What Is Considered Overtime In Nyc

Plenty of employees in New York City work irregular hours. Their shifts arent consistent they work a little less one day and a lot more the other. Even if you have regular hours, it can be challenging to tell your standard shift apart from the point youre entering the overtime zone. To know whether youre entitled to overtime pay, you first need to understand what is considered overtime work in NYC.

Overtime provisions are defined by a set of laws that fall in the category of labor laws. On a federal level, the US Department of Labors Fair Labor Standards Act sets strict overtime work regulations.

Taking cues from the federal labor law, each state and city has the option to extend additional protections to their workers . This is why employment laws in New York State are slightly different than those in other states.

Exempt And Nonexempt Employees

The first thing to clear up when talking about the overtime law is that the FLSA recognizes two types of employees: those exempt from minimum wage and overtime pay and those who are not. Exempt employees are not eligible to receive overtime pay.

Employees exempt from overtime pay have a base salary of at least $684 per week and work a white-collar job. The FLSA defines five groups of exempt employees: administrative, executive, professional, computer, and outside sales employees. For an employee to qualify for an exemption, they need to perform the primary duties outlined in the FLSA. Job titles do not exclude an employee from overtime pay if they dont perform the duties relevant to the overtime exemptions.

If you are working a blue-collar job or in any way dont belong to the category of exempt employees, you are eligible for overtime pay.

Overtime Law In New York

Eligible employees must receive overtime compensation when working more than 40 hours in a week, according to the Fair Labor Standards Act. Some workers may be exempt from overtime pay under NY overtime law. For more information about overtime laws in New York, visit the New York Department of Labor’s labor standards page.

You May Like: Toll Calculator Dc To Nyc

Were You Not Paid Overtime When You Worked More Than 40 Hours In A Workweek Call Samuel & Stein

The experienced New York City Wage and Hour attorneys at SAMUEL & STEIN are dedicated to asserting and defending the rights of employers and working people throughout New York and New Jersey. We have the resources, experience, and knowledge necessary to ensure your legal rights are protected and you are not taken advantage of. Call us today by dialing 681-4193 or use the convenient Evaluate Now box on our webpage. Together we can help answer your questions and protect your rights.

New York State Meal Breaks

- Factory workers

- Must be given at least a 60 minute break for a noonday meal.

- For shifts starting between 1:00 p.m. and 6:00 a.m., factory workers must be given a 60 minute meal break halfway between the start and end of the shift.

All workers, including white collar management staff, are covered by these provisions.

Shorter meal periods of not less than 30 minutes are permitted if this does not create a hardship for employees.

In situations in which there is only 1 employee on duty, the employee can eat on the job without being relieved as long as the employee voluntarily consents to the arrangement. However, if the employee requests an uninterrupted meal period, they must be given one.

Don’t Miss: Can I Register A Car Online In New York

Who Is An Exempt Employee

Some jobs are exempt from overtime under the federal FLSA, but can still receive overtime under New York State Labor Law. While these employees must be paid overtime, New York Law requires an overtime rate of 1.5 time the state minimum wage, regardless of the employeeâs actual regular rate of pay.

For an employee to be considered exempt from federal overtime laws, their specific job duties and salary must meet all the requirements set by either the U.S. Department of Labor or the New York State Labor Law. State overtime requirements do not cover federal, state and local government employees. It does cover nonprofit organization, and private and charter school non-teaching employees.

The following types of employees are frequently exempt from federal overtime rules:

- Executive

- Employees employed as âlearned professionalâ

- Members of Religious Orders

- Taxi Drivers

Bonus And Incentive Payments For Salary Employees

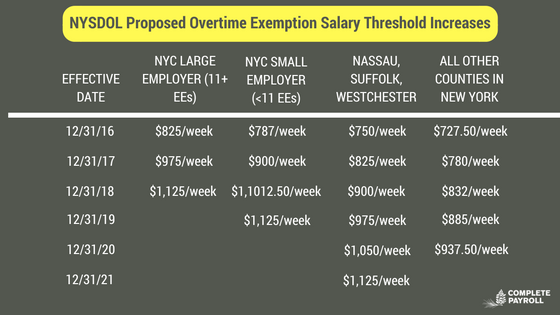

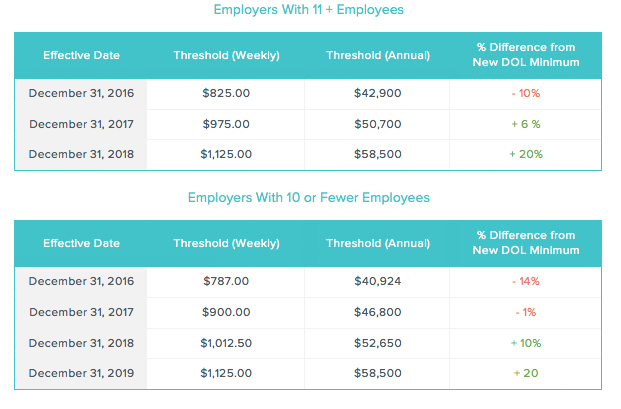

In 2020, the Department of Labor instituted a change in how employees weekly salary amounts are calculated for purposes of the salary basis test discussed above. If the employee is paid nondiscretionary bonuses or other incentive pay, such as commissions, at least once per year, then the employer can count those payments towards the employees weekly salary to determine whether the salary meets the minimum salary threshold under the salary basis test.

However, there is an important limit to this new ruleemployers may only use employee bonuses and incentive payments to account for a maximum of 10% of the threshold salary level. Thus, employers in New York City can only use employee bonuses and incentive payments to account for a maximum of $112.50 per week . For example, if an employee makes $950 per week, and then she makes an additional $2,000 that week on commission, she earns a total salary of $2,950 that week. However, only $112.50 of her $2,000 commissions earned is counted towards her weekly salary for purposes of the salary basis test. Thus, while the employees actual weekly income far surpasses the $1,125.00 per week threshold, only a total of $1,062.50 counts towards her weekly income for purposes of the salary basis test, so this employee would NOT be exempt from overtime pay during this workweek.

You May Like: How To Start An Llc In New York State

Salaried Employees And Overtime

Salaried employees are also eligible for overtime unless they fit into one of the exceptions below. Just because you are paid a salary rather than by the hour does not mean your employer can avoid paying you overtime.

For example, salaried employees can file unpaid overtime lawsuits.

However, there are a number of exemptions to the overtime rules. An unpaid overtime lawyer can determine whether you are exempt from overtime laws.

Recent Cases Of Overtime Wage Abuse In The Restaurant Industry In New York City

Overtime wage abuses happen frequently in popular New York City restaurants that you have probably enjoyed frequenting. Just last year, an assistant manager at an IHOP restaurant on Staten Island won $40,000 in a settlement for unpaid overtime wages. IHOP wrongly classified her assistant manager position as exempt from overtime pay benefits. However, assistant managers are not always exempt from the overtime wage provisions in the FLSA and New York Labor Laws.

A Subway located at Times Square in New York City reached a similar $42,500 settlement last year when a sandwich preparer alleged that he did not receive overtime pay. He claimed to have worked up to 60 hours a week making sandwiches and preparing toppings. Yet, he never received any overtime pay. Subway has faced many similar lawsuits in the past. Most notably, Subway violated wage payment laws more than any other fast food restaurant in 2014.

Finally, at L & B Spumoni Gardens, a pizzeria located in Brooklyn in New York City, a former cook filed a federal lawsuit last March. While working there for thirteen years, the former cook alleged that the owners often skirted employees of mandatory overtime pay. Despite working up to 75 hour work weeks, the cook claims that he always received the same hourly pay rate. The complaint filed in Brooklyns federal court revealed that there are 16 similarly situated employees at the pizzeria.

Read Also: Where Is The Wax Museum In New York

Deducting Employees Pay For Breaks That They Did Not Take Is Definitely Another Way To Cheat Your Employee Out Of Their Overtime Pay

For instance, employees do not get the benefit of the full meal break and are not paid for the time. This in turn becomes an automatic-deduction policy and you lose your overtime pay.

Seems a bit illegal, dont you think?

Our New York overtime lawyers think so and are fighting for employees and their overtime pay.

What Is Compensatory Time

Compensatory time also called comp time. This involves a policy where an employer gives workers time off at a later date instead of overtime pay for the extra hours they work. For instance, an employee who works 45 hours in a work week would be given 5 hours off the following week, or another time, instead of receiving 5 hours of overtime pay.

An employer who forces employees to take comp time instead of overtime pay may be breaking federal law if the employer is a private business. Privately owned businesses are typically not permitted to have comp time policies instead of paying overtime. Some state and local government employers may give comp time if they meet certain specific requirements.

Read Also: Delete New York Times Account

Defining A Workweek: Understanding When Overtime Pay Kicks In

Employees are only paid when they work more than 40 hours in a workweek. Therefore, just because an employee works more than his or her normal amount of hours in a day, that does not mean that the employee is entitled to overtime. The employee must work more than 40 hours in a workweek, not more than a normal day.

Therefore it is important to define a workweek. Unfortunately, this is not the same for every business or employee because a workweek does not mean a calendar week. Employers are free to set what they want as a workweek. Typically this coincides with a pay period.

Under New York law, an employer may set its own workweek but it must fix that period and make it regularly recurring. The workweek must be a consecutive 168 hours that the employer measures compensation and scheduling for an employee, which means 7 days in a row of all 24 hours. During this period, if an employee works more than 40 hours the employee must be paid overtime.

It is important to note that an employer cannot average weeks to make an employee only work 40 hours. For instance, if a pay period is two weeks and the employee works 60 hours one week and 20 hours the other week, the employer cannot say that the pay period was 80 hours which averaged 40 each to avoid paying overtime. In this situation, the employer would be required to pay 20 hours of overtime for the first week, and none for the second week.

What Counts As Overtime

The law requires that employees must be paid one and a half times their regular rate of pay for all hours worked more than 40 hours in any given week.

You are not entitled to overtime pay simply because you work more hours in a single day than you usually work. Overtime is calculated based on the number of hours worked during a workweek.

Overtime means more than 40 hours in a seven-day workweek.

Overtime requirements apply on a workweek basis. Your workweek is a fixed and regularly recurring period of 168 hours seven consecutive 24-hour periods. The workweek does not need to begin or end on any particular day of the week or begin at any particular hour of the day.

For example, a bank might use a Monday through Sunday workweek, while a retailer might use Saturday through Friday. However, it is illegal for employers to adjust the workweek in order to avoid paying employees overtime.

The law prohibits averaging hours worked in a two-week period.

Employers cannot take an average number of hours an employee worked in a two-week period to satisfy overtime laws, even if the standard pay period is two or more weeks.

For example, if you worked 50 hours last week but only 30 hours this week , your employer still has to pay you for 10 hours of overtime at time and one half for last week.

Employers cannot pay a flat rate for 40 hours regardless of hours worked.

However, your employer is legally allowed to prohibit overtime and to terminate workers that violate the rule.

Read Also: Pay Your Ticket Online Ny

Holidays / Vacation / Sick Leave

New York state law does not require payment for time not actually worked such as, holidays, sick time, or vacation.

If an employer provides these benefits, they may impose any conditions they choose, including the forfeiture of such benefits under certain circumstances. These policies must be in writing and the employees must be notified of the policy otherwise, the employer must pay the employee for accrued vacation upon termination of employment.

Am I An Administrative Employee

To determine if an employee qualifies as exempt for being an administrative employee, the federal government has created a test. Under the test, the employee must:

- Meet a salary basis test, meaning that they are given a fixed salary every week regardless of the amount of work that is done. Under the FLSA, the minimum salary that can qualify is $455 a week.

- Have primary duties which include office or non-manual work that relates to general business operations.

- Be expected to use discretion and independent judgment.

Recommended Reading: What Airlines Fly To Cabo San Lucas From New York

How Some Employers Use The Exception To Avoid Paying Overtime To Any Computer Employees

Of course, not every worker employed in the computer field will qualify for this exemption. Many tech support positions or help desk employees have job duties that do not meet the statutory requirements for exemption. Similarly, employees who simply use computer hardware and software as an integral part of their position will not necessarily qualify for the exemption.

The New York State Department of Labor addressed this issue in an interesting case involving a worker employed as a database analyst. The employer described the work as a data intensive position in the financial industry, which required the worker to analyze the performance of asset-backed securities to resolve cash flow payment. The employee also acted as a liaison for computer data businesses. Ultimately, the Department of Labor concluded that these duties did not meet the statutory requirements for the job duties of an exempt computer worker.

As another example, a worker who installs and maintains software on the company computers will likely not meet the requirements for the exemption. Why? Because she does not work as a systems analyst or programmer. Instead she installs and maintains software. Thus, even though her work depends on computers, because her job duties do not encompass systems analysis or software engineering, she is likely not exempt and therefore entitled to overtime if she works more than 40 hours in a week.

Wage And Hour Lawyers In New York

Famighetti & Weinick PLLC are employment lawyers on Long Island. Famighetti & Weinick handle wage and hour lawsuits in New York, including cases involving unpaid minimum wage and unpaid overtime. The employment lawyers can be contacted at 631-351-0050 or on the internet at .

Also Check: Can I Register A Car Online In New York

Who Is Eligible For Overtime

Employees earning less than $35,308 a year and who dont work in any of the exempt roles mentioned above are typically eligible for overtime. Workers who receive a salary and usually work in excess of 40 hours a week are usually eligible , and a Department of Labor ruling in September 2019 added 1.3 million new eligible workers in a move due to become effective on January 1, 2020.

Some jobs are covered for overtime at the federal level. In cases where an employee is subject to both the state and federal minimum wage laws, theyre entitled to whichever is higher. These federally covered roles include firefighters, paramedics, and police.

Nurses and paralegals are also covered due to their often-long hours of work, and it is prohibited to mandate overtime for nurses who are protected under Section 167 of the Labor Law. The Department of Labor offers e-tools that provide further help and advice about overtime for both employers and employees.

What Is An Unpaid Overtime Lawyer

An unpaid overtime lawyer specializes in filing claims for unpaid wages. Also known as a wage theft lawyer or an employment lawyer, these attorneys understand wage and hour laws, FLSA rules, and overtime laws.

Contact an unpaid overtime lawyer in your state to learn more about state overtime laws, the time limit to file a claim in your state, and the process of filing an unpaid overtime lawsuit.

Don’t Miss: Registering A Vehicle In New York

Overtime Pay In New York

The Fair Labor Standards Act and the New York Labor Law require that most employees receive overtime pay for all hours worked over 40 in a workweek. Overtime pay is one and one half times the regular rate of pay. Famighetti & Weinick PLLC are employment lawyers in New York and handle many of the issues discussed below relating to overtime pay in New York.

An Overview Of Flsa Ot And Unpaid Wages Rules For Your State

When you work longer hours than usual, making sure that youre paid correctly is even more important. And if you work more than 40 hours a week, then you may be one of the many employees that qualify for overtime compensation.

There are many misconceptions about overtime pay that make it difficult to understand if you qualify for overtime. There are a lot of common beliefs out there that may or may not be accurate. Thinking that working more than 8 hours in a day, working more than five days in a week, or working on weekends qualifies people for overtime tend to be common, inaccurate beliefs. It pays to know whether or not you are entitled to overtime pay in New York by becoming familiar with the states overtime laws.

Recommended Reading: Nyc.gov/parkingservices