Making Coverage Expansion Provisions In American Rescue Plan Act Permanent

What is the plan?

This proposal would make permanent the expansion of marketplace subsidies enacted on a limited-time basis by the American Rescue Plan Act . The ARPA made it easier for people to buy insurance plans through state marketplaces, such as the New York State of Health Marketplace, by enhancing premium tax credits for people previously eligible for such subsidies and by expanding subsidy eligibility for those previously above the income cutoff.

Who would be eligible?

Lawfully present New York State residents who are already eligible for PTCs andfor the first timeresidents with incomes above 400% of FPL who buy their own marketplace coverage.

How many people would gain coverage?

In New York State, the number of uninsured residents is estimated to drop by 163,000 people in 2022

How would the plan be financed?

Individuals pay a monthly premium that is dependent on income . Those below 150% of FPL are eligible for a silver plan from the New York State of Health Marketplace with no premium. The premium subsidies are paid for by the federal government.

What would overall costs be?

It is estimated that federal spending would increase by $17.6 billion in 2022 . On average, there would be considerable savings for people who currently buy nongroup insurance : a more than 20% reduction in premium and out-of-pocket costs.

Reference for Cost and Coverage Impact

Dont Miss: Pay Ny Tickets

Essential Plan Expansion For Undocumented Immigrants

What is the plan?

This proposal would build on the Basic Health Plan option in New York, called the Essential Plan. The Essential Plan is a public free- or low-premium plan for individuals with incomes above levels eligible for Medicaid. The proposal would remove the immigration status eligibility component for the Essential Plan, allowing all who qualify based on income to enroll.

Who would be eligible?

Undocumented and Permanently Residing Under Color of Law immigrants who earn less than 200% FPL would become eligible . PRUCOL immigrants are immigrants without documentation, but whose presence is known to U.S. officials and who are not at risk of deportation. PRUCOL categories include Deferred Action for Childhood Arrivals recipients.

How many people would gain coverage?

It is estimated that the current uninsured rate would be reduced by 10%, with about 110,000individuals gaining coverage.

How would the plan be financed?

Individuals would pay income-based premiums of either $0 or $20 per month. Although federal funding for the Basic Health Plan is currently the Essential Plans main source of funding, federal funding would not be available for the expansion population. Instead, the State would have to pick up the cost of the subsidized premium for the expansion population.

What would overall costs be?

References for Legislation and Analysis of Cost and Coverage Impacts

New York Exchange Overview

New York has fully embraced the Affordable Care Act, with a state-run exchange, expanded Medicaid, and a Basic Health Program. The state-run exchange is called New York State of Health. It is one of the most robust exchanges in the country, with 12 insurers offering individual market plans for 2022 .

There are also 12 insurers offering Essential Plan coverage for 2022 , and nine insurers offering small business plans through NY State of Healths SHOP exchange .

You May Like: The Wax Museum Nyc

What Does The Essential Plan Cover

The Essential Plan covers the same 10 benefits that every health insurance plan in New York must cover, including doctor visits, hospital stays, prescriptions, etc. Preventive care like health screenings and annual well visits are still free. You may also receive free vision and dental care or pay an extra premium for these benefits, depending on your income.

Doesnt My Employer Have To Offer Me Health Insurance

That depends on the size of your employer. For companies employing at least 50 full-time workers, working a minimum of 30 hours per week, they are required to at least offer a health insurance option to their employees.

Companies employing less than 50 full-time workers are exempt from the employer mandate and can choose not to offer their employees health insurance without penalties.

Read Also: Wax Museums New York

What Types Of Plans Does The Ny State Of Health Offer

The exchange offers insurance plans at four different levels that at least meet the minimum requirements for insurance plans sold under the Affordable Care Act. Those tiered insurance plans are broken down into Metals bronze, silver, gold, and platinum level insurance plans. The plans are further broken into Healthy NY, HCTC Healthy NY, or Non-Group/Individual HMO/PSO.

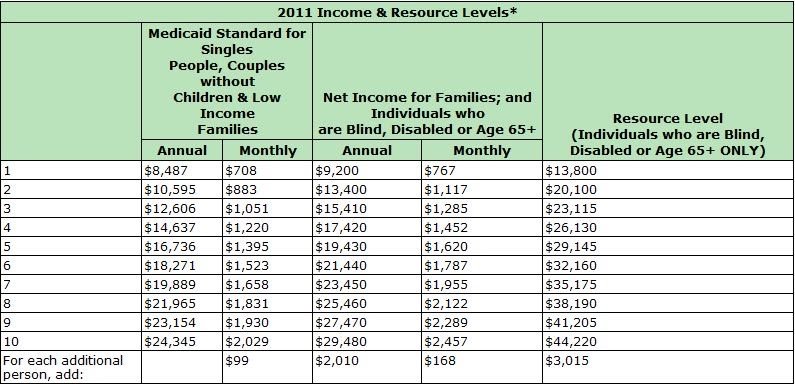

Eligibility Requirements For Medicaid In Ny

Since Medicaid is designed for low-income individuals and families, there are specific income and asset requirements that you must meet, depending on various factors, as we will discuss below.

To be eligible for Medicaid in NY, you must also meet the following eligibility criteria.

- You must be a U.S. national, citizen, permanent resident, or legal alien.

- You must be a resident of New York.

- You must need help with medical care/insurance coverage.

- Your financial situation must fall within the low-income category .

In addition to these requirements, you must also be one of the following:

- Pregnant

- 65 years of age or older

Read Also: Wax Museum Hours Nyc

The Marketplace In Your State

No matter what state you live in, you can enroll in affordable, quality health coverage.

Kentucky: For 2022 coverage, use Kynect to enroll

Starting October 1, 2021, Kentucky residents will no longer enroll in coverage through HealthCare.gov. Instead, theyll use Kynect.ky.gov. Enroll for 2022 as soon as November 1, 2021.

Continue using HealthCare.gov for 2021 coverage information.

Maine: For 2022 coverage, use CoverME to enroll

Starting October 1, 2021, Maine residents will no longer enroll in coverage through HealthCare.gov. Instead, theyll use CoverMe.gov. Enroll for 2022 as soon as November 1, 2021.

Continue using HealthCare.gov for 2021 coverage information.

New Mexico: For 2022 coverage, use beWellnm to enroll

Starting October 1, 2021, New Mexico residents will no longer enroll in coverage through HealthCare.gov. Instead, theyll use beWellnm.com. Enroll for 2022 as soon as November 1, 2021.

Continue using HealthCare.gov for 2021 coverage information.

The History Of Health Insurance In New York State

New York State has one of the countrys most progressive health insurance systems. Since 1990, New York State residents have enjoyed the benefits of community rating and guaranteed issue. These two laws are key components of the Affordable Care Act that went into effect on March 23rd, 2010.

Respectively community rating and guaranteed issue mean insurance companies cannot charge people more based on their background or medical history, and deny health insurance coverage to anyone for any reason.

These two laws have expanded health insurance coverage to many New Yorkers since their introduction more than 20 years ago. However, these two policies have also contributed to higher health insurance costs in the state.

Before the Affordable Care Act being enacted and allowing these two laws to now become a right for Americans, some experts thought health insurance rates nationwide would increase. By some estimates, premiums were said to rise by as much as 30 percent, according to a study released by the Society of Actuaries.

In New York. however, it was thought that health insurance rates could fall by as much as 14 percent when the rest of the Care Act was to take effect, according to the same study.

Again, before the Affordable Care Act, states that already have community rating and/or guaranteed issue laws on the books like Maine, Vermont, Massachusetts, and New Jersey thought theyd also see the same cost declining effect.

Don’t Miss: Nyc Birth Records

Is There Any Other Financial Assistance Available

Yes. If you qualify for a premium tax credit, you may also qualify for a cost-sharing reduction that would help you pay for such out-of-pocket expenses as deductibles and copays. You must enroll in a Silver-level plan to get this assistance. If youve collected unemployment benefits this year, even for just one week, you may qualify for an almost $0/month premium health coverage option, thanks to the American Rescue Plan. If, however, you’re already enrolled in a marketplace plan, you can update your application to apply this additional subsidy moving forward. You’ll also be able to claim the additional subsidies for the months during which you were eligible when you file your 2021 federal income tax return. This extra financial help will expire at the end of 2021.

How Do I Enroll In New York Individual And Families Insurance

When enrolling in a family plan, you must consider the needs of every family member enrolled. Financial assistance is based on your households combined income. Family size impacts your premium and deductibles. Enrolling in individual plans is more straightforward because you only have your own health needs and income to consider.

The three primary types of plans offered in New York include:

- Health Maintenance Organization plans typically cost less than other health coverage types and have some restrictions that can affect your ability to access care. For example, you may have to ask for a referral if you want to see a specialist and your network is local.

- Preferred Provider Organization plans dont require referrals and usually offer nationwide coverage but tend to cost more than HMO plans. Most PPOs also have out-of-network benefits.

- Exclusive Provider Organization plans will cover services received outside the network, but usually at a higher rate than in-network care.

You May Like: How To Pay Nyc Parking Tickets Online

New York Health Insurance: Find Affordable Plans

See how you can get affordable health insurance in New York, including marketplace plans, Medicare, and Medicaid.

Reviewed by: Tammy Burns, insurance and health care consultant

- IX.

New York has one of the most robust health insurance exchanges in the country, so you have an array of affordable options. Individuals, families, and small business owners can all find coverage that meets their health care needs and budget.

New York State Of Health Marketplace

If you wish to sell, solicit or negotiate accident and health insurance through the NY State of Health marketplace, you must be currently licensed by the Department of Financial Services as:

- a life and/or accident/health agent under Section 2103 with the accident/health line of authority

- a life and/or accident/health broker under Section 2104 with the accident/health line of authority

- as a property & casualty broker under Section 2104 with the property and casualty lines of authority

- as a property & casualty agent under Section 2103 with the property and casualty lines of authority

In addition, you must be certified by the NY State of Health marketplace.

Recommended Reading: Italian Consulate Nyc Passport

What Types Of Alternative Health Insurance Plans Are Available In New York

The most popular form of cost-sharing plans are faith-based plans. In a faith-based plan, members share health care costs with other members. You dont need to be a member of a particular denomination , to participate in a plan. While these plans can be relatively low-cost, most faith-based plans dont cover pre-existing conditions, mental health care, or pregnancy. Since the federal government and New York dont consider them health care plans, these plans are unregulated. If you would like to join a faith-based plan, make sure you ask lots of questions before enrolling.

What Is The Ny State Of Health

NY State of Health is the official name of the New York State of Health Plan Marketplace, also known as the New York State Health Benefit Exchange. Its an open marketplace where individuals and families can search for and then purchase affordable health insurance as part of the Affordable Care Act .

Also Check: Nyc Pay Ticket Online

A Culture Of Consumer Protections And Health Care Reform

Over the years, New York has implemented various regulations to enhance consumer protections, including

- A higher actuarial value requirement than the federal government imposes. (And as of 2019, New York requires silver plans to have an actuarial value that can only vary between 70% and 72%, not counting cost-sharing reduction variations of silver plans. Under federal rules, silver plans can have an actuarial value between 66% and 72%, but New York is no longer allowing a negative de minimis variation for silver plans.

- Surprise balance billing protections ,

- Extending the definition of small group to groups with up to 100 employees

- Not allowing premiums in the small group and individual market to vary based on age or tobacco use.

New Yorks Assembly has passed several bills over the years that would create a single-payer system in the state, but none of the bills have survived in the Senate. The 2021 legislation is A.6058 and S.5474, although neither advanced out of committee.

What If I Already Have Insurance

If you are enrolled in a health insurance plan that existed before the Affordable Care Act becoming law on then you can choose to keep that same plan after the rollout of the majority of the ACA provisions on Jan. 1, 2014.

This is called having your insurance plan, grandfathered in.

However not all insurance companies or businesses may choose to grandfather in their plans. For the best information contact your insurance company or your human resource department.

Don’t Miss: Tolls Calculator Ny

Community Healthadvocates Can Help

www.communityhealthadvocates.org |

Helpline: 614-5400

Community Health Advocates is New Yorks statewide consumer assistance program. CHA provides information on, advice, and help solving health care and health insurance problems for consumers and small businesses.

CHA is in your neighborhood. CHA utilizes a toll-free hotline to provide help throughout the state.

CHA speaks your language. CHA provides services in 9 languages and has translation services for any who need it.

All CHA services are free. CHA provides quality services at no cost no matter what type of insurance you have, even if you dont have insurance. CHA can give you information and help you with things like finding a health plan, troubleshooting insurance problems, managing medical bills, or filing appeals.

New York Child Health Plus Healthcare

New York State offers Child Health Plus as a health insurance plan for kids. Depending on your familys income, your child may be eligible to join either Child Health Plus A or Child Health Plus B. Both Child Heath Plus

Head Start is a Federal program that promotes the school readiness of children from birth to age five from low-income families by enhancing their cognitive, social, and emotional development. Head Start programs provide a learning environment that su

Am I Going To Get A Tax Break To Help Pay For My Health Insurance

Maybe. If your income falls between 138 and 400 percent of the Federal Poverty Line you will receive credit paid directly to your insurer to help offset the cost of health insurance. It should also be added that these tax credits will only be available to those purchasing health insurance through the health care exchange and those who qualified for the subsidy.

The credit will be set up on a sliding scale so the lower your income the bigger your tax credit.

You May Like: Nyc Tolls Calculator

What If I Already Have Health Insurance

If you already have coverage through your employer or directly through an insurance provider but are eligible for lower premiums, you can switch to New York State of Health. But you may not qualify for tax credits if you opt out of your employers plan unless those premiums exceed a certain portion of your household income. The premiums would need to be more than 9.83 percent of your household income for individual coverage or more than 8.27 percent for family coverage in order for you to qualify for the tax credits. If you get coverage through the Consolidated Omnibus Budget Reconciliation Act of 1985 because you were terminated from a job or were put on reduced hours, but are no longer getting 100 percent of your premiums covered under a special pandemic subsidy , you may be able to save money by switching to a New York State of Health plan. Be sure to select a life qualifying event when you apply for coverage before your COBRA coverage ends to make sure there’s no gap. If youre not sure about whether making this switch makes sense for you, you can ask for free advice from a certified insurance broker.

The Essential Plan Debuted In 2016 By 2021 Enrollment Had Grown To 914000

In April 2015, New York State of Health announced that they would introduce a Basic Health Program in 2016 dubbed the Essential Plan. Enrollment in the Essential Plan began on November 1, 2015 for coverage effective January 1, 2016. BHPs are an option available to all states under the ACA, but only New York and Minnesota elected to establish BHPs.

Under ACA rules, BHP coverage is available to people with income too high for Medicaid but no higher than 200% of the poverty level. For 2022 coverage, thats $25,760 for a single individual.

In New York, the BHP is available from a variety of private carriers, has no deductible and no monthly premium .

Prior to 2016, enrollees with incomes between 139% and 200% of poverty were eligible for premium subsidies and cost-sharing subsidies, but switching to the BHP has resulted in lower premiums and lower cost-sharing for many of them. About 40% of NY State of Healths private plan enrollees in 2015 had incomes below 200% of the poverty level. They became eligible instead for the Essential Plan in 2016, which is a more affordable option than the coverage they had in 2015.

Thanks to the American Rescue Plan, New York received an additional $750 million in federal funding for the Essential Plan.

Recommended Reading: Tolls Between Dc And Nyc

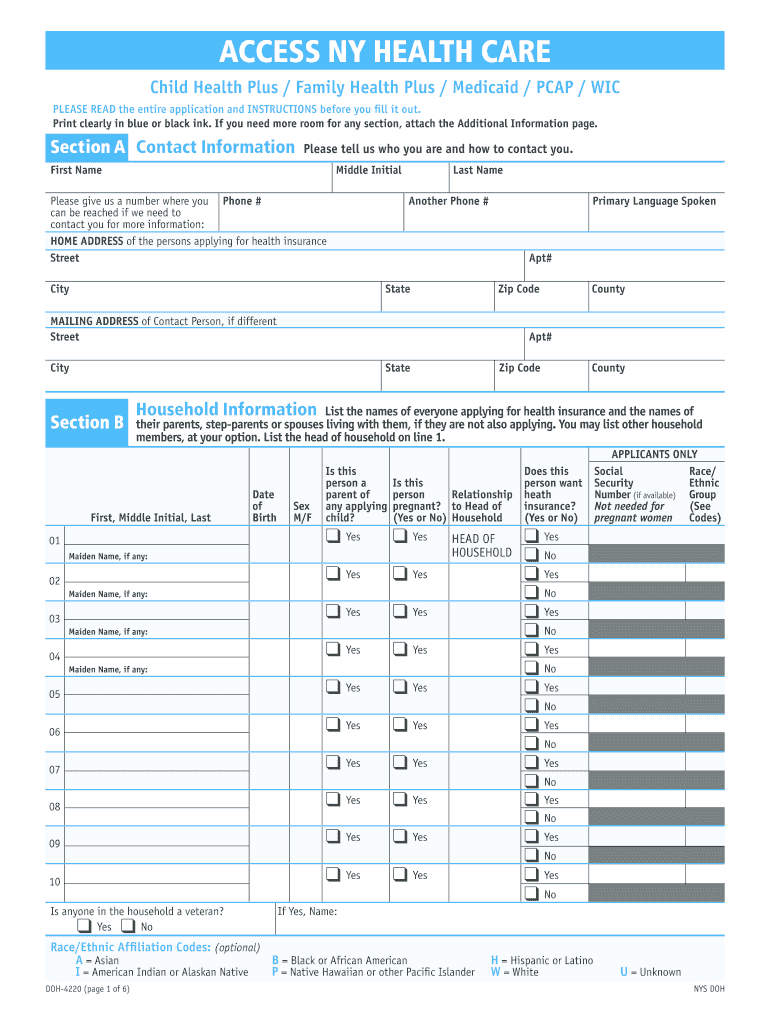

What Proofs Will You Have To Bring To Apply For Medicaid

The evidence you need will vary depending on your age, medical conditions, and a few other factors.

These are some general requirements to give you an idea of what is needed.

Your case worker will let you know if there are any specific requirements for your application. Contact your local Medicaid office for more details.

Here is a list of the documents that you will need when applying for Medicaid in NY.