How Much Does The Ny State Of Health Insurance Plan Cost

Health insurance plans sold through the New York State Health Benefit Exchange have risen steadily since the creation of the NYSOH. Original estimates expected health insurance rates to fall. Unfortunately due to several factors, rates have increased annually. The major factors attributed to rate increase are

- Less carrier competition in the marketplace

- a greater pool of unhealthy insureds

- younger people not signing up for insurance as anticipated

- Congress removing promised risk optimization funding to insureds

Insurance Plans Sold Through The Ny State Of Health Insurance Marketplace Need To Cover Certain Essential Benefits

Any NY health insurance plan sold through the NY State of Health will need to include coverage for medical services in the following 10 categories under the Affordable Care Act legislation:

- Ambulatory patient services, such as doctors visits and outpatient services

- Emergency services

- Preventive and wellness services and chronic disease management

- Pediatric services, including oral and vision care

States will also play a role in determining which minimum essential benefits will be covered under the Affordable Care Act.

Alternative Approaches To Improving Health Care Affordability

Fortunately, the substantial economic and fiscal disruption that the New York Health Act would cause is not necessary to make health care and coverage more affordable for more New Yorkers. Three-fourths of uninsured legal U.S. residents are already eligible for some form of subsidized coverage. In New York, the proportion is even greater, because the state has drawn funds from the Affordable Care Acts Medicaid expansion.

For most of the remaining uninsured, the problem is not the absence of subsidies. The problem is the high underlying cost of health care.

Three-fourths of legal U.S. residents are already eligible for subsidized coverage.

The principal driver of unaffordable health care is unaffordable prices charged by the providers of health care goods and services such as prescription drugs and hospital care.

New York could make a proactive effort to rein in hospital prices through stronger antitrust enforcement, greater transparency, and by highlighting exploitative pricing practices by health care providers. New York could learn from the private Medicare Advantage program, by capping monopoly providers prices at those of Medicares. The state could reform the significant flaws in the way it regulates non-group health insurance, for example by eliminating the requirement that carriers offer similar prices to any enrollees, regardless of their age.

Read Also: How Much In Tolls From Baltimore To Nyc

Ny State Of Health Is The #1 Place To Shop Health Insurance

THIS PAGE HAS BEEN UPDATED TO REFLECT CHANGES IN 2021. IF YOU NEED ASSISTANCE COMPLETING AN APPLICATION, CONTACT US AT 215-4045

New York State of Health is the official name of the New York State Health Plan Marketplace, also known as the New York State Health Benefit Exchange . The marketplace was created by the Affordable Care Act and is the place where New Yorks individuals, families, and small businesses can shop for affordable health insurance.

Under the Affordable Care Acts regulations, each state is required to have a health insurance exchange, either operated by the state or by the federal government as well as quasi-state/federal government-run exchanges. New York State opted to establish and operate its exchange.

Since October 2013, NY State of Health customers has been able to shop for and compare different health insurance plans from a variety of insurers through the online marketplace.

These health insurance plans from NY State Health are available right here through Vista Health Solutions for you to explore and purchase .

Please take the time to explore our FAQs about the Affordable Care Act, and a brief history of New York health insurance.

Cheapest Health Insurance By Metal Tier

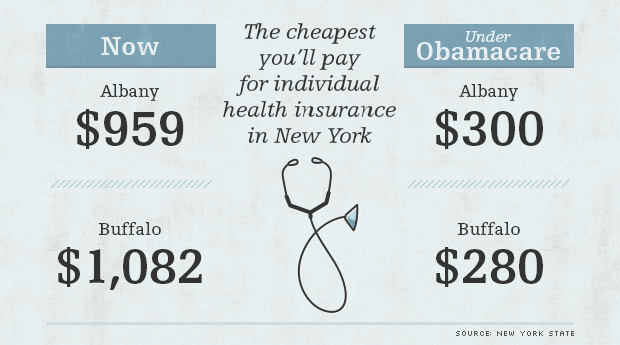

To help you to compare prices and choose the best policy, we identified the most affordable health insurance plans available in the state of New York.

Independent Health is the cheapest provider of Bronze, Silver and Platinum policies. Fidelis Care offers the cheapest Gold plan.

Health insurance is offered at five different tier levels in New York: Catastrophic, Bronze, Silver, Gold and Platinum. However, our analysis excludes Catastrophic plans because of their limited availability.

Don’t Miss: Register Car In New York

% Average Rate Increase In The Individual Market For 2022

In New York, open enrollment for 2022 health plans began on November 16, 2021. The overall weighted average rate increase for 2022 amounts to 3.7%, which is the second-smallest percentage increase since ACA-compliant plans became available in 2014.

New Yorks individual/family market insurers initially proposed a weighted average rate increase of 11.2% for 2022, but as has been the case over the last several years, the New York Department of Financial Services approved rate increases that were quite a bit smaller than the insurers proposed.

Metro Plus was the only insurer with an approved rate change equal to what they proposed. Approved rates for all of the other insurers were lower than the insurers had proposed.

The following average rate changes were approved for the insurers that offer individual/family coverage through New York State of Health :

In addition, Healthfirst Insurance Company, which offers individual market plans only outside the exchange, is increasing average premiums by 8.8% for 2022 .

Its important to understand that net rate changes for people who receive premium subsidies can be quite different from the overall rate changes for that persons plan, since it also depends on how the benchmark plan premium changes.

For perspective, heres a look back at rate changes for NY State of Health plans since 2014:

In their summary of rate filings for 2018, NYDFS included this:

Finding The Best Health Insurance Coverage In New York

The best health insurance policy for your family will depend on the availability of plans in your area, as well as your medical and financial situation. When deciding on the right type of plan, you should determine affordability by reviewing the premiums and deductibles for each metal tier. Generally, if you have an emergency savings account and don’t expect to have significant health or medical expenses, then a lower metal tier plan with more affordable premiums would make more financial sense.

Gold and Platinum plans: Best if you expect high medical costs

Gold and Platinum plans are the highest tier health insurance policies available in New York. These plans often have the most expensive monthly premiums but come with lower deductibles and out-of-pocket maximums.

For this reason, Gold and Platinum plans can be the most cost-effective for people with higher medical costs, as they would reach the deductible quickly and can then be eligible for the cost-sharing benefits of coinsurance.

For example, if you frequently use expensive prescription drugs, an upper-tier health plan could be the right choice.

Silver plans: Best for people with a low income or average medical costs

Silver plans are middle-ground policies that fall between Gold and Bronze plans with regard to premiums and out-of-pocket expenses. We would recommend a Silver plan in most situations â but if you are very healthy, Bronze may be best in terms of cost-effectiveness.

Don’t Miss: Wax Museum Parking

Which Insurance Is Best For Health

Best Health Insurance Plans in India Health Insurance Companies Health Insurance Plans Maximum Sum Insured Amount HDFC Ergo General Insurance My Health Suraksha Rs. 75 Lakh Care Health Insurance Care Policy Rs. 6 Crore Care Health Insurance Care Freedom Policy Rs. 5 Lakh Bajaj Allianz General Insurance Health Guard Policy Rs. 50 Lakh.

Contact The New York Exchange

About our health insurance quote forms and phone lines

We do not sell insurance products, but this form will connect you with partners of healthinsurance.org who do sell insurance products. You may submit your information through this form, or callto speak directly with licensed enrollers who will provide advice specific to your situation. Read aboutyour data and privacy.

The mission of healthinsurance.org and its editorial team is to provide information and resources that help American consumers make informed choices about buying and keeping health coverage. We are nationally recognized experts on the Affordable Care Act and state health insurance exchanges/marketplaces.Learn more about us.

If you have questions or comments on this service, pleasecontact us.

Read Also: Nyc Tolls Calculator

Health Insurance Rate Changes In New York

Health insurance rates are determined by each insurer and are submitted for approval to the New York state exchange. For 2022, the largest cost increase occurred in Platinum plans, which rose in price by nearly 3%. That’s $29 per month more than the previous year.

| Metal tier |

|---|

Monthly premiums are for a 40-year-old adult.

Affordability Is Not An Option

In New York State, businesses with 50 or more full-time employees are required to provide affordable health insurance. That means the insurance plan must cover at least 60 percent of medical expenses, and not cost an employee more than 9.83 percent of their annual income. If a business fails to meet those requirements, it will pay a penalty.

Grandfathered plans are not subject to the affordability requirement.

You May Like: How To Find Your Mugshot Nyc

Child Health Plus Coverage For Children

In New York, Child Health Plus is a health insurance program for children in households that have incomes that are too high to qualify for Medicaid but are less than 400% of the federal poverty level. Like Medicaid plans, Child Health Plus plans are managed by the same insurance carriers on the individual and small-business market.

Families with children under the age of 19 who qualify for Child Health Plus pay significantly lower health insurance rates for covering the children. The amount a family contributes is based on the family size and household income, with premiums per child ranging from $9 to $60 per month.

For families with multiple children, the maximum contribution is three times the per-child premium. For example, if you fall into the $9-per-child threshold group, then the maximum you would pay for all your children would be $27, even if you purchase coverage for more than three children.

Maximum monthly income per number of children to be eligible for Child Health Plus

| Cost per month |

|---|

Which Insurers Offer 2022 Coverage In The New York Marketplace

For 2022 coverage, there are twelve insurers that offer exchange plans in New York:

- Capital District Physicians Health Plan

- Emblem

- Excellus Health Plan

- Fidelis

- Healthfirst PHSP

- Health Plus HP

- Highmark Western and Northeastern New York

- Independent Health Benefits Corporation

- UnitedHealthcare of New York

Recommended Reading: Ez Pass Toll Calculator Ny

What Is Covered And How Much Will It Cost

Coverage and cost depend on where you live, the type of plan you choose, your household income and the age and disability status of you and your family. If you qualify for Medicaid, you will be able to get free or low-cost coverage and may not need to worry about premiums or copays, depending on your level of income. All New York State of Health plans cover 10 essential benefits, including:

- Emergency services and hospitalization

- Pregnancy, maternity and newborn care

- Mental health services

- Chronic disease management and pediatric care

- Prescription drugs

Insurance companies cannot deny coverage because of preexisting conditions. When you apply, you can identify your medical needs and choose a plan that makes financial sense for you and your family. All New York State of Health plans cover basic dental services for children, including cleanings and exams. But adults who want dental coverage must add it to their policy. Deductibles and out-of-pocket costs vary between plans enrolling in a family plan can cut costs.

How Can I Purchase Health Insurance

You can get health care coverage through: A group coverage plan at your job or your spouse or partners job. Your parents insurance plan, if you are under age 26. A plan you purchase on your own directly from a health insurance company or through the Health Insurance Marketplace. Government programs such as.

You May Like: How To Pay Ticket Online Ny

The Rand Corporations Analysis Of The New York Health Act

In 2018, a group of researchers at the RAND CorporationJodi Liu, Chapin White, Sarah Nowak, Asa Wilks, Jamie Ryan, and Christine Eibnerpublished an optimistic analysis of the New York Health Act, concluding that the bill would increase employment by 2 percent over a 10 year period, even though the Act would require, in their estimation, approximately $1.7 trillion in new state taxes between 2022 and 2031, tripling the states tax burden.

Importantly, because health care spending typically grows at faster rates than other forms of spending, the RAND researchers project that the New York Health Acts tax burden will grow at 4.7% per year from 2022 to 2031, compared to 3.6% per year for the states pre-existing revenue streams.

Combined with President Bidens proposed doubling of the capital gains tax rate, the 18.6% New York Health Act surtax on non-wage income modeled by RAND would lead to a 75.5% combined federal and state capital gains rate for high earners in New York City. It is difficult to envision many of those high earners remaining in New York under such a regime.

The RAND authors have performed some useful calculations that we will explore below. Nonetheless, while the RAND researchers describe their work as unbiased, they explicitly declined to take into account numerous factors that would have painted a much less flattering picture of the New York Health Act. These include:

Governor Pushed Back Against Gop Efforts To Repeal The Aca

In January 2017, as President Trump was poised to take office and it was clear that GOP lawmakers were going to push hard for ACA repeal, New Yorks then-Governor Andrew Cuomo announced that 2.7 million people were at risk of losing Medicaid coverage in New York if the ACA was repealed and not replaced with something equally robust, and that the state budget impact would be $3.7 billion.

Although most of the New Yorks Medicaid enrollees were already eligible under the states pre-2014 guidelines, the state estimated that several million Medicaid enrollees would have lost coverage if the ACA had been repealed. Thats because the state was using 1115 waivers to expand coverage eligibility in the years prior to ACA implementation, and the federal government was splitting the cost with the state as called for in the waivers.

But those waivers expired after Medicaid expansion was implemented. If the ACAs Medicaid expansion had been repealed, eligibility would have reverted to much lower thresholds: parents with dependent children would have been covered with income up to 94% of the poverty level , and childless adults wouldnt have been eligible at all. The state would have been allowed to spend their own money to extend those guidelines, but it would have been fiscally challenging without the federal match.

Ultimately, the ACA survived the legislative onslaught in 2017 and a Supreme Court case that upheld the law in 2021.

Medicaid expansion in New York

Read Also: Registering A Vehicle In New York

Doesnt My Employer Have To Offer Me Health Insurance

That depends on the size of your employer. For companies employing at least 50 full-time workers, working a minimum of 30 hours per week, they are required to at least offer a health insurance option to their employees.

Companies employing less than 50 full-time workers are exempt from the employer mandate and can choose not to offer their employees health insurance without penalties.

Will I Need To Get A New Doctor

That depends. Major insurance providers, including Empire Blue Cross and UnitedHealthcare of New York, offer New York State of Health plans, but not all doctors accept them. You can talk to your primary care physician or use the New York State of Healths comparison tool to see whether a certain doctor or practice will accept a marketplace plan.

You May Like: How Much Are The Tolls In New York

How Does This Affect My Healthy Ny Plan

On January 1st, 2014, Healthy NY ceased to provide care for individuals and solos, but rather only pursing small businesses. Its benefits will match the benefits of a Gold plan which could bring up the price.

Those individuals who were enrolled in a Healthy NY plan on March 23, 2010, when the Affordable Care Act was signed into law are eligible for grandfathered status. Individuals and sole proprietors not eligible for grandfathered status will be moved over to the exchange.

At the New York State Health Benefit Exchange, the equivalent health insurance coverage to the Healthy NY plans will be plans sold at the gold level.

New York Exchange Overview

New York has fully embraced the Affordable Care Act, with a state-run exchange, expanded Medicaid, and a Basic Health Program. The state-run exchange is called New York State of Health. It is one of the most robust exchanges in the country, with 12 insurers offering individual market plans for 2022 .

There are also 12 insurers offering Essential Plan coverage for 2022 , and nine insurers offering small business plans through NY State of Healths SHOP exchange .

Don’t Miss: New York Pass Reviews

Does New York State Offer Health Insurance

New York State offers free and low-cost public health insurance programs for low-income New Yorkers. Individuals and families can qualify for public health insurance even if they have income, own a house, own a car, or have a bank account. You can get public health insurance at any time during the year.

What Are The Pros And Cons Of Unitedhealthcare

Pros and Cons of AARP UnitedHealthcare Medicare Advantage Pros Cons The $0 premium and $0 deductible plans are available in most areas. PPO plan premiums are slightly higher than average in some areas. Most plans include Part D plus generous extra benefits, including dental, vision, nurse hotline, and fitness membership.

Read Also: Dc To New York Tolls