New York State Estate Taxes

The state of New York levies an estate tax on the estates of deceased taxpayers.

For the 2019 tax year, the state has a basic exclusion amount of $5.74 million. If youre a resident of New York and your estate and includable gifts are worth less than this amount, the state wont assess any estate taxes. Above that amount, though, the marginal tax rate is based on the amount above the exclusion threshold. Here are the 2018 rates.

| Tax rate |

|---|

| $10,100,001 and more |

New York City Sales Tax Calculator

Invoicing clients or selling to customers and need to know how much sales tax to charge? Use our simple sales tax calculator to work out how much sales tax you should charge your clients. Input the amount and the sales tax rate, select whether to include or exclude sales tax, and the calculator will do the rest. If you dont know the rate, download the free lookup tool on this page to find the right combined NYC rate.

How Much Is New York Sales Tax Everything You Need To Know

Sales tax rates can vary in the Empire State. Taxes 101

Although the city of New York has some of the highest sales taxes in the country, less than half of that is attributable to the states share of the pie. On the whole, the combined sales and use tax for the state of New York is just 4 percent, but once local and city governments add in their own rates, the average rate is pushed all the way up to almost 8.5 percent, putting New York among the 10 highest average sales tax rates in the country.

The New York City sales tax rate is much higher at 8.875 percent, including the state sales tax rate, a city sales tax rate of 4.5 percent and the Metropolitan Commuter Transportation District surcharge of 0.375 percent. But there are ways to get around sales taxes in New York City. Clothing and footwear purchases under $110 are exempt from city and state taxes, and if youre visiting the city but dont live there, you can even get a 10 percent discount to counterbalance the sales tax at certain stores by stopping at the visitors booth.

| 7% to 8.875% |

Recommended Reading: Players On The Brooklyn Nets

Have You Heard About The Homeowner Tax Rebate Credit

The homeowner tax rebate credit is a one-year program providing direct property tax relief to eligible homeowners in 2022.

If you’re a homeowner who qualifies, we’ll automatically send you a check for the amount of the credit. Your amount will depend on where your home is located, how much your income is, and whether you receive Enhanced or Basic STAR.

Imposed Sales Tax On Vapor Products

Effective December 1, 2019, a new 20% supplemental sales tax will apply to retail sales of vapor products in New York, which should be collected by a vapor products dealer. Any business that intends to sell vapor products must be registered as a vapor products dealer before making sales of vapor products. The Tax Department is developing an online registration process. In addition, if a taxpayer has debit blocks on their bank account, even if the taxpayer has already authorized sales tax payments to the Tax Department, the taxpayer must communicate with their bank to authorize their vapor products registration payment.

You May Like: How To Calculate Pay After Taxes

Don’t Miss: How To Establish An Llc In New York

New York State Sales Taxes

Whether youre a New York resident or a visitor, youll pay a sales-and-use tax on goods purchased in the state. The state charges a flat 4% rate, but your actual rate can vary based on any local sales tax imposed by the city, county or school district in which the sale occurs. For example, the sales tax rate for New York City is 8.875%, while its 7.5% in Ontario County.

Also, theres an additional sales tax of 0.375% on sales made within the Metropolitan Commuter Transportation District.

Check the states website for a list of sales-and-use tax rates by jurisdiction. Or you can use the states online tool to look up the rate by address.

New York State Property Taxes

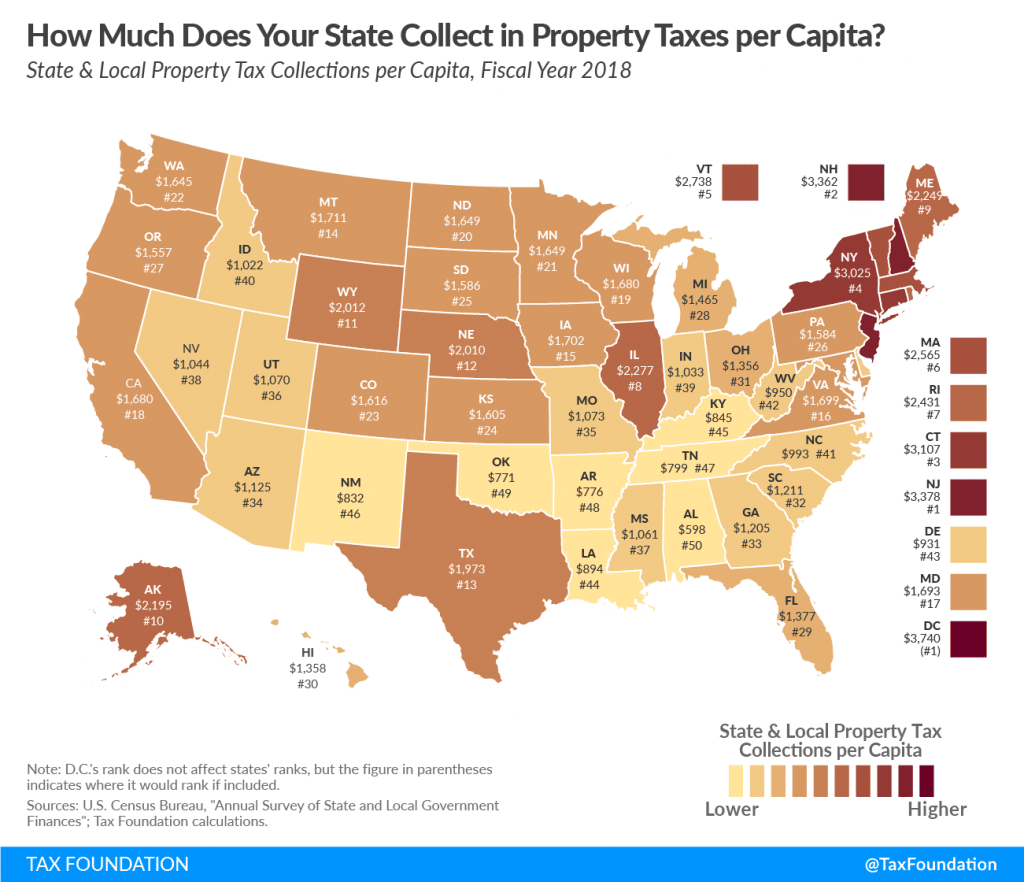

In the Empire State, property taxes are assessed by school district, municipality, county or special district. New York does not have a state-level property tax.

In general, though, New York property taxes are 96% higher than the national median. You can use a map provided by the state to check the three-year average for property taxes in your county, or check with your local assessor to get the current rate.

To help reduce the impact of property taxes on your finances, several property tax exemptions are available in areas throughout the state. But you should check with your local tax assessor to find out which ones are available where you live.

Also, you may be able to qualify for a property tax relief credit on your New York state return. The tax credit can kick in if you

- Live in a school district thats in compliance with the states property tax cap

- Youre receiving either the Basic or Enhanced STAR exemption or credit

- Have an income of $275,000 or less

- Have paid school property taxes for the tax year

If youre receiving the Basic STAR exemption or credit, the amount of the property tax relief credit can range from 10.5% to 85% of your STAR savings, depending on your income level. If youre receiving the Enhanced STAR exemption or credit, the credit is 34% of your Enhanced STAR savings, regardless of your income level.

Also Check: Concerned Dental Care Of The Bronx

New York Appeals Court Upholds Goldman Sachs Capital Gains Tax Treatment

In 2008, Goldman Sachs investment company Petershill US IM Master Fund LP purchased 9.9% of Claren Road Asset Management LLC . Goldmans Master Fund had no activity or physical presence in New York City but Claren was engaged in business activities in the city. Since Goldman owned a certain percentage of the investment, when Goldman sold their ownership of Claren in 2010 it is expected that Goldman pays capital gains tax on the profit, however, Goldman Sachs did not. Due to Goldman Sachs not reporting the capital gain on their 2010 New York City General Corporation tax return, it led to a New York audit in 2014 and eventually a $4 million assessment.

Goldman Sachs protested the assessment in 2018 when an administrative law judge had sided with the city. Following this, in 2022, Goldman Sachs had gone to the appellate court where they also sided with the city concluding, while the investment teams business acumen may have influenced the timing of petitioners sale of its partnership interest, it was rational for the Tribunal to conclude that the capital gain was attributable to the value of Claren on the date it was sold. Since Claren had business activities in New York, the courts found it to be reasonable that the nexus established by Claren allows them to tax on profits of the company.

How Much Are Ny Documentation Fees

Dealerships often charge buyers something known as documentation or doc fees in addition to taxes. These fees account for the costs incurred by the dealership when preparing and filing the necessary documentation for the purchase of a vehicle. The average documentation fee is $75 in the state of New York.

Recommended Reading: Do The New York Yankees Play Tonight

Overview Of New York Taxes

New York state has a progressive income tax system with rates ranging from 4% to 10.9% depending on taxpayers income level and filing status. Living in New York City adds more of a strain on your paycheck than living in the rest of the state, as the Big Apple imposes its own local income tax on top of the state one. New York Citys income tax system is also progressive and rates range from 3.078% to 3.876%.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

New York State Extends Income Tax Filing Deadline

New York states income tax filing deadline is being moved to July 15 to comply with the federal governments decision to push back the traditional filing date due to the coronavirus outbreak.

Disclaimer: Please note this is the information that is readily available at this time, it is subject to change so please consult your Withum tax advisor.

Don’t Miss: How Much Is A 3 Bedroom Apartment In New York

Technical Memorandum Issued By The Department Of Taxation And Finance

Pursuant to the enactment of the 2019-2020 Budget Bill, the Department of Taxation and Finance issued a technical memorandum discussing the sales tax collection requirements for marketplace providers. The memorandum reflects an increase in the sales threshold amount from $300,000 to $500,000, which is retroactive to June 1, 2019. Taxpayers affected by this change must register with the Department at least 20 days before beginning business in the state. This memorandum supersedes TSB-M-19S issued on May 31, 2019. S, 17/10/2019.)

What Is My Tax Account Balance

Your tax account balance is the total amount you paid throughout the year toward the tax on the income you made. Your balance includes:

- any estimated tax payments made using software, from your online services account, or with Form IT-2105, Estimated Tax Payment Voucher for Individuals,

- any overpayment from last years return that you asked us to apply to the following year, and

- if you filed an extension, any payment made using software, from your online services account, or with Form IT-370, Application for Automatic Six-Month Extension of Time to File for Individuals.

Note: If your employer withheld taxes from your paycheck, that amount is shown on your pay stub and the W-2 you receive at the end of the year. The amount is not included in your tax account balance as shown on your Account Summary homepage.

You May Like: When Does New York Vote In The Primary

New York City Musical And Theatrical Production Tax Credit For Corporate And Personal Income Tax

On July 23, 2021, Governor Andrew Cuomo announced the New York City Musical and Theatrical production tax credit which is designed to revitalize the theater district after its closure due to the Covid-19 pandemic by offering up to $100 million in tax credits. The two-year program for approved companies will allow tax credits for up to 25% of qualified production expenditures such as sets, costumes, sound, lighting, salaries, fees, advertising costs, etc. First-year program applicants can receive up to $3 million per production and second-year applicants up to $1.5 million. Companies can receive credits for tax years beginning on or after January 1, 2021, but before January 1, 2024. Applications must be submitted by December 31, 2022, and final applications no later than 90 days after the production closes or 90 days following the program end date of March 31, 2023, whichever comes first.

New York City Income Tax

New York City has a separate city income tax that residents must pay in addition to the state income tax. The city income tax rates vary from year to year. The tax rate you’ll pay depends on your income level and filing status. It’s based on your New York State taxable income. There are no city-specific deductions. But some tax credits specifically offset the New York City income tax.

If you work for the city but don’t live there, you must still pay an amount equal to the tax you would have owed if you had lived there. This rule applies to anyone who began employment after January 4, 1973.

Read Also: How To Dress Like A New York Woman

New York Proposes Three New Tax Rates / Tax Brackets Which Would Raise Highest Individual Rate

Revised budget proposals from each of the New York State Assembly and the New York State Senate would include three additional personal income tax brackets for individuals with income over $2.155 million. Each respective proposal includes the same three new tax rates9.85 percent, 10.85 percent and 11.85 percentbut imposes such rates at differing income thresholds. The current maximum individual tax rate in New York is 8.82 percent. The new brackets and rates would be effective for the 2021 tax year.

Respond To A Department Notice

If you receive a bill or notice, respond online. It’s the easiest, fastest way. We’ll walk you through the process.

Note: If your refund status says we sent you a letter requesting additional information, see Respond to a letter for more information and to review our checklists of acceptable proof.

You May Like: Can I Go To College For Free In New York

Are Military Benefits Taxed In New York

New York does not tax military pensions. Active-duty pay is taxed like normal income if you are a resident of the state. If you werent a full-time New Yorker when you entered the military but were assigned duty in the state, youre considered a nonresident. So your military pay is tax exempt in New York.Military spouses may be eligible for certain tax benefits under the federal Servicemembers Civil Relief Act, including income tax exemption and an option to use the same state of residency as the service member.

How To Use The New York State Tax Calculator

Before we start, we need a set of information, including your filing status, as indicated in the New York income tax rate table we shared above. Then:

Suppose you are a single filer with an AGI of $43,000 living in New York City and want to know your 2022 total income tax. Let’s start with your FICA, which will be: $ \small \$43,\!000 \times 7.65 \% $43,000×7.65%. The result is $3,290.

Now, it is time for your federal income tax. After considering the 2022 deductions we showed above, your taxable income is $30,050 . Consequently, considering the federal tax progressive income, you pay $1,028 plus 12% of the amount over $10,275, which equals a total federal tax of $3,401.

Let’s explain that a bit more: try the New York state tax calculator and in the Results section press Display and select: Add federal income tax brackets. You will see a table like the one below:

In that table, you will notice that you reach the 12% bracket, but your income is only partially taxed at that percentage. It is the 11.32% effective tax rate at which your income is evaluated.

We continue calculating the New York state income tax. Here you could go ahead and check the other display option: add state income tax brackets.

To learn how to calculate it, follow the next steps:

Subtract the deductions and exemptions. This means we have an AGI of $ \small \$43,\!000 – \$8,000 $43,000$8,000, according to the tables above. Consequently, our taxable income is $35,000.

Recommended Reading: How Do I Get Free Health Insurance In New York

New York Sales Tax Rates By City

The state sales tax rate in New York is 4.000%. With local taxes, the total sales tax rate is between 4.000% and 8.875%.

New York has recent rate changes .

Select the New York city from the list of popular cities below to see its current sales tax rate.

Sales tax data for New York was collected from here. Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

Recommended Reading: When Are Taxes Due 2021

Corporation Tax Changes In 2019 Budget

This summary highlights the corporation tax changes that were part of the 2019- 2020 New York State budget. Most notably, several tax law provisions were amended, including the contributions to the capital of a corporation, entire net income for stock life insurance companies, and unrelated business taxable income. Additionally, electronic filing and payment mandates have been extended through December 31, 2024, and the tax shelter penalty and reporting requirements have been extended through July 1, 2024.

Recommended Reading: How To Elope In New York State

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

The Nyc Household Credit

You might qualify for the New York City Household Credit if you canât be claimed as a dependent on another taxpayerâs federal income tax return. This credit is available to resident and part-year residents of New York City.

The amount of the credit is determined by your income and filing status. Credit amounts range from $15 to $30, with an additional $10 to $30 for each additional exemption claimed on your federal return.

Don’t Miss: Is The New Yorker And New York Times The Same

How To Claim And Report Ny Gambling Winnings For Taxes

Winnings that surpass a specific threshold will automatically trigger notification to the IRS. The W-2G Form is filled out by the payor and indicates the amount won and how much tax, if any, was withheld from the payout. Bettors should expect to receive a W-2G Form if gambling winnings exceeded any of these minimum thresholds during the previous calendar year:

- $5,000 or more from poker tournaments .

- $1,200 or more from slot machines or bingo.

- $600 or more from sports betting or any pari-mutuel event , provided the payout was at least 300 times the wager amount.

- $600 or more from daily fantasy sports.

If the winnings were non-cash prizes, such as a vehicle or boat, the fair market value of each prize should be reported.

New Yorkers with winnings in New Jersey or other states may be required to file a non-resident return if gambling winnings exceeded $5,000. Even if that threshold wasnt met, include the winnings on your federal and NY income tax returns. Report your total gambling winnings as Other Income on Form 1040, Schedule 1, Line 8.

Dont Miss: How Much Does H& r Block Charge To Do Taxes