Best For Customer Reviews

Here are how some of the most popular renters insurance companies in NYC stack up in terms of customer satisfaction.

| Company |

|---|

| 815 |

These figures suggest that Lemonade and State Farm offer the best customer service in NYC as far as renters insurance companies are concerned. USAA also performs exceedingly well however, USAA insurance is only available to veterans, military service members and their eligible family members.

Not Reporting Theft Or Vandalism To The Police

If you experience damage or loss due to criminal activity you must file a police report. Insurance companies take this step extremely seriously as this adds mountains of credibility to your claim.

Imagine the insurance company receiving your claim that your laptop and tablet are missing from your home due to a robbery with no evidence but your word.

They would be crazy to give you a penny.

How Does Renters Insurance Work In New York City Ny

If you have purchased New York City renters insurance and there is an incident in your home that causes damage, destruction or loss of one or more items at some point during the coverage period , then filing a claim with your provider should be quick and easy.

Once everything is approved, the company will send you a check to cover any damages according to your insurance policy.

Recommended Reading: Forms Needed To Register A Car In Ny

Get A Free New York Renters Insurance Review

- Increase or decrease your deductible

- Determine the home insurance coverage options that are right for your budget and situation. For instance, did you recently build a garage or gazebo you need covered? Have you installed a protective device that could qualify you for a discount? The On Your Side® Review is a great time to make these types of updates to your policy.

- Review our responsive home insurance claim policy

What Is Covered By Renters Insurance In New York

Renters insurance in New York can help you if:

- Your apartment building has a fire and your personal items are damaged or damage to your apartment leaves you with no place to live.

- Someone breaks into your apartment and steals your laptop, cell phone, or flat screen TV.

- A visiting guest slips and falls in your apartment and decides to sue you for his injuries.

Without insurance coverage, you’d be responsible for replacing your personal items even if their loss isn’t your fault. The cost to replace your clothes, laptop, and furniture out of pocket may be substantial.

Read Also: Madame Tussauds New York Parking

How Much Is Homeowner Insurance In Ny

Homeowners insurance premiums in New York are broken down by city. In 2021, the average yearly cost of homeowners insurance in New York will be $987 per year for a $250,000 deductible and a dwelling coverage of $250,000. This implies that New Yorkers pay more than $300 less per year for house insurance than the national average of $1,312 per year.

Lemonade: Best Renters Insurance For Seamless Policy Purchase & Filing Claims

Lemonade is a millennials dream insurance company with its exceptional user experience in its mobile application.

This insurance company has made the complexity of insurance easy to understand and complete within a matter of minutes.

Lemonades financial strength or their ability to deliver claims to policyholders in a swift manner also makes this company a wonderful option for renters in a city like New York where every penny saved is a lucky day.

Unlike other insurance companies, you dont have to get on the phone with a claims agent and instead communicate directly through the app using AI and saving time.

The app also allows you to quickly add-on services such as coverage for earthquakes, flooding, groundwater, and landslides which are not included in standard coverage.

| Pros | |

|---|---|

| Innovative user experience on both the mobile application and computer. | Limited discount options. |

| Pet insurance options for renters with pets. | |

| Customizable coverage amounts. | |

| Social good company. |

Recommended Reading: How Many Tolls From Baltimore To New York

Compare Renters Insurance Online

The renters insurance providers you consider also affect the quotes you see. Traditional insurers cover renters, but they may charge higher rates unless you bundle that coverage with auto insurance or other policies.

Meanwhile, there are plenty of online insurance startups that provide renters insurance at competitive rates. You can use our tool to find and start comparing renters insurance options today.

What To Know About New York Renters Insurance

Renters insurance isnt mandated by law in New York, but many landlords require it when you sign a lease. Either way, it may be worth buying to protect your finances in case disaster strikes.

Standard renters insurance covers your belongings for theft, one of the most common crimes in New York City. Your belongings are generally covered even when youre not at home. So if someone steals your laptop from a coffee shop, itll probably be covered . Renters insurance also covers damage due to fires.

New York state is prone to a variety of natural disasters, including thunderstorms, snowstorms, floods and tropical storms. Note that not all of these are covered by a standard renters policy. For example, flooding is typically not covered, but damage from a snowstorm might be.

Say you live on the top floor of an apartment building, and a heavy blizzard causes part of the roof to cave in. Any resulting damage to your belongings would likely be paid for because the weight of ice, snow and sleet is one of the standard perils that most renters insurance policies cover.

But if a tropical storm causes a flash flood, ruining the furniture in your basement apartment, you probably wouldnt be covered unless you had separate flood insurance.

» MORE:Complete guide to hurricane insurance

Recommended Reading: Ny Wax Museum Discount Tickets

Which Company Has The Cheapest Renters Insurance In New York City

No company is the end-all-be-all of cheap renters insurance. It’s true that some companies tend to be less expensive. But, the cheapest company for you depends on your profile. The best way to get cheap renters insurance is by combining it with your car insurance policy. But in a city like New York, cars are rare. New Yorkers can consider combining with other property insurance or even life insurance. And dont forget to comparison shop along the way!

Coverage Types That Impact Cost

Different coverage types can impact the cost of your monthly premiums. These include:

- Personal property coverage – Your personal property coverage limit is the amount of coverage you have for personal possessions like electronics, clothes and other valuable items. You may have to purchase optional add-on coverage for valuable items like jewelry.

- Liability Coverage – Liability coverage covers your legal liability if someone injures themselves or their property is damaged in your apartment. It may also cover the cost of legal defenses if they sue you.

- Living Expenses Coverage – If you need to leave your apartment due to damages, living expenses coverage pays for your alternate living arrangements, like a temporary hotel stay.

Don’t Miss: Wax Museum Nyc Address

Is Lemonade An Insurance Company

Lemonade, Inc. is a for-profit corporation that makes lemonade. Lemonade Inc. provides renters insurance, homeowners insurance, auto insurance, pet insurance, and term life insurance in the United States, as well as contents and liability policies in Germany and the Netherlands, and renters insurance in France. Lemonade Inc. is headquartered in San Francisco, California. The companys headquarters are in New York City.

What Are The Risks To Consider In New York

Unfortunately, most renters insurance policies do not cover damages to your personal property caused by a flood or an earthquake. New York tenants do face the risks of natural hazards such as snowing, storm, and flood . Therefore, it is also a good idea to check with your insurance agent and learn more about what policies are available that cover these specific disasters.

Last but not least, thanks to the increased risk of the exposure of personal information on the Internet in todays digital world, it is also important to check if your renters insurance provides identity theft protection.

Don’t Miss: What Time Is Shabbos In Ny

Whats The Best Way For Me To Quickly And Easily Compare Insurance Quotes

Quote comparison sites like Insurify use cutting-edge AI technology to provide free personalized quotes in just minutes to customers. With an average user rating of 4.8/5 from 2,900+ reviews,Insurifyis the #1 highest-ranked insurance comparison platform in America. And, unlike other quote comparison companies, Insurify never sells your data to scammers.

Nationwide: Best Home Renters Insurance For Best Standard Coverage

Nationwide renters insurance is rated fifth out of the top rental insurers and has some of the best premiums for renters in NYC.

Nationwides standard policies also include Brand New Belongings coverage, which is like replacement cost coverage.

If you file a personal property claim, Nationwide will pay you the depreciated value of your belongings.

If replacing the items costs more than the claim reimbursement, Nationwide will issue another payment to cover the difference.

Most insurance companies only offer replacement cost coverage as an add-on so this coverage option sets Nationwide out from the pact.

| Pros | |

|---|---|

| Customer service is not 24/7. | |

| More coverage options in basic coverage than other insurers. | Average customer satisfaction. |

| Unique coverage for renters making additions or alterations to their rental home. | |

| Strong financial strength rating. |

- Content like furniture, clothing, and other items.

- Loss of use.

- Claims-free discount

Recommended Reading: How To Register A Vehicle In Ny

Why Is Homeowners Insurance So Expensive

Homeowners insurance premiums differ from state to state, but they are on the increase everywhere. In addition to industry-wide price hikes, your house insurance quotes may be expensive due to a variety of variables, including your credit score, the age and value of your property, the kind of construction used, the location, and your vulnerability to natural disasters.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: How Much To Register A Car In Nys

Does Renters Insurance Cover Me Or My Community

Have you just signed a lease on a new rental property? If so, congratulations! Are you asking yourself does renters insurance cover me or my community ? If so, the next step you should take is to get renters insurance. A common misconception people have when they choose not to get renters insurance is they believe they dont need itRead More

Obtain All The Discounts You Qualify For

If you can prove you’re a lower-risk customer, you’ll often pay lower rates. So if you’re a tenant with fire alarms, burglar alarms, deadlocks or other safety features, you may be entitled to a discount from your insurer.

Spend some time going through the application to make sure you’ve checked off all the qualifying discounts. If you own a vehicle, consider getting your auto insurance and renters insurance from the same company for a bundle discount.

Read Also: How To Start An Llc In New York State

How Do You File A Claim For Medical Liability

Under your renters insurance policy you should have coverage for personal liability and medical liability. Both may come into play in the same scenario.

For example, someone who was injured in your house or apartment decides to sue you.

The personal liability would cover the lawsuit and the medical liability would cover the injured person’s medical bills.

You do not file a claim for medical liability. The claimant here is the injured person who has incurred medical expenses.

The injured party should be given your insurance policy number and instructions on how to file a claim.

You should document the incident in detail, and gather as many witnesses as possible.

Increase Your Homes Security

Lowering your rental insurance can be as simple as getting a home security system or alarm installed in your apartment if no other security measures have been put in place in your rental building such as security cameras or a doorman.

Be sure to speak to your landlord about the possibility first.

New York City requires all apartments and houses to be outfitted with smoke detectors, so this is an automatic plus.

However, you can do one better by keeping a fire extinguisher in your unit.

Also Check: How Many Tolls From Va To Ny

Do You Need Renters Insurance To Rent An Apartment In New York

No, renters insurance is, generally, not required or mandatory like auto insurance for tenants in New York, however, it’s strongly advisable.

It’s a way to protect all your property in your apartment, including your electronics.

If your apartment is burglarized, for example, and you dont have renters insurance, you will have to pay out of pocket to replace all the items that were stolen or damaged and are entitled to nothing.

With renters insurance, your policy will cover your losses potentially saving you thousands of dollars.

In addition, there are individual landlords or management companies that may make purchasing renters insurance and providing proof of purchase compulsory in order to sign a lease.

State Farm: Best Renters Insurance For Customer Service

| Pros | Cons |

|---|---|

| Great ratings with top rating agencies S& P and Moody’s as well as an industry-best A++ rating with A.M. Best | Limited discounts |

| Application and quotes are available online and easy to navigate | |

| Digital resources are available on their website | |

| Customizable coverage limits |

State Farm is the largest insurance insurer in the country.

They have over 18,000 agents working and offer reliability and affordability as what sets them apart from other insurers.

You May Like: Is The New York Pass Worth Buying

Can You Share New York City Renters Insurance With Roommates

When you’re living in a shared space, it’s important to get all of your housemates on the same page with regards insurance.

You can list multiple people under one policy and this is an excellent way so everyone knows what their responsibilities are going forward – from emergencies down to who does laundry every day!

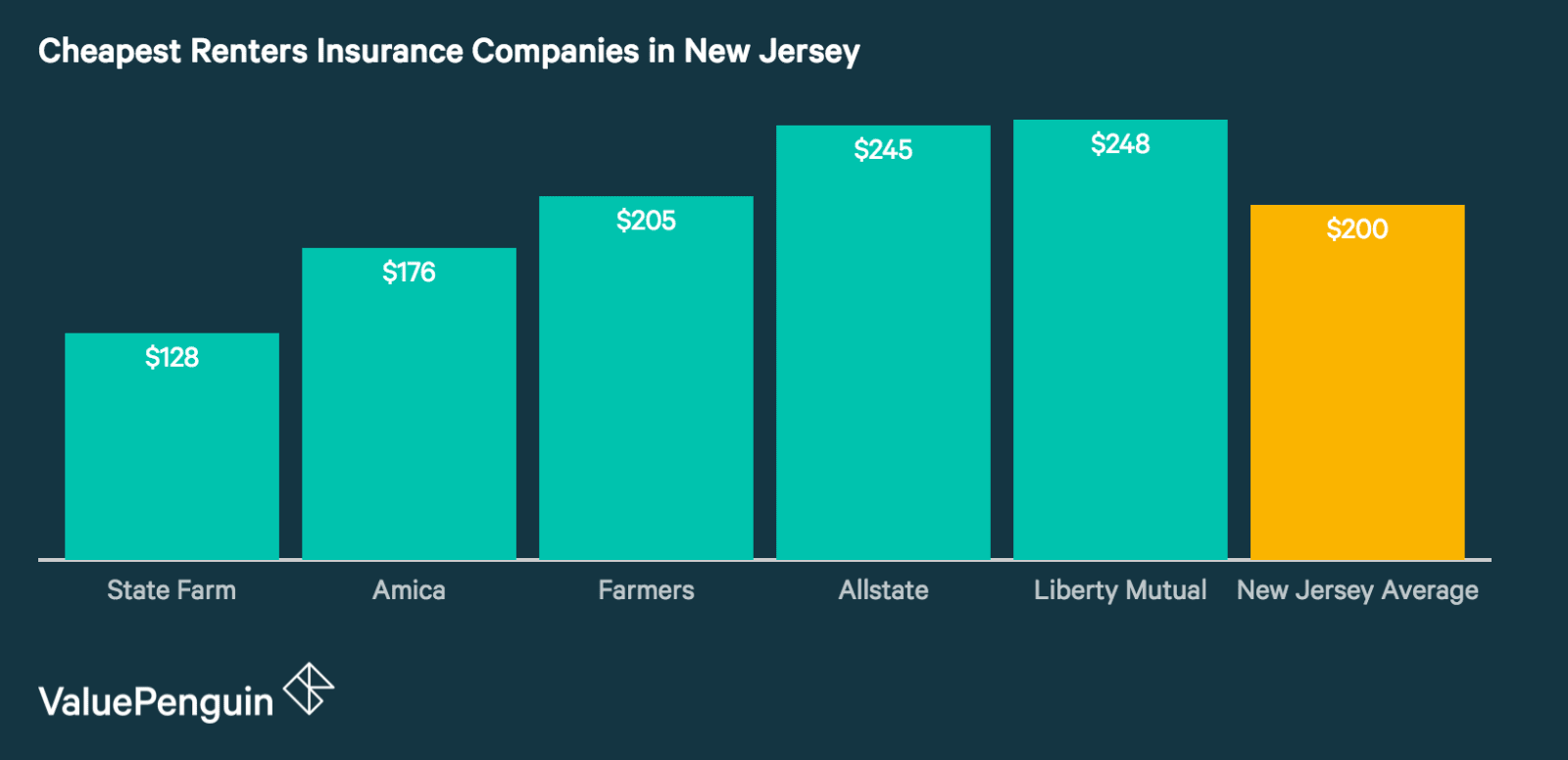

Cheap Renters Insurance In New York By Carrier

Renters insurance is designed to protect a renter’s personal possessions against damage or theft. When finding cheap renters insurance in New York by carrier, it is easy to be overwhelmed with the many options available. But don’t worry we have got you covered, we have compared renters insurance costs from major insurance providers in New York and prepared a list of cheap renters insurance companies.

Among the carriers surveyed, State Farm is the cheapest insurance company that offers insurance policies to renters in New York at about $147 a year, on average. Find below renters insurance rates of other cheapest renters insurance companies in New York.

| Company name |

|---|

Don’t Miss: Registering A Car In New York State

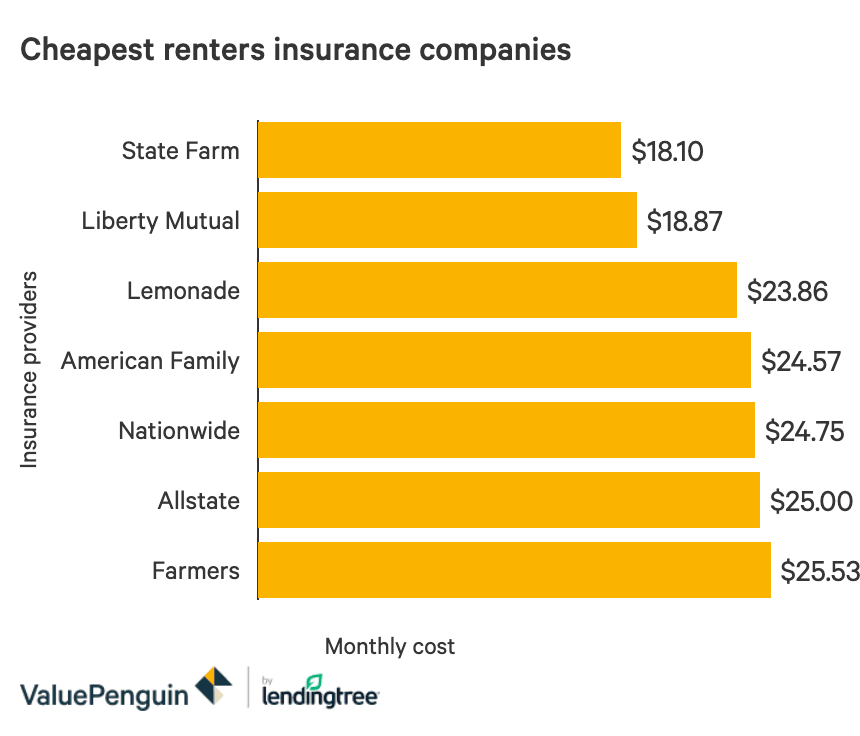

Cheap Renters Insurance Companies In New York

Cost is a a major factor for New Yorkers shopping for renters insurance. Our research found that Lemonade is the most affordable company in the state. A Lemonade policy costs an average of $61 per year, while the next most affordable insurer in New York is State Farm, with an average annual rate of $125.

These prices are for a plan with personal property coverage of $20,000, liability coverage of $100,000 and a deductible of $500. The premiums are based on costs obtained from multiple ZIP codes across New York.

Personal Property Coverage:

Financial Stability

On top of standard coverage, Nationwide presents optional add-ons such as theft extension, valuables plus, water backup and earthquake coverage.You can ask for a free quote over the phone or online. Nationwide provides discounts for being claim-free, installing a safety device or bundling multiple policies.

What Renters Insurance Typically Does Not Cover In New York

Renters insurance in New York generally covers many emergencies but excludes the following relatively common events.

- Home Structure: Damage to the buildings frame and structure is excluded. Obtaining coverage for the building structure is your landlords responsibility.

- Flooding: Certain water damage is reimbursed, but not damage due to flooding. If you live in an area prone to flooding, you should get adequate coverage by buying insurance through the National Flood Insurance Program .

- Other Exclusions: Standard renters coverage excludes jewelry and other valuable items that exceed property limits, damage to your car, your roommates property and damage from earthquakes. You can consider getting add-on coverage for these issues.

Read your renters insurance policy carefully to find out what it covers so you can make an accurate claim.

Recommended Reading: New York Times Delete Account

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.