Fee On Hotel Occupancy In New York City

In addition to the state and local sales taxes on hotel occupancy, a hotel unit fee in the amount of $1.50 per unit per day applies to hotels located in New York City. These fees are reported on Schedule N, Selected Services in New York City. See TSB-M-05S, Fee on Hotel Occupancy in New York City, for additional information on the hotel unit fee, and for the definition of a unit in a hotel.

Historical New York Tax Policy Information

|

|

This article does not contain the most recently published data on this subject. If you would like to help our coverage grow, consider donating to Ballotpedia.

The historical New York tax policy information below is presented as it was written on Ballotpedia in 2015. For more current information regarding tax policy, click here.

| Tax policy in New York |

| Tax rates in 2015 |

| Tax collections per capita: $3,898 |

New York generates the bulk of its tax revenue by levying a personal income tax and a sales tax. The state derives its constitutional authority to tax from Article XVI of the state constitution.

Tax policy can vary from state to state. States levy taxes to help fund the variety of services provided by state governments. Tax collections comprise approximately 40 percent of the states’ total revenues. The rest comes from non-tax sources, such as intergovernmental aid , lottery revenues and fees. The primary types of taxes levied by state governments include personal income tax, general sales tax, excise taxes and corporate income tax.

HIGHLIGHTS

New York State Income Tax

Personal income tax in New York is on a progressive system with eight brackets ranging from 4 percent up to 8.82 percent, which is only paid by people earning more than $1 million a year.

| New York State Income Tax | |

| 2018 Estimated Income Taxes | |

| $1,077,550 up | 8.82% |

New York state income tax is also notable for the addition of a separate bracket for top earners that started with a 2009 bill, which created whats now known as the millionaires tax that boosts rates to close to 9 percent for top earners.

Find Out: How Much Money You Would Have If You Never Paid Taxes

Don’t Miss: How Much Does A Cremation Cost In New York

State Of New York Tax Rate Summary

New York continues to have some of the highest tax rates in the country. Its standard deductions are less than those at the federal level. New York taxes include:

- Income tax rates: 4% to 10.90%

- Standard deductions: $3,100 to $16,050

- Estate tax rates: 3.06% to 16%

- Sales tax: 4% plus up to 8.8% added on by municipalities

Do I Have To Pay New York State Income Tax

Generally, you have to file a New York state tax return if:

-

Youre a New York resident and youre required to file a federal tax return or your federal gross income plus New York additions was more than $4,000 .

-

Youre not a New York resident but got income from a source in New York during the tax year.

If youre not a resident of New York but your primary workplace is there, your days telecommuting during the pandemic are still considered days worked in New York unless your employer established an office at your telecommuting location. Generally, you will continue to owe New York State income tax on income earned while telecommuting.

» MORE:See what federal tax bracket youre in

Read Also: How To Pay A Ticket Online New York

New York City Musical And Theatrical Production Tax Credit For Corporate And Personal Income Tax

On July 23, 2021, Governor Andrew Cuomo announced the New York City Musical and Theatrical production tax credit which is designed to revitalize the theater district after its close due to the Covid-19 pandemic by offering up to $100 million in tax credits. The two-year program for approved companies which will allow tax credits for up to 25% of qualified production expenditures such as sets, costumes, sound, lighting, salaries, fees, advertising costs, etc. First year program applicants can receive up to $3 million per production and second year applicants up to $1.5 million. Companies can receive credits for tax years beginning on or after January 1, 2021 but before January 1, 2024. Applications must be submitted by December 31, 2022 and final applications no later than 90 days after the production closes or 90 days following the program end date of March 31, 2023, whichever comes first.

Sales Taxes Imposed By Certain School Districts

Certain school districts in New York State impose sales tax on utilities and utility services. A school districts utility tax is in addition to the tax imposed by the state and by the county and/or city in which the school district is located. You can look up the combined tax rate on utility services sold in a school district by entering the delivery address of the utility or utility service in our online Jurisdiction/Rate Lookup by Address.When you enter the address, youll find a description of the applicable utility or utility service. These services fall into three categories:

- residential energy sources and services,

- nonresidential energy sources and services, and

- telecommunications services.

The school districts that impose these taxes, and the applicable tax rates, are listed on Schedule B, Taxes on Utilities and Heating Fuels and Schedule T, Taxes on Telephone Services. See also Tax Bulletin Residential Energy Sources and Services .

Recommended Reading: New Yorker Magazine Poetry Submissions

Combined State And Local Sales Tax Rates

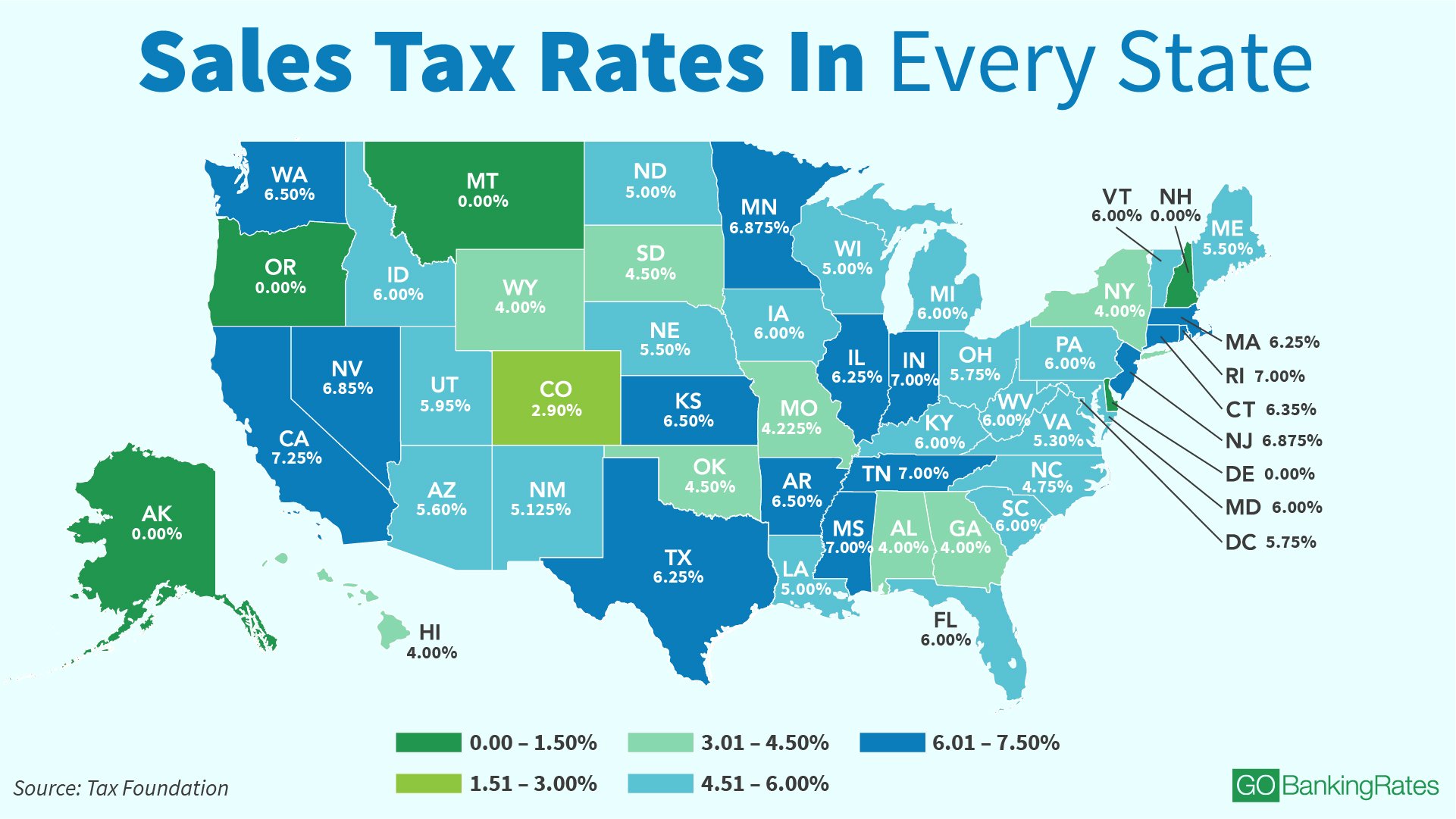

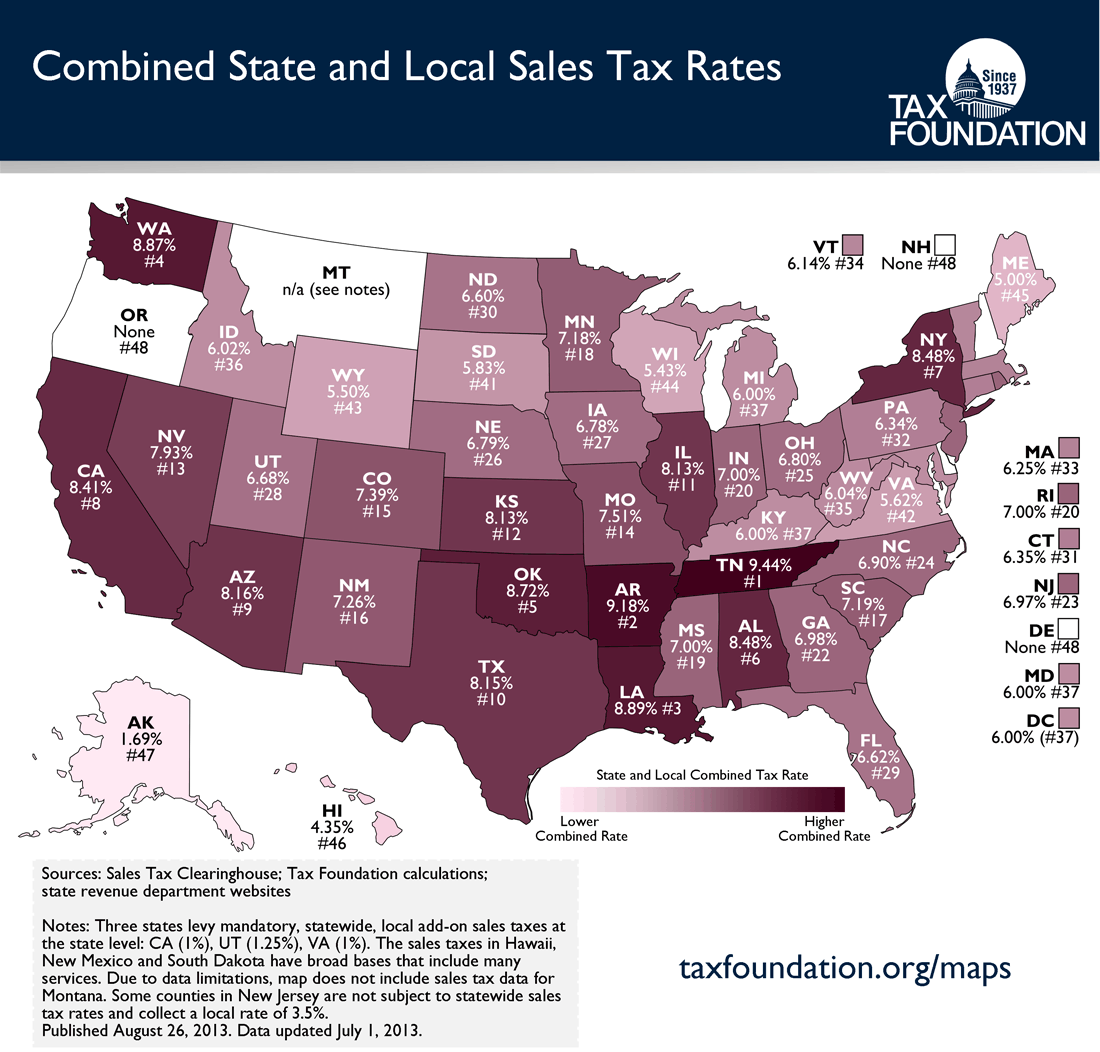

Five states do not have statewide sales taxes: Alaska, Delaware, Montana, New Hampshire, and Oregon. Of these, Alaska allows localities to charge local sales taxes.

The five states with the highest average combined state and local sales tax rates are Louisiana , Tennessee , Arkansas , Washington , and Alabama . The five states with the lowest average combined rates are Alaska , Hawaii , Wyoming , Wisconsin , and Maine .

New York Proposes Three New Tax Rates / Tax Brackets Which Would Raise Highest Individual Rate

Revised budget proposals from each of the New York State Assembly and the New York State Senate would include three additional personal income tax brackets for individuals with income over $2.155 million. Each respective proposal includes the same three new tax rates9.85 percent, 10.85 percent and 11.85 percentbut imposes such rates at differing income thresholds. The current maximum individual tax rate in New York is 8.82 percent. The new brackets and rates would be effective for the 2021 tax year.

Recommended Reading: What Airlines Fly To Cabo San Lucas From New York

County City Taxes Mean New York State Sales Tax Rates Will Vary

Throughout the rest of the state, sales and use tax rates will vary depending on the county and city youre in. And New York counties typically add an additional 4 percent or more to your taxes every time you make a qualifying purchase. The highest rates are in the five counties that make up New York City, but Oneida and Erie county each have a 4.75 percent rate in addition to New Yorks 4 percent. The counties with the lowest additional sales tax rate are Saratoga County, Warren County and Washington County, only adding another 3 percent to every purchase.

Everything You Need to Know: New York State Taxes

Heres a look at each county in New York and its prevailing sales tax rate:

| 8% |

Jurisdiction Reporting Codes And Rate Changes

When you file your sales and use tax returns, you must report the sales tax collected for each jurisdiction separately. The Tax Department has assigned a specific reporting code for tax due for each local jurisdiction, which allows for proper accounting of the tax collected. As long as you use Sales Tax Web File or use the sales tax returns available from the Tax Department for the reporting period you are filing, the correct codes and rates will be provided to you.You can learn about rate changes in a few different ways:

Subscription service – We encourage you to register to receive e-mail notifications related to sales tax, including rate changes. These e-mail notifications include links to recently updated Web content and publications that list sales tax rates for localities.

Read Also: How To Delete New York Times Account

New York State Sales Taxes

Whether youre a New York resident or a visitor, youll pay a sales-and-use tax on goods purchased in the state. The state charges a flat 4% rate, but your actual rate can vary based on any local sales tax imposed by the city, county or school district in which the sale occurs. For example, the sales tax rate for New York City is 8.875%, while its 7.5% in Ontario County.

Also, theres an additional sales tax of 0.375% on sales made within the Metropolitan Commuter Transportation District.

Check the states website for a list of sales-and-use tax rates by jurisdiction. Or you can use the states online tool to look up the rate by address.

Sales And Other Taxes

The state’s sales tax has been set at 4% since June 1, 2005, but local municipalities can add up to 8.88%. Food, prescription drugs, and non-prescription drugs are exempt, as are clothing and footwear costing less than $110 per item.

The state imposes a motor fuel tax that includes a:

- Motor fuel excise tax

- Petroleum business tax

- Petroleum testing fee

The state gasoline tax was 32.98 cents a gallon as of February 2021 state and federal taxes together are 51.38 cents per gallon. The cigarette tax is $4.35 per pack of 20.

Read Also: Pay Ticket Online New York

Types Of Residency Status In New York

|

If your New York residency type is … |

New York taxes this part of your income |

|---|---|

|

Resident |

» MORE: Track the status of your state tax refund

RESIDENT STATUS RULES

In general, youre a resident of New York for tax purposes if your permanent home is there , or if you leased or owned a place there and spent 184 days or more in New York state during the tax year.

-

New York considers your permanent home the place you intend to return to after things like vacations, business trips, military assignments or the end of a college semester.

-

There are special rules for people who were in a foreign country for at least 450 of 548 consecutive days.

-

Where you vote, where your drivers license and registration are issued or where your will is are not primary factors in establishing domicile. Its more about where your stuff is and where you spend your time.

You file Form IT-201. You may have extra paperwork if you live in New York City or Yonkers, since those cities assess local income tax on top of state tax.

PART-YEAR RESIDENT STATUS RULES

Generally, youre a part-year resident of New York if you were a nonresident for some of the tax year. This is often the case for people who moved to New York from another state.

-

If youre a part-year resident, you pay New York state tax on all income you received during the part of the tax year you were a resident of New York, plus on income from New York sources while you were a nonresident.

NONRESIDENT STATUS RULES

New York Auditing Income Tax Returns Of Certain Nonresident Remote Employees

New York tax authorities are focused on auditing 2020 income tax returns filed by nonresidents who work for New York employers. During the course of the Coronavirus Pandemic, the New York Department of Taxation and Finance directed nonresidents whose primary office is in New York to count telecommuting days as time working in the state. More specifically, TSB-M-06I, issued in 2006, provides that in order for any work days to be allocated outside of New York State, such services must be because the employers necessity and not the employees convenience. Applying this rule, unless telecommuting was because of necessity of the employer, employee services rendered remotely were to be considered New York work days. However, there may be legal challenges to that position because taxpayers are arguing telecommuting was a requirement and, in many cases, mandated rather than simply being based upon convenience. Moreover, the U.S. Supreme Court will rule on a similar issue as requested by New Hampshire, which is challenging Massachusetts taxation of residents working remotely.

Don’t Miss: How Much Is A Flight To Italy From New York

New York Updates Estimated Tax Payment Instructions

The New York Department of Taxation and Finance has issued a bulletin alerting taxpayers of updated instructions for Forms IT-2105, Estimated Tax Payment Voucher for Individuals, and IT-2106, Estimated Tax Payment Voucher for Fiduciaries. The updates reflect recently enacted increased personal income tax rates for the following taxpayers: married taxpayers filing jointly with income over $2,155,350 single filers, married taxpayers filing single, and estates and trusts with income over $1,077,550 and heads of household with income over $1,616,450.

May 26, 2021

Is There A Tool That I Can Use To Calculate Ny Car Sales Tax

To calculate the sales tax you may pay for a vehicle in New York, you can use the tool provided by the New York State Department of Taxation and Finance website. This tool enables individuals to input their zip code and address to get an estimate of the total state and local taxes they may be subjected to pay for a vehicle. You will then multiply the sales price of your vehicle by the tax rate provided for your address in New York.

Recommended Reading: Toll Calculator Virginia

New York Sales Tax Nexus

Businesses that have a physical location in the state of New York are required to collect sales tax. This is known as “nexus”. Most other businesses will not have New York sales tax nexus, except for the following:

- Businesses that sell tangible personal property and make 12 or more deliveries of these products using their own vehicles. In other words, delivery by common carrier or LTL providers do not count toward these deliveries.

- You have employees or other representatives in state who solicit sales or products or services.

- You solicit the sale of tangible personal property or services via catalog or other advertising materials, and have some additional connection with the state.

- If you are associated with a vendor in-state, via an ownership test. (See this PDF for complete details.

- If you have New York affiliates, and your sales to New York buyers exceeds $10,000 in a calendar year, you will incur click-through nexus, and be required to collect and remit sales tax, the same as an in-state retailer.

New York State Taxes: Everything You Need To Know

Taxes in the Empire State won’t make you feel like royalty. Taxes 101

New York state tax has the second-highest average tax rate in the country, with the typical New Yorker paying over a quarter of their income to state and federal governments. And thats just at the state level. For the 8.5 million-plus people living in New York City the least tax-friendly city in America additional city taxes mean theyre shelling out even more.

So, why are New Yorkers paying more in taxes than most of the rest of the country? Heres a closer look at all of the state taxes in New York state.

| New York State Taxes | |

| State Sales Tax Rate Range | 7% 8.875% |

| State Income Tax Rate Range | 4% 8.82% |

| 3.06% 16% |

Don’t Miss: Rolling Loud New York Line Up

How Are Rebates And Dealer Incentives Taxed

Many dealers offer cash incentives or manufacturer rebates on the sticker price of a vehicle in order to encourage sales. For example, a $1,000 cash rebate may be offered on a $10,000 car, meaning that the out of pocket cost to the buyer is $9,000.

New York taxes vehicle purchases before rebates or incentives are applied to the price, which means that the buyer in this scenario will pay taxes on the vehicle as if it cost the full $10,000.

The Role Of Competition In Setting Sales Tax Rates

Avoidance of sales tax is most likely to occur in areas where there is a significant difference between jurisdictions rates. Research indicates that consumers can and do leave high-tax areas to make major purchases in low-tax areas, such as from cities to suburbs. For example, evidence suggests that Chicago-area consumers make major purchases in surrounding suburbs or online to avoid Chicagos 10.25 percent sales tax rate.

At the statewide level, businesses sometimes locate just outside the borders of high sales-tax areas to avoid being subjected to their rates. A stark example of this occurs in New England, where even though I-91 runs up the Vermont side of the Connecticut River, many more retail establishments choose to locate on the New Hampshire side to avoid sales taxes. One study shows that per capita sales in border counties in sales tax-free New Hampshire have tripled since the late 1950s, while per capita sales in border counties in Vermont have remained stagnant. At one time, Delaware actually used its highway welcome sign to remind motorists that Delaware is the Home of Tax-Free Shopping.

State and local governments should be cautious about raising rates too high relative to their neighbors because doing so will yield less revenue than expected or, in extreme cases, revenue losses despite the higher tax rate.

Don’t Miss: Where To Watch Csi New York