What Is The Current Wall Street Journal Prime

2 As of Aug. 2021, it is once again down to 3.25%. 1 Generally, the rate is dictated by changes from the Federal Reserves Federal Open Market Committee, which meets every six weeks and reports on the level of the federal funds rate. The WSJ prime rate provides a gauge for the prime rate at banks across the industry.

How Does Prime Rate Affect You

Prime Interest Rates affect you because they form the basis for how lenders determine interest rates for financial products such as personal loans, credit cards, and loans for small and medium sized enterprises. The Prime Rate is also used as thebase or reference rate forAdjustable Rate Mortgagesand other variable rate loans. If there is an increase in the Prime Interest Rate, in most cases there will be an increase in the interest rates used for other loans also.

What Is The Prime Lending Rate

Just like how the federal funds rate is the interest rate that banks lend to each other, the prime lending rate is the interest rate that the bank lends to its customers. Banks generally have the same prime lending rate at any certain point in time, which means that when yourecomparing mortgage lendersfor thelowest mortgage rates, the rate that you qualify for will also depend on your credit quality and financial position.

Prime Lending Rate and Credit Spreads

| Average Interest Rate |

|---|

Source:Federal Reserve Bank of St. Louisas of November 24, 2021, and theFederal Reserve Boardas of November 5, 2021

Read Also: New York Times Magazine Poetry Submissions

Two Ways The Prime Rate Affects You

Banks base most interest rates on prime. That includes adjustable-rate loans, interest-only mortgages, and . The rates are often prime plus a certain percentage because banks have to cover the losses they incur on loans that never get repaid. The higher the percentage above prime, the more perceived risk there is.

Some of the riskiest loans are credit cards. Whenever the prime rate rises, variable credit card rates rise, too. And when that happens, your monthly payments may increase. Conversely, a drop in prime lowers your borrowing costs. That’s why you should pay close attention to when the Fed raises or lowers the fed funds rate.

The prime rate also affects liquidity in the financial markets. A low rate increases liquidity by making loans less expensive and easier to get. When prime lending rates are low, businesses expand, and so does the economy. Similarly, when rates are high, liquidity dries up, and the economy slows down.

Odds At 100% The Us Prime Rate Will Rise To At Least 450% After The June 15 2022 Fomc Monetary Policy Meeting

| Prime Rate Prediction |

Prime Rate Forecast

As of right now, our odds are at 100% the Federal Open Market Committee will vote to raise the target range for the benchmark fed funds rate, from the current 0.75% – 1.00%, to at least 1.25% – 1.50%, at the June 15TH, 2022 monetary policy meeting, with the U.S. Prime Rate rising to at least 4.50%

“…Sure. So 75 basis point increase is not something the committee is actively considering. What we are doing is we raised 50 basis points today. And we said that, again, assuming that economic and financial conditions evolve in ways that are consistent with our expectations, there’s a broad sense on the committee that additional 50 basis increases should be on, 50 basis points should be on the table for the next couple of meetings. So we’re going to make those decisions at the meetings, of course, and we’ll be paying close attention to the incoming data and the evolving outlook, as well as to financial conditions…”

0.6%7.2%5.464%5.2%4.00%Symptoms of COVID-19, which may appear 2-14 days after exposure

- Fever

Emergency warning signs for COVID-19 include:

- Difficulty breathing or shortness of breath

- Persistent pain or pressure in the chest

- New confusion or inability to arouse

- Bluish lips or face

NB:Stay tuned for the latest odds, and for current U.S. economic data

Read Also: How Much Does It Cost In Tolls From Va To Ny

Why Do Lenders Charge Different Customers Different Interest Rates

The reason banks charge their most creditworthy customers a different rate as compared to others is because of default risk. Default risk is the risk taken by the banks when they lend money to customers who might not be able to pay back the loan orinterest payments. Large corporations are less likely to default on their loans and hence they receive the Prime Interest Rate. Customers who are more likely to default such asindividuals with a lower credit scoreare charged the Prime Interest Rate plus an additional margin because of higher risk.

How Do I Calculate Mortgage Payments

For much of the population, buying a home means working with a mortgage lender to get a mortgage. It can be difficult to figure out how much you can afford and what youre paying for.

Using a mortgage calculator can help you estimate your monthly mortgage payment based on your interest rate, purchase price, down payment and other expenses.

To calculate your monthly mortgage payment, heres what youll need:

- The home price

You May Like: Tolls Calculator Ny

What Is The Current Prime Rate

The prime lending rate is a key interest rate that affects many other rates. See why it matters to you.

The prime rate is the best interest rate major banks offer to their borrowers with the best credit. In other words, the least risky ones.

The prime rate rose this week for the second time this year, after the Federal Reserve increased its key benchmark rate by a half-point to try to quell inflation.

The two rates move together, and the increase means higher borrowing costs for car loans, home equity lines of credit and credit cards.

Weve Answered The Most Frequently Asked Questions When It Comes To Fees

What types of fees do banks charge?

Some of the more common fees that could be associated with your Scotiabank account are outlined below. We recommend reviewing the summary of account fees page for details specific to your account.

ABM service fees

While its free to withdraw money from any Scotia ABM, you could be charged a small fee to withdraw from either chequing or savings account at another banks ABM in Canada. Certain accounts waive this fee. Cash advance fees from your Visa will also add a $3.50 fee.

Optional feature fees

Sending money to friends, family, or even yourself at a different account using Interac e-Transfers could mean paying an additional fee for each transfer. Many Scotiabank accounts do offer unlimited free Interac e-Transfers. Additionally, if you are someone who occasionally goes into overdraft, you could be charged $5 per month or per use depending on which overdraft protection plan you have on your account.

International transfer fees

If you need to send money internationally, you may be charged $1.99 per transfer depending on your account. As well, if you receive any incoming wire transfers, you will be charged $15 CAD/USD per transfer. The fee will depend on the currency of the account.

Paper statement fees

Is there a fee to close a Scotiabank account?

If I have multiple savings accounts, do I pay more than one fee?

How much is the monthly account fee?

Recommended Reading: Airlines That Fly To Italy From New York

Prime Rate News From Around The Industrialized World

Tuesday, July 5, 2022 The Reserve Bank of Australia , Australia’s central bank, has raised the target for its cash rate by 50 basis points , from 0.85% to 1.35%. Therefore, the benchmark rate in Australia is now 1.35%.

Thursday, June 30, 2022: The Sveriges Riksbank, Sweden’s central bank, has raised its policy rate by 50 basis points , from 0.25% to 0.75%. Therefore, the benchmark rate in Sweden is now 0.75%. Established in 1668, the Riksbank is the world’s oldest bank.

Friday, June 24, 2022: The Reserve Bank of Zimbabwe , Zimbabwe’s central bank, has raised its Bank Policy Rate from 80% to 200%. Therefore, the benchmark rate in Zimbabwe is now 200%.

Wednesday, June 17, 2022: The Bank of Japan, Japan’s central bank, has voted to maintain its Short-Term Policy Interest Rate at -0.1%. Therefore, the Prime Rate in Japan remains at 1.48%.

Thursday, June 16, 2022: The Bank of England , the central bank for the United Kingdom, has raised its benchmark interest rate by 25 basis points , from 1.00% to 1.25%. Therefore, the benchmark rate in the UK is now 1.25%.

Tuesday, June 7, 2022 The Reserve Bank of Australia , Australia’s central bank, has raised the target for its cash rate by 50 basis points , from 0.35% to 0.85%. Therefore, the benchmark rate in Australia is now 0.85%.

Wednesday, June 1, 2022: The Bank of Canada, Canada’s central bank, has raised its benchmark target overnight interest rate from 1.00% to 1.50%. Therefore, the Prime Rate in Canada is now 3.70%.

Examples Of New York Prime Interest Rate In A Sentence

-

A. Bankers Trust Company and Morgan Guaranty Trust Company of New York, as their respective Prime Rate provided that if less than three of such banks have the same rate in effect, the median of the five rates shall be the New York Prime Interest Rate.

-

Tenant shall pay to Landlord at once, upon notice by Landlord, any sum paid by Landlord to remove such liens, together with interest at the New York Prime Interest Rate from the date of such payment by Landlord.

-

All sums so paid by Landlord and all necessary incidental costs together with interest thereon at the New York Prime Interest Rate, from the date of such payment by Landlord, shall be payable to Landlord on demand.

-

For the purposes of computing interest hereunder, the New York Prime Interest Rate in effect on the last day of a month shall be deemed to be such rate in effect throughout the succeeding month.

Also Check: Pay Traffic Tickets Online Nyc

Recommended Reading: Tolls From Baltimore To New York

Quick Answer: What Is Canadas Prime Rate Right Now

Prime Rates in Canada The Prime rate in Canada is currently 2.45%. The Prime rate is the interest rate that banks and lenders use to determine the interest rates for many types of loans and lines of credit. These can include credit cards, HELOCs, variable-rate mortgages, car and auto loans, and much more.

You May Like: Open An Llc In Ny

Secured Overnight Financing Rate Data

The Secured Overnight Financing Rate is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities. The SOFR includes all trades in the Broad General Collateral Rate plus bilateral Treasury repurchase agreement transactions cleared through the Delivery-versus-Payment service offered by the Fixed Income Clearing Corporation , which is filtered to remove a portion of transactions considered specials. Note that specials are repos for specific-issue collateral, which take place at cash-lending rates below those for general collateral repos because cash providers are willing to accept a lesser return on their cash in order to obtain a particular security.

The SOFR is calculated as a volume-weighted median of transaction-level tri-party repo data collected from the Bank of New York Mellon as well as GCF Repo transaction data and data on bilateral Treasury repo transactions cleared through FICCs DVP service, which are obtained from the U.S. Department of the Treasurys Office of Financial Research . Each business day, the New York Fed publishes the SOFR on the New York Fed website at approximately 8:00 a.m. ET.

Recommended Reading: Toll Calculator Baltimore To Nyc

Don’t Miss: Nyc Wax Museum

What Is The Date Of The Next Federal Reserve Meeting 2021

Policymakers will also provide their latest thinking on the path for interest rates in their updated quarterly economic projections, and could pencil in two or three increases next year. When they last released the projections in September, officials were split on whether they would raise rates at all in 2022.2 days ago

Related

The Prime Rate And Variable

If you have credit cards or a home equity line of credit, you feel the movements in the U.S. prime rate most closely.

Interest rates on those products change in sync with the prime rate. The adjustable rate on a HELOC might be advertised as prime plus 1% or prime plus one, for example.

The interest rate on that hypothetical home equity line will go up from 4.5% to 5% now that the benchmark rate is increasing. Again, the current prime rate is 4%.

In similar fashion, a credit card might have an annual percentage rate, or APR], described as prime plus 11.49% or prime plus 9.99%.

Also Check: Pay My Car Ticket Online

Read Also: How Much To Register A Car In Ny

Prime Rate History For 1999

Investing in securities involves risks, and there is always the potential of losing money when you invest in securities.

This material does not take into account your particular investment objectives, financial situations or needs and is not intended as a recommendation, offer or solicitation for the purchase or sale of any security, financial instrument, or strategy. Before acting on any information in this material, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only correct as of the stated date of their issue.

Merrill Lynch, Pierce, Fenner & Smith Incorporated makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation . MLPF& S is a registered broker-dealer, registered investment adviser, Member SIPC and a wholly owned subsidiary of BofA Corp.

Trust and fiduciary services are provided by Bank of America Private Bank, a division of Bank of America, N.A., Member FDIC, and a wholly-owned subsidiary of Bank of America Corporation . Insurance and annuity products are offered through Merrill Lynch Life Agency Inc. , a licensed insurance agency and wholly-owned subsidiary of BofA Corp.

Prime Rates And Student Loans

Variable interest rate student loans will be affected by the Prime Rate. Variable Rate loans that were previously taken out and loans that will be currently taken will benefit from the lower Prime Interest Rate in the market today. Variable rate student loans have not been offered by the federal government since 2006, whereas private lenders still offer variable rate student loans. Therefore, a majority of college students on fixed rate loans cannot benefit from the low interest rates prevailing in the markets currently.

Recommended Reading: Direct Flights To Cabo San Lucas From Nyc

The 10 Most Recent Prime Rate Changes

| Effective Date |

|---|

| 4.50% |

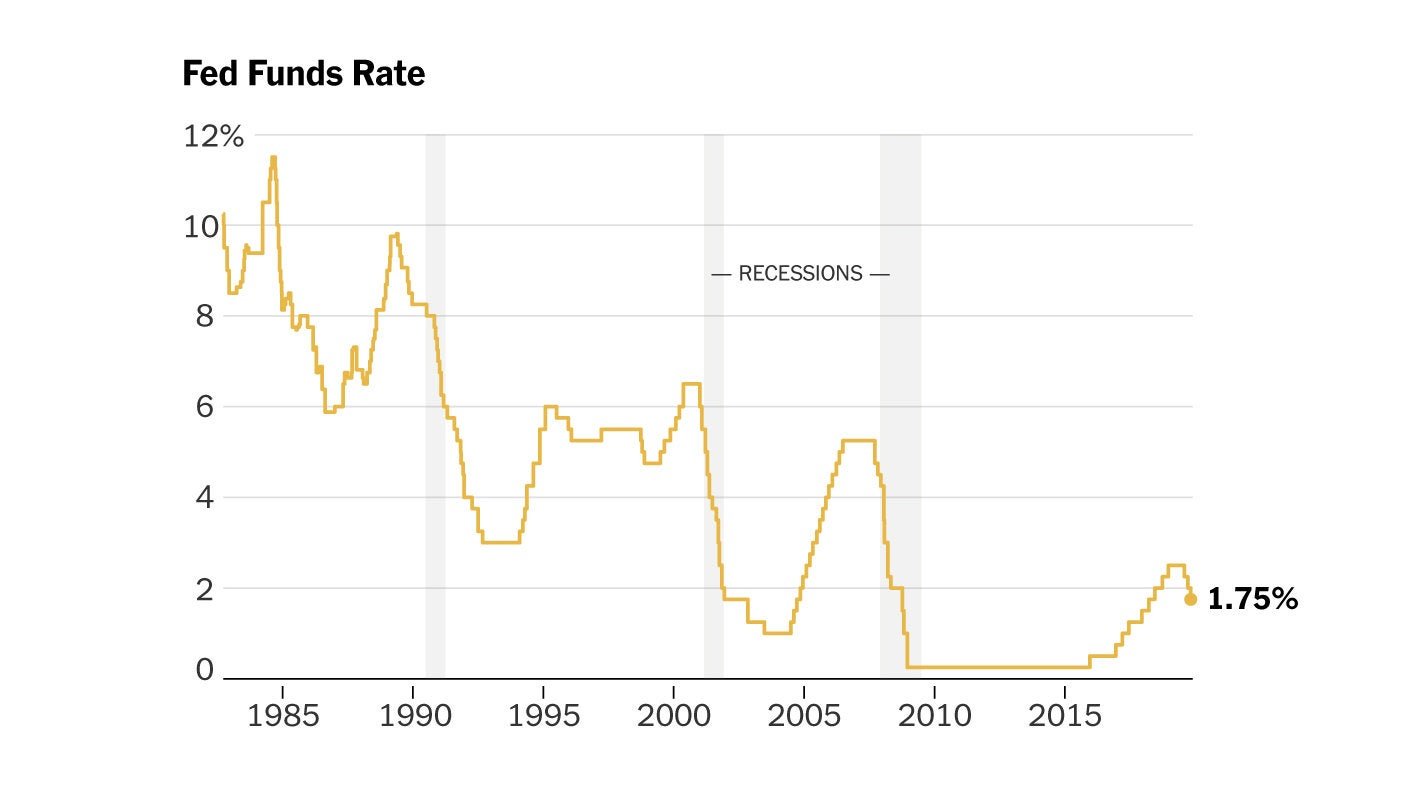

As you can see from the table, plus the longer-term chart below, the prime rate today is at historic lows. It cant drop any further because the fed funds rate is the lowest it can be without going negative.

The last time rates were this low was during the financial crisis, when prime rates were also 3.25% starting in December of 2008, says Daniel Milan, managing partner of Cornerstone Financial Services in Southfield, Mich.

Rates began to rise in 2015 or so and continued to rise until March of 2020 due to Covid-19. If you go back further into history, you never saw rates this low as you would often see them in the mid-high single digits or even the low double digits especially in the 80s and 90s, he says.

What Things Does The Prime Rate Affect

Here’s how the prime rate affects different types of everyday debt and loans. Of course, a variety of other factors affect your interest rate. The terms can be higher or lower based on the prime rate, plus your , your risk profile, your type of loan, your location, and the length of time it will take you to repay.

Read Also: How To Register A Vehicle In Ny

Prime Rate And Variable Interest Rates

Most banks base their other interest rates on the prime rate.

In general, rates for credit cards are variable, but are typically the prime rate plus a certain set percentage. While the prime rate may change, the variable rates usually change in parallel. And, because these rates are variable, they are often the most sensitive to Fed rate hikes.

How Is The Prime Rate Determined

The prime rate isnt determined by the Fed, but instead by individual banks. However, the prime rate is influenced by something called the federal funds rate, which is set by the Federal Open Market Committee consisting of twelve Fed members.

The federal funds rate is the rate banks charge each other for short-term loans. It is currently 0% to .25%. Banks use this rate as a starting point to set the prime rate for consumers. The prime rate is often roughly 3% higher than the federal funds rate .

The Fed meets roughly eight times a year to discuss potential adjustments to the federal funds rate, based on the economys current conditions. For instance, the Fed announced two emergency rate cuts in March to help combat the negative economic impact of the coronavirus. These rate cuts resulted in a decrease in the federal funds rate, which in change lowered the prime rate and the interest rate for many consumer financial products.

Recommended Reading: How Much Are The Tolls To Nyc

Also Check: Tolls To New York City