Instructions For Responding To A Bill Or Notice

We created step-by-step instructions to help you successfully respond to a bill or notice online. Whether you agree with our notice or bill, need to provide additional information, or want to challenge a Tax Department decision, responding online is the fastest, easiest way to resolve an issue.

Do I Have To Pay New York State Income Tax

Generally, you have to file a New York state tax return if:

-

Youre a New York resident and youre required to file a federal tax return or your federal gross income plus New York additions was more than $4,000 .

-

Youre not a New York resident but got income from a source in New York during the tax year.

If youre not a resident of New York but your primary workplace is there, your days telecommuting during the pandemic are still considered days worked in New York unless your employer established an office at your telecommuting location. Generally, you will continue to owe New York State income tax on income earned while telecommuting.

» MORE: Track the status of your state tax refund

RESIDENT STATUS RULES

In general, youre a resident of New York for tax purposes if your permanent home is there , or if you leased or owned a place there and spent 184 days or more in New York state during the tax year.

-

New York considers your permanent home the place you intend to return to after things like vacations, business trips, military assignments or the end of a college semester.

-

There are special rules for people who were in a foreign country for at least 450 of 548 consecutive days.

-

Where you vote, where your drivers license and registration are issued or where your will is are not primary factors in establishing domicile. Its more about where your stuff is and where you spend your time.

PART-YEAR RESIDENT STATUS RULES

NONRESIDENT STATUS RULES

Us New York Implements New Tax Rates

New Yorks recently-enacted budget legislation provides for $212 billion in state spending and temporarily increases the current top personal income tax rate of 8.82% to 10.9% for individual filers whose taxable income is over $25,000,000. The new rates are retroactive to the beginning of the 2021 tax year and are effective through the 2027 tax year.

Recommended Reading: How To Apply For Disability In New York State

New York City Income Tax

New York City has a separate city income tax that residents must pay in addition to the state income tax. The city income tax rates vary from year to year. The tax rate you’ll pay depends on your income level and filing status, and it’s based on your New York State taxable income. There are no city-specific deductions, but some tax credits specifically offset the New York City income tax.

If you work for the city but don’t live there, you must still pay an amount equal to the tax you would have owed if you had lived there. This rule applies to anyone who began employment after Jan. 4, 1973.

Overview Of Income Tax Rate Changes

The legislation establishes three new marginal income tax rate brackets for individuals that are effective for the 2021-2027 tax years. Previously, the highest individual income tax rate of 8.82% was imposed on joint filers with income over $2,155,350 .

The new rate brackets and rates are as follows:

- 9.65% for joint filers with New York taxable income in excess of $2,155,350 but not more than $5,000,000.

- 10.30% for all taxpayers with New York taxable income in excess of $5,000,000 but not greater than $25,000,000.

- 10.90% for all taxpayers with New York taxable income in excess of $25,000,000.

Read Also: Submit To The New York Times

New York State Sales Taxes

Whether youre a New York resident or a visitor, youll pay a sales-and-use tax on goods purchased in the state. The state charges a flat 4% rate, but your actual rate can vary based on any local sales tax imposed by the city, county or school district in which the sale occurs. For example, the sales tax rate for New York City is 8.875%, while its 7.5% in Ontario County.

Also, theres an additional sales tax of 0.375% on sales made within the Metropolitan Commuter Transportation District.

Check the states website for a list of sales-and-use tax rates by jurisdiction. Or you can use the states online tool to look up the rate by address.

New York City Income Tax Credits

Tax credits reduce the amount of income tax that you owe. They come directly off any tax you owe to the taxing authority. Some credits are refundableyou’ll receive a refund of any portion of the credit that’s left over after reducing your tax liability to zero.

New York City offers several tax credits. They can offset what you owe the city, but they won’t affect the amount of New York State income tax you might owe.

You May Like: How Much Are Tolls From Maryland To New York

What Is New York Tax Law Article 1402

The specific language of the New York Mansion Tax may be found in Article 1402-a, which is reproduced below:

New York Tax Law Article 1402-a:

In addition to the tax imposed by section fourteen hundred two of this article, a tax is hereby imposed on each conveyance of residential real property or interest therein when the consideration for the entire conveyance is one million dollars or more. For purposes of this section, residential real property shall include any premises that is or may be used in whole or in part as a personal residence, and shall include a one, two, or three-family house, an individual condominium unit, or a cooperative apartment unit. The rate of such tax shall be one percent of the consideration or part thereof attributable to the residential real property. Such tax shall be paid at the same time and in the same manner as the tax imposed by section fourteen hundred two of this article.

Notwithstanding the provisions of subdivision of section fourteen hundred four of this article, the additional tax imposed by this section shall be paid by the grantee. If the grantee is exempt from such tax, the grantor shall have the duty to pay the tax.

Technically speaking, the modification to New York Tax Law kept the original 1% Mansion tax in place while adding an additional surcharge tax for sale prices of $2 million or more as part of a new section of the New York Tax Law §1402-b .

The rate of such tax shall be:

Other New York City Taxes

New York City charges a sales tax in addition to the state sales tax and the Metropolitan Commuter Transportation District surcharge. But food, prescription drugs, and non-prescription drugs are exempt, as well as inexpensive clothing and footwear.

There’s also a state and local tax on hotel rooms for inexpensive to moderately-priced rooms. This tax rate includes New York City and New York State sales taxes, as well as a hotel occupancy tax. Rooms renting for less expensive prices are subject to the same tax rates, but at lesser nightly dollar amount fees.

Medallion owners or their agents pay a tax for any cab ride that ends in New York City or starts in the city and ends in Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, or Westchester counties. This tax, known as the taxicab ride tax, is generally passed on to consumers. Medallion owners are those who are duly licensed with a medallion by the Taxi Limousine Commission of New York City.

Also Check: Register Car In Ny

The Nyc Earned Income Credit

Full-year residents and part-year residents of NYC who qualify for and claim the federal Earned Income Credit can claim the New York City Earned Income Credit. New York State offers an Earned Income Credit as well. You can still qualify for an NYC Earned Income Credit even if you don’t qualify for the state credit. And you can claim both if you do qualify for the state credit. This tax credit is also refundable.

The average NYC Earned Income Credit is about $2,400. As with the federal EIC, income limits apply based on how many qualifying children you support.

Can I Be A Resident Of New York State If My Domicile Is Elsewhere

You may be subject to tax as a resident even if your domicile is not New York.

You are a New York State resident if your domicile is New York State OR:

- you maintain a permanent place of abode in New York State for substantially all of the taxable year and

- you spend 184 days or more in New York State during the taxable year. Any part of a day is a day for this purpose, and you do not need to be present at the permanent place of abode for the day to count as a day in New York.

In general, a permanent place of abode is a building or structure where a person can live that you permanently maintain and is suitable for year-round use. It does not matter whether you own it or not.

For more information see:

Don’t Miss: Delete Nytimes Account

What Is New York Citys New Congestion Tax Scheme

Posted by Boldizsar Hajas on Wednesday, December 1st, 2021, 4:59 PMPERMALINK

Back in 2019 the New York State legislature approved a congestion pricing plan for downtown New York City.

The basic concept is simple: tax people for entering highly congested areas, thus reducing the traffic.

This idea is meant to harness the nonlinear nature of traffic congestion. As a highway reaches its design capacity, each additional vehicle added to the road creates more congestion than the vehicle that came before it. Also, the reverse is true. That is what the policy is built upon: even a small decrease in the number of vehicles can visibly ease congestion.

New York would be the first stateto introduce such a plan, formally named the Central Business District Tolling Program. The planned pricing area would consist of Manhattan downtown, that is all streets and roadways south of 60th Street, except the FDR Drive, the West Side Highway, sections of the Battery Park Underpass and Hugh Carey Brooklyn-Battery Tunnel that connect the FDR Drive to the West Side Highway.

The pricing is not determined yet and will be decided according to how many credits and exemptions are given out, but it will likely be around $12 14 for passenger vehicles, and $25 for trucks. The fee would operate on a once-a-day basis.

Taken on 23 April 2018, 08:49:52

Posted by Garrett Smith on Friday, January 14th, 2022, 10:49 AMPERMALINK

Escape From New York City: The Pandemic And Its Tax Implications

CEO & Founder of Global Taxes, LLC – 212-803-3327 or 917-834-9307

The phrase unprecedented times has often been repeated in the news when reporting about the current Covid-19 pandemic. Truth be told, we are not living in precedented times at all. In fact, if you know your global history, the world has experienced many plagues and pandemics far worse than the one it is experiencing now. However, there are aspects of this pandemic that lend itself to being described as unprecedented. For example, the virus itself acts in ways that scientists have never witnessed before in the life cycle of other viruses.

In a similar vein, New York City is experiencing events that are unprecedented. It is observing a mass exodus of its residents. They are moving out of the City to other parts of the state or out-of-state. With this mass exodus comes the questions being asked by taxpayers as to the implication a change of residency has on their 2020 tax bill. There is a lot of misinformation being circulated in the press and elsewhere that is convincing taxpayers a move out of New York City will reduce, if not eliminate, their City taxes. Cited here is a thumbnails sketch of the rules and regulations associated with residency and taxes. It is being presented here in the hope that it will prevent you, the reader, from making a grievous error. Consider this message wholeheartedly and you just may avoid being hit with a hefty City income tax bill comes Tax Day 2021.

Read Also: How Much Is The Wax Museum In Nyc

New York City Property Tax

The New York City Department of Finance values residential and commercial properties. A tentative value value assessment is sent out to property owners on May 1 each year for most communities. A final assessment is then sent out if there aren’t any changes.

New York City assessments are based on percentages of market value, and those percentages can vary based on the type of property. You have a right to appeal if you don’t agree with your assessment.

Property tax rates are set each year by the mayor and by city council, and they can vary depending on the type of property. They’re applied to property values to help determine each homeowner’s annual tax liability. Property taxes are due either in two semi-annual payments for homes with assessed values of more than $250,000, or four quarterly payments for homes with assessed values of $250,000 or less.

New York City offers several exemptions and property tax reductions, including exemptions for senior citizens, veterans, and the disabled. The New York State STAR exemption for owner-occupied housing is also available, as well as property tax abatements or reductions for certain individuals.

The 2021-2022 New York State budget also gives homeowners a break in the form of a tax credit for any portion of real property taxes that exceeds 6% of their qualified adjusted gross incomes if their QAGI is less than $250,000.

How Your New York Paycheck Works

When you start a job in the Empire State, you have to fill out a Form W-4. Your new employer will use the information you provide on this form to determine how much to withhold from your paycheck in federal income taxes. How much you pay in federal income taxes depends on several factors like your marital status, salary and whether or not you have additional taxes withheld from your paycheck.

The 2020 W-4 includes notable revisions. The biggest change is that you won’t be able to claim allowances anymore. Instead, you’ll need to input annual dollar amounts for additional income and things like non-wage income, total annual taxable wages, income tax credits and itemized and other deductions. The form also utilizes a five-step process that asks you to enter personal information, claim dependents and indicate any extra income or jobs.

All employees hired as of Jan. 1, 2020 must complete the form. If you were hired before then, you don’t need to worry about filing a new W-4 unless you plan on changing your withholdings or getting a new job.

You May Like: Can I Go To College For Free In New York

Getting Your New York Tax Refund

If your state tax witholdings are greater then the amount of income tax you owe the state of New York, you will receive an income tax refund check from the government to make up the difference.

It should take one to three weeks for your refund check to be processed after your income tax return is recieved. E-filing your return and filing early can help ensure your refund check gets sent as quickly as possible.

Once you’ve filed your tax return, all you have to do is wait for your refund to arrive. If you want to check the status of your New York tax refund, you can visit the New York Income Tax Refund page.

What Is The Nyc Sales Tax

NYC sales tax varies depending on the item that’s being purchased. Clothing and footwear under $110 are exempt from NYC sales tax. Sales tax on most other items and services is 4.5%. The city charges a 10.375% tax and an additional 8% surtax on parking, garaging, and storing vehicles for a total tax of 18.375%. There’s a Manhattan Resident Parking Tax exemption from the 8% surtax.

Also Check: Ny Wax Museum Discount Tickets

What Are The Rules For New York City Residency

The requirements to be a New York City resident are the same as those needed to be a New York State resident. You are a New York City resident if:

- your domicile is New York City or

- you have a permanent place of abode there and you spend 184 days or more in the city.

All city residents income, no matter where it is earned, is subject to New York City personal income tax. Nonresidents of New York City are not liable for New York City personal income tax.

The rules regarding New York City domicile are also the same as for New York State domicile. If your permanent and primary residence that you intend to return to and/or remain in after being away is located in one of the five boroughs of New York City, it is considered a New York City domicile.

Your New York City domicile does not change until you can demonstrate with clear and convincing evidence that you have abandoned your city domicile and established a new domicile outside New York City. Even if you live in a location outside of the city for a period of time, if its not the place you attach yourself to and intend to return to, its not your domicile. Your domicile will still be New York City and you will still be considered a New York City resident.

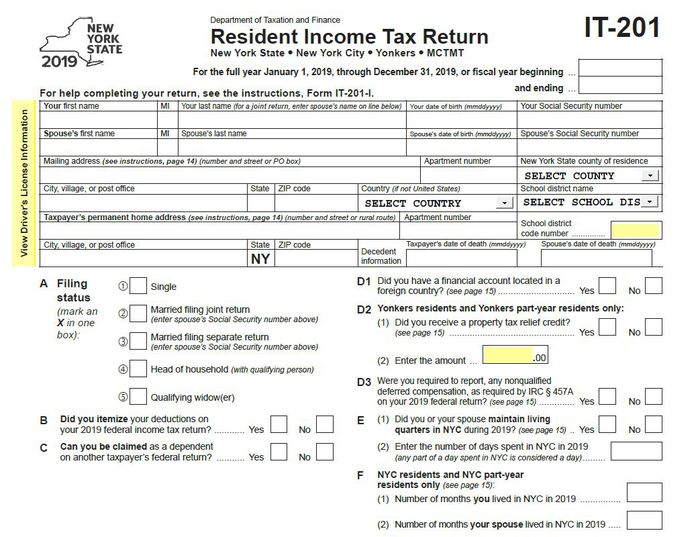

For more information see, IT-201-I, Instructions for Form IT-201 Full-Year Resident Income Tax Return.

Tips For Filing Taxes

- A financial advisor can help you develop a tax strategy to benefit your investing and retirement goals. SmartAssets free tool matches you with financial advisors in your area in 5 minutes. If youre ready to be matched with local advisors, get started now.

- If you dont know whether youre better off with the standard deduction versus itemized, you might want to read up on it and do some math. Educating yourself before the tax return deadline could save you a significant amount of money.

- Figure out whether youll be getting a refund or will owe the government money so you can plan your household budget accordingly. SmartAssets tax return calculator can help you figure this out.

Don’t Miss: New York Pass Reviews