Gains Or Losses From Real Property

In the past, the rules in this area were clear. Under current legislation, the phrase real property located in this state as defined in Tax Law section 631 is redefined to include interests in a partnership, limited liability company, S corporation, or closely held C corporation owning real property located in New York State if the value of the real property exceeds 50% of the value of all of the assets in the entity. There is a two-year lookback rule to avoid taxpayersstuffing assets into an existing entity before a sale. For sales of entity interests occurring on an after May 7, 2009, any gain recognized on the sale of an interest in that entity will be allocated among the assets in the entity, and the amount allocated to New York real property will be treated as New York-source income.

Nys Reaping Big Rewards On The New York Exit Tax

New York conducted 30,000 nonresidency audits between 2010 and 2017, recouping around $1 billion from the practice.

State auditors have collected $144,270 per audit since 2015.

New York State has a high success rate on audits because they go through a residents credit card and bank statements.

They also use new high-tech tools that include tracking phone records and social media. Auditors also review veterinary and dental records.

New York is also working extensively to catch those individuals who fake their move to Florida.

Floridas residents arent subjected to any income or estate tax, unlike New York.

Even Blanca Ocasio-Cortez, the mother of Representative Alexandria Ocasio-Cortez,touted Floridas low-tax system.

She fled New York for Florida. She told the Daily Mailfrom her home in Eustis:

New York Median Household Income

| Year | |

|---|---|

| 2010 | $54,148 |

What your tax burden looks like in New York depends on where in the state you live. If you live in New York City, you’re going to face a heavier tax burden compared to taxpayers who live elsewhere. Thats because NYC imposes an additional local income tax.

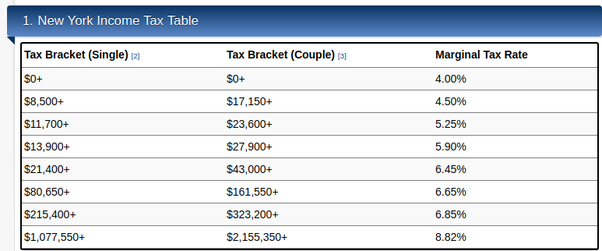

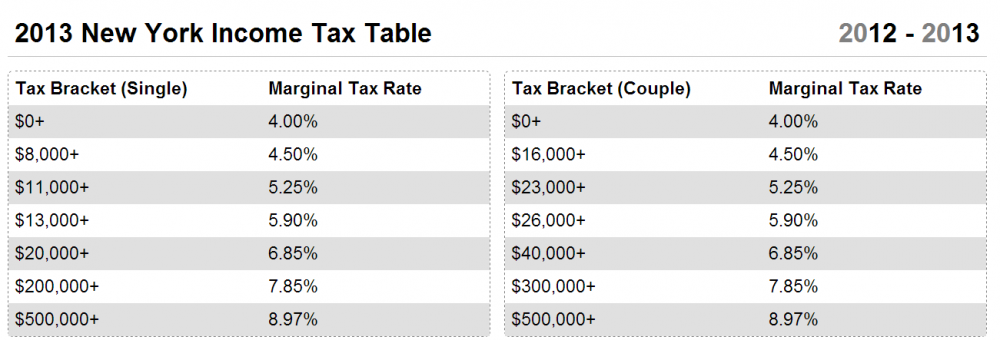

New York States progressive income tax system is structured similarly to the federal income tax system. There are eight tax brackets that vary based on income level and filing status. Wealthier individuals pay higher tax rates than lower-income individuals. New Yorks income tax rates range from 4% to 8.82%. The top tax rate is one of the highest in the country, though only individual taxpayers whose taxable income exceeds $1,077,550 pay that rate. For heads of household, the threshold is $1,616,450, and for married people filing jointly, it is $2,155,350.

Taxpayers in New York City have to pay local income taxes in addition to state taxes. Like the states tax system, NYCs local tax rates are progressive and based on income level and filing status. There are four tax brackets starting at 3.078% on taxable income up to $12,000 for single filers and married people filing separately. The top rate for individual taxpayers is 3.876% on income over $50,000. The rates are the same for couples filing jointly and heads of households, but the income levels are different.

Yonkers also levies local income tax. Residents pay 16.75% of their net state tax, while non-residents pay 0.5% of wages.

Don’t Miss: New York Times Travel Submissions

Technical Memorandum Issued By The Department Of Taxation And Finance

Pursuant to the enactment of the 2019-2020 Budget Bill, the Department of Taxation and Finance issued a technical memorandum discussing the sales tax collection requirements for marketplace providers. The memorandum reflects an increase in the sales threshold amount from $300,000 to $500,000, which is retroactive to June 1, 2019. Taxpayers affected by this change must register with the Department at least 20 days before beginning business in the state. This memorandum supersedes TSB-M-19S issued on May 31, 2019. S, 17/10/2019.)

New York Proposes Three New Tax Rates / Tax Brackets Which Would Raise Highest Individual Rate

Revised budget proposals from each of the New York State Assembly and the New York State Senate would include three additional personal income tax brackets for individuals with income over $2.155 million. Each respective proposal includes the same three new tax rates9.85 percent, 10.85 percent and 11.85 percentbut imposes such rates at differing income thresholds. The current maximum individual tax rate in New York is 8.82 percent. The new brackets and rates would be effective for the 2021 tax year.

You May Like: Glacier Tax Prep Nyu

Benefits Of Using Curadebt

Once youve got a clearer picture of what CuraDebt can offer you lets look into the advantages from using CuraDebt.

The first is that CuraDebt will only charge you once youve paid off your debt. Additionally they only charge a 20% fee while many companies charge 25 percent.

Then, if youre done with the debt settlement program, you can also sign up for their credit restoration program.

Its a great method to improve your credit without having to go in debt again. However, the program runs in a different way for each individual according to your personal situation.

Finally, CureDebt looks into your financial obligations to help with settlements and negotiations. It means that the amount you owe wont rise over time. Theyll also be looking into any violations by creditors with the assistance of their in-house experts.

New York Ptet Election Due Date Relief

New York may be providing some limited relief for the New York Pass-through entity tax election that is due today, October 15, 2021. Per New Yorks website as updated today, it explains that if you cannot opt in by the October 15 deadline for one of the below three reasons, to submit a question to the NY PTET support team .

- Youre waiting for us to process a Form CT-6, Election by a Federal S Corporation to be Treated As a New York S Corporation, you submitted on or before October 15

- Youre experiencing difficulties creating or logging in to your Business Online Services account or

- Youre receiving an error message, such as We cannot confirm your eligibility as a New York S corporation or partnership, when you try to opt in through your account.

The website explains when you submit the question, you must explain why you could not opt in on time. You must also retain documentation to show you attempted to make an election prior to the October 15 deadline and make this documentation available to the department upon request. Once your issue is resolved, New York will contact the taxpayer to assist in completing the election after the deadline.

If you are unable to make the PTET election by October 15 and you do not submit a question with an explanation proving you have one of the issues listed above by October 15, you cannot elect in to PTET for the 2021 taxable year.

Also Check: Toll Calculator Dc To Nyc

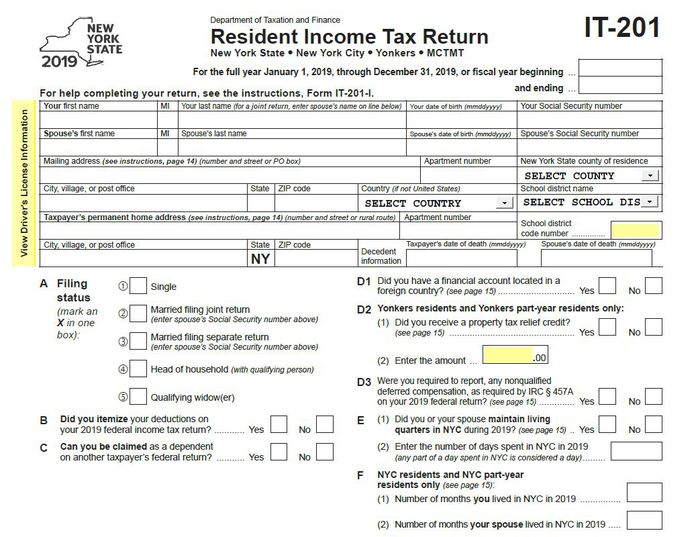

New York State Extends Income Tax Filing Deadline

New York states income tax filing deadline is being moved to July 15 to comply with the federal governments decision to push back the traditional filing date due to the coronavirus outbreak.

Disclaimer: Please note this is the information that is readily available at this time, it is subject to change so please consult your Withum tax advisor.

New York Proposes Capital Gains Business Tax Surcharges

Revised budget proposals from each of the New York State Assembly and the New York State Senate would include a one percent surcharge on the capital gains of certain individuals for tax years beginning on or after January 1, 2021. The capital gain surcharge would be imposed in addition to individual income tax. Further, both proposals call for a surcharge to be imposed on corporations for tax years beginning on or after January 1, 20201. While both surcharges are structured differently, in either case the tax would apply to corporations with income or receipts above a designated threshold. The Assembly proposal calls for an 18 percent surcharge, while the Senate proposal would permanently raise the corporate franchise tax rate from 6.5% to 9.5%. Lastly, the Assembly version of the Bill would reinstate the 0.15 percent capital base tax that had previously been repealed for tax years beginning in 2021.

Read Also: How Much Are Tolls From Dc To Nyc

Sales And Other Taxes

The state’s sales tax has been set at 4% since June 1, 2005, but local municipalities can add up to 8.88%. Food, prescription drugs, and non-prescription drugs are exempt, as are clothing and footwear costing less than $110 per item.

The state imposes a motor fuel tax that includes a:

- Motor fuel excise tax

- Petroleum business tax

- Petroleum testing fee

The state gasoline tax was 32.98 cents a gallon as of February 2021 state and federal taxes together are 51.38 cents per gallon. The cigarette tax is $4.35 per pack of 20.

Business Return General Information

Important resources for Corporate filers can be found .

Due Dates for New York Business Returns

Corporations

- Original returns: April 15, or same as IRS, or for fiscal year filers the 15th day of the fourth month following the close of the year.

- Returns on Extension: Corporations can file for a six month extension by filing Form CT-5 by the due date of the return. Two additional three month extensions can also be filed.

S-Corporations

- Original returns: March 15, or same as IRS, or for fiscal year filers the 15th day of the third month following the close of the year.

- Returns on Extension: S Corporations can file for an automatic six month extension by filing Form CT-5.4 by the due date of the return.

Partnerships

- Original returns: March 15, or same as IRS, or for fiscal year filers the 15th day of the third month following the close of the year.

- Returns on Extension: Partnerships can file for an automatic six month extension by filing Form IT-370-PF by the due date of the return.

Fiduciary

- Original returns: April 15, or same as IRS, or for fiscal year filers the 15th day of the fourth month following the close of the year.

- Returns on Extension: Fiduciaries can file for an automatic six month extension by filing Form IT-370-PF by the due date of the return.

Business Extensions

Extension requests can be filed through TaxSlayer Pro as well as online at the Department of Taxation and Finance website here.

Amended Business Returns

Recommended Reading: Average Hotel Price In New York

What Is Sales And Use Tax

When you read about sales tax in New York, youll see talk of Sales and Use Tax. What is use tax and why do you have to pay it?

As you might know, sales tax applies to goods and services you buy within a state. Use tax is an equivalent tax that you pay on items that you purchase outside of the state. It ensures that out-of-state retailers dont benefit just because they dont have to pay the in-state sales tax. The use tax in New York is the same as the sales tax. The two taxes are also mutually exclusive so if you pay one of them, you wont have to pay the other.

Lets look at an example to show how use tax works: Imagine youre a New York resident and you buy a computer somewhere within the state. The seller will collect the regular New York sales tax. But if you buy a computer from New Hampshire, the seller wont collect the New York sales tax. That means you can get the computer without paying the full tax on it. So New York collects a use tax. New York requires residents to report their out-of-state spending in their New York income taxes.

New York City Musical And Theatrical Production Tax Credit For Corporate And Personal Income Tax

On July 23, 2021, Governor Andrew Cuomo announced the New York City Musical and Theatrical production tax credit which is designed to revitalize the theater district after its close due to the Covid-19 pandemic by offering up to $100 million in tax credits. The two-year program for approved companies which will allow tax credits for up to 25% of qualified production expenditures such as sets, costumes, sound, lighting, salaries, fees, advertising costs, etc. First year program applicants can receive up to $3 million per production and second year applicants up to $1.5 million. Companies can receive credits for tax years beginning on or after January 1, 2021 but before January 1, 2024. Applications must be submitted by December 31, 2022 and final applications no later than 90 days after the production closes or 90 days following the program end date of March 31, 2023, whichever comes first.

Recommended Reading: The Wax Museum Nyc

Instructions For Responding To A Bill Or Notice

We created step-by-step instructions to help you successfully respond to a bill or notice online. Whether you agree with our notice or bill, need to provide additional information, or want to challenge a Tax Department decision, responding online is the fastest, easiest way to resolve an issue.

Gop Says State Budget Delivers Major Tax Relief Dems Disagreeyour Browser Indicates If You’ve Visited This Link

The New Hampshire Senate issued a news release Monday saying the Republican state budget delivers major tax relief for communities, but Democrats say it is not sustainable. “New Hampshire municipalities are receiving a 45 percent increase in revenue from the Meals and Rentals Tax,

The Telegraph

Read Also: How Much Is Cremation Nyc

Other New York Tax Facts

At New Yorks Online Tax Center, taxpayers can view and pay tax bills, including estimated taxes view and reconcile estimated income tax accounts file a state sales tax no-tax-due return and upload wage reporting.

New York taxpayers can check the status of their refunds by using the New York State Department of Taxation and Finances online refund tracker.

New York taxpayers can learn about their rights in Publication 131.

For more information, visit the website of the New York Department of Taxation and Finance.

Schedule A Tax Allocation Consultation With The Attorneys At Hodgson Russ Llp

In today’s world, many taxpayers lead complex lives and may travel to multiple states as part of business, family obligations and other experiences. If you are subject to a New York State nonresident audit or have questions about residency or nonresidency issues, contact the attorneys at Hodgson Russ LLP for a consultation.

Read Also: New York Times Paywall Smasher Extension

Imposed Sales Tax On Vapor Products

Effective December 1, 2019, a new 20% supplemental sales tax will apply to retail sales of vapor products in New York, which should be collected by a vapor products dealer. Any business that intends to sell vapor products must be registered as a vapor products dealer before making sales of vapor products. The Tax Department is developing an online registration process. In addition, if a taxpayer has debit blocks on their bank account, even if the taxpayer has already authorized sales tax payments to the Tax Department, the taxpayer must communicate with their bank to authorize their vapor products registration payment.

The New York State Income Tax Rate Is Based On A Progressive Tax Schedule Which Means Higher

Whats more, New York City, along with Yonkers, residents may end up paying more personal income tax than taxpayers who live in other cities in the state. The New York state income tax rate isnt the only one to be concerned about, though.

Here are some things to know about the taxes you may be subject to if you live or work in the state of New York.

Also Check: How To Register A Car In Ny From Out Of State

Whats Taxed And What Isnt

The majority of retail sales are subject to sales and use tax in New York. Some things, like cars and other motor vehicles, are taxed on the residence of the buyer and not the place where you actually buy the vehicle.

There are also a number of things that are exempt from sales tax. Some common examples are groceries, newspapers, laundering and dry cleaning, prescription drugs and feminine hygiene products. Clothing and footwear are not taxable if they are less than $110. If they are over $110, they are subject to regular sales tax rates. Any water delivered through mains and pipes is not taxable. However, public utilities like gas, electricity and telephone service are subject to sales tax.

Renting a car gets expensive in New York. If you rent a passenger car, New York state charges a sales tax of 6%. There is also a 5% supplemental tax if you rent the car within the metropolitan commuter transportation district . If you pay for any parking services , you will pay the New York sales tax of 4% plus any local sales taxes.

You can find a more complete breakdown of taxable goods and services with New York States Quick Reference Guide for Taxable and Exempt Property and Services.

How Do New York Tax Brackets Work

Technically, you don’t have just one “tax bracket” – you pay all of the New York marginal tax rates from the lowest tax bracket to the tax bracket in which you earned your last dollar. For comparison purposes, however, your New York tax bracket is the tax bracket in which your last earned dollar in any given tax period falls.

You can think of the bracketed income tax as a flat amount for all of the money you earned up to your highest tax bracket, plus a marginal percentage of any amount you earned over that. The chart below breaks down the New York tax brackets using this model:

| For earnings between $0.00 and $8,500.00, you’ll pay 4% |

| For earnings between $8,500.00 and $11,700.00, you’ll pay 4.5%plus $340.00 |

| For earnings between $11,700.00 and $13,900.00, you’ll pay 5.25%plus $484.00 |

| For earnings between $13,900.00 and $21,400.00, you’ll pay 5.9%plus $599.50 |

| For earnings between $21,400.00 and $80,650.00, you’ll pay 6.21%plus $1,042.00 |

| For earnings between $80,650.00 and $215,400.00, you’ll pay 6.49%plus $4,721.43 |

| For earnings between $215,400.00 and $1,077,550.00, you’ll pay 6.85%plus $13,466.70 |

| For earnings over $1,077,550.00, you’ll pay 8.82% plus $72,523.98 |

Read Also: New York To Italy Flight