Financial Help With Marketplace Plans In New York

The federal government provides financial assistance based on your income and household size. You can receive help through premium tax credits, cost-sharing reductions, or both when you enroll through the Marketplace.

- Premium Tax Credits : This lowers your monthly premium on any metal plan. Before 2021, you qualified for help paying for health insurance if you earned between a certain range .In 2021, you qualify for subsidy help if you pay more than 8.5% of your household income on health insurance. In 2020, more than half of New York enrollees received subsidies.9 The average subsidy was $325.10

- Cost-Sharing Reductions : This lowers your out-of-pocket costs only on silver plans. You must earn up to 250% of the FPL to qualify, or $43,100 for a family of two. Just 12% of New York enrollees got CSRs in 2020.11

How Much Does Company

The National Business Group on Health report provides key insights into group health insurance trends and costs. According to their news release:

In 2020, the average group health insurance cost per employee per year is $15,375 . This means that the cost of the average employer-sponsored premium increased 5 percent from 2019.

How Does Medicaid Provide Financial Assistance To Medicare Beneficiaries In New York

Many Medicare beneficiaries receive financial assistance through Medicaid with the cost of Medicare premiums and services Medicare doesnt cover such as long-term care.

Our guide to financial assistance for Medicare enrollees in New York includes overviews of these programs, including Medicare Savings Programs, long-term care coverage, and eligibility guidelines for assistance.

Don’t Miss: How Much Are Tolls From Virginia To New York

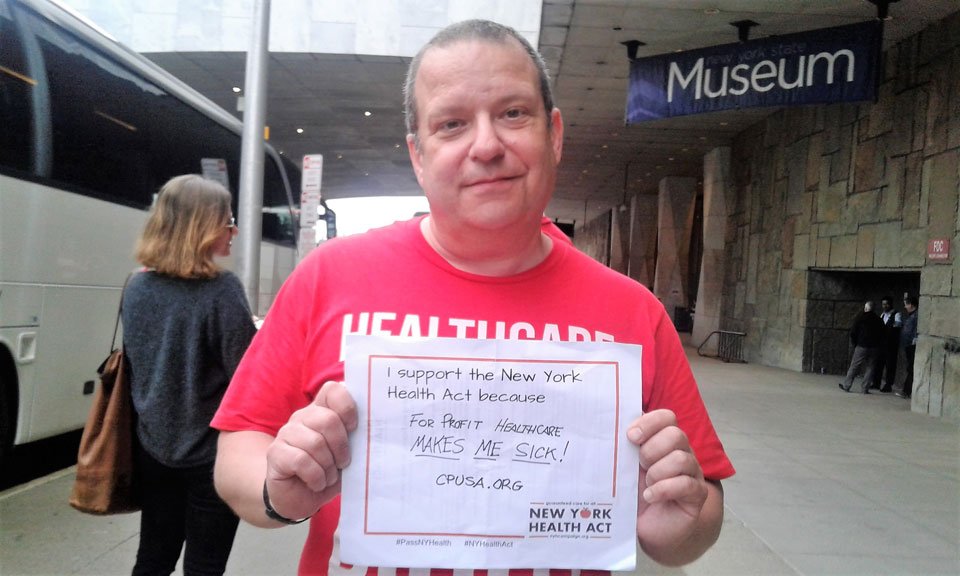

Why Should Businesses Support The New York Health Act

The New York Health Act would be hugely beneficial to businesses. Instead of paying a per employee premium, the business would pay a proportionally smaller tax to the government to offset the cost coverage. Business owners can focus on running their businesses, instead of fighting health insurance companies. The savings can be passed on to their customers, and allow them to pay more in wages. For more on the business case for universal, single-payer healthcare, visit: www.fixithealthcare.com

Can I Buy Private Insurance

Private insurance that duplicates benefits offered under New York Health could not be offered to New York residents. Thats important to prevent a 2-tier system, so wealthy New Yorkers have a stake in maintaining the quality of New York Health. But private coverage could be sold for benefits that would be outside the NY Health program, like purely cosmetic surgery.

Also Check: How To Submit Poetry To New York Times Magazine

Where To Buy Private Health Insurance

You can purchase an ACA plan at Healthcare.gov through Aug. 15, 2021, in most states, or beginning again Nov. 1 each year.

You can buy a private marketplace plan directly from an insurance company or insurance broker at any time. Search online for carriers and brokers, and compare several different plans and premium costs to find the right product for you.

The Bottom Line On Off

In summary shopping around for quotes on health plans is a smart move every open enrollment. The more you understand what the private insurance market offers, the better your chances of finding the best plan for you. That being said, if you qualify for cost assistance your best choice will almost always be a subsidized marketplace plan.

Read Also: New York Times Paywall Smasher Browser Extension

The Individual Coverage Hra

Beginning January 2020, employers have access to the individual coverage HRA . With this HRA, businesses of any size can offer employees an HRA without maximum reimbursement limits, and they are not limited by company size. The ICHRA also allows businesses to set eligibility guidelines and offer different allowance amounts to different employees based on 11 different employee classes.

Age 29 Rider Coverage Expansion

Under the Affordable Care Act, young adults can be covered under their parents’ health insurance plans up to the age of 27. Because of the way insurance is priced in New York, it is preferable for young adults to stay on their parents’ plans until the legal age limit, since the additional cost is at most 70%â85% of the parents’ health plan premium.

For example, say your young adult child has passed the age of 27 but does not have a job or sustainable income to pay for their own insurance. In this case, you could pay a small extra premium along with your normal health insurance rate that would allow your coverage to support your son or daughter. To qualify, the young adult must:

- Be unmarried.

- Not be insured or eligible for insurance through their employer.

- Live, work or reside in New York state or the insurance carrier’s coverage area.

Read Also: Rolling Loud Vip Munchie Pack

Change In Average Health Insurance Cost For 2021

From 2020 to 2021 health insurance rates decreased across the nation by over 2%. Additionally, year over year, Indiana saw the largest jump in health insurance costs across all metal tiers increasing nearly 10%. Including Indiana, 21 states had their rates increase on average from 2020 to 2021.

Both Pennsylvania and New Jersey switched their health insurance exchanges from being government-based to state-based. Interestingly, New Jersey had an increase in rates of close to 9% due to the change, while Pennsylvania’s rates went down decreasing by 8%.

On the other hand, rates in Iowa and Maryland decreased the most year over year, falling 20% and 17%, respectively. Overall, 27 states experienced a decrease in health insurance premiums.

| State |

|---|

Policy premiums are for a 40-year-old applicant.

How Will We Pay For The New York Health Act

Many people assume expanding coverage will mean a more expensive system. But the reality is that there is so much waste, fraud, and profiteering in the current system, that moving to a universal, single-payer model actually costs less than the status quo for both the state and 90% of individuals. Below is a graph that shows the funding sources, as well as estimated costs to individuals by income bracket for the NY Health Act. These are based on conservative estimates from the RAND Corporation that savings compared to the current system is $11 billion. The bottom line is that not only is it a moral imperative to guarantee everyone access to care as a right and public good, it is fiscally conservative. We simply cannot afford not to have a single-payer system.

For a deeper dive into the cost and savings of the system to the state and individuals,

You May Like: Where Is The Wax Museum In New York

Medicare Enrollment In New York

As of July 2020, nearly 3.7 million people were covered by Medicare in New York, amounting to about 19 percent of the states population.

In most cases, Medicare enrollment goes along with turning 65 years old. But people who have been receiving disability benefits for at least 24 months are also eligible for Medicare .

In New York, 15 percent of Medicare beneficiaries are under 65 and eligible due to disability, which is the same as the nationwide average .

What About People Who Work For Insurance Companies

Reducing our current bloated insurance bureaucracy will inevitably lead to some job loss. However, the adoption of a single-payer system is expected to lead to the creation of many new jobs in other industries throughout the state. Once employers are freed from the burden of buying private insurance for their workers, they will have much more money to invest in their business and hire more workers.

For those who currently work for private insurance companies, or in the billing department for providers, there is funding in the bill to support their transition to new employment. Some will transition to work in the new system, and others may take on roles for care coordination or healthcare delivery. The economic impact study performed in 2015 estimated that over 70% of the displaced workers will have new jobs within six months. By the end of the second year, over 99% of the displaced workers will have found new employment. While this may present individual challenges, advocates prioritize a just transition to meaningful and well-compensated work in the new system.

You May Like: Where To Watch Csi New York

Wont This Be A Huge New Tax Increase

No. We will actually save billions of dollars because we wont be paying for insurance company administration or health care provider costs for dealing with them. Additional savings through State bargaining for reduced pharmaceutical and equipment prices. We wont be paying regressive premiums, or any deductibles, co-pays, or out-of-network charges. Property taxes will go down because local governments wont pay for Medicaid, and health care for their employees will be cheaper. New Yorkers will have more money in our pockets and better health care for our families, and the tax that pays for the plan will be based on ability to pay.

What Metal Tier Of Health Insurance Should I Purchase

The best metal tier of health insurance will depend on your health, insurance needs, age and family situation. Generally, younger and healthier individuals will not require a higher metal tier such as Gold or Platinum since they will not use the insurance as frequently.

On the other, families with children may want to consider Silver health insurance as this policy will have considerably more coinsurance benefits compared to Bronze or Catastrophic. Individuals with monthly drug prescriptions or personalized health care will want to consider a Gold plan or higher since these provide the most benefits. Read more

Also Check: Hollywood Wax Museum Parking

Overview Of Total Coverage In Canada

In Canada, there are two types of plans that make up your total health coverage: Basic plan and extended plan.

Your basic plan, as an international student, is through UHIP . This plan is specifically tailored for international students to provide them with similar coverage to the government plan.

Your extended health plan is administered by your student union. Below is where you can get information regarding your extended health plan and who you can contact if you have questions:

- Undergrad students: Your student union is York Federation of students . For information regarding the plan, please visit: . If you have further questions, you may contact .

- Grad students : Your student union is Graduate Student Association . For information regarding the plan, please visit: . If you have further questions, you may contact health@yugsa.ca.

- Grad students : If you are a TA, your extended health plan will be provided through CUPE as an employee. For information regarding your extended health plan, please visit: .

For a detailed infographic showing the difference between basic and extended health plans, click here.

How Does New York Health Reduce Costs

New York Health reduces costs by cutting waste, not by denying care to patients. As proven in other countries, providing universal coverage is actually much cheaper since you arent paying for insurance companies marketing, claims denial departments, shareholder profits, or bloated CEO salaries. Also, when people have more access to care, they get treatments earlier before conditions worsen and become more costly. Even prescription medicine costs less, since the government could negotiate bulk prices.

In addition, doctors charge less when they dont have to pay for extra staff to manage all the intricate billing that comes with private insurers. The cost of employing huge departments to handle all this red tape gets passed on to you, making everything more expensive.

In fact, our government already spends MORE per person on healthcare just for the elderly and poor under Medicare and Medicaid than the Canadian government spends to provide healthcare for every citizen.

NYH controls costs through:

Read Also: Newyorklottery.net

How Is The Ny Health Act Able To Improve The Response To A Pandemic

Across the world, universal healthcare systems that prioritized public health interventions have been better able to handle the COVID-19 pandemic.

In universal systems, no one lost their health insurance when they lost their job. Here in NYS, at least 300,000 people lost their health insurance in 2020. In the middle of a pandemic.

The NY Health plan will guarantee New Yorkers access to high quality care no matter your employment, age, income, race, or immigration status. It even covers full-time workers who live outside of New York State.

Doctors and nurses can spend time caring for patients, and not fighting health insurance companies to approve care.

A more coordinated system will better be able to manage supply, staff, and vaccine distribution based on where resources are needed most.

Most importantly, profit will not be the motivation for healthcare decisions. The system will instead prioritize high quality and equitable outcomes for people.

More information on COVID and the NY Health Act can be found here.

Factors That Affect Premiums

Many factors that affect how much you pay for health insurance are not within your control. Nonetheless, it’s good to have an understanding of what they are. Here are 10 key factors that affect how much health insurance premiums cost.

The coverage offered by employers contributes to several of the biggest factors that determine how much your coverage costs and how comprehensive it is. Lets take a closer look.

You May Like: Thrush Poetry Submissions

Individual And Family Health Plan Guide

This guide will help compare differences between ACA compliant plans and Non-ACA plans. Non-ACA plans can save you a great deal of money and offer greater access to providers. Having said that, Non-ACA plans arent for everyone. If you have significant health issues and very specific needs you may need to stay in an ACA plan. Keep reading for more information.

Non-ACA Short Term Medical plans

Cost* Those whose incomes are within the sweet spot can obtain sizable subsidies making their ACA plan little to no money.

How Do I Get Health Insurance

Health insurance gives you better access to medical services, can improve your health, and protects you from paying high out of pocket costs if you get sick. New York State has a health insurance marketplace where you can shop for both public and private health plans called the NY State of Health, or NYSOH. You also have the option to purchase off-marketplace plans offered by various insurance companies. These plans are all subject to the Affordable Care Act rules of minimum essential coverage and other ACA protections. Some important things to consider when choosing a plan are your eligibility, the services and benefits offered by the plan, and the cost of the plan.

Below is a list of health insurance programs offered in New York State. Click on the program to find out more information about your health plan options. If you need assistance choosing a health plan that works best for you, please contact CHA at 888-614-5400.

You May Like: New York Ticket Pay

Is Health Insurance Getting More Expensive

It certainly feels like it. And its true that over the last decade, health care costs have risen significantly. The average family is paying 55% more in their premium in 2020 versus 2010 according to the Kaiser Family Foundation.5 And that number is up 22% since 2015.6 But premiums have only risen 4% when comparing 2020 against 2019.7

Health care costs also change based on where you live. In some states theyre up, in other places theyre lower.

If you feel like youre drowning in sky-high health insurance costs, there are some ways to save money on health insurance. Dont give up hope. You always have options, even if it just helps your budget a little. There are also some ways to save on health care costs your insurance doesnt cover.

And if youre trying to cut costs while paying off debt, or youre just starting to budget and barely making ends meet, you might want to choose a high-deductible and lower-premium plan that will kick in if you have serious medical issues or an accident. This allows you to focus on your necessities before you tackle an expensive health care plan.

How Much Is Private Health Insurance

What you’ll pay for a private health insurance plan depends on many factors, including:

- Your income and age

- Number of people on the plan

- Insurance company

- Plan type

- Plan tier

- Benefits

Research suggests that the average monthly premium for an ACA plan is $456 for individual coverage and $1,152 for family coverage.

“Take this data with a grain of salt $456 per month as a benchmark, but young and healthy policyholders should expect to pay far less for a basic policy, while older policyholders with pre-existing health conditions should expect to pay far more,” Martucci notes.

According to the Urban Institute’s latest findings, the US average benchmark premium for a Silver ACA marketplace plan held by a 40-year-old nonsmoker in 2021 is $443 per month, down from $451 tallied last year.

The average premium cost for a private marketplace plan may be higher or lower, based on different factors. For instance, New York plan costs an average $575 compared to Florida, which costs $449 on average per month.

Read Also: How Much Are Tolls From Virginia To New York