How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

New York Share Of Us Millionaires Is Decreasing

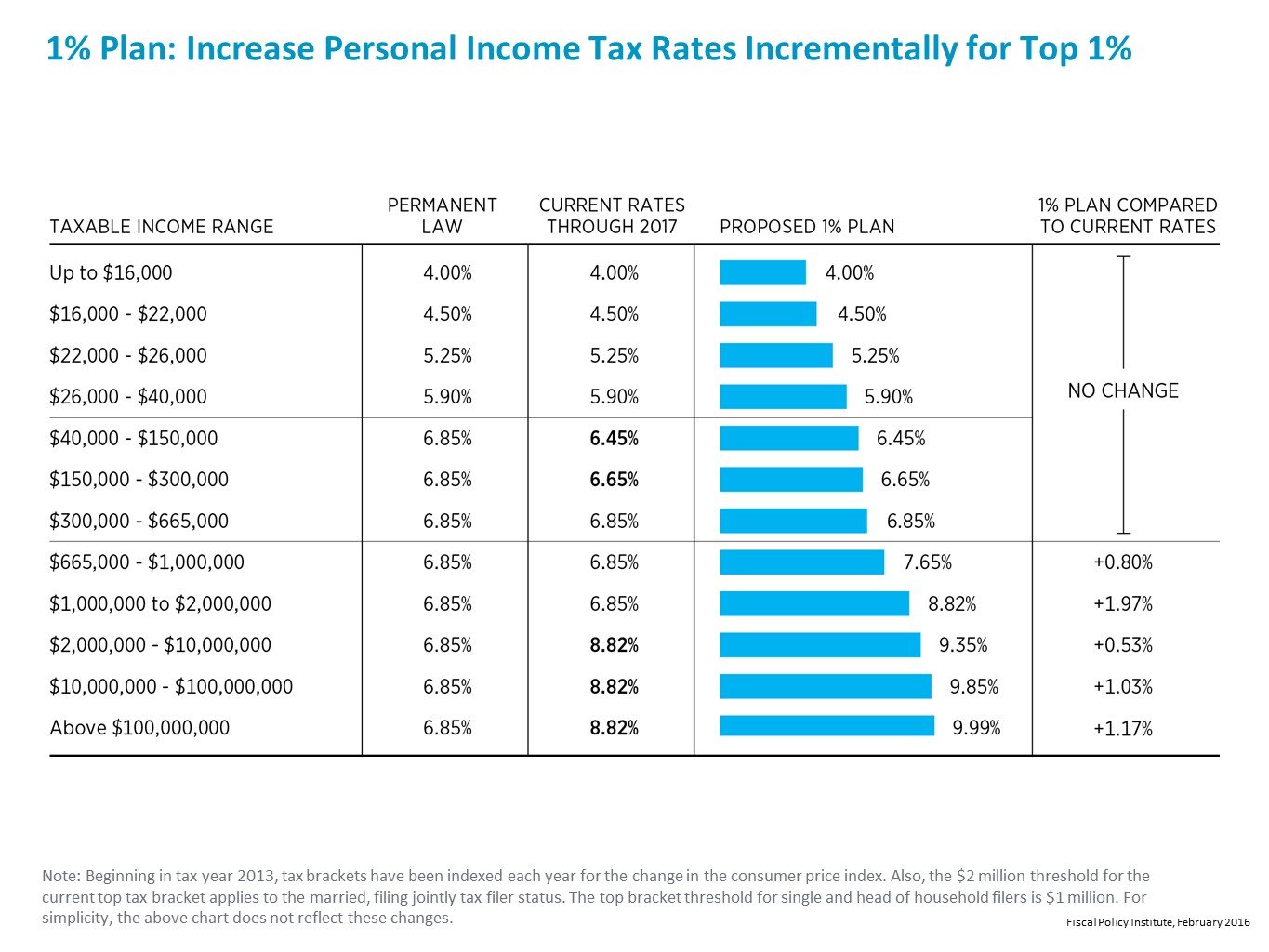

Between 2010 and 2017 the number of United States tax filers with adjusted gross incomes of $1 million or more increased 75 percent, which is more than 50 percent faster than growth in New York. In 2010 New Yorks share of millionaires was 13 percent compared to 7 percent in Florida. Between 2010 and 2017 New Yorks share of the nations millionaires decreased by 15 percent , while Floridas increased by 26 percent . The decreasing share of millionaires may be caused by a number of factors, including personal income tax rates. It is concerning because New York State and New York City are very dependent on tax revenues from millionaires, with almost 40 percent of personal income tax revenues coming from this group of taxpayers.6

There were even greater shifts in the share of capital gains earned by New Yorks millionaires, which have important revenue impacts for states coffers. Ordinary income is taxed where it is earned however, capital gains are taxed by the state of residency . For example, if a New Jersey resident works in New York, he or she pays New York taxes on wages earned in New York, but if the person earns capital gains, that income is taxed only by New Jersey.7 Individuals who derive most of their incomes from capital gains have a strong incentive to establish residency in a low tax state.

Changes For Some In New York City Create The Highest Combined Local Tax Rate In The Country

New York Citys highest earners would be taxed at a top combined state and city income-tax rate of 14.8% under a new state law.

Taxes are going up for New Yorks highest earners.

Legislation passed Wednesday raises income-tax rates on single filers with more than about $1.1 million of income and joint filers reporting more than about $2.2 million. The changes mean top earners in New York City will be subject to the highest combined local tax rate in the country.

Also Check: Register Vehicle In Ny

Federal Tax On Taxable Income Manual Calculation Chart

If your taxable income is $49,020 or less.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

If your taxable income is more than $49,020, but not more than $98,040.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

If your taxable income is more than $98,040, but not more than $151,978.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

If your taxable income is more than $151,978, but not more than $216,511.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

If your taxable income is more than $216,511.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

Getting Your New York Tax Refund

If your state tax witholdings are greater then the amount of income tax you owe the state of New York, you will receive an income tax refund check from the government to make up the difference.

It should take one to three weeks for your refund check to be processed after your income tax return is recieved. E-filing your return and filing early can help ensure your refund check gets sent as quickly as possible.

Once you’ve filed your tax return, all you have to do is wait for your refund to arrive. If you want to check the status of your New York tax refund, you can visit the New York Income Tax Refund page.

Don’t Miss: How Do I Apply For Disability In New York State

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

Nys And Yonkers Withholding Tax Changes Effective January 1 2022

We revised the 2022 New York State personal income tax rate schedules to reflect certain income tax rate reductions enacted under the Tax Law. We also updated the New York State and Yonkers resident withholding tax tables and methods for 2022. These changes apply to payrolls made on or after January 1, 2022.

- Calculate 2022 New York State withholding tax amounts using Publication NYS-50-T-NYS , New York State Withholding Tax Tables and Methods.

- Calculate 2022 Yonkers resident and nonresident withholding tax amounts using Publication NYS-50-T-Y , Yonkers Withholding Tax Tables and Methods.

- NOTE: There were no changes to the New York City resident wage bracket tables and exact calculation methods. Please continue to use Publication NYS-50-T-NYC , New York City Withholding Tax Tables and Methods.

Recommended Reading: How Much To Register Car In Ny

New York Median Household Income

| Year | |

|---|---|

| 2010 | $54,148 |

What your tax burden looks like in New York depends on where in the state you live. If you live in New York City, you’re going to face a heavier tax burden compared to taxpayers who live elsewhere. Thats because NYC imposes an additional local income tax.

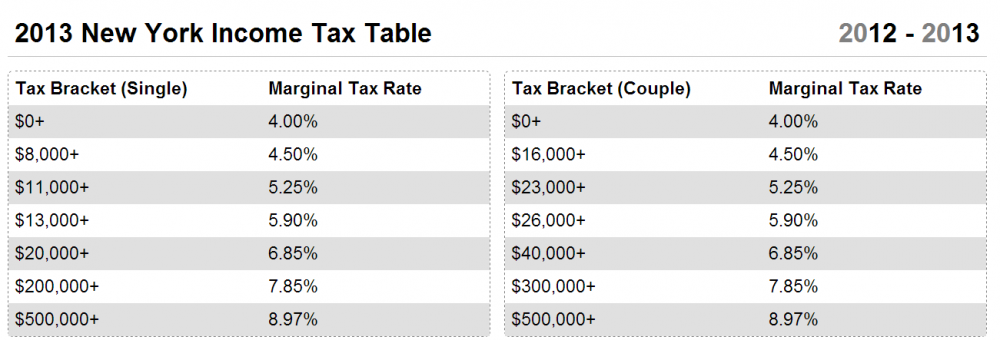

New York States progressive income tax system is structured similarly to the federal income tax system. There are eight tax brackets that vary based on income level and filing status. Wealthier individuals pay higher tax rates than lower-income individuals. New Yorks income tax rates range from 4% to 8.82%. The top tax rate is one of the highest in the country, though only individual taxpayers whose taxable income exceeds $1,077,550 pay that rate. For heads of household, the threshold is $1,616,450, and for married people filing jointly, it is $2,155,350.

Taxpayers in New York City have to pay local income taxes in addition to state taxes. Like the states tax system, NYCs local tax rates are progressive and based on income level and filing status. There are four tax brackets starting at 3.078% on taxable income up to $12,000 for single filers and married people filing separately. The top rate for individual taxpayers is 3.876% on income over $50,000. The rates are the same for couples filing jointly and heads of households, but the income levels are different.

Yonkers also levies local income tax. Residents pay 16.75% of their net state tax, while non-residents pay 0.5% of wages.

What Is The New York Single Income Tax Filing Status

There are five filing status available to New York state taxpayers: Single, , , Head of Household, and Qualifying Widow. These five filing status are visible as check boxes on both the IRS Form 1040 and the New York Form IT-201.

Single is the filing type you select if you are not married, do not have children, and have no dependants for example. Filing as Single generally results in paying higher federal and New York state income tax rates compared to the other four filing statuses.

Single status tax payers in most states have a relatively lower standard deduction and fewer family oriented credits available to reduce their income tax liability.

Read Also: Can I Register A Car Without A Title In Ny

Overview Of New York Taxes

New York state has a progressive income tax system with rates ranging from 4% to 8.82% depending on taxpayers income level and filing status. Living in New York City adds more of a strain on your paycheck than living in the rest of the state, as the Big Apple imposes its own local income tax on top of the state one. New York Citys income tax system is also progressive and rates range from 3.078% to 3.876%.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

- Our Tax Expert

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

Inheritance And Estate Taxes

New York has no inheritance tax.

An estate is required to file a New York state estate tax return if the total of the federal gross estate plus the federal adjusted taxable gifts and specific exemption exceed the basic exclusion amount, and the individual was either a New York resident at the time of death or a US resident or citizen whose estate included real or tangible personal property located in New York.

The basic exclusion amount, or BEA, is adjusted each year. For deaths on or after April 1, 2017, and on or before Dec. 31, 2018, the estate value exclusion amount is $5.25 million. For deaths on or after January 1, 2019 and before January 1, 2020, the exclusion amount is $5.74 million.

Don’t Miss: How To Register A Car In Ny From Out Of State

Child And Dependent Care Credit

You qualify for the child and dependent care credit if you are eligible for the federal child and dependent care credit, whether you claim it or not on your tax return. The is determined by the number of your qualifying children and the amount of child care expenses paid during the year. The credit is worth up to $2,310 for the tax year 2020. If the credit is more than the amount you owe in taxes, you can receive a tax refund.

More Help With Taxes In New York

So, get help with H& R Block Virtual! With this service, well match you with a tax pro with New York tax expertise. Then, you will upload your tax documents, and our tax pros will do the rest! We can help with your NY taxes, including federal deductions for paying state taxes.

Prefer a different way to file? No problem you can find New York state tax expertise with all of our ways to file taxes.

Related Topics

Learn the tax implications of the first time home buyer tax credit and if you need to repay it from the tax experts from H& R Block.

Don’t Miss: Va Toll Calculator

Federal Tax Rates For 2021

- 15% on the first $49,020 of taxable income, plus

- 20.5% on the next$49,020 of taxable income , plus

- 26% on the next$53,939 of taxable income , plus

- 29% on the next $64,533 of taxable income , plus

- 33%of taxable income over$216,511

The chart below reproduces the calculation on page 5 of the Income Tax and Benefit Return.

New York State Estate Taxes

The state of New York levies an estate tax on the estates of deceased taxpayers.

For the 2019 tax year, the state has a basic exclusion amount of $5.74 million. If youre a resident of New York and your estate and includable gifts are worth less than this amount, the state wont assess any estate taxes. Above that amount, though, the marginal tax rate is based on the amount above the exclusion threshold. Here are the 2018 rates.

| Tax rate |

|---|

| $10,100,001 and more |

Read Also: New York State Tickets Pay Online

How Do New York Tax Brackets Work

Technically, you don’t have just one “tax bracket” – you pay all of the New York marginal tax rates from the lowest tax bracket to the tax bracket in which you earned your last dollar. For comparison purposes, however, your New York tax bracket is the tax bracket in which your last earned dollar in any given tax period falls.

You can think of the bracketed income tax as a flat amount for all of the money you earned up to your highest tax bracket, plus a marginal percentage of any amount you earned over that. The chart below breaks down the New York tax brackets using this model:

| For earnings between $0.00 and $8,500.00, you’ll pay 4% |

| For earnings between $8,500.00 and $11,700.00, you’ll pay 4.5%plus $340.00 |

| For earnings between $11,700.00 and $13,900.00, you’ll pay 5.25%plus $484.00 |

| For earnings between $13,900.00 and $21,400.00, you’ll pay 5.9%plus $599.50 |

| For earnings between $21,400.00 and $80,650.00, you’ll pay 6.21%plus $1,042.00 |

| For earnings between $80,650.00 and $215,400.00, you’ll pay 6.49%plus $4,721.43 |

| For earnings between $215,400.00 and $1,077,550.00, you’ll pay 6.85%plus $13,466.70 |

| For earnings over $1,077,550.00, you’ll pay 8.82% plus $72,523.98 |

How Do You Pay The New York City Income Tax

The New York City income tax is due on April 15th, when you file your federal and state tax returns. Because calculating your local income tax is relatively simple compared to your other tax returns, many tax preparers will file your New York City income tax return for free.

If you file your own taxes, the New York City tax collector will likely mail you a copy of the tax forms you need by April. Unfortunately, many leading e-file providers do not support local income taxes. New York City may have a proprietary e-filing system you can use alongside your state and federal e-filing provider.

Read Also: Opening A Llc In Ny

State Income Tax Brackets

| $60,000+ | 3.876% |

Youll note that in our discussion of tax rates above that we used the term taxable income. This is different from actual income earned, because it accounts for tax deductions and exemptions. In New York, the standard deduction for a single earner is $8,000 . This means that when calculating New York taxes, you should first subtract that amount from your income .

What Is Tax Abatement In Nyc

A tax abatement is a tax break on property or business taxes. Owners of co-ops and condos in NYC who meet certain requirements can qualify to have their property taxes reduced. The requirements include using the co-op or condo as a primary residence, not owning more than three residential units in any one development , and not being part of the Urban Development Action Area Program.

You May Like: New York Rolling Loud Lineup

New York Income Tax Rate 2020

New York state income tax rate table for the 2020 – 2021 filing season has eight income tax brackets with NYtax rates of 4%, 4.5%, 5.25%, 5.9%, 6.09%, 6.41%, 6.85% and 8.82% for Single, Married Filing Jointly, Married Filing Separately, and Head of Household statuses.

The New York tax rate is mostly unchanged from last year. A couple of small changes were made to the middle bracket tax rates. The income tax bracket amounts are unchanged this year. New York income tax rate and tax brackets shown in the table below are based on income earned between January 1, 2020 through December 31, 2020.

| 8.82% |

Please reference the New York tax forms and instructions booklet published by the New York State Department of Taxation and Finance to determine if you owe state income tax or are due a state income tax refund. New York income tax forms are generally published at the end of each calendar year, which will include any last minute 2020 – 2021 legislative changes to the NY tax rate or tax brackets. The New York income tax rate tables and tax brackets shown on this web page are for illustration purposes only.