Business Permits And Licenses

Depending on your industry and geographical location, your business might need federal, state, and local permits/licenses to legally operate in New York. This is true whether you form an LLC or any other type of business structure.

Learn more about state and local licensing with our guide to getting a New York business license.

Step : Get A New York Llc Ein

What is an EIN? EIN stands for Employer Identification Number. EINs are a nine-digit number assigned by the Internal Revenue Service to help identify businesses for tax purposes. It is essentially a Social Security number for a business.

An EIN is sometimes referred to as a Federal Employer Identification Number or Federal Tax Identification Number .

Why do I need an EIN? An EIN is required to:

- Open a business bank account

- File and manage federal and state taxes

- Hire employees

What if I already have an EIN for my sole proprietorship? The IRS requires that sole proprietorships get a new EIN when converting to an LLC.

Where do I get an EIN? You can get an EIN for free from the IRS. Getting an EIN is an easy process that can be done online or by mail.

FOR INTERNATIONAL EIN APPLICANTS: You do not need a SSN to get an EIN. For more information, read our How to Get an EIN as a Foreign Person guide.

Provide An Official Address For Your Llc

Every LLC in New York must have a designated street address. This could be your companys office building, your home address or any physical address of your preference. The address can be outside the state of New York, but it cannot be a P.O. Box.You may also be able to use a virtual mailbox for your business address. Incfile can provide you with a New York virtual mailbox, where we’ll receive your mail and scan it for your online review. This can be especially desirable if you run a home-based business and don’t want your home address published as part of your businesss public record.

Don’t Miss: New York Speeding Ticket Pay Online

Sites Like Legalzoom Do Not Handle The New York Llc Publication Requirement

We get it extra cash can be hard to come by when youre trying to get your new business off the ground. It can be tempting to cut corners to save a few filing fee dollars, and unfortunately that leads too many entrepreneurs into the trap of relying on automated legal services like LegalZoom. While these services may offer unbeatable prices, we all know the old saying if something seems too good to be true, it probably is.

What happens all too often is that you end up spending the money you saved, and then some, trying to fix the problems these automated services create, when the mess could have been avoided by simply hiring an experienced attorney in the first place. One of the problems we see most often is when clients rely on LegalZoom to create their New York Limited Liability Company , only to realize later that theyve failed to comply with the New York LLC publication requirement.

Does A New York Llc Need An Ein

Youll need a federal tax ID if you want to hire employees, be taxed as an S corporation, or file certain federal excise returns. Just about every bank will require you to have an EIN for your New York LLC. To fill out local tax filings or permit and license applications, youll often need an EIN as well. While you can sometimes use your personal social security number instead, why put your personal information at risk when you dont have to?

Recommended Reading: Dmv Tvb Office

Open Your New York Llc Bank Account

Put on your lucky shoes. Its time to open a business account for your LLC. Youll need to bring the bank the following:

- your New York LLCs EIN

- a copy of your Articles of Organization

- a copy of your Operating Agreement

- your business license

You need an LLC bank account to keep your business finances separate from your personal finances.

One of the biggest upsides of an LLC is that it creates a legal separation between you and your business. This separation is valuable, especially when it comes to liability.

Letting your personal and business finances intermingle erodes that separation. To keep it intact, you need to open and use an LLC bank account.

Yes. If your LLC intends to accept credit card payments, youll need a bank account for depositing funds after the payments are cleared and settled. This is a basic requirement of any payment processor, and youll need the bank account in advance of applying for your merchant account.

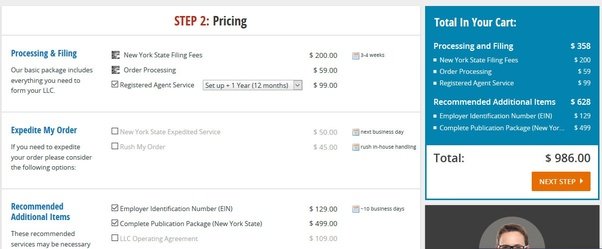

Fast Facts: Your Budget And Timeline

Here is an overview of the total paperwork, cost, and time it takes to form an LLC in New York. Be sure to read the final step in this guide – “Ongoing Filings” – to understand your ongoing costs to maintain a compliant New York LLC.

Paperwork

- Form DOS-1336: Articles of Organization

- Publishing affidavits

- Form DOS-1708-f-l: Certificate of Publication

- Operating Agreement

- IRS Form SS-4: Obtain an EIN

Cost

- Formation: $200 + optional $25-150 expedite fee

- Publisher fees: ~$200, fees vary

- Certificate of Publication: $50

Time

- Formation: ~14 business days. Within 24 hours for $25 expedite fee. On the same day for $75 expedite fee. Within 2 hours of receipt for $150 expedite fee.

Read Also: Change Llc Name Ny

How To Make A Website

Check out our how to build a website guide to learn how creating a website isnt as difficult as it might seem. With the right tools, a good guide, and a bit of patience, you can learn how to make a website for your business in no time.

Recommended: Read our review to find the best website builder for small business.

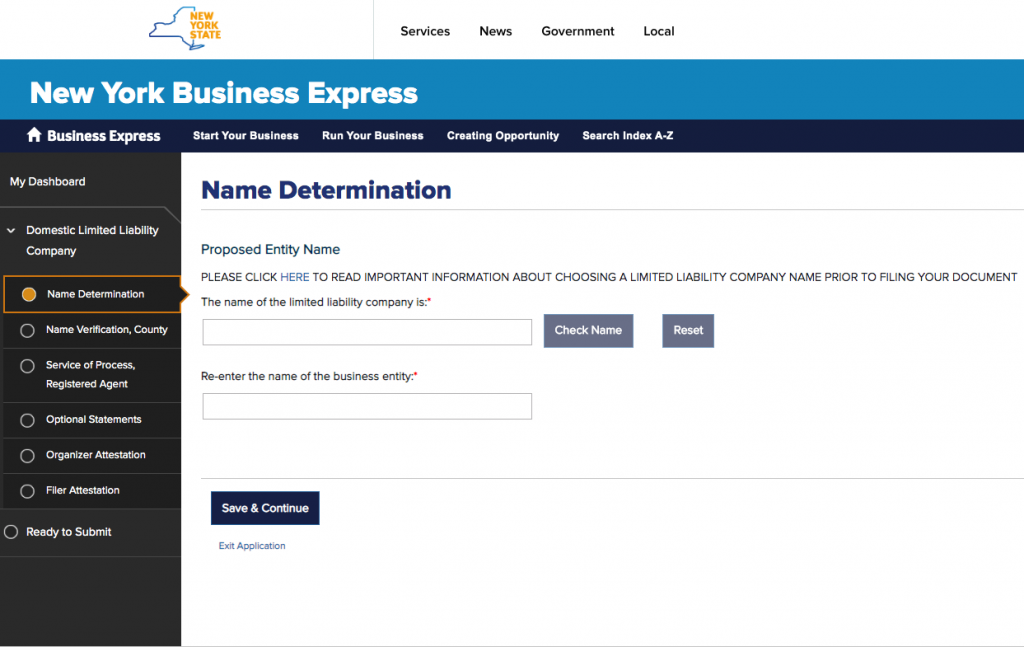

Choose A Name For Your Llc

In New York, your LLC’s name must contain the words “Limited Liability Company” or the abbreviations “LLC,” or “L.L.C.”

Your LLC’s name must be distinguishable from the names of other business entities already on file with the New York Secretary of State. Names may be checked for availability at the New York Department of State Division of Corporations business name database.

You may reserve a name for 60 days by filing an Application for Reservation of of Name with the New York Department of State Division of Corporations. The application must be filed by mail. The filing fee is $20.

Using an Assumed NameYou don’t have to use your LLC’s official legal name registered in your Articles of Organization when you do business out in the real world. Instead, you can use an assumed name, also called a fictitious buisness name, “DBA” , or trade name. To do so in New York, you must register your assumed name with the New York Department of State. You register by filing by postal mail a Certificate of Assumed Name. The filing fee is $25. For more on registering business names, see Nolo’s article How to Register a Business Name.

Also Check: New York State Tickets Pay Online

New Yorks Llc Publication Requirement

A quick Google search on how to form an LLC in New York will tell you that the state has a very straightforward publication requirement and filing fee structure. Many entrepreneurs know about it going in because, while it is mandatory, its also one of the most widely unpopular New York LLC laws.

The publication requirement is laid out in section 206 of the NY Limited Liability Company Law, which dictates strict formatting and content guidelines, but essentially the law mandates that any new LLC publish an announcement of its formation in two different newspapers, one daily and one weekly, for six weeks, within 120 days of forming. What isnt obvious from the face of the law is the cost involved for LLCs based in New York City, the publication bill can add up to nearly $2,000 in some cases.

Where the problem comes in with automated websites like LegalZoom is that clients often mistakenly believe that the publication costs are included in the quoted LLC formation package, when in reality theyre not. Youre paying them simply for the paperwork that you could file yourself online with the Department of State. When you incorporate through LegalZoom, the publication requirement still falls on you.

Meet The New York Llc Publication Requirement

Once youve successfully filed your Articles of Organization, New York LLCs are required to publish a copy of their Articles of Organization or a notice about the LLCs formation within 120 days of its effective date. The notices must be published once each week for six successive weeks in two separate newspapers. The first newspaper must be a weekly publication, while the second has to be a daily newspaper. Newspaper designations are determined by the county clerk. By law, the notice must include:

- The name of the LLC

- The purpose of your business

- The filing date of the Articles of Organization with the state

- The county in which the business office of the LLC is located

- The street address of the principal business location, if any

- A statement that the Secretary of State has been designated as the registered agent

- An address where the Secretary of State can receive service of process

- The name and address of an additional registered agent, if any, who can receive service of process for the LLC instead of the Secretary of State

- A specific date of dissolution, if any

The publisher of each newspaper will provide an Affidavit of Publication once the notice has been published. Youll send the affidavits to the New York Division of Corporations with a completed New York Certificate of Publication form and a check to pay for the filing fee.

New York Small Business Services

Recommended Reading: Nys Parking Tickets Pay Online

Choose A Unique Business Name And Complete A New York Business Search

You’ll need a distinctive and original name for your New York LLC thats not being used by any other business in the state. Our Business Name Generator can help you brainstorm names if you’re having trouble coming up with a good one. First, read up on the state’s naming rules in the New York Business Names section of this guide.Once you’ve chosen a name, make sure it’s available in the state by using our free tool to do a New York entity search. You can also perform a search on the NYS Department of State website.

Other Forms You May Have To File

In addition to filing the main return, you may be required to complete one or more schedules that are used to report certain transactions. Schedules A, B, CW, FR, H, N, P, T, and W must be filed with your return under certain conditions, as described below:

See our Sales Tax Web File for more information.

You May Like: New York Life Insurance Cancellation

How To Form An Llc In Ny Yourself

Are you ready to make it official? To get your LLC on the books, you need to file Articles of Organization with the New York Department of State. If youve already registered in another state, you dont need to form another LLC. Instead, youll need to submit a Certificate of Authority for a New York foreign LLC. You can only file by paper, and you must attach a Certificate of Good Standing, Certificate of Existence, or Certificate of Status from your LLCs home state. The filing fee is $250.

To start a New York LLC, your first step is to file Articles of Organization.

Your Sales And Use Tax Return

Your sales and use tax return is a summary of your business activity, including:

- gross sales

- purchases or uses subject to tax

- sales tax, use tax, and any special taxes you collected or were required to collect and

- current information regarding your business.

How frequently you must file sales tax returns depends on the amount of your taxable sales , or the amount of tax due. Even if your business did not make any taxable sales or purchases during the reporting period, you must file your sales and use tax return by the due date.

The chart below summarizes which sales tax form to file. The forms and schedules are further explained on the following pages of this bulletin and in the links provided.

Quarterly Filers

| Monthly |

Read Also: How Much Does A Paralegal Make New York

Learn About Annual Report And Tax Filing Requirements For New York Llcs

By David M. Steingold, Contributing Author

If you want to start and run a New York limited liability company , you’ll need to prepare and file various documents with the state. This article covers the most important ongoing reporting and state tax filing requirements for New York LLCs.

Annual Report

Unlike most other states, New York does not require LLCs to file an annual report. However, New York does require many LLCs to pay an annual fee .

Requirements For The Articles Of Organization

The document required to form an LLC in New York is called the Articles of Organization. The information required in the formation document varies by state. New York’s requirements include:

- Registered agent.Listing the name and address of a registered agent is optional in New York. LLCs must, however, include the address to which legal documents, such as Service of Process, should be sent. The registered agent or person at the Service of Process address must be available during normal business hours.

Recommended Reading: Where Is The Wax Museum In New York

Write Your New York Llc Operating Agreement

An LLC operating agreement is just what it sounds like: an agreement on how the LLC is going to operate. You dont have to file it with the NY Department of State, but you do need to have one.

A good operating agreement will include basic info about your LLC, but it should also get into the nitty gritty. How much money are members contributing? How will profits and losses be allocated? What if a member wants out? And how will you handle it if God forbid things go south and you need to dissolve?

Hashing it out over pizza is great, but you need to get it in writing.

Three reasons:

1.) Its the law.

2.) Itll be helpful for solving problems down the road.

3.) The bank will want to see it when you open a business account.

Yes, even a single-member LLC needs an operating agreement. It might be different than a multi-member LLC operating agreement, but you should still have one to show the bank.

Yes. When you hire us to form your New York LLC, youll get an operating agreement template that is specific to your business structure.

Obtain Ny Business Permits

Every state and locality has different requirements for operating businesses. In New York, over 30 professions require a license from the state. Examples include barbers, security guards, healthcare professionals, home inspectors and real estate brokers. If your business is in a highly regulated industry, such as food service or childcare, youll likely need a special permit to operate. New York States Business Express Wizard can help identify the licensing regulations for your business. You can also contact your city, borough or county licensing agency to learn more.

Also Check: Where Is The Wax Museum In New York

Apply For Business Licenses And Permits

Depending on what your business does and where it is located, there will likely be various business licenses and permits needed before starting your business. Some common registrations include:

- Business License Some cities require businesses to obtain licensing before they can start.

- Professional License Certain services such as barbershops, accountants, salons, and others must be licensed.

- Sales Tax Certificate of Authority To sell products and certain services in New York State, registration with the New York Department of Taxation and Finance will be necessary.

Related: What Business Licenses are Needed in New York?

Assign A York Registered Agent

Someone who receives official correspondence and is responsible for filing reports with the New York Secretary of State is known as a Registered Agent. If you have an LLC, New York requires you to have a Registered Agent. You’ll appoint your Registered Agent when you file the Articles of Organization to create your business.You can fill this position, assign another manager in your business or use a Registered Agent service. If your New York Registered Agent is a person, they must have a physical street address in New York and must be present during business hours to receive important documents on behalf of your company.All of Incfiles business formation packages include Registered Agent service. Its free for the first year and just $119 per year after that. You’ll also have access to a digital dashboard to view any document we’ve received on your behalf.

Recommended Reading: How To Win The New York Lottery

Forming A Limited Liability Company

New York recognizes many business forms including the limited liability company , corporation, limited partnership, sole proprietorship, general partnership and other less familiar forms. Each has its own advantages and disadvantages. For any particular venture, personal and business circumstances will dictate the business form of choice. The Department of State cannot offer advice about the choice of business form and strongly recommends consulting with legal and financial advisors before making the choice. Forming an LLC should only be done after careful analysis. The following information has been developed to answer your questions regarding formation of an LLC and to assist in the filing of the Articles of Organization. Department of State staff cannot provide legal advice, however, they are available to assist in answering questions about filing LLC documents. Please contact the Department of State, Division of Corporations, State Records and Uniform Commercial Code, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231 or a representative at 473-2492 or email us with any questions you may have.

Next Section