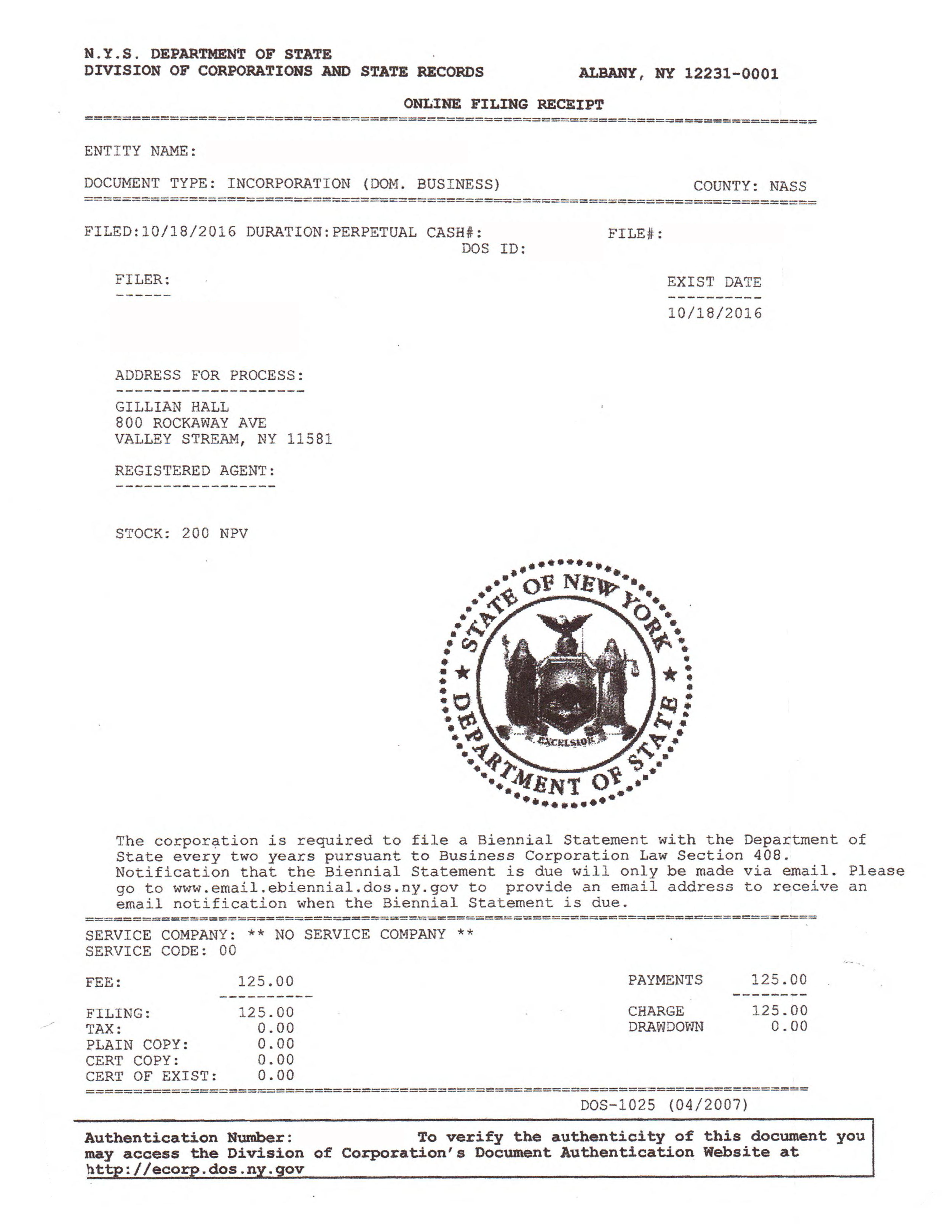

When Is The New York Biennial Statement Due

The filing period for your New York Biennial Statement is the month in which your original Articles of Organization were filed. Its due every other year.

When you sign up for Northwest, we send you reminders for your Biennial Statement due dates. Want one less thing to worry about? With our business renewal service, we can complete and submit your Biennial Statement for you for $100 plus the state fee.

Creating An Llc In Ny: Eligibility Requirements

The New York Department of State sets the eligibility requirements for LLCs in the state of New York. You need to meet one of two qualifications to create an LLC in NY:

There are also industry, licensing and zoning rules to follow, many of which are specific to your city or municipality. For example, starting a daycare, a food service establishment, or a home-based business all require special permits. In NYC, even temporary situations or one-time events, such as a grand opening in a public park or on a city block, require express permission from the city.

Research the rules for location-specific requirements and get the necessary licenses and permits so you can legally start your LLC in NY. For guidance on legal obligations, consult the business resources your city offers. In NYC, you can use the step-by-step online business wizard to determine exactly how to start a business in the city.

Limited Liability Companies And Limited Liability Partnerships

A limited liability company is an unincorporated organization, with one or more members, each having limited liability for the contractual obligations and other liabilities of the company, other than a partnership or trust, that is formed for any lawful business purpose under the Limited Liability Company Law of New York State or under the laws of any other jurisdiction.

A limited liability partnership is a partnership whose partners are authorized to provide professional services and that has registered as a limited liability partnership under Article 8-B of the Partnership Law of New York State or under the laws of another jurisdiction.

Also Check: Where To Watch Csi New York

How To File Articles Of Incorporation In New York

Filing the Articles of Incorporation Electronically Use the New York State Department of Corporations online filing system. Select Domestic Business Corporation. Under the heading of Online Filings, you will select Domestic Business Corporation to begin creating your online Certificate of Incorporation.

How Can I Withdraw My Nys Dba

Contact your county clerk for county-specific instructions for withdrawing your DBA for your unincorporated business.

For incorporated businesses, you will need to file for discontinuance of your assumed name with the NY Department of State. You can find the Certificate of Discontinuance of Assumed Name form here.

Don’t Miss: How To Transfer A Dba In New York

Obtain Business Licenses And Permits

The licenses and permits required for an LLC in can vary, depending on a number of variables:

- Location

- Type of Business

- Industry

If you would like to see more in-depth information on licenses and permits, please feel free to visit the content in our learning library that covers business licenses and permits.

How Do I Open A Bank Account For My New York Llc

To open a bank account for your New York LLC, you will need to bring the following with you to the bank:

-

A copy of the New York LLC Articles of Organization

-

The LLC operating agreement

-

The LLCs EIN

If there are multiple members in the LLC, you may also want to bring an LLC resolution to open a bank account that states that the person going to the bank is authorized by the members to open the account in the name of the LLC. Northwest can help with this as wellLLC bank resolutions are one of the many free legal forms we provide to ensure you can get your LLC started fast.

Don’t Miss: Where To Stay In New York

Step : Create A New York Llc Operating Agreement

All New York LLCs are required to have an operating agreement. This may be a verbal or written agreement.

What is an operating agreement? An operating agreement is a legal document outlining the ownership and operating procedures of an LLC.

Why are operating agreements important? A comprehensive operating agreement ensures that all business owners are on the same page and reduces the risk of future conflict.

For more information on operating agreements, read our New York LLC operating agreement guide.

Recommended: Download a template or create a Free Operating Agreement using our tool.

FAQ: Creating a New York LLC Operating Agreement

Do I need to file my operating agreement with the State of New York?

No. The operating agreement is an internal document that you should keep on file for future reference. However, many states like New York do legally require LLCs to have an operating agreement in place.

Service And Membership Restrictions

A New York PLLC can only provide the professional services indicated in its articles of organization. The practice of multiple professional disciplines is not allowed for PLLCs in the professions of medicine, dentistry, veterinary medicine, licensed clinical social work, mental health counseling, psychoanalysis, creative arts therapy, and marriage and family therapy. PLLCs that combine design professions are allowed as long as there is at least one PLLC member licensed for each professional service provided by the PLLC. A New York PLLC generally can engage in any other, non-professional business activities permitted under the state’s LLC laws. In general, only licensed professionals can be members of a New York PLLC. And, finally, remember that New York PLLCs and/or their members are subject to the regulation of the relevant state professional licensing authorities.

You May Like: Where To Stay In New York Tourist

How To Become A Corporation In New York

The New York template Certificate of Incorporation suggests reporting 200 shares, without par value. This is how most new corporations begin. You should meet with an attorney to discuss your planning and strategies related to issuing corporate shares. Name the Secretary of State for service of process.

Step : New York Llc Ein You Need One Heres How To Get It

What is an EIN? The Employer Identification Number , Federal Employer Identification Number , or Federal Tax Identification Number , is a nine-digit number issued by the Internal Revenue System an Employer ID Number is used to identify a business entity and keep track of a businesss tax reporting. It is essentially a Social Security number for the company.

Why do I need an EIN? An EIN number is required for the following:

- To open a business bank account for the company

- For Federal and State tax purposes

- To hire employees for the company

Where do I get an EIN? An EIN is obtained from the IRS by the business owner after forming the company. This can be done online or by mail.

Read Also: How Much Should I Save To Move To New York

I Have A New York State Llc How Do I File My Taxes

Clients will frequently tell me they have an LLC and expect that to explain everything. However, as an accountant, the LLC status does not tell me anything . In other words, LLC status is more a legal term rather than a tax-related term. What you want to know about your business is: are you a:

- Single member LLC

- S Corp

- C Corp

- Partnership

Being an LLC means you can actually be filing under any of the above. If you have not specifically indicated to the IRS or any state that you are a partnership or corporation, then you are a single-member LLC and can file on your schedule C. This is actually beneficial for several reasons:

- Schedule C tax returns are flow-through, so all losses incurred in the ordinary course of business will be deductible on your personal return

- Schedule C tax returns are easier to complete and accounting fees are typically much lower for this sort of business as opposed to running a partnership or corporation return and then separately booking the income into your individual return

The drawbacks to filing your business as self-employment income include the following:

This schedule then feeds directly into your personal return. This is the easiest type of return to produce, and will eventually end up on your NY state IT-201 return. If you are a partnership or corporation, your taxes will go on a form 1065 or 1120/1120s return.

What Is A Foreign New York Llc

A foreign New York LLC is any LLC formed outside of New York but registered to do business in the state. For example, if you formed an LLC in Connecticut but wanted to conduct business in New York as well, you would register as a foreign LLC in New York by filing an Application for Authority with the New York Secretary of State. Like domestic LLCs, foreign LLCs in the state have to file New York Biennial Statements. Northwest can register your foreign New York LLC for you today!

Don’t Miss: How Much Is The New York Times Newspaper

Complete The Process By Filing With The New York Department Of State

Once youve obtained our consent and prepared the Certificate of Dissolution, youre ready to file with the Department of State. Your filing must include:

- one Certificate of Dissolution and

- a check for $60 payable to the New York Department of State.

You may file in person or by mailing to:

NEW YORK DEPARTMENT OF STATEDIVISION OF CORPORATIONS99 WASHINGTON AVEALBANY NY 12231

You may also fax the completed Certificate of Dissolution, the consent of the New York State Department of Taxation and Finance, consent of the New York City Department of Finance, if required, and a Credit Card/Debit Card Authorization Form to the Division of Corporations at 474-1418.

Once the Department of State accepts the Certificate of Dissolution for filing, theyll issue your corporation a filing receipt. The filing receipt establishes the date that the corporations existence comes to an end.

Tax Treatment Of Llcs And Llps

- The New York personal income tax and the corporate franchise tax conform to the federal income tax classification of LLCs and LLPs.

- An LLC or LLP that is treated as a partnership for federal income tax purposes will be treated as a partnership for New York tax purposes.

- An LLC or LLP that is treated as a corporation, including an S corporation, for federal income tax purposes will be treated as a corporation for New York tax purposes or as a New York S corporation if the New York S election is made .

- A single-member LLC that is treated as a disregarded entity for federal income tax purposes will be treated as a disregarded entity for New York tax purposes.

- If the SMLLC is disregarded and the single member is an individual, the SMLLC will be treated as a sole proprietorship for New York tax purposes.

- If the SMLLC is disregarded and the single member is a corporation, including an S corporation, the SMLLC will be considered a division of the corporation for New York tax purposes.

- If the SMLLC is disregarded and the single member is a partnership, the SMLLC will be considered a division of the partnership.

- For information regarding the tax treatment of an LLC or LLP for purposes of the New York City Business Corporation Tax, New York City General Corporation Tax , and the New York City Unincorporated Business Tax , please visit the New York City Department of Finance Business webpage.

Also Check: How To Submit Poetry To New York Times Magazine

What Is Membership Interest

Membership interest is your percentage of ownership of the LLC. Membership interest is normally proportionate to your investment. So how does this work?

Imagine your LLC has 5 members. 4 members each invest $1,000 in the business. One member invests $6,000. The total contribution of all members is $10,000. The 4 members each own 10% of the business. The moneybags member who shelled out $6,000 owns 60% of the business.

Typically, this also means that the 4 members would each get 10% of any profits, and moneybags would get 60%. Exactly how profits and losses are allocated, however, can be adjusted in the operating agreement as long as changes are in line with IRS requirements and New York laws.

Publish Notice Of Llc Formation

NY state law requires you to publish a copy of your articles of organization or a notice of your LLC formation in two newspapers for six consecutive weeks within 120 days of your LLC formation.

You have to publish your notice in newspapers approved by the NY county where your LLC is located. To find out which newspapers are acceptable, contact your county clerk. If you choose to publish a notice instead of your articles of organization, be sure the LLC name in the notice matches the Department of States records as set forth in your initial articles of organization.

To get your notice published, contact the newspapers yourself or hire a third-party service to handle it for you. The newspapers will provide you with an affidavit of publicationâtheyll also charge a publication fee. NYC-based business may have to pay several thousand dollars due to steep publishing rates for NYC newspapers. To save money, you might choose a registered agent outside NYC so you can use that address as your LLCs office address. That way you could run your publication notice in a newspaper in that county, which likely has lower publishing rates.

Once youve fulfilled the publication requirement, youll need to submit a Certificate of Publication, along with a $50 filing fee, to the New York Department of State.

Read Also: Is Car Insurance Required In New York

Create A Name For Your New York Llc

Before you register your LLC, you’ll need to come up with a name. Your business name needs to be catchy for branding purposes and legitimate for legal purposes.

We go into depth on this topic in our LLC naming guide. Well go over the basics below.

Naming Your LLC

First, brainstorm some possibilities. Use our LLC name generator to get the ideas flowing.

Next, make sure your name meets New York guidelines:

- it contains the words limited liability company, limited company, LLC or L.L.C.

- it doesn’t contain words like academy, bank, lawyer, mortgage, university, or doctor

- it must be distinguishable from any other entity or trade name registered in New York

- full list of New York naming guidelines

Next, do a New York LLC name search with the Secretary of State to find out if your name is available in New York.

If your business name is available and meets guidelines, youll be able to register it when you file your New York Articles of Organization with the Secretary of State.

Is the URL available? Before you commit 100% to a name, check to see if theres a good web domain available.

We recommend buying your domain right away because even if launching a business website isnt on your radar right now, it will be soon.

Powered by GoDaddy.com

How To Get Articles Of Organization New York State

The New York state articles of organization LLC is available to the public and you can get it via:

- Online- by going to the state site, you can request the forms online after creating an account. This method works great for people who want to complete the process online i.e., filling the details, making the payment and submitting the paperwork

- The state site the form is readily accessible on the New Yorks Business Express website and you do not even have to open an account. All you need to do is to download it, fill it and send it to the authorities.

Accessing the New York LLC articles of organization will not cost you anything. However, please note that you will need to pay a fee when filing the form with the state.

Recommended Reading: When Is Billie Eilish Coming To New York

What Is A Professional Service

Under the relevant New York law, professional service is defined only generally, as any type of personal service which may be lawfully rendered by a member of a profession within the purview of that profession. Other states’ laws often provide itemized lists of professional services. These lists typically include, at a minimum, physicians, surgeons, dentists, lawyers, certified public accountants, professional engineers, architects, and veterinarians, but usually include other professions, as well.

While New York’s LLC law does not provide an itemized list of professional services, it does have provisions that indicate that all of the followingwhen properly licensed by the stateconstitute professional services:

- the practice of medicine

- professional engineering, land surveying, architectural and/or landscape architectural services

- clinical social work services

- mental health counseling services

- applied behavior analysis services, and

- the practice of law.

If you’re unsure whether your New York licensed or authorized profession is considered a professional service for the purpose of forming a PLLC, check with a local business attorney.

Domestic New York Llc Name Change Instructions

We recommend using the Certificate of Amendment Name Change Only as its easier than Form 1358. The instructions below are for Form 2120.

Insert Name of Domestic Limited Liability Company: On the first line, enter your existing/old LLC name. Make sure to include the designator, such as LLC or L.L.C..

FIRST: The name of the limited liability company is: Enter your existing/old LLC name again.

If the name of the limited liability company has been changed, the name under which it was organized is: For most filers, this will be left blank. Youd only have something here if this is the second time youre changing your LLC name.

SECOND: The date of filing of the articles of organization is: This is the date your LLC was approved by the New York Division of Corporations. You can find this date on your approved Articles of Organization. Or you can search your LLC name on the Business Entity Database page. Click on your LLC name and look for the Initial DOS Filing Date.

THIRD: The amendment effected by this certificate of amendment is as follows: The state has technically already filled this section in for you. It will read, Paragraph FIRST of the Articles of Organization relating to the name of the limited liability company is hereby amended to read as follows:

FIRST: The name of the limited liability company is: Enter your new LLC name here. Make sure to include the designator. As per section 204 of the NY LLC law, the allowable designators in New York State are:

- LLC

You May Like: How To Move To New York Without A Job