Regular Certificate Of Authority

You must apply for a regular Certificate of Authority if you will be making taxable sales from your home, a shop, a store, a cart, a stand, or any other facility from which you regularly conduct your business. It does not matter whether you own or rent the facility.

If you make sales at a show or entertainment event, such as a craft show, antique show, flea market, or sporting event, you must apply for a regular Certificate of Authority, even if your sales are only on an isolated or occasional basis. The department no longer issues the Certificate of Authority for Show and Entertainment Vendors that was previously issued for these vendors. See TSB-M-08S, Changes Regarding the Issuance of Certificates of Authority to Show and Entertainment Vendors.

International Startups Need Legal Counsel For Business In Nyc

Internationally-based startups or other non-NYS entities already have challenges by doing business in another country or state. New York City poses special challenges for new businesses that may not be easy to deal with from abroad. If you have a startup or business based outside of New York, contact us today for legal counsel. We can help you navigate the complexities of bringing your business to New York.

How Do I Get A Certificate Of Authority Id Number In New York

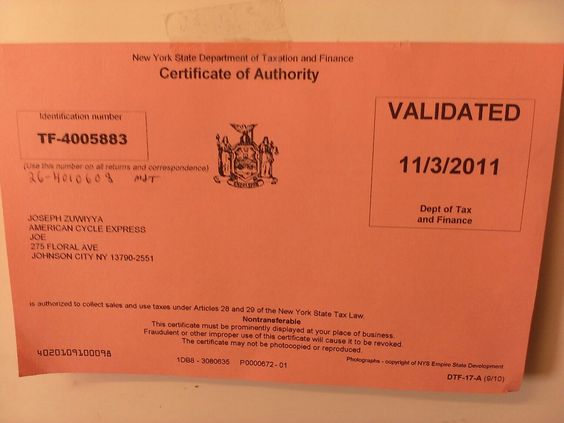

In New York State, the Certificate of Authority, also known as the Certificate of Authority to Collect Sales Tax, is the Sales Tax ID number the state requires a business to use when collecting sales tax. Requests for a Sales Tax ID number must go through the New York State Department of Taxation and Finance. The NYS Department of Taxation and Finance accepts requests for the Certificate of Authority online via the DTF-17 Register for a Sales Tax Certificate of Authority application on the Online Permit Assistance and Licensing system.

Select the “Certificate of Authority to Collect Sales Tax” link from under the heading. Click the “OK” button on the pop-up dialog box that opens.

Fill in the fields on the application form window that pops open. The form requests various information about your business including the type of business, reason for applying for a Sales Tax ID, business legal and DBA names and address, as well as your Federal I.D. Number . If you don’t have an FEIN, apply for it through the site by clicking the “Apply for FEIN” button in Section C and following the on-screen instructions.

Apply by mail as an alternative. Call 485-2889 to request a paper application. Once you fill it, send the application to:

New York State Tax Department Sales Registration Unit W. A. Harriman Campus Albany, New York 12227

After applying by mail, it typically takes four to six weeks before the Certificate of Authority arrives.

Tips

Warnings

References

Read Also: How To Pay Ticket Online Ny

When Do I Need A Certificate Of Authority

The most common reasons for applying for a certificate of authority include:

- Opening an office or physical location within the foreign state

- Hiring an employee who resides within the state

- Before beginning a contract or a job in a new state

- A vendor or banks requirements

- Licensing authority requirements

Certificate Of Authority: Definition

A Certificate of Authority shows that you are authorized to do business in a state other than your original formation state. A Certificate of Authority is a requirement in most states.

Its important to note that the name of the document can vary from state to state. It may be known as an Application for Authority, Application for Registration, Application to Transact Business, Qualification Certificate, or another name.

To complicate matters further, the requirements and process for acquiring the certificate can vary by jurisdiction.

Did you know?A Certificate of Authority can mean different things in different states. In New York, a Certificate of Authority is issued by the New York Tax Department and contains your sales tax ID. With the certificate, your business is granted the right to collect sales tax and issue and accept most New York State sales tax exemption certificates.

Don’t Miss: Wax Museum Nyc Address

You Must File Sales Tax Returns

Once you receive your Certificate of Authority, you are considered to be in business for sales tax purposes even if you never make a sale or never open the doors of your establishment. Therefore, it is very important that you file your sales tax returns on time, even if you have no taxable sales. There are penalties for late filing even if you owe no tax. You can file your sales tax returns online using the Tax Departments Online Services, located on our website. To learn more about the filing requirements, see Tax Bulletin Filing Requirements for Sales and Use Tax Returns .

New York Certificate Of Good Standing Faq

What is a New York certificate of good standing?

A certificate of good standing is a legal document that confirms that your business is compliant with state regulations.

In New York, a certificate of good standing is known as a certificate of status.

Certificates of good standing are also known as certificates of existence or certificates of compliance.

How do I get a certificate of good standing?

You can get a New York certificate of status by remaining compliant with state regulations and ordering a certificate by mail or by fax.

How much does a certificate of good standing cost?

In New York, ordering a Certificate of Status costs $25.

How soon do you need a certificate of good standing?

Because many banks and insurance companies will want a business’s certificate of good standing in order to do business, we recommend getting one as soon as possible.

How long is the certificate of good standing valid for?

A New York certificate of status does not have a set expiration date. However, requesters such as banks, creditors, and foreign business states often have their own guidelines for a certificate’s validity.

What does a certificate of good standing mean?

Obtaining a New York certificate of status means that the state recognizes your business as both active and compliant.

When do you need a certificate of good standing?

Who is required to get a certificate of good standing?

Where do I find a certificate of good standing?

Also Check: New York Register Car

Ny Certificate Of Authority

If you currently operate an incorporated business out of state, its considered a Foreign Corporation to New York and you must apply for NY Certificate of Authority to do business. If youd like to expand your Corporation into New York, you will need a Certificate of Authority from the state of New York Division of Corporations. This is obtained by successfully filing an Application for Authority and paying the foreign qualification fee. At New York Registered Agent, we help people form Foreign Corporations in New York every day, but if you have the time and patience you can file an Application for Authority yourself.

The first thing you should do is make sure you need to establish a New York Foreign Corporation.

What Are The Penalties For Not Obtaining A Certificate Of Authority

The most serious consequence of failing to obtain a Certificate of Authority is that the foreign state may deny your company the right to bring or maintain a lawsuit or conduct other legal proceedings in their court system. For example, if a partner or customer violates a contract, you would not be able to sue to recover damages or enforce the contract .

Another costly consequence is that states will assess fines, penalties, and back taxes for the time your company was transacting business without a Certificate of Authority. Some states may also fine individual officers or agents of your business.

You May Like: How Much Are Tolls From Ohio To New York

For Foreign Nonprofit Corporations:

| New York Department of State – Division of Corporations, State Records and Uniform Commercial Code | |

| Form: | |

|

Certified copies not required. |

|

| Certificate of Good Standing Requirement: |

Certificate of existence dated within the last year or, if your state doesn’t issue certificates, a certified copy of your articles of incorporation and amendments. |

Edits To Your Business License

Mailing Address Change: If you change your mailing address during the year, contact the Business License Department to report the change.

Change of Location: If you change your location during the period your license is valid, you may have to go through the application process all over again. Please call the Business License desk before you change locations to find out if you must reapply.

Closing your Business License: You must cancel your Business License if you are no longer operating your business in Syracuse.

Recommended Reading: How To Become A Registered Nurse In Nyc

Offline New York Sales Tax Certificate Of Authority Application Form

While generally slower than applying online, you can apply for a New York Sales Tax Certificate of Authority for your business offline using Form DTF-17, the “Application to Register for a Sales Tax Certificate of Authority”.Form DTF-17 can be downloaded from the Department of Taxation and Finance here .

How To Get A New York Resale Certificate

A business can purchase items to resell without paying state sales tax. The tax liability is passed from the wholesaler or distributor to the retailer, who will then charge sales tax to the end-user of the item.

Wholesalers and distributors will require a sales tax number and fill out a New York Resale Certificate to document the items being purchased are for resale.

Recommended Reading: Tolls From Nj To Va

How To Obtain A Pllc Certificate Of Authority In New York

A Certificate of Authority is a document issued by the New York State Education Department, Office of the Professions, which indicates their approval for a new professional service provider to open a PLLC or PC. .

During the application process the Office of the Professions must review the proposed Articles of Organization for the new PLLC, review the Members professional licensure credentials, and review other application documents specific to each profession. If the documents are legally sufficient, the Office of the Professions may issue a Certificate of Authority, which is required by the Department of State along with the Companys organizational documents in order to establish the new entity.

The Department of Education processing time can take several months, so ensuring that the organizational documents are drafted correctly upon first submission is critical. This can save much time by eliminating the need to resubmit. The Department also frequently refuses applications for various reasons so if youre on a timeline please contact us to inquire about our PLLC formation services.

Legal Consequences Of Not Obtaining Proper Business Documents

If you are doing business without a Certificate of Authority or a Resale Permit, you arent properly reporting your tax exemptions or remitting sales tax you should have collected from customers. New York imposes up to a $10,000 fine for operating a business without a Certificate of Authority. You will get fined $500 on the first day and $200 each additional day until you get your certificate.

Don’t Miss: Registering Vehicle In Ny

For Foreign Professional Corporations:

| New York Department of State – Division of Corporations, State Records and Uniform Commercial Code | |

| Form: | |

|

Certified copies not required. |

|

| Certificate of Good Standing Requirement: |

Certificate of existence dated within the last year or, if your state doesn’t issue certificates, a certified copy of your articles of incorporation and amendments. |

What Is A Registered Agent

A registered agent receives service of process and government notices on behalf of your business. When you prepare your New York Certificate of Authority application, you must list a registered agent with a physical address within the state .

Many businesses do not have an individual or physical address in a new state. Listingour local registered agent address on your certificate of authority application meets the states requirements. Additionally, you get same day document scanning from our local office in all 50 states and DC. Our registered agent service is a flat rate of $99 per year, and you can easily add our service to any certificate of authority order.

Don’t Miss: Madame Tussauds New York Parking

We Make The Process Of Getting A New York New York Certificate Of Authority Simple

When you choose to work with Business Licenses, LLC, our experienced professionals can handle even the hardest parts of obtaining a certificate of authority for you.

Understanding your legal obligations to various levels of government can be intimidating. From researching your requirements to contacting multiple government agencies, to collecting the necessary paperwork, we understand that obtaining a certificate of authority can be a lot to handlein addition to your other professional obligations.

When you use our site LicenseSuite,we simplify what you need to do by reducing the many hours of research and helping with the frustrating outreach to government officials.

Simply type in your city and state, enter your industry and click ‘Get Licensed.’

From there, you’ll get everything you need at LicenseSuite, a proprietary Business Licenses, LLC website. LicenseSuite provides one central location for all you need to obtain a certificate of authority.

Why spend hours or days struggling to figure out your legal requirements when Business Licenses, LLC can give you everything you need in one place?

You Must Be Registered

If you have a business that is required to collect and remit sales tax in New York State, the NY Department of Taxation will require you to have a valid NYS Certificate of Authority .

Before you begin selling tangible items or services that are subject to sales tax in New York State, the State of New York requires that you must be registered with the NYS Tax Department of Taxation and Finance to collect sales tax.

The New York State Department of Taxation and Finance is the governmental agency that governs the collection and remittance of sales tax.

You cannot legally make taxable sales in the State of NY, collect sales tax, or issue exemption certificates until you receive your Certificate of Authority.

You must apply for a NYS Certificate of Authority at least 20 days prior to begin operating your business.

An exemption certificate is a form that a buyer will give to the seller so that there is a record as to why you did not collect the sales tax on a particular transaction.

To request a Certificate of Authority, you can apply online at the NYS Tax Department website.

If accepted, NYS will mail you a Certificate of Authority.

The Certificate of Authority must be displayed at your business.

If you have more than one location, each location requires its own Certificate of Authority.

You May Like: How Many Tolls From Md To Nyc

Register A Ny Foreign Corporation Yourself

Looking to save some money? You can file your Foreign Corporation Application for Authority yourself. To do so, you must submit the same documents mentioned above:

- New York Foreign Corporation Application for Authority

- Certificate of Existence/Good Standing from Your Home State

A Certificate of Existence/Good Standing is generally obtained from your local Secretary of State office. It must be dated within one year.

When filling out your Application for Authority, be aware that there are numerous restricted or prohibited words and phrases that cannot be used as part of your Corporation name. In addition, the name of your company must include one of the following: Corp,Corporation,Inc, or Incorporated. If your name does not conform to these specific laws, you will need to select a fictitious name for use in New York that does.

Once your Application is complete, you must mail it or deliver it to the following address:

Department of State

Where Can I Get A New York New York Certificate Of Authority

A New York, New York Certificate of Authority can only be obtained through an authorized government agency. Depending on the type of business, where you’re doing business and other specific regulations that may apply, there may be multiple government agencies that you must contact in order to get a New York, New York Certificate of Authority.

Unfortunately trying to figure out where you can get a New York, New York Certificate of Authority can get complicated and time intensive. Without help from Business Licenses, LLC, it can be challenging to even understand all the steps to getting your New York, New York certificate of authority.

Rather than having to get in contact with multiple government entities, we provide you with everything you need to know for all your certificate of authority requirements. We also offer professional help, where our experts can complete your New York, New York certificate of authority paperwork and submit them on your behalf.

Read Also: How Much To Register A Car In New York

How To Apply For A Nys Certificate Of Authority

Registering with the NYS Taxation and Finance Department and applying for a Certificate of Authority can be done online through New York State’s business portal, the New York Business Express. There is no cost involved in the process.

During the registration and application process, you’ll be required to fill out Form DTF-17.1, Business Contact and Responsible Person Questionnaire. For this form, you’ll need contact information and ownership and profit distribution percentages for each business contact. You’ll also need the social security number of each responsible person, along with the date they assumed business responsibilities and a summary of their main business duties.

To complete the application, you’ll also need the following information:

- Your reason for applying

- Your business’s entity type, for example, LLC

- The date you plan to start selling taxable goods and services

- Bank account information for the account where you’ll deposit sales taxes collected

- Any relevant license or permit numbers

- Your tax preparer’s information, if you’ll be using one to prepare your sales tax returns

Processing time is approximately five days, and if your application is approved, your Certificate of Authority will be mailed to you.