How Much Is Car Insurance For A 25

Hitting 25 years of age helps bring down the cost of auto insurance. The annual average nationwide for a 25-year-old is $737. That is for a standard liability policy that includes $50,000 for bodily injury per person, $100,000 max for all injuries and $50,000 of property damage . A bare-bones state minimum policy cost is a bit less at $657. You need a full-coverage policy for sure if your car is leased or financed has an average annual rate of $1,957.

Faqs About New York Car Insurance

While New York doesnt offer a special insurance program for low-income drivers, there are a few rules that keep car insurance companies from discriminating against low-income drivers in New York. Car insurance companies in New York are not allowed to factor in your occupation or level of education when calculating your car insurance premium. The idea is to make sure that insurance costs are based on driving performance and history rather than income or socio-economic factors.

It is against the law in New York to deny anyone with a valid drivers license the opportunity to apply for car insurance, regardless of the drivers citizenship, immigration status, or legal status. The New York Drivers License Access and Privacy Act commonly known as the Green Light Law also protects drivers from being denied insurance coverage based on race, creed, skin color, national origin, disability, sex, marital status, or advanced age.

New York drivers with a DUI conviction can still be insured. However, they can expect their car insurance rates to increase by 85 percent on average. DUIs and other major traffic violations stay on your New York driving record for as long as ten years.

The Cheapest Car Insurance In New York For 2022

MoneyGeek gathered quotes from top insurers in New York to identify the best and cheapest car insurance in New York. Depending on the company you choose, rates can vary by over $5,000 a year, with GEICO being the cheapest option.

Compare Auto Insurance Rates

Ensure you’re getting the best rate for your auto insurance. Compare quotes from the top insurance companies.

GEICO is the cheapest car insurance option for the average New York driver. However, since your age, driving history and credit score also affect premiums, the cheapest option for you depends on your profile.

For example, Progressive and State Farm have the lowest annual premiums for drivers with a DUI, while Erie is the cheapest insurer for seniors. For military members and veterans, USAA is the cheapest car insurance provider in New York.

For those looking for an even more local solution, we also broke down the cheapest companies by city, as well as the best car insurance companies in New York for those looking to balance quality service and cost.

To find out how MoneyGeek calculated the cheapest car insurance in New York, read our methodology.

You May Like: What Airlines Fly To Cabo San Lucas Mexico

Cheapest Full Coverage Car Insurance In New York For 20

Drivers in New York with clean driving records may want to consider the following companies, which had the lowest average rates:

Main Street America: $1,983 per year, or about $165 per month.

Progressive: $2,505 per year, or about $209 per month.

Erie: $2,519 per year, or about $210 per month.

Geico: $3,033 per year, or about $253 per month.

Allstate: $3,955 per year, or about $330 per month.

Which Cities Have Cheap Car Insurance In Ny

The cheapest cities for car insurance in the state of New York include Elmira, Binghampton, Watertown, Jamestown, and Rochester. Other areas that rank favorably include Schenectady, Rome, Troy and Albany.

The average cost of car insurance in these areas ranges from around $1,000 per year to just under $1,300 a year, which is about $84 to $108 per month on average.

Your location is one of the most important factors that determines the price you pay for car insurance in New York, but its not the only one. The type of vehicle you drive, your driving record, your age and gender, and your financial responsibility all factor into the final policy price.

The next section details average car insurance quotes in NY by vehicle segment. This will give you a good idea of the types of vehicles that have the overall cheapest insurance rates. Following the insurance rates by segment section, we will show you the cars, pickup trucks, and SUVs that are cheapest to insure in New York.

You May Like: Frontier Poetry Submissions

Cheapest Luxury Car Insurance In New York

Luxury cars like the Acura ILX, Alfa Romeo Giulia, and Audi S3 have average car insurance rates ranging from $1,490 for the Acura ILX up to $1,882 for the Audi S3.

The luxury car with the cheapest car insurance rates in New York is the Acura ILX at $1,490 per year, or about $124 per month. The Acura ILX costs $1,314 less per year than the most expensive midsize luxury car to insure, the BMW M5.

The table below shows the 20 cheapest luxury cars to insure in New York. Vehicle size is noted in the table along with annual and monthly average insurance cost.

| Make/Model |

|---|

Get Rates in Your AreaWhy is this important?

Table Data Details:

Many larger luxury cars like the Infiniti Q60, BMW 740i, Mercedes-Benz S450, and Porsche Panamera are not show in the table due to the higher cost of car insurance for these models. Complete rankings for all compact, midsize, and large luxury cars can be found on our luxury car insurance comparisons page.

Cheapest Car Insurance In New York For Drivers With An At

In New York, having an at-fault accident on your record will increase the cost of your car insurance significantly. On average, a driver with an at-fault accident will pay $5,003 per year for car insurance.

The most affordable car insurance companies in New York for drivers with at-fault accidents are:

- Erie: $2,695 per year

- Allstate: $2,795 per year

USAA is the cheapest option in New York if you have an at-fault accident, but it is only available to members of the military and their families.

Cheapest Car Insurance With an At-Fault Accident

- Company

Show more

You May Like: Glacier Tax Prep Nyu

Cheapest Car Insurance Quotes For Drivers With Poor Credit: Geico

Geico offers the best quotes for drivers with poor credit, at $2,719 per year. Geico’s full coverage rates for these drivers are $1,622 cheaper than average and only 22% more expensive than average for drivers with average credit.

Drivers with poor credit in New York can pay more than double the rates of drivers with good credit.

| Company |

|---|

USAA is only available to current and former military members and their families.

How Much Does Car Insurance Cost In New York City

Average auto insurance cost in New York City is $2,878 per year, or about $240 per month for a policy that provides full coverage. It costs 85.6% more to insure the average vehicle in NYC than the U.S. average rate of $1,551.

In the state of New York, the average price for car insurance is $1,620 per year, so the average cost in New York City is $1,258 more per year. When rates are compared to other cities in New York, the cost to insure a car in New York City is $1,234 per year more than in Buffalo, $598 per year more expensive than in Rochester, and $1,500 per year more expensive than in Syracuse.

The chart below shows average car insurance cost in New York, NY for all 2022 models. Rates are averaged for all NYC Zip Codes and shown not only by driver age, but also by physical damage deductibles.

| $2,976 | $248 |

In the chart above, the cost of car insurance in New York ranges from $2,178 per year for a 60-year-old driver with a policy with high deductibles to $6,614 per year for a 20-year-old driver with a low deductible. From a monthly standpoint, the average cost in the prior chart ranges from $182 to $551 per month.

NYC car insurance rates are different for every driver and can also be very different depending on the company. Since there can be such a large difference in rates, it stresses the need for accurate free auto insurance quotes when shopping online for more affordable car insurance.

Average car insurance rates in New York for drivers age 16 to 60

| $7,792 | $7,224 |

Don’t Miss: How Much Are Tolls From Virginia To New York

How Much Car Insurance Coverage Do I Need In New York

If your car is registered with the NY Department of Motor Vehicles, your insurance must meet the following New York liability coverage minimums:

- Bodily injury liability coverage: $25,000 per person and $50,000 per accident

- Property damage liability coverage: $10,000 per accident

- Uninsured/underinsured bodily injury coverage: $25,000 per person and $50,000 per accident

- Personal injury protection: $50,000

While these are the minimum coverages New York requires you to have, everyone’s insurance needs are different. Visit our Coverage Calculator to get a personalized recommendation.

In New York City Which Vehicles Are Cheapest To Insure

The vehicles with the lowest cost average auto insurance prices in New York City tend to be crossovers and small SUVs like the Mazda CX-5, Nissan Kicks, Buick Encore, and Nissan Rogue Sport.

Average car insurance rates for those crossover SUVs cost $2,398 or less per year to have full coverage.

Other models that rank towards the top in our overall cost comparison are the Subaru Impreza, Subaru Ascent, Toyota Corolla Cross, and Ford Maverick.

Average auto insurance rates are a few dollars per month higher for those models than the compact SUVs that rank near the top, but they still have average rates of $208 or less per month.

The following table details the cheapest vehicles to insure in NYC, ordered starting with the cheapest.

| Rank |

|---|

Get Rates in Your AreaWhy is this important?

Table Data Details:

A list of 30 vehicle models with cheap New York City car insurance is great if you just want the lowest rates. But considering we track over 700 vehicles, there are a lot of rates not being shown. So lets rethink this and list the models with the lowest rates in a format that is more usable, by automotive segment.

Also Check: Tolls To New York City

How Much Is Temporary Car Insurance: Average Temporary Car Insurance Cost Per Day

Temporary car insurance or short term car insurance policies are mostly sold by car rental services to cover rented vehicles for short period of times, be it one day car insurance, five days, one week or one month. Temporary car insurance covers the damages done to the rented vehicles at the time the renter was using it. Temporary car insurance cost can get quite expensive, up to $25 a day. This is why we strongly suggest you to choose non owner policy over temporary car insurance, which will allow you to save a lot of money, while keeping you covered.

What Is The Average Cost Of Car Insurance In New York

The average cost of car insurance in New York is $1,692 per year according to thezebra.com.2 Thats 13.7% higher than the national average. Of course, your auto insurance cost will depend on many different factors including your age, where you live, and your driving history.

Some people get the bare minimum coverage, while others prefer the comfort and security of more protection. Liberty Mutual customizes your New York auto insurance, so you only pay for what you need.

Recommended Reading: Ship Alcohol To New York

Cheapest Car Insurance Quotes After A Speeding Ticket: Progressive

Drivers in New York who have been caught speeding could find the cheapest full coverage car insurance with Progressive. Compared to the average cost for people with a speeding ticket, Progressive’s rates are $1,056 cheaper per year.

Getting a speeding ticket can raise your rates by about half as much as being in an accident: A ticket increases rates by 15% on average, while a typical increase after an at-fault crash is 38%.

| Company |

|---|

*USAA is only available to current and former military members and their families.

The Average Cost Of Car Insurance In New York

According to our team’s expert analysis, the average car insurance rate in New York for a driver age 30 is $177 per month or $2070 per year for full coverage. That’s an extra $300 per year over the national average . New York drivers will pay $81 per month for liability limits of 50/100/50. The average monthly car insurance premium for state-mandated coverage is $78, or $936 annually.

Use our average car insurance rates tool to compare rates when shopping for car insurance. Enter your ZIP code to find out the typical premium in your area. You’ll also see the highest and lowest rates from the six main car insurance companies surveyed to get a sense of what the most cost-effective option is in your location.

Read Also: Tolls From Dc To Nyc

Average Car Insurance In Ontario For A New Driver

New drivers, especially if you are under 25 years of age, will pay some of the highest insurance premiums in Ontario. Drivers with a G1 drivers license will pay more than a driver with a G2 or a G drivers license. As you progress through the licensing system, your rates will decrease.

Expect the average car insurance in Ontario for a new driver to be considerably more than the provincial average.

How To Get The Best Car Insurance Yearly Cost

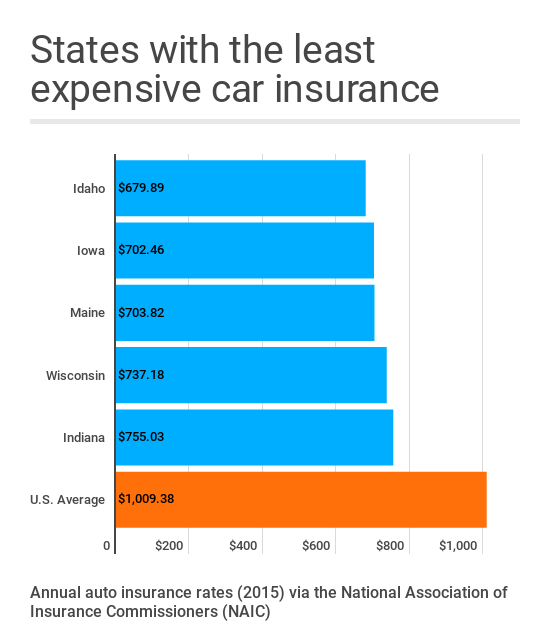

Check out the infographic to find more interesting facts on car insurance prices. It will help prepare you when you start shopping for the best auto insurance.

However, the cheapest coverage isnt always the best. Other factors, like the quality of customer service, the companys financial strength, and the number of optional coverages and discounts, all determine auto insurance quality.

As a matter of fact, you can check our ratings of all the major US insurance companies in our reviews about the average cost of car insurance. It will help you make a shortlist of the best insurance companies for your profile.

So, once youve done that, request a quote from at least five companies, compare auto insurance offers, and choose the one you like the most. Thats the road to finding the best car insuranceits that easy.

Don’t Miss: How To Register A Used Car In Ny

Cheapest Full Coverage Car Insurance For Drivers In New York

We found that Progressive offers cheap full coverage car insurance for New York drivers with a quote of $1,489 for an annual premium or 40% cheaper than the average rate. Erie is the next best option at $1,540 per year or 38% less expensive than New Yorks average $2,462 insurance rate.

| Insurer |

|---|

*USAA is for qualified military personnel, their spouses, and direct family members. Rates may vary depending on driver profiles and zip codes.

Those who qualify for USAA benefits can get their full coverage auto insurance at just $125 per month for liability, collision, and comprehensive coverage.

The average driver in New York paying for full coverage insurance is $2,462 or $205 per month. Drivers can find cheaper auto policies by comparing top car insurance providers rates like those listed here.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Average Car Insurance Rates By State Per Year

Car insurance cost varies depending on the state you are a resident of as well. Below is a table that displays a state by state rates for minimum coverage, full coverage and a general average auto insurance rate by state.

Minimum liability coverage only pays for damages that you incur on others and their properties, so your car is not covered by the minimum policy in accidents where you are at fault.

Full coverage includes collision insurance and comprehensive insurance, which means damages to your car caused by accidents, natural disasters, fire, damage done by animals, and theft.

The total average auto insurance rate shows the overall average car insurance rates by state annually.

It is important to note that among all the states, Michigan has the highest average price of car insurance, with a minimum coverage cost of $1,855 and an average full coverage cost of $3,150. Michigans average minimum coverage costs even more than the average full coverage costs of the 16th highest insurance rate, Texas, which is $1,823.

| State |

|---|

| $1,700 |

Recommended Reading: Plateman Staten Island Ny

How To Save On Car Insurance In New York

While New York may be one of the most expensive states for auto insurance, fortunately there are numerous opportunities to save on your auto insurance premiums.

- Shop around: Comparing one carrier to another is often the best way to save on your car insurance premiums.

- Discounts: Each carrier has its own list of discounts for you to take advantage of. From bundling policies to making good graces, there is a wide variety of discounts available.

- Improve your credit score: Your credit is directly linked to how much you pay for your premiums. The higher your credit score, the lower your premiums.

- Increase your deductible: Your deductible is the amount you are responsible for out of pocket. If you have a low deductible, your premiums will increase. By raising your deductible, you lower your premiums by as much as $500 annually.