How To Get An Itin Number Disclaimer Number 90

Como sacar el tax id number in new york. Los números de identificación fiscal son números de seguimiento de nueve dígitos que utiliza el irs de acuerdo con las leyes fiscales. El irs emite todos los números de identificación fiscal de los estados unidos excepto el número de seguridad social , que es emitido por la administración de seguridad social (ssa o social security. The free municipal identification card for new york city residents, ages 10 and up, idnyc helps new yorkers access a wide variety of services and programs offered by the city.

So your itin tax id not only helps you file a tax return, it ensures you get the refund you deserve as quickly as possible. An employer identification numbers or tax identification number is required for those who want to form a business, create a trust or an estate in the united states. administer tax law for 36 taxes and fees, processing nearly $37.5 billion and more than 10 million tax filings annually

Puede solicitar el ein en línea si su negocio principal se ubica dentro de los estados unidos o en uno de los territorios estadounidenses. Ny.gov id is an online service that enables citizens, state and local government employees, businesses, and others to access ny.gov id participating government online services. The employer id number is used by the irs to identify the tax accounts of employers.

New York Fashion Week Spring 2020 Attendees Pictures Nyfw Street Style Fashion Street Style

Pin On Doyouremembercom

Do I Need An Ein For My Llc

An LLC will need an EIN if it has any employees or if it will be required to file any of the excise tax forms listed below. Most new single-member LLCs classified as disregarded entities will need to obtain an EIN. An LLC applies for an EIN by filing Form SS-4, Application for Employer Identification Number.

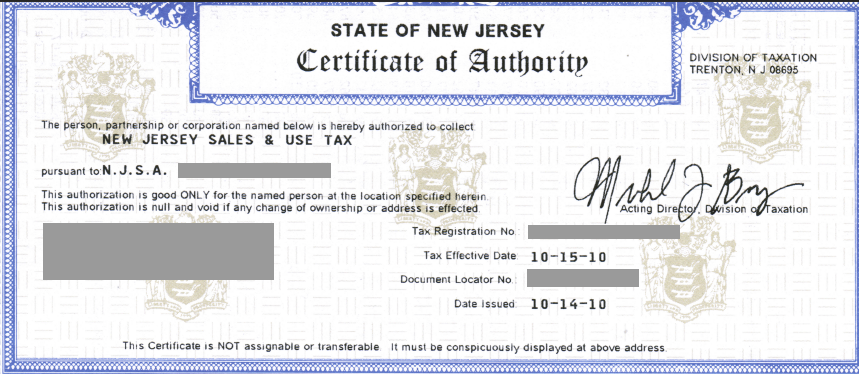

Types Of Certificates Of Authority

The Tax Department issues two types of Certificate of Authority for sales tax purposes, regular and temporary. The type of Certificate of Authority you need is based on the expected duration of your business activities. The same form and application process are used for both types of certificates however, the temporary certificate will be issued with a beginning and ending date.

You May Like: What Time Is Shabbos In New York

Information Needed To Register For A Sales Tax Permit In New York

Before you begin the process of registering with the state, make sure you have access to the following information:

- Federal tax ID, typically called the EIN, issued by the IRS

- Knowledge of your business entity structure

- Business owner information

- Start date with the state of New York

- Your estimated yearly tax liability with New York

Applying for your Certificate of Authority with the State of New York is a two-step process.

Start by following thislink.

You will select New Users, Register Here.

You will then be redirected to a different site in order to create your online profile. Once you have created your profile, you can then go back to .

You will select Get started and follow the prompts to apply for your Certificate of Authority with New York.

What Happens After You Apply for a Sales Tax Permit in New York?

You should receive your Certificate of Authority in the mail within 7-10 business.

You will also receive a PIN number in the mail that will help you access your online account. Once you receive that PIN number letter, please create your account at

Select Login and follow the prompts.

**Please note that New York quarterly filing frequencies are different than most states. The reporting periods covered by quarterly returns are March 1 through May 31, June 1 through August 31, September 1 through November 30, and December 1 through February 28/29.

Filing A Business Name

Anyone who conducts a business under a name other than his or her own must file a business name with the County Clerk of the county in which the business is being conducted. To file a business name, you need to complete the necessary documents. These forms can be downloaded or obtained from most commercial / legal stationery stores and attorneys. Some of these forms include:

View a complete list of available forms.

Completed Forms

Once the appropriate forms are completed and notarized, you may bring or mail them with the appropriate fee to: Nassau County Clerk’s Office

Division of Business NamesMineola, NY 11501

You May Like: Where Is The Wax Museum In New York

Regular Certificate Of Authority

You must apply for a regular Certificate of Authority if you will be making taxable sales from your home, a shop, a store, a cart, a stand, or any other facility from which you regularly conduct your business. It does not matter whether you own or rent the facility.

If you make sales at a show or entertainment event, such as a craft show, antique show, flea market, or sporting event, you must apply for a regular Certificate of Authority, even if your sales are only on an isolated or occasional basis. The department no longer issues the Certificate of Authority for Show and Entertainment Vendors that was previously issued for these vendors. See TSB-M-08S, Changes Regarding the Issuance of Certificates of Authority to Show and Entertainment Vendors.

Step : Choose A Registered Agent In New York

In New York, the Secretary of State acts as the registered agent for all New York LLCs by default. You can, however, choose to designate someone besides the Secretary of State as the registered agent for your New York LLC.

If you choose to use a registered agent service, the Secretary of State will still be the first point of contact for the state and for anyone who might serve your LLC with legal action.

The Secretary of State will forward the following to your LLCs principal address or the address of your designated registered agent:

- All formation documents

- Any service of process information

- Documents regarding taxation and reporting

Why would you use a registered agent service in New York?

1. Reduce Publication Costs

New York requires newly formed LLCs to publish a notice of formation in local newspapers. Publication costs around $1,500 or more if the principal address is in New York City. A registered agent service located outside the city allows an LLC to use the registered agents address as the principal address which greatly reduces the cost of publication.

2. Maintain Privacy

New York’s LLC publication requirements mandate that your principal LLC address be publicly shared. Hiring a registered agent service will allow you to use their address instead of yours which will protect your personal privacy.

For help with completing the form, visit our New York Articles of Organization guide.

FAQ: Filing New York LLC Documents

You May Like: Pay Ticket Online New York

How To Get A Resale Certificate In New York

Home » How to Start a Business in New York » How to get a Resale Certificate in New York

Quick Reference

When a business purchases inventory to resell, they can do so without paying sales tax. In order to do so, the retailer will need to provide a New York Resale Certificate to their vendor.

Learn more about what a resale certificate is, how to get one, and more.

Quick Reference

How To Obtain A Certificate Of Good Standing In New York

A Certificate of Good Standing, known in New York as a Certificate of Status, verifies that your LLC was legally formed and has been properly maintained. Several instances where you might need to get one include:

- Seeking funding from banks or other lenders

- Forming your business as a foreign LLC in another state

- Obtaining or renewing specific business licenses or permits

You can order a New York LLC Certificate of Status by mail, by fax, or in person.

Request a Certificate by Mail, by fax, or In Person From the New York Department of State

Note: Fax filings must include a form.

Also Check: Toll Calculator Dc To Nyc

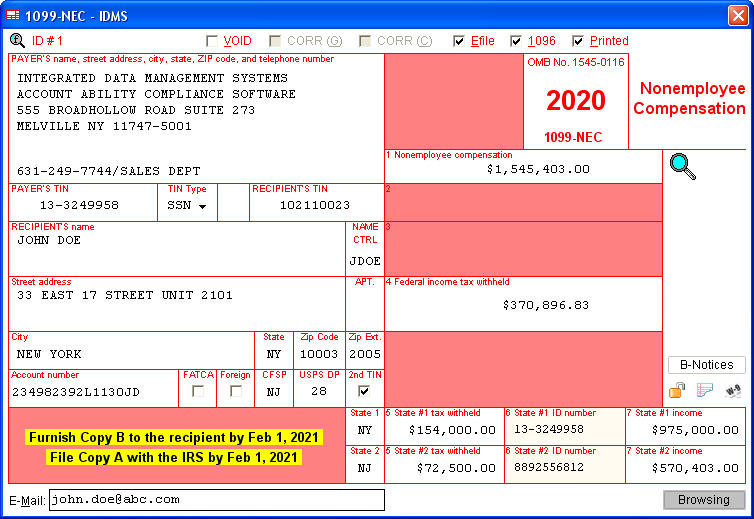

Step : Get A New York Llc Ein

What is an EIN? EIN stands for Employer Identification Number. EINs are a nine-digit number assigned by the Internal Revenue Service to help identify businesses for tax purposes. It is essentially a Social Security number for a business.

An EIN is sometimes referred to as a Federal Employer Identification Number or Federal Tax Identification Number .

Why do I need an EIN? An EIN is required to:

- Open a business bank account

- File and manage federal and state taxes

- Hire employees

What if I already have an EIN for my sole proprietorship? The IRS requires that sole proprietorships get a new EIN when converting to an LLC.

Where do I get an EIN? You can get an EIN for free from the IRS. Getting an EIN is an easy process that can be done online or by mail.

FOR INTERNATIONAL EIN APPLICANTS: You do not need a SSN to get an EIN. For more information, read our How to Get an EIN as a Foreign Person guide.

New York State Sales Tax Online Registration

Any business that sells goods or taxable services within the state of New York to customers located in New York is required to collect sales tax from that buyer. This will include all online businesses. Any seller which conducts business and has a major presence within the state must collect sales tax in New York must pay taxes to the state. Therefore, these sellers required to file for a Sales tax certificate. By not doing so the business may face sanctions or other types of penalties. Additionally, depending on the businesses location and tax jurisdiction, localities such as counties, cities, and other districts can also add additional sales and use taxes.

You May Like: How Much Are Tolls From Virginia To New York

Wait For Your New York Llc To Be Approved

Wait for your New York LLC to be approved by the Department of State before applying for your EIN. Otherwise, if your LLC filing is rejected, youll have an EIN attached to a non-existent LLC.

However, if this does happen, you can always cancel your EIN and then apply for a new one. And you dont have to wait for your cancellation to go through before applying for a new EIN.

Secure An Ein Before Starting A Business In New York

Before starting a company in the city, its best to take the proper steps to make your business a legal establishment. Its always smart to operate under an employer identification number, or EIN. Having this number assigned to your company will assure that you are not personally liable for any legal issues that may arise. If you dont already have an EIN, skip the line and go online to apply for a Federal ID in New York. Applications are accepted around the clock, and you are guaranteed to be approved by the next business day. Your EIN will be sent to you as soon as your application has been reviewed.

Whenever you apply for a federal ID in New York at IRS-EIN-Tax-ID.com, you will notice that the forms are clear and easy to understand. However, if you have any questions during the application process, you can always reach out to a customer service representative. No matter what time you decide to apply, you will be able to get customer support. Whether you reach out via email or phone, there will always be a representative ready to answer your questions. Once you are approved and assigned your unique EIN, you will be able to start up your business in the city and begin making money.

You May Like: New York Tickets Pay Online

Who Can Get A Non

A person with lawful status in the US of any age can get a non-driver ID card. You must apply at a DMV office. 1 We will give you a temporary non-photo document at the DMV office. Due to a greater than normal volume of renewals, there may be a delay in receipt of your permanent document. Your temporary document is valid for 60 days.

You can find a complete list of the documents that the DMV accepts at How to Apply for a New York License Permit/Driver License/Non-Driver ID Card ID-44

Complete this guide to make sure you have the proofs of identification you need before coming.

Fees for Standard Non-Driver ID Cards

| Standard Non-Driver ID Card | |

|---|---|

| Under age 62, your next birthday is within the next 6 months | 4 years |

| Under age 62, your next birthday is more than 6 months away | 8 years |

| Under age 62 and receive SSI | 10 years |

| Age 62 or older and receive SSI | 10 years |

| Any age and receive temporary assistance | 4 years |

Fees for REAL ID Non-Driver ID Cards

| REAL ID Non-Driver ID Card | Valid |

|---|---|

| Under age 62, your next birthday is within the next 6 months | 4 years |

| Under age 62, your next birthday is more than 6 months away | 8 years |

| Under age 62 and receive SSI | 8 years |

| Age 62 or older and receive SSI | 8 years |

| Any age and receive temporary assistance | 4 years |

Fees for Enhanced Non-Driver ID Cards

Reduced fee or ‘No Fee’ non-driver IDs

To get a reduced fee or ‘No Fee’ non-driver ID, you must you must apply by mail or at a DMV office .

Age 62 or older and receive Supplement Security Income

Do You Need To Get A Sales Tax Certificate In New York State

You may need a Sales Tax Certificate if any of the following apply your business:

- You have a physical office or place you conduct

- You sell or ship products to a buyer in New York

- You have a distribution location such as a storage area or warehouse space

- You have employees physically present in New York

- You have changed your business structure or moved to a new location

- You have personal short term real property rentals

- Your business leases or rents personal property

- Your business has real rental property

- Your business manufactures products for retail sale

- Your business imports goods from out side of New York for retail sale

- Your business purchases wholesale items for resale in the state of New York

- Your business provides taxable services within the state of New York

Don’t Miss: Becoming An Elementary Teacher In New York

How To Register For An Ein In New York

Home » How to Start a Business in New York » How to Register for an EIN in New York

Quick Reference

One of several steps most businesses will need to take when starting a business in New York is to register for an Employer Identification Number and New York state tax ID numbers. These numbers are most commonly used to register a business with the federal and state government in order to pay sales taxes, payroll taxes, and withhold taxes from employee wages.

Lets review in more detail what this number is used for when it is required, the cost, and how to register.

Also See: Guide to Starting a Business in New York

Quick Reference

New York Employer Tax Information

To sign up for Square Payroll in New York, you must be a registered employer with the New York State Department of Labor and the New York Department of Taxation and Finance, and provide us with both your New York Employer Registration Number and your Unemployment Insurance Tax Rate.

Read Also: Starting Llc In Ny

To Establish A Sole Proprietorship In New York Here’s Everything You Need To Know

In New York, you can establish a sole proprietorship without filing any legal documents with the New York State Government. There are four simple steps you should take:

To find out how to establish a sole proprietorship in any other state, see Nolo’s 50-State Guide to Establishing a Sole Proprietorship.

1. Choose a Business Name

In New York, a sole proprietor may use his or her own given name or may use a trade name. If you plan to use an assumed name or trade name, state law requires that the name be distinguishable from the name of another company currently on record. It is also a good idea to choose a name that is not too similar to another registered business because of common and federal law trademark protections. To make sure your business name is available, run a search in the following government databases:

2. File a Fictitious Business Name

If you use a business name that is different from your legal name, New York requires you to file a certificate of fictitious business name. This is a mandatory requirement in New York. To file your fictitious business name, you must fill out an application available from the county clerk’s office in the location where you intend to do business. The filing fee will vary depending on the county.

Next Steps

What Is An Ein Number

An EIN Number stands for Employer Identification Number and it will be issued by the IRS to your New York LLC.

An EIN is to your New York LLC what a Social Security Number is to a person. It helps the IRS identify your business for tax and filing purposes.

Having an EIN for your New York LLC allows you to open a separate bank account under the LLCs name, apply for certain licenses and permits, and handle employee payroll .

Even though its called an Employer Identification Number, it doesnt mean that you have to have employees. The EIN is just a type of Taxpayer Identification Number that identifies your New York LLC with the IRS.

Also Check: How To Submit Poetry To New York Times Magazine