying for an employer identification number.

Recommended Reading: Erase New York

About Starting An Online Business In New York

Several things must be considered to successfully open an online business that adheres to New York small business law. It’s vital that you obtain the proper licenses and permits to be considered a legally operating online business. The type of business you’re establishing may require one or more licenses and/or permits before you can begin operation. These include authorization from the federal government, state government, and local city or county authorities.

If the business will be involved with dangerous activities such as firearms, drug manufacturing, or selling alcohol, federal permits and licenses are required. You likely won’t need a federal license or permit if your business isn’t involved in these types of activities. There’s also a difference between an online business selling a product and providing a service in regard to the type of permit needed.

The information and resources you may need to start an online business are available on these websites:

- New York State Department of State Division of Licensing Services for federal permits and licenses.

- New York City Department of Consumer Affairs for local permits and licenses for New York City.

- The New York Better Business Bureau. Visit this site for information about the type of business structure that addresses the needs of your business. An example would be setting up your business as a sole proprietorship or limited liability company.

For Foreign Professional Corporations:

| New York Department of State – Division of Corporations, State Records and Uniform Commercial Code | |

| Form: | |

|

Certified copies not required. |

|

| Certificate of Good Standing Requirement: |

Certificate of existence dated within the last year or, if your state doesn’t issue certificates, a certified copy of your articles of incorporation and amendments. |

Don’t Miss: New York Toll Costs

How To Register A Business In New York

This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow’s legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.There are 11 references cited in this article, which can be found at the bottom of the page. This article has been viewed 7,970 times.

The process of starting a business can be just as nerve-wracking as it is exciting. If you live in the state of New York and have decided to start a business, you’ll first need to choose a business structure. If you decide to incorporate your business or form an LLC, you’ll have to register it with the NYS Department of State. However, even if you don’t need to do that, you’ll still need to register for taxes, as well as any other licenses or permits you need to operate your business legally. Once you’ve registered and gotten all the licenses and permits you need, maintain your records according to state guidelines to avoid any legal trouble with your business.XResearch source

Choose A Business Idea

Take some time to explore and research ideas for your business. At this stage, take into consideration your own interests, skills, resources, availability, and the reasons why you want to form a business. You should also consider the likelihood of success based on the interests and needs of your community. Read our article for more tips onhow to evaluate business ideas.

After you select an idea, consider drafting a business plan to evaluate your chances of making a profit. When you create a plan, you will have a better idea of the startup costs, your competition, and strategies for making money. Typically, investors and lenders will ask to review your business plan before providing financial assistance. To learn more about the benefits of business plans and how to create one for your enterprise seeWhy You Need to Write a Business Plan.

Also Check: Disability Application Ny