New York State Paid Family Leave Program: What Small Businesses Need To Know

New York has established a paid family leave insurance program that will enable workers to take up to 12 weeks of paid time away from work in order to care for a loved one or bond with a new child. The New York State Paid Family Leave Program is funded by modest employee contributions, and employees who take leave will be guaranteed job protection.

This document is intended to answer any questions small employers in New York might have about the program and its effects on small business owners and their employees.

Your Fein Is Important

Each business that is a legal entity has its own, unique Federal Employer Identification Number assigned to it. The FEIN is the Board’s primary identification for that business.

Employers must notify their insurance carrier of FEIN when

- Obtaining or modifying disability and Paid Family Leave benefits coverage.

- Changing their legal entity type.

- Adding new legal entities to their business operations.

When an employer obtains an insurance policy, it is the insurer’s responsibility to electronically notify the Board of that coverage using the employer’s FEIN.

If the FEIN on your notice is the correct legal FEIN , contact your insurance carrier and request they submit the correct FEIN to the Board.

If the FEIN on the policy is the correct legal FEIN , send a copy of your CP575 issued by the Internal revenue Service to the New York State Department of Labor, Registration Section, State Office Campus, Building 12, Albany, NY 12240 or fax it to 485-8010.

When Are Employees Eligible For Paid Family Leave

Employees who are regularly scheduled to work at least 20 hours per week are typically eligible to take paid family leave once they have worked for a firm for 26 consecutive weeks. Additionally, part-time employees who work less than 20 hours per week are eligible for paid family leave once they have worked for a firm for 175 days.

Read Also: A& p Auto Cicero New York

What Effects Will Pfl Have On Businesses

- Based on the experience of businesses in California and other states that have implemented paid leave programs, PFL has proven it does not have a significant effect on businesses. The program is entirely funded by employees employers do not have to pay employees salaries while they are on leave.

- A recent poll conducted for Small Business Majority found a majority of small businesses already have some type of policyformal or informalin place when it comes to family medical leavetime an employee would take to care for a family member with a serious illness or caregiving need. More than 7 in 10 small business owners have either a formal written policy, a consistent but not written policy or informal policy provided on a case-by-case basis to provide family medical leave. Of the small business owners who do offer family medical leave, 61% offer full or partial pay and 22% offer pay depending on the employee.

New York Paid Family Leave

NY PFL provides paid, job-protected leave for employees working in New York to take care of their loved ones.

NY PFL is designed to partially replace wages of employees who need to take family leave to:

- Care for a family member2 with a serious health condition.

- Bond with a child during the first 12 months after birth, adoption or foster care placement.

- Care for a family member when a spouse, domestic partner, child or parent is deployed abroad on active military service.

Employees may be eligible to receive NY PFL benefits when the following criteria is met:

- Full-time employees: Employees are eligible after working for a covered employer for 20 or more hours per week for 26 consecutive weeks.

- Part-time employees: Employees working less than 20 hours per week are eligible after working 175 days for a covered employer.

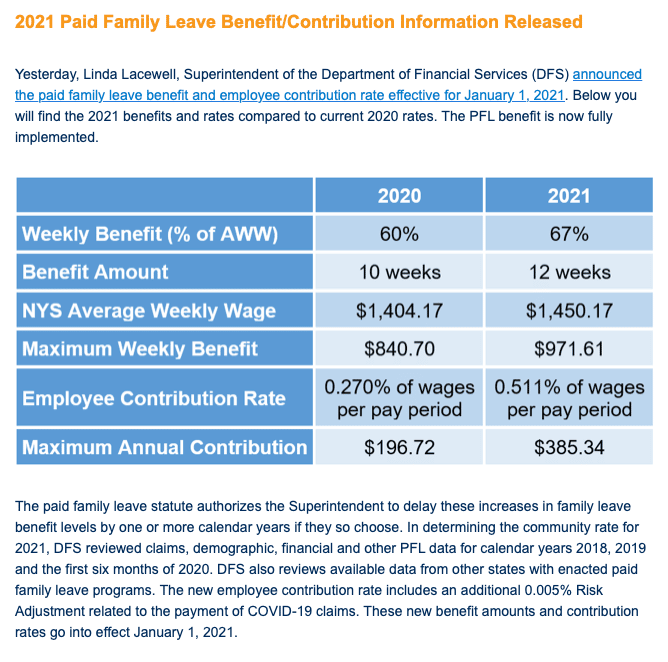

Benefits: Effective Jan. 1, 2022, employees will receive 67% of their average weekly wage up to the maximum weekly benefit amount of $1,068.36. Eligible employees can take up to 12 weeks of paid leave in any 52-week period.

Contributions: This program is funded by payroll deductions from covered employees. Each year, the Department of Financial Services sets the employee contribution rate to match the cost of coverage. For 2022, the contribution rate is .511% of employees’ weekly wages up to the annual taxable wage base of $75,408.84, to a maximum of $423.71 per year.1

Also Check: What City Is Time Square In New York

Under What Circumstances Can Employees Take Paid Family Leave

Employees can take paid family leave for the following reasons:

- to care for a close relative with a serious health condition

- to bond with a newborn child or newly placed adoptive/foster child within the first 12 months and

- to assist family members in certain circumstances when another family member is on, or called to, active military duty.

Unlike under the Family and Medical Leave Act , employees are not entitled to paid family leave due to their own medical conditions.

How Does Paid Family Leave Interact With Other Leave

Firms may require paid family leave to run concurrently with FMLA leave where applicable, provided that firms notify employees of such leaves running concurrently. An employee may elect for paid family leave to run concurrently with other paid time off, including vacation or paid sick leave, to receive his/her full salary. In cases where employees opt to supplement their paid family leave benefits with paid time off and firms pay employees their full salary/wages, firms can request reimbursement from their insurance carrier for any paid family leave benefits . An employee may not receive short-term disability and paid family leave benefits at the same time, but may receive them consecutively where applicable as permitted by law. An employee who is eligible for both short-term disability benefits and paid family leave benefits during the same 52-week period cannot receive more than 26 total weeks combined of disability and family leave benefits during that period of time.

Don’t Miss: How To Grill New York Strip Steak

How To Request A Paid Family Leave: Link

Reminders:

- Paid Family Leave benefits will be paid through payroll.

- Paid Family Leave benefits are taxable. You will receive a Form 1099 along with your year-end W-2.

- More information about Paid Family Leave can be found at ny.gov./paidfamilyleave.

Syracuse University recognizes the New York Paid Family Leave Benefits that provides support when employees need time away from work for certain family matters. Employees in CA, CT, DC, MA, NJ, RI, and WA are eligible for paid family leave benefits according to their states regulations.

Can You Opt Out

Paid Family Leave is not optional for eligible employees. Coverage can only be waived if:

- You regularly work 20 hours or more per week, but you won’t be in employment with that employer for 26 consecutive weeks or

- You regularly work fewer than 20 hours per week and you will not work 175 days in a 52-week period.

Employers must offer a waiver to employees who qualify for one.

If you waive coverage, you will not make contributions and will not be eligible for Paid Family Leave benefits.

Also Check: When Is The Hurricane Hitting New York

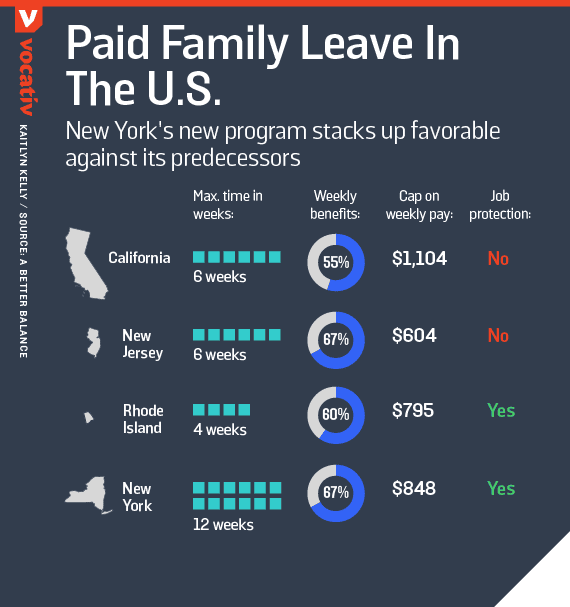

Do Other States Have Similar Programs

- Yes. California , New Jersey and Rhode Island have paid family and medical leave insurance programs. Californias Paid Family Leave program has been in effect for more than 10 years. New Jerseys Family Leave Insurance program has been in effect for seven years, and Rhode Islands Temporary Caregiver Insurance program has been in effect for three years. All programs have been implemented successfully. Evidence suggests that neither California, nor New Jersey nor Rhode Islands program has imposed a burden on businesses, and all have had significant benefits for employees. Moreover, many employers find that the program is actually good for their businesses, boosting employee loyalty and lowering turnover.

What Is The New York State Paid Family Leave Program

- The Paid Family Leave Program is an insurance program administered by the state that will enable workers in New York to take up to 12 weeks of paid time off in order to care for a seriously ill family member, bond with a new child or to address certain issues related to family members military service. A family member constitutes children, grandchildren, spouses, domestic partners, parents, parents of spouses or partners, siblings or grandparents. A parent can take leave to bond with a newborn, newly adopted child or foster child.

- Employees will be eligible for paid leave benefits after working full-time for their employer for 26 weeks, or part-time for 175 days.

You May Like: When Is The Democratic Primary In New York

Maternity Leave Benefits In New York

New York is one of the states with laws dedicated to maternity leave. Heres everything you need to know about maternity leave benefits in New York.

The Family Medical Leave Act and New York Paid Family Leave covers New York maternity leave. Since both apply, an employer can choose whether both benefits apply, or the employee will be limited to one.

Are There Notice Requirements

Yes. Firms are required to post notice of their compliance with paid family leave law. A printed notice describing paid family leave should be displayed in plain view, where employees and applicants can readily observe it. This notice will be provided by a firmâs insurance carrier. For firms who choose to self-insure, this notice can be obtained by contacting . Firms should also update their employee handbooks to include a paid family leave policy and distribute the revised handbooks, highlighting the new law and policy in a cover letter or email to employees.

Don’t Miss: Does New York Vote On Super Tuesday

Use Of Ny Family Leave:

Beginning January 1, 2018, employees may use paid family leave:

- To care for a family member with a serious health condition

- To bond with the employees child during the first 12 months after the childs birth or after the placement of the child for adoption or foster care or

- Because of any qualifying exigency arising out of the fact that the spouse, domestic partner, child, or parent of the employee is on active duty in the armed forces of the United States.

Paid Family Leave And Other Types Of Leave

Employees can choose to have NYPFL time run concurrently with any vacation/ PTO time so that they receive their full pay during periods of leave, but they cannot be required to do so. If the employer requires accrued PTO to be used concurrently with FMLA, and the employee is eligible for both NYPFL and FMLA that will run concurrently, accrued PTO will run concurrently with both FMLA and NYPFL.

Although an employees own illness is not covered under NY PFL, for maternity leave, a birthing parent may elect to take NY PFL instead of disability leave, or take disability leave for maternity and then NYPFL bonding leave.

Employees may not use NY PFL while they are collecting workers compensation benefits and are not working.

Read Also: How Do I Cancel My New York Life Insurance Policy

What You Need To Do

- For more information, visit this website to obtain a claim form.

- Speak with your employer if youre planning to request leave. In most cases, you need to provide 30 days advance notice before taking a leave. Your employer must also complete a portion of the claim form.

- Submit the claim form with required documentation to:Ullico Claims Service Center

How Does My Firm Obtain Paid Family Leave Coverage

Firms are required to obtain paid family leave coverage or to self-insure. Paid family leave coverage will be automatically added to New York State Insurance Fund disability benefits policies effective January 1, 2018. Firms can choose to deduct the premium cost for their paid family leave policies from employees through a payroll deduction, or they can choose to cover the cost themselves.

Recommended Reading: The Manhattan At Time Square Hotel

Will Employers Have To Pay Employees Salaries While Theyre On Leave

- No. The program is entirely funded by employees employers do not have to pay employees salaries while they are on leave. Many small businesses that previously could not afford to offer paid leave to their employees will be able to offer the benefit through the PFL Program. This helps small businesses compete for the best employees, and gives employers peace of mind that they are doing whats best for their workers. Employers that already offer paid family leave can expect to see cost-savings.

Benefits Available During Paid Family Leave Link

Employees taking a Paid Family Leave in 2022 receive the following benefits:

- 67% of their average weekly pay, up to a maximum of 67% of the New York statewide average weekly wage

- Up to 12 weeks of leave, which can be taken all at once or on an intermittent basis

- Continuation of health and other benefits with payment of the required premium contributions

You May Like: Luxury Hotels In Midtown Manhattan

Maternity Leave Eligibility In New York

The federal Family and Medical Leave Act and the New York Paid Family Leave cover New York maternity leave. An employer has the right to implement either or both FMLA and PFL.

FMLA covers public and private employers who have 50 or more employees. To qualify for the leave, an employee must have worked 12 months at the corporation and a minimum of 1,250 hours during the 12 months.

Employees qualify for maternity leave under FMLA under one of the following conditions:

- The birth of a child requires time for the care of a newborn

- A child is placed in the care of an employee for adoption or foster care

- An employees child has a serious health condition that requires time to care for the child or

- An employee has serious health conditions due to pregnancy and cannot perform the essential functions of their job.

New Yorks PFL covers most public and private employers who have one or more employees. Employees are eligible for the leave benefits after working 26 consecutive weeks with a minimum of 20 hours per week. Public employers have the choice to opt-in or out of the leave.

Eligible employees may seek paid time off for:

- Bonding with a newborn, adopted, or fostered child

- Caring for a child with serious health conditions or

- Assisting a loved one when a child is deployed on active military duty.

Eligibility For Paid Family Leave Link

Staff and student employees, including graduate assistants, working in New York State are eligible if they meet the following requirements:

- If a regular work schedule is 20 or more hours per week, an employee is eligible after 26 consecutive weeks of employment

- If a regular work schedule is less than 20 hours per week, an employee is eligible after working 175 days.

Faculty continue to be eligible for leaves of absence and paid parental leave benefits, and may request administrative leave through their departments, as appropriate. New Yorks legislation establishing Paid Family Leave does not apply to those working in a teaching capacity.

Also Check: How To Travel To Niagara Falls From New York City

What Benefits Does The Paid Family Leave Law Provide To Employees

In 2018, an eligible employee will be entitled to eight weeks of paid family leave at 50 percent of the employeeâs average weekly wage, capped at $653 per week. ). The number of weeks of paid leave and the percentage of wages noted above will increase annually until 2021, when the law will provide 12 weeks of paid family leave at 67 percent of an employeeâs average weekly wage, capped at 67 percent of the New York State Average Weekly Wage. Employees are entitled to take the maximum benefit of paid family leave entitlement in any 52-week period. Firms must also maintain an employeeâs existing health benefits for the duration of leave.

Can An Employee Take Paid Family Leave And Ny Statutory Disability Leave Together

New York statutory disability leave and New York Paid Family Leave benefits cannot be claimed at the same time. DBL can only be used for an individuals own disability whereas Paid Family Leave is intended to be used to care for others. Examples include bonding with your child, caring for an ill family member, or for a qualifying emergency related to a family members military duty or call to active duty.

Combined, DBL and NY PFL must not amount to more than the 26-week benefit max during any 52 consecutive calendar weeks.

Don’t Miss: Family Court In The Bronx

General And Special Employment

Who is responsible for providing Paid Family Leave coverage in situations where there is both general and special employment?Employees in certain industries may have more than one employer. Under the Workers Compensation Law, a general employee of one employer may be a special employee of another. The general employer pays the employees wages and may provide required employee benefits. The special employer takes control of the employee for a limited time. If there is a dispute over who is responsible for Paid Family Leave benefits, general employment is presumed to continue but the special employer would also be liable. While the parties may contract between themselves concerning the scope of their responsibilities, the NYS Workers Compensation Board would determine the liable employer if there is a dispute.

A general and special employer may decide between them to designate full responsibility for Paid Family Leave to the general employer. However, absent an agreement otherwise, the general and special employers may both be found liable.

For example, if an employee works for a motion picture project employer as a general employee, and a certain film production company as a special employee, the MPPE may collect employee contributions and provide paid family leave benefits to the employee through its insurance policy, but the special employer also remains liable for compliance absent an agreement providing otherwise or the general employer maintaining control.