General Rules For Naming Your S Corp Or C Corp

The rules below generally apply to all corporations, wherever they are formed.

Your New York Corporation Name Must Be Unique

The name you have chosen for your S Corporation or C Corporation cannot be used by any other registered business in the state of New York. This is why you must check business name availability on the NY Secretary of State website.

The Name of Your Corporation Cannot Be Similar to Other Businesses in New York

The name of your NY S Corporation or C Corporation cannot be similar to another formal business name in New York. The following terms cant be used to say your business name is different from another business name:

- Suffixes, such as Corporation, Company, Incorporated, Incorporation, Limited, Corp., Co., Inc., Ltd., LLC, etc.

- Definite articles like A, And, An, & , The, etc.

- The singular, plural or possessive forms of a word

- Abbreviations, punctuation, symbols, fonts, typefaces, etc.

For example, you cant claim that Purple People Co., Purple People Corporation, Purple People Incorporated, Purple People Corp. or Purple People are different from one another.

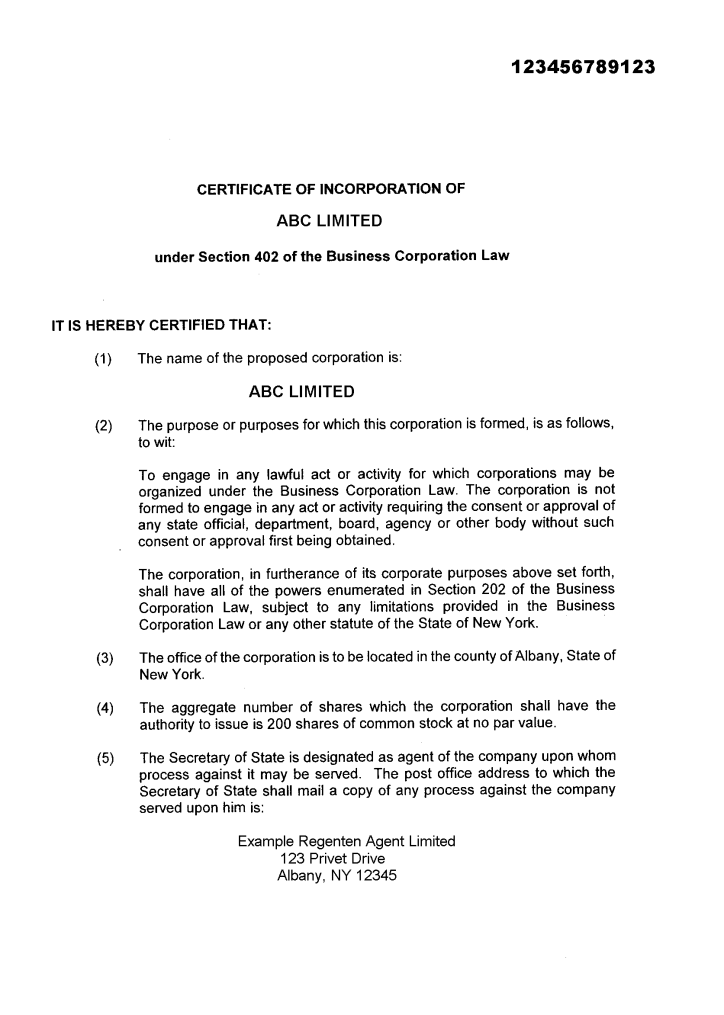

Your New York Corporation Name Must Contain Certain Words

The words Incorporated, Corporation, Limited or their abbreviations generally need to appear in your business name, normally at the end.

Other General Rules on Naming Your New York Corporation

Specific Rules for Naming Your New York Corporation

Obtain Applicable Federal Licenses For Your New York Business

If your business activities are regulated by a federal agency, youll likely need to obtain some sort of licensure or permitting at the federal level.

Specific license requirements and fees vary depending on the industry in which your business operates and the services your business provides. Below are some industries that are regulated by the federal government and require federal licenses or permits.

Differences Between A Dba And An Llc

At first glance, a DBA may seem similar to a limited liability company . After all, the acronyms are often discussed together and both let you conduct business using an identity other than your legal name.

However, this is essentially where the similarities end. DBAs are fictitious namesnot business structures . Meanwhile, an LLC is a formal business entity that is legally separate from its owners. It allows owners to avoid liability in the event of a lawsuit or other attempts to go after their private assets. LLCs also have tax advantages for some business owners.

If you require more than just an legitimate alias, you might want to consider an LLC or another formal business structure. Otherwise, a DBA is usually good enough to legitimize your chosen trade name.

Read Also: What Is The Nicest Hotel In New York City

New York Incorporation Faqs

How to incorporate in New York?

incorporate.com will complete several steps to help facilitate your organization’s New York incorporation. In most cases, the steps are as follows:

Why incorporate in New York?

There are numerous reasons to incorporate in New York. Many businesses and nonprofit organizations choose to incorporate in New York because it affords easy access to a large population of consumers.

Ready to create your company?

A business must complete paperwork, secure unregistered names, and pay appropriate fees before it can become a limited liability company in New York.

Unique Features About Incorporating In New York

- Incorporating in New York is fast if you use expedited service. The 24-hour expedited service is well worth the $25.00 fee.

- Extensive list of restricted or forbidden words. Make sure to have an expert screen your name to see if there is some potential problem that will cause delay .

- Extensive list of corporate purposes for which other states must give consent prior to filing by the Secretary of State.This includes the cumbersome and needless process by which professional corporations and professional limited liability companies are formed.

- New York does not require a registered agent. The Secretary of State is your agent for service of process you only need to give a postal address that the Secretary of State can use to mail any process served against you. However, you are allowed to have a registered agent, and if you are located outside the United States, you will need an agent to accept service of process for youinside the United States.

- Every New York LLC, limited partnership, professional limited liability company and registered limited liability partnership must publish notice of formation in two newspapers in the county where the office is located for six consecutive weeks then file the affidavits of publication with the Secretary of State within 120 days.

- If you are planning to practice a licensed profession with your new company in New York State, then you will need to set up a Professional Corporation or Professional Limited Liability Company .

You May Like: New York Times Poetry Submissions

Open Company Bank And Credit Accounts

To keep business and personal expenses separate, you should open a separate account for your business. In addition, getting business credit cards is how you begin to build a company credit profile and can later qualify for larger loans and lines of credit. To open the account simply call your chosen bank and inquire on the steps to open a business bank account. Typically youll need a) your filed paperwork, b) your EIN and c) a company resolution authorizing your company to open the account .

Learn The Rules For Qualifying Your Llc To Do Business In New York

By David M. Steingold, Contributing Author

If you own a business that was created in a state other than New York, you will need to qualify or register that business in New York if you want to do business there. Here is an overview of the rules on how to qualify your foreign limited liability company to do business in New York.

Don’t Miss: Wax Museum Parking

How To Register A Business Name In New York

Registering a business name in New York is done when you form your business entity with the state. You must first choose your business structure, then do a business name search to ensure name availability. Afterward, you must form your entity with your business name with the state. Some businesses may also prefer to just register a DBA. Follow our step-by-step instructions and read our FAQs to get started.

How to Register a Business Name in New York

2021-08-27

Instructions For Corporations Partnerships Trade Names Name Changes Etc

The names of all corporations, partnerships, limited liability companies and trade names must receive prior approval from the department of financial services for use in New York. Name changes for entities must also receive prior approval. The name must first be submitted to the department for consideration, and either approval or disapproval will be forwarded in writing, along with the appropriate licensing application and/or instructions. After receiving department approval, follow the instructions below and on the application.

Please note: the licensee can only do business in the name in which he/she or it is licensed.

Also Check: How To Submit Poetry To New York Times Magazine

Documents For A New York State Business License

Before applying for a New York state business license, gather the appropriate documents. Gathering the necessary documents beforehand will ensure that you receive all of the permits and licenses that you need to operate your business legally.

Other documents that you might need when applying for your license include:

- Your tax ID number

- Any licenses required to operate machinery, vehicles, or other items.

You can begin the license application process once you have gathered these items.

How To Incorporate In New York

- Optional: Choose a Registered Agent Service: In New York, the Secretary of State acts as the registered agent by default, though you may choose to use an alternative service.

- Optional: Corporations can elect S-Corporation status with the IRS by filing IRS Form 2553.

- Hold an Organizational Meeting to properly organize the corporation, take contributions from the shareholders, elect directors and officers, issues stock, adopts the Corporate Bylaws and more.

You May Like: Watch Kourtney And Kim Take New York

Choose A Business Entity And Register Your Business

The next step in starting your business in New York is crucial: choosing a business entity. The business entity you choose will determine how youre taxed, your management and ownership structure, and your degree of legal protection. Your registration process will also differ depending on your business entity.

In New York, a few of the more common business structures are sole proprietorships, partnerships, LLCs, and corporations and among those structures, LLCs are especially popular, as theyre easy to form, easy to maintain, and they provide the owners with legal protection. Learn more in our guide to forming an LLC in NY.

Its always recommended that you consult legal or financial professionals to help you determine which type of business structure makes the most sense for your particular business. You can also take a look at New Yorks Business Express new business checklist to learn more about what each type of business structure entails, how to register with the state, how much the formation fee will cost, and their ongoing requirements.

Pro tip: Using this new business checklist will provide you with personalized, step-by-step guidance about starting a business in New York, and it only takes about 10 minutes to fill out.

Trademarks And Service Marks

You must be careful that your New York LLC name doesn’t infringe on the trademark or service mark of another business. The easiest way to ensure you’re not infringing is to perform a trademark search through Incfile. If the trademark isn’t already in use, you can even register it yourself.

Let Incfile run a trademark search for you.

You May Like: What Airlines Fly From New York To Myrtle Beach

Annual And Ongoing Requirements

DBA: Your Fictitious Business Name should be valid for 5 years at which point youll need to renew it with the county.

LLC: New York LLCs and corporations must file a biennial report during their anniversary month of incorporation.

Corporation: New York corporations must keep complete books and records of account at their principal place of business. These records must include minutes of all shareholder, executive, and director meetings, list the names and addresses of all shareholders, the number and shares of each, and the date each became a shareholder. LLCs and Corporations will pay a filing fee.

Franchise Taxes: New York businesses are required to pay an annual franchise tax based on several categories, outlined here.

which can automate most or your ongoing compliance tasks.

Select A Business Entity

The next step to starting a business in New York is selecting a business entity.

The business entity is sometimes referred to as a business structure or legal entity, which refers to how a business is legally organized. There are four primary business entities: sole proprietorship, partnership, corporation, and Limited Liability Company . A brief description of each is below.

A Sole Proprietorship is an individual that decides to go into business. This is the easiest and least expensive of the four entities to set up as there is no state filing. The ease of startup is a big selling point however, a major downside to the sole proprietorship is that the owner is personally responsible for all debts and actions of the company. If the business is sued, the owners personal assets are potentially at risk. Another potential downside is that the owner will pay self-employment tax on all business profits and may be more costly than some other entities.

Related: What is a sole proprietorship?

Related: What is a partnership?

There are multiple ways a corporation can elect to be taxed, which includes the C-corporation and S-corporation. Electing how the entity should be taxed is complicated, so be sure to talk with your CPA as there is the potential of double taxation where profits and dividends are both taxed. Also, there is no self-employment tax with a corporation, as income to the owner will come from either a salary or dividends, which may be beneficial.

Read Also: Pay Traffic Tickets Online Nyc

What Happens If You Don’t Register

If your LLC does business in New York without a certificate of authority, it cannot bring a lawsuit in any New York court. However, not having a certificate of authority does not invalidate your LLC’s contracts or prevent your LLC from defending a lawsuit in New York. Also, a member or manager of the LLC is not liable for the LLC’s contractual obligations or other liabilities solely because the company is doing or has done business in New York without a certificate of authority.

Choose The Right Business Idea

The first step toward business ownership is deciding what kind of business to start. Look for an idea that suits your interests, your personal goals, and your natural abilities. This will help you stay motivated when the going gets tough and will greatly improve your odds of success. We have assembled a comprehensive list of small business ideas to help you get started. Need inspiration? Here were the most popular ideas among our New York visitors in 2020:

Find the Right Business Idea for You

Our free Business Ideas Generator will help you identify great businesses that match your interests and lifestyle.

Read Also: Submissions Poetry To The New Yorker

Filing A Dba In Ny For Llcs Corporations And Llps

Incorporated businesses must file their certificate of assumed name with the New York Department of State. The following business types are considered incorporated:

- For-profit Corporations, Non-Profit Corporations

- Limited Partnerships, Limited Liability Partnerships

- Limited Liability Companies

- Any Foreign Filing Entities

If you need to know how to file a NY DBA for a sole proprietorship or partnership, go back to those requirements.

How To File A Dba In New York

New York requires a company use its true legal name to conduct business any company seeking to use a name other than its legal name must file for a DBA.

- Check your business name by calling the County Recorder or visiting their website .

- Obtain a Certificate of Assumed Name. Note that if you are a corporation, limited partnership, or LLC, you must instead obtain a certificate complying with Section 130 of the General Business Law.

- File the forms with the County. The fee for filing is $25, plus any associated countys fees. For corporations, the fee is $100 for each county within New York City, and $25 for each county outside.

Recommended Reading: How Much Are Tolls From Virginia To New York

What Is A Dba Good For

A DBA is required for many businesses in order to legally operate and provides information on the people operating a business. In addition to the legal requirement, a DBA offers other benefits such as proving the existence of a business, opening a bank account under a business name, registering a merchant account to accept credit cards, and others.

Licenses And Permits That You Might Need

Depending on your industry, you may need more than just a New York City business license or a State of New York business license. If you work in transportation, for instance, your employees will need commercial driver’s licenses. Other industries that require additional licenses and permits include:

- Food service

- Communications

- Construction

It is important to research your industry’s requirements to make sure you have the appropriate licenses and permits. Without them, you could face serious fines. The state or city could even stop your business from operating until you have the right documents in order.

If your business plans to operate in the city, then you will typically need a New York City business license, as well as one from the state. Some other cities in New York also require local permits and licenses. Contact your city manager’s office to determine whether you need additional documents to operate legally in the area.

incorporate.com, of course, can complete these steps for you. That way, you can concentrate on developing your business rather than having to cut through bureaucratic red tape and hunt down the correct personnel to determine whether you have all of the necessary permits to operate.

Recommended Reading: Flights From New York To Cabo San Lucas

Find The Right Name For Your New York State Corporation

Whether youre searching for the right New York corporation name or registering your business with the NY Department of State, we can help. Weve got all the information you need on New York corporation searches, S Corporation and C Corporation naming rules, fictitious names and registering your business.

How Much Does A Dba Cost In Ny

DBA filing fees vary depending on the location of the business and the business type.

Sole proprietor and partnership DBA fees are assessed by the county where the business is located. You must access your county directly for specific fee information. You can do this online or by calling the county clerk. You can find your counties’ contact information on the NYSAC.org website.

Fees for incorporated businesses like LLCs and corporations are as follows:

$25 for the Certificate of Assumed Name$10 Certified Copy of Certificate of Assumed Name$150 2-hour processing, $75 Same day, $25 within 24 hours

Additional Fees For Corporations Only

$100 for each NYC county where the business is or will be conducted within New York City $25 for each county where the business is or will be conducted outside New York City$1,950 to include every New York State county and the Certificate of Assumed Name combined

Don’t Miss: Hollywood Wax Museum Parking