Find A Registered Agent In New York

The registered agent is a necessary part of all LLCs formed in New York. Your business will not be considered official without this position.

What is a registered agent?A registered agent is a person or business who receives all official government mail and service of process notices on behalf of the LLC.

Why do you need a registered agent?New York law requires you to appoint a registered agent so that the state government has a consistent contact person for your LLC.

What are the main requirements for a registered agent?

- The registered agent must have a physical address not a P.O. Box

- The registered agent must be available during business hours

Who can be a registered agent in New York?

- A state resident with a physical address in New York

- An LLC or corporation that is licensed to conduct business in New York

Can I be my own registered agent for my business?You are legally allowed to be your own registered agent as long as you have a physical address in New York.

Is being my own registered agent discouraged?Since the registered agents name and address are publicly listed, LLC business owners who choose to be their own registered agent risk compromising their personal information.

Tip: Avoid the hassles and choose Swyft Filings to fill the registered agent needs for small businesses in New York. Find more information here.

Six Obtain Business Licenses And Permits

Most businesses in New York are required to obtain some kind of state license or permit to operate legally in the state. You can use the NYS Business Wizard for help determining the requirements for your PLLC. You will also need to confirm that you meet the necessary licensing requirements for your profession. The New York Office of the Professions maintains a list of professions online. As with taxes, you should also check with your PLLCs city and county to confirm if any local licensing requirements apply to your business.

Publish Notice Of Llc Formation

NY state law requires you to publish a copy of your articles of organization or a notice of your LLC formation in two newspapers for six consecutive weeks within 120 days of your LLC formation.

You have to publish your notice in newspapers approved by the NY county where your LLC is located. To find out which newspapers are acceptable, contact your county clerk. If you choose to publish a notice instead of your articles of organization, be sure the LLC name in the notice matches the Department of States records as set forth in your initial articles of organization.

To get your notice published, contact the newspapers yourself or hire a third-party service to handle it for you. The newspapers will provide you with an affidavit of publicationâtheyll also charge a publication fee. NYC-based business may have to pay several thousand dollars due to steep publishing rates for NYC newspapers. To save money, you might choose a registered agent outside NYC so you can use that address as your LLCs office address. That way you could run your publication notice in a newspaper in that county, which likely has lower publishing rates.

Once youve fulfilled the publication requirement, youll need to submit a Certificate of Publication, along with a $50 filing fee, to the New York Department of State.

Read Also: Wax Museum Nyc Times Square

What Should I Know About New York Llc Taxes

New York uses a progressive scale to determine personal net income taxes, which ranges from 4% to 8.82%. The state also has a 4% sales taxalthough cities and counties can stack on local sales taxes as well. The maximum total sales tax tops out at 8.88% , but the average total sales tax is 7.959%.

Most LLCs are taxed as either partnerships or S corporations , so you shouldnt have to worry about corporate net income taxes, right? Well, not exactly. While you wont pay the actual corporate net income tax, New York has still found a way to tax your income at the entity level with its Annual Filing Fee. This fee ranges from $25 for LLCs with income of or below $100,000 in the previous tax year, to $4,500 for LLCs with income of more than $25,000,000.

Property taxes are also worth a noteAlthough New York does not collect property taxes at the state level, it does at the local level. The average effective property tax rate is 1.68%. If you do decide to invest in New York property, your attorney will likely advise creating an LLC to protect your personal assets. At Northwest, we can form your New York LLC for as low as $425. Or, pay just $44 out the door with our VIP monthly payment option.

Can A New York Llc Help Me Live More Privately

Yes. While you cant remove all ownership information from New York public filings , a New York LLC can still help you reduce your public footprint. You can maintain a significant degree of address privacy by listing our address on public docs instead of your own. Check out our page on living privately with an LLC to learn more.

Read Also: How Much Are Tolls From Virginia To New York

Form Your New York Llc Online

Note: As of December 2018, the New York Division of Corporations has changed their online LLC filing process. Online LLC filings are now done through the New York Business Express. The instructions below reflect the most up-to-date online filing procedures.

1. Getting Started Visit the New York Limited Liability Company page to get started. Scroll down to How to Apply and click Apply Online as an owner If you already have a NY.gov Business Account, then you can login. If you dont have a NY.gov Business Account, click Register Here.

2. NY.gov Business Account Registration Enter your name, email address, and a preferred username. Then check off Im not a robot and click Create Account. Review your information and click Continue. Youll see an email activation message. Click Finish at the bottom and close the browser tab/window.

3. Email activation, security questions, and password Go to your email inbox and click the activation link that the state sent you. Youll be redirected to a page where you must create 3 security questions. Keep this saved with your passwords. Once finished, click Continue. Create your account password and make sure this is saved as well. Then click Continue. On the next page, click Go to MyNy. Scroll down to the bottom of the page and click NY BUSINESS EXPRESS

Two Designate A Registered Agent

Every PLLC in New York is required to designate a registered agent, which is the individual or business entity that receives government correspondence on behalf of your business, then forwards those documents to you.

In New York, the Secretary of State acts as agent for service of process for domestic LLCs, including PLLCs. Appointing a registered agent in addition to the Secretary of State is optional. If you choose to designate a registered agent, such agent must be a natural person who is a resident of New York or has a business address in New York, a domestic limited liability company or an authorized foreign limited liability company, or a domestic or foreign corporation authorized to do business in New York.

Without a registered agent, you could lose your good standing with the state of New York, and the state also has the right to dissolve your PLLC if they decide to. In a worst-case scenario, the state could fail to alert you regarding a lawsuit against your company, which could even lead to a judgment against your business because you didnt defend yourself.

Our Recommendation

At the end of the day, we recommend hiring a dedicated registered agent service to handle these requirements. Doing so will help eliminate junk mail and more importantly, keep your personal and/or business address off public record.

Recommended Reading: How To Pay A Ticket Online New York

New York Business Permits & Licenses

Does a New York LLC need business licenses and permits?

To operate your LLC in New York you must comply with federal, state, and local government regulations. For example, restaurants likely need health permits, building permits, signage permits, etc.

The details of business licenses and permits vary from state to state. Make sure you read carefully. Dont be surprised if there are short classes required as well.

Fees for New York business licenses and permits will vary depending on what sort of license you are seeking to obtain.

Always obtain the necessary New York business licenses and permits for your LLC here are some helpful links:

- Federal: Use the U.S. Small Business Administration guide to federal business licenses and permits.

- State: Apply for licenses, permits and register with The State of New Yorks License Center.

- Local: Chamber of Commerce and local business licenses and permits.

S After Forming An Llc

After forming your LLC, it’s important to:

- Open a Business Bank Account. A business bank account legally separates personal finances from business finances. This separation is required to maintain your LLC’s corporate veil .

- Research New York Business Licenses and Permits. For help, visit our How to Get a New York Business License guide. There are also business license services that can help.

- File Your New York LLC Biennial Report. File online with the New York Department of State every two years by the end of the month in which the LLC was formed.

Need Help Forming an LLC?

Read our Best LLC Services review to learn more about pricing and packages.

You May Like: Pay Ticket Online Ny

Decide On A Business Structure

There are 3 basic options: a DBA, a Corporation or an LLC. .

- A DBA or Doing Business As is not really a separate structure, but just a different name that an individual or partners use as their business name.

- A Corporation is a separate entity that has a structure that includes shareholders, directors and officers. More complex than a DBA but the entity of choice for large companies and startups that intend to raise funding. Some professions are required to choose what is known as a Professional Corporation or PC .

- An LLC or Limited Liability Company is a newer type of business that is both a separate entity but provides very easy management and taxation. Has largely replaced the DBA and Corporation in popularity recently as it provides liability protection but with much less complexity than a Corporation.

Obtain Your Federal Employer Identification Number

Your EIN is like your Social Security Number for your company. Its required for Corporations and LLCs and optional for DBAs . However, if you are a DBA and dont obtain an EIN you will be forced to use your Social Security Number on many documents so its typically recommended you obtain the EIN to prevent identity theft.

To obtain an EIN you can apply online with the IRS or via IRS Form SS-4.

TIP: We will obtain your EIN for you if you we form your company.

You May Like: What Airlines Fly To Cabo San Lucas From New York

Amendment Of The Filing

An LLC needs to contact the Department of State if it wants to amend the LLC’s filing. An LLC filing may be amended to change the business name or to edit other important details. To make amendments, submit the completed Certificate of Amendment to Articles of Organization form to the New York Department of State, along with the $60 filing fee.

Wait A Second What’s So Great About Forming A New York Llc Anyways

Do you like adaptability? Control? Not losing sleep over personal liability for business debt? Then form an LLC.

- Limited Liability: Forming a business entity like an LLC or corporation creates a legal separation between you and your business. If something goes wrong and you get sued, creditors can typically only go after business assets to pay off debts.

- Pass-Through Taxation: Unlike New York corporations, LLCs are taxed as pass-through entities by default. Profits and losses incurred pass through your business, straight to you. Unless you change tax designations, you report LLC earnings on your personal return.

- Flexible Ownership: Corporations are for people who like rules, formalities, and prestige. LLCs are for people who like control. When you form a New York LLC, youre not beholden to shareholders or a board, and you can have as many managers or members as you want.

Also Check: How Much Does It Cost In Tolls From Va To Ny

Complete The New York Publication Requirement

Section 206 of the New York Limited Liability Company Act mandates that new LLCs must publish a Notice of LLC Formation. The notice must be published:

in two newspapers a daily and a weekly

within 120 days of formation

in newspapers circulated in the county where the LLCs principal office will be located and

once a day and once a week for six consecutive weeks.

You must include the following information in your notice:

the name of your LLC

the date the LLC was formed

the county where your main office is located

your LLC’s street address

a statement that the Secretary of State has been designated as an agent of the LLC upon whom process against it may be served

the address where the NY Secretary of State may forward any process against the LLC

the name and address of your Registered Agent

a statement that the Registered Agent is to be the agent of the LLC upon whom process against it may be served

the purpose of the LLC, which can be a statement such as the purpose of the LLC is to engage in any lawful act or activity and

the date the LLC will dissolve. If you plan to run your LLC indefinitely, you can use the word perpetual here.

Contact the County Clerks office in the county where your business is located to ensure you choose newspapers that fulfill this requirement.

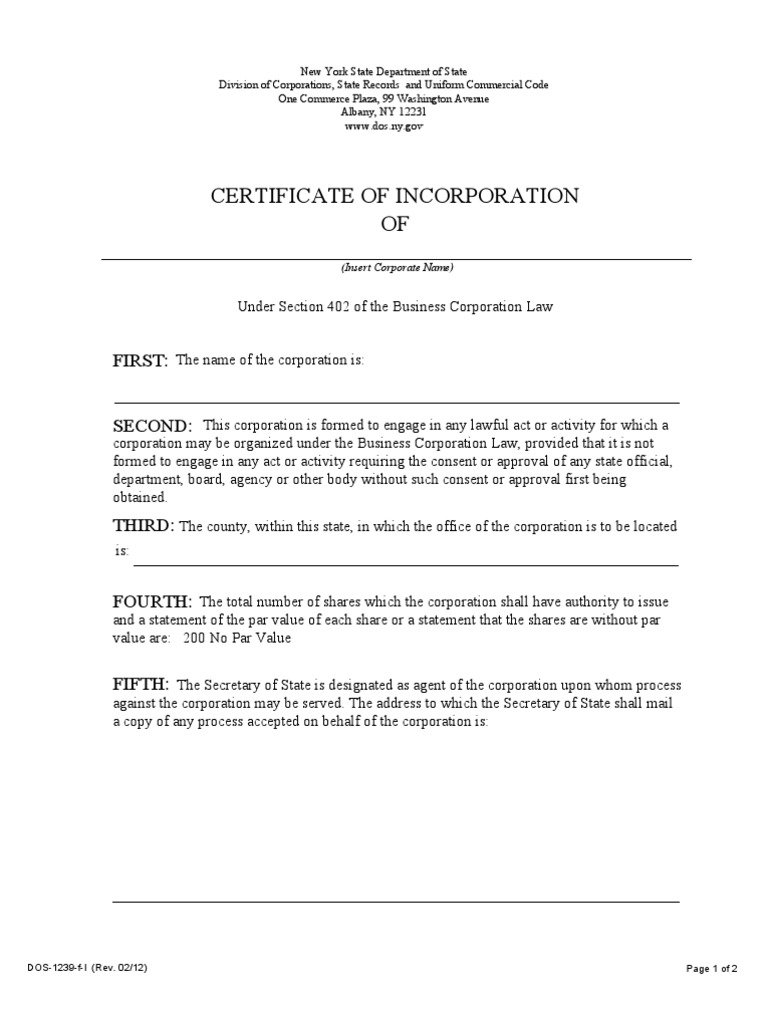

Where to File Your

Albany, NY 12231-0001

Important:

Start An Llc In New York

This guide will show you everything you need to know about starting an LLC in New York.

If youre looking for a reliable DIY guide for starting an LLC in New York, look no further.

Below youll find all the information you need to launch your business and handle any associated costs. Follow each step carefully and your LLC will be established and ready to hit the ground running.

That said, the process can be complex, with various filings and costs, so if at any point you need help, you can hire an LLC registration service.

Don’t Miss: What Airlines Fly To Cabo San Lucas From New York

File The Formation Documents With The State

This is where the LLC formation process kicks into high gear. Lets check back in with Fanny.

Shes reserved her unique business name, designated a registered agent, and shes ready to get her LLC off the ground. Its time for Fanny to take on the most important LLC document: the Articles of Organization. This filing creates a record for Fannys Florals and Design, LLC with the New York Department of State, giving it the authorization to commence business in the state.

You can file the Articles of Organization one of four ways: online, by mail, by fax, or in person. So, whether you like the ease of electronic documents or prefer to leave a paper trail, theres an option for you. But no matter which route you take, the filing costs $200.

Step : Follow New York Llc Publication Requirements

What is New York’s LLC publication requirement? Within 120 days of formation, LLCs must publish a notice of LLC formation in two newspapers for six successive weeks in the county of the LLC’s principal office or designated registered agent’s office.

Can I pick any newspapers I want? No. The newspapers must be approved by the local county clerk of the county you designate in your Articles of Organization. After publication, the printer or publisher of each newspaper will provide you with an affidavit of publication.

Where do I file my Certificate of Publication? You must submit your Certificate of Publication along with your affidavits of publication to the New York Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

Read our full New York publication requirements guide to learn more.

File a Certificate of Publication With the New York Division of Corporations, State Records and Uniform Commercial Code

Fee: $50 payable to the Department of State

New York City has fees upwards of $1,500$2,000 for newspaper publishing. One way to save on fees is to designate a registered agent service thats located outside of the city.

Recommended: ZenBusiness Registered Agent Service is located in Albany, where typical newspaper publishing fees range from $80$100.

FAQ: New York LLC Publication Requirements

What doe a notice of formation look like?

Format:

Example:

Recommended Reading: Where Is The Wax Museum In New York

One Choose A Pllc Name

Your PLLCs name is often the first impression you get to make on potential customers, and therefore it goes without saying that this is an important step. There are a few different aspects to take into consideration when selecting a name for your business:

Legalities

New York requires that a professional limited liability companys name end with the words “Professional Limited Liability Company” or “Limited Liability Company” or the abbreviation “P.L.L.C.,” “PLLC,” “L.L.C.,” or “LLC.” The name must accurately describe the profession for which the company was formed and may not be misleading. If the name references a specialized area of professional practice, evidence must be submitted substantiating the authority to use such specialty designation. In addition, the name of a deceased person may not be used unless 1) such person’s name was already part of the name at the time of such person’s death, or such person’s name was part of the name of an existing partnership or professional corporation and at least two-thirds of such partnership’s partners or corporation’s shareholders, as the case may be, become members of the PLLC.

Explanatory Naming

Another aspect to consider is including language that explains what your business does. For example, if youre a doctor, put the word physician or the initials MD in your PLLC name. Additionally, if your business has strong values like being environmentally friendly, you can indicate that by including the word green.