Services Subject Only To New York City Sales Tax Are:

- beautician services, barbering, and hair restoring

- tanning

- electrolysis

- massage services

- services provided by weight control and health salons, gymnasiums, Turkish and sauna baths, and similar facilities, including any charge for the use of these facilities

- written or oral credit rating services S, New York City Local Sales Tax on Credit Rating Services) and

- oral credit reporting services not delivered by telephone.

Sales Tax Exemptions In New Jersey

In New Jersey, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers.

Several examples of exemptions to the sales tax are most clothing items, prescription drugs, and jewelry.

Many states have special, lowered sales tax rates for certain types of staple goods – such as groceries, clothing and medicines. Restaurant meals may also have a special sales tax rate. Here are the special category rates for New Jersey:

Clothing

OTC Drugs

These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items. Groceries are generally defined as “unprepared food”, while pre-prepared food may be subject to the restaurant food tax rate.

Candy and soda may be included or excluded from any preferential tax rate depending on whether or not the state considers them to be a “grocery”:

is NOT considered a groceryis NOT considered a grocery

Sales Tax Filing Frequency

The New York Department of Taxation and Finance will assign you a filing frequency. Typically, this is determined by the size or sales volume of your business. State governments generally ask larger businesses to file more frequently. See the filing due dates section for more information.

New York sales tax returns and payments must be remitted at the same time both have the same due date.

Recommended Reading: What Is Kate Spade New York

New York Sales Tax Filing Due Dates

It’s important to know the due dates associated with the filing frequency assigned to your business by the New York Department of Taxation and Finance. This way you’ll be prepared and can plan accordingly. Failure to file by the assigned date can lead to late fines and interest charges.

The New York Department of Taxation and Finance requires all sales tax filing to be completed by the 20th of the month following the assigned filing period. Below, we’ve grouped New York sales tax filing due dates by filing frequency for your convenience. Due dates falling on a weekend or holiday are adjusted to the following business day.

It’s important to note the state of New York defines annual and quarterly filing due dates based on a calendar year of March 1 through February 28/29.

| Filing Frequency |

|---|

Whats Taxed And What Isnt

The majority of retail sales are subject to sales and use tax in New York. Some things, like cars and other motor vehicles, are taxed on the residence of the buyer and not the place where you actually buy the vehicle.

There are also a number of things that are exempt from sales tax. Some common examples are groceries, newspapers, laundering and dry cleaning, prescription drugs and feminine hygiene products. Clothing and footwear are not taxable if they are less than $110. If they are over $110, they are subject to regular sales tax rates. Any water delivered through mains and pipes is not taxable. However, public utilities like gas, electricity and telephone service are subject to sales tax.

Renting a car gets expensive in New York. If you rent a passenger car, New York state charges a sales tax of 6%. There is also a 5% supplemental tax if you rent the car within the metropolitan commuter transportation district . If you pay for any parking services , you will pay the New York sales tax of 4% plus any local sales taxes.

You can find a more complete breakdown of taxable goods and services with New York States Quick Reference Guide for Taxable and Exempt Property and Services.

Read Also: What Airlines Fly To Cabo San Lucas From New York

Who May Use Exemption Certificates

You may use an exemption certificate if, as a purchaser:

- you intend to resell the property or service

- you intend to use the property or service for a purpose that is exempt from sales tax or

- you make purchases as an agent or employee of tax-exempt nonprofit organizations or government entities.

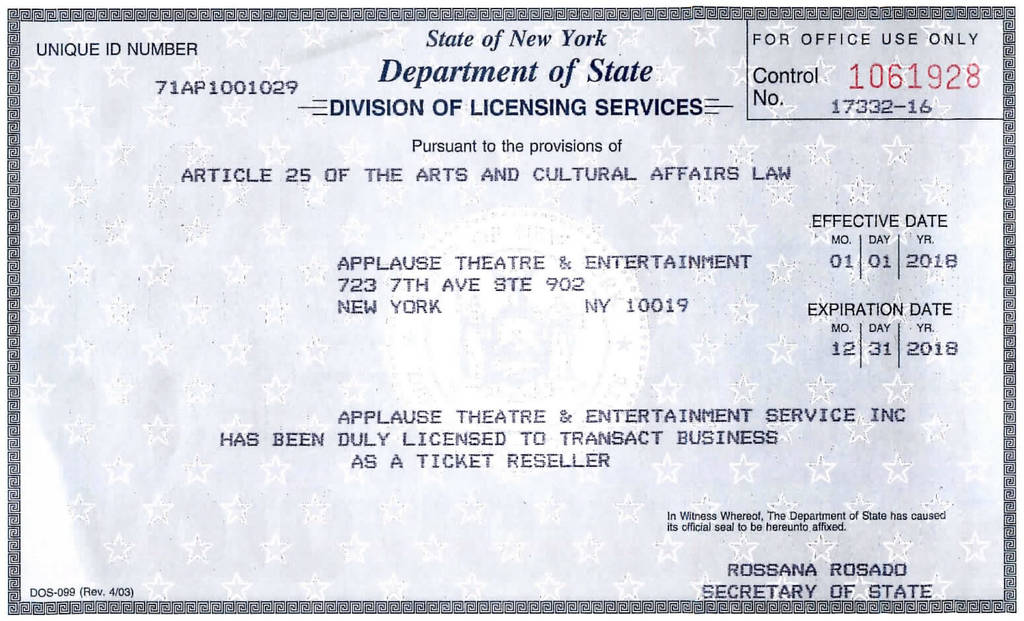

In some cases, you must also have a valid Certificate of Authority to use an exemption certificate . Note that many exemption certificates are very specific about what type of purchaser may use the certificate see the certificates instructions for details.

Most sellers must have a valid Certificate of Authority in order to accept an exemption certificate. A properly completed exemption certificate accepted in good faith protects the seller from liability for the sales tax not collected from the purchaser.

Exemption certificates of other states or countries are not valid to claim exemption from New York State and local sales and use tax.

New York State Sales Tax

In the state of New York, the sales tax that you pay can range from 7% to 8.875% with most counties and cities charging a sales tax of 8%.

The sales tax rate in New York actually includes two separate taxes: sales tax and use tax. The state groups these together when talking about sales tax and both taxes are the same rate so it doesnt matter where you purchase things. New York sales tax is currently 4%. Each county then charges an additional sales tax between 3% and 4.5%.

Counties in the metropolitan commuter transportation district also collect a sales tax of 0.375%. This applies to all taxable sales within the counties of Bronx, Kings , New York , Queens, Richmond , Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, Westchester.

| Sales Tax in New York Counties |

| County |

| 8% |

You May Like: Nyc Parking Ticket Online Hearing

New York Utility Tax Exemption

Utilities consumed in the state of New York are generally subject to sales and use tax. However, there are several utility tax exemption opportunities in the state of New York.

In New York, utilities include purchases of gas, electricity, refrigeration and steam. Below are discussions of some of the more common utility tax exemption opportunities in the state of New York categorized by three main industry groups.

Distinguishing Goods From Nontaxable Items

Since services and intangibles are typically not taxed, the distinction between a taxable sale of tangible property and a nontaxable service or intangible transfer is a major source of controversy. Many state tax administrators and courts look to the “true object” or “dominant purpose” of the transaction to determine if it is a taxable sale. Some courts have looked at the significance of the property in relation to the services provided. Where property is sold with an agreement to provide service , the service agreement is generally treated as a separate sale if it can be purchased separately. Michigan and Colorado courts have adopted a more holistic approach, looking at various factors for a particular transaction.

Recommended Reading: How To Delete New York Times Account

Tangible Personal Property And Services

Whether sales of a particular good or service are taxable may depend on many factors. You should consult our publications and tax bulletins for more detailed explanations of what property and services are subject to sales tax. See the listing below for examples of taxable tangible personal property and services.The term tangible personal property means any kind of physical personal property that has a material existence and is perceptible to the human senses .

How To Calculate Use Tax

Use tax is generally due on the consideration given or contracted to be given for the property or service, or for the use of the property or service, including any charges by the seller to the user for shipping or handling. Generally, the rate of tax used to compute the use tax due is the rate in effect where the business takes delivery of an item or service, or where it uses the item or service, if higher.

Consideration is the dollar value of all amounts paid for any property or service. It can include:

- money

- assumption of liabilities

- fees, rentals, royalties

- charges that a purchaser, lessee, or licensee is required to pay and

- any other agreement for payment.

Calculating use tax on purchases of tangible personal property

Any use tax due on tangible personal property purchased by a business is computed on the price paid by the business for the property.

Example: Your business purchased a dozen desks at $750 each for retail sale to your customers at $1,250 each. You subsequently withdrew one desk from inventory to be used in your office. Use tax is computed on $750.

Calculating use tax on tangible personal property manufactured, processed, or assembled by the user

If you are engaged in a business that manufactures, processes, or assembles tangible personal property and you take an item that you made from inventory and use it in New York State, you owe use tax. The amount of the use tax depends on these factors:

Six-month rule

Don’t Miss: The Wax Museum New York

Sales Tax Exemptions In New York

In New York, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers.

Several examples of exemptions to the state sales tax are over the counter prescription medications, certain types of food and groceries, some types of medical devices, family planning products, some types of machinery and chemicals which are used in development and research, and certain types of shoes and clothes that are less than 110 dollars. An item of clothing or footwear that costs $110 or more is subject to the full state tax rate. Sales tax is calculated per item, so even if you buy two or more items that add up to $110 or more, you only pay tax on the items that individually cost $110 or more.

Many states have special, lowered sales tax rates for certain types of staple goods – such as groceries, clothing and medicines. Restaurant meals may also have a special sales tax rate. Here are the special category rates for New York:

Clothing

OTC Drugs

EXEMPT

These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items. Groceries are generally defined as “unprepared food”, while pre-prepared food may be subject to the restaurant food tax rate.

Candy and soda may be included or excluded from any preferential tax rate depending on whether or not the state considers them to be a “grocery”:

is NOT considered a groceryis NOT considered a grocery

Installing Repairing Maintaining Or Servicing Exempt Machinery And Equipment

Charges to a manufacturer for installing, maintaining, servicing, or repairing exempt production machinery and equipment are also exempt from sales tax.Installing means setting up or putting something in place for use. For example, the installation of plumbing or electrical fixtures needed for the operation of production equipment is exempt from sales tax.Maintaining, servicing, and repairing are terms used to cover all activities that relate to keeping things in a condition of fitness, efficiency, readiness, or safety, or restoring them to such condition.

You May Like: Paying Parking Tickets Online Nyc

Misplacing A Sales Tax Exemption/resale Certificate

New York sales tax exemption and resale certificates are worth far more than the paper theyre written on. If youre audited and cannot validate an exempt transaction, the New York Department of Taxation and Finance may hold you responsible for the uncollected sales tax. In some cases, late fees and interest will be applied and can result in large, unexpected bills.

Are Services Shipping Installation Etc Taxable In New York

The taxability of transactions involving services, shipping, and installation of tangible goods can be slightly complicated with various laws applying to slightly different situations. To learn more about how these transactions, and other more complicated situations, are subject to the New York sales tax see the New York sales taxability FAQ page.

You May Like: Flights From New York To Cabo San Lucas

Is Equipment Rental Taxable In New York

4.8/5TaxableEquipmentrentalsequipmentequipment

Similarly, you may ask, is rent subject to sales tax in New York?

Sales and use taxes do not apply to many transactions. Among the common transactions that are not subject to the sales tax are the following: sales or rentals of real property sales of most personal services

One may also ask, do you pay sales tax on rentals? However, if you are renting the equipment to someone, but you will operate the equipment, you do not need to pay sales and use tax on the rental. Only the service is charged tax. However, if you rent out the leased equipment without operating it yourself, a sales and use tax applies. The total tax rate is 8.25 percent.

Also to know, what items are exempt from sales tax in New York?

Clothing, footwear, and items used to make or repair exempt clothing sold for less than $110 per item or pair are exempt from the New York State 4% sales tax, the local tax in localities that provide the exemption, and the ?% Metropolitan Commuter Transportation District tax within exempt localities in the MCTD.

Are background checks taxable in New York?

Accordingly, receipts from the sales of Petitioner’s background check services will be subject to State and local sales and use taxes under Section 1105 of the Tax Law. It is noted, however, that purchases made by organizations described in Section 1116 of the Tax Law are not subject to sales and use tax.

Examples Of Taxable Tangible Personal Property Services And Transactions That Are Subject To Sales Tax Are:

- tangible personal property:

You May Like: Where Is The Wax Museum In New York

What Is Sales And Use Tax

When you read about sales tax in New York, youll see talk of Sales and Use Tax. What is use tax and why do you have to pay it?

As you might know, sales tax applies to goods and services you buy within a state. Use tax is an equivalent tax that you pay on items that you purchase outside of the state. It ensures that out-of-state retailers dont benefit just because they dont have to pay the in-state sales tax. The use tax in New York is the same as the sales tax. The two taxes are also mutually exclusive so if you pay one of them, you wont have to pay the other.

Lets look at an example to show how use tax works: Imagine youre a New York resident and you buy a computer somewhere within the state. The seller will collect the regular New York sales tax. But if you buy a computer from New Hampshire, the seller wont collect the New York sales tax. That means you can get the computer without paying the full tax on it. So New York collects a use tax. New York requires residents to report their out-of-state spending in their New York income taxes.

Triggering New York Sales Tax Nexus

The need to collect sales tax in New York is predicated on having a significant connection with the state. This is a concept known as nexus. Nexus is a Latin word that means “to bind or tie,” and its the deciding factor for whether the state has the legal authority to require your business to collect, file, and remit sales tax.

Read Also: Tickets To Italy From New York

What Transactions Are Generally Subject To Sales Tax In New York

In the state of New York, sales tax is legally required to be collected from all tangible, physical products being sold to a consumer. Some examples of items that exempt from New York sales tax are over the counter prescription medications, certain types of food and groceries, some medical devices, family planning products, some types of machinery and chemicals that are used in development and research, and certain types of shoes and clothes that are priced under one hundred and ten dollars.This means that an individual in the state of New York who sells school supplies and books would be required to charge sales tax, but an individual who owns a store which sells clothing is not required to charge sales tax on all of its products.

Taxable And Exempt Shipping Charges In New York

New York sales tax may apply to charges for shipping, delivery, freight, handling, and postage.

Shipping and handling charges billed by the vendor to the customer are generally taxable in New York if the sale is taxable, whether the charges are combined or separately stated on the invoice. Shipping and handling charges billed by the vendor are generally exempt when the sale is exempt, whether combined or separately stated.

When a vendor charges a single charge for delivery of both taxable and nontaxable property or services, the entire charge is generally subject to tax. However, if taxable and nontaxable charges are separately stated on a bill, and the charge for delivery is separately stated and allocated between taxable and non-taxable sales, the charge to deliver the taxable goods is taxable and the charge to deliver the exempt goods is exempt.

If a customer arranges delivery by a third person and pays that person directly, the third persons delivery charge is not taxable, even if the item delivered is taxable.

There are exceptions to almost every rule with sales tax, and the same is true for shipping and handling charges. Specific questions on shipping in New York and sales tax should be taken directly to a tax professional familiar with New York tax laws.

For additional information, see the New York State Department of Taxation and Finance, Shipping and Delivery Charges.

Don’t Miss: What Time Is Shabbos In New York