Form A Corporation Or Business

OFFICE CLOSURES

Beginning November 29, the Division of Corporations, State Records and Uniform Commercial Code Customer Service Counter in Albany New York will begin accepting documents that are dropped off. Customers will be able to drop off any documents for processing. Documents that are dropped off will be returned to customers via mail.

The Department of State will accept in person legal process served on the Secretary of State or Department of State as statutory agent of a corporation or other business entity, by appointment. For service of process issues, including the scheduling of an appointment, please call 518-473-2492 so that arrangements can be made to effectuate service.

Customers are encouraged to use the online filing system available on the Department of State’s website to form business corporations and limited liability companies.

All other services can be mailed to:

Department of State

How To Form A New York Corporation

Incorporating a business in New York? Get an easy-to-follow explanation about what forms youll need, information about fees, timelines, naming requirements and more.

A corporation protects your personal assets from liability for your businesss debts and obligations. It also helps protect you personally if someone sues one of your business partners or employees. There may also be other advantages to incorporating your business, such as tax savings and increased appeal to investors.

Decide On A Business Structure

There are 3 basic options: a DBA, a Corporation or an LLC. .

- A DBA or Doing Business As is not really a separate structure, but just a different name that an individual or partners use as their business name.

- A Corporation is a separate entity that has a structure that includes shareholders, directors and officers. More complex than a DBA but the entity of choice for large companies and startups that intend to raise funding. Some professions are required to choose what is known as a Professional Corporation or PC .

- An LLC or Limited Liability Company is a newer type of business that is both a separate entity but provides very easy management and taxation. Has largely replaced the DBA and Corporation in popularity recently as it provides liability protection but with much less complexity than a Corporation.

You May Like: Ny Car Registration

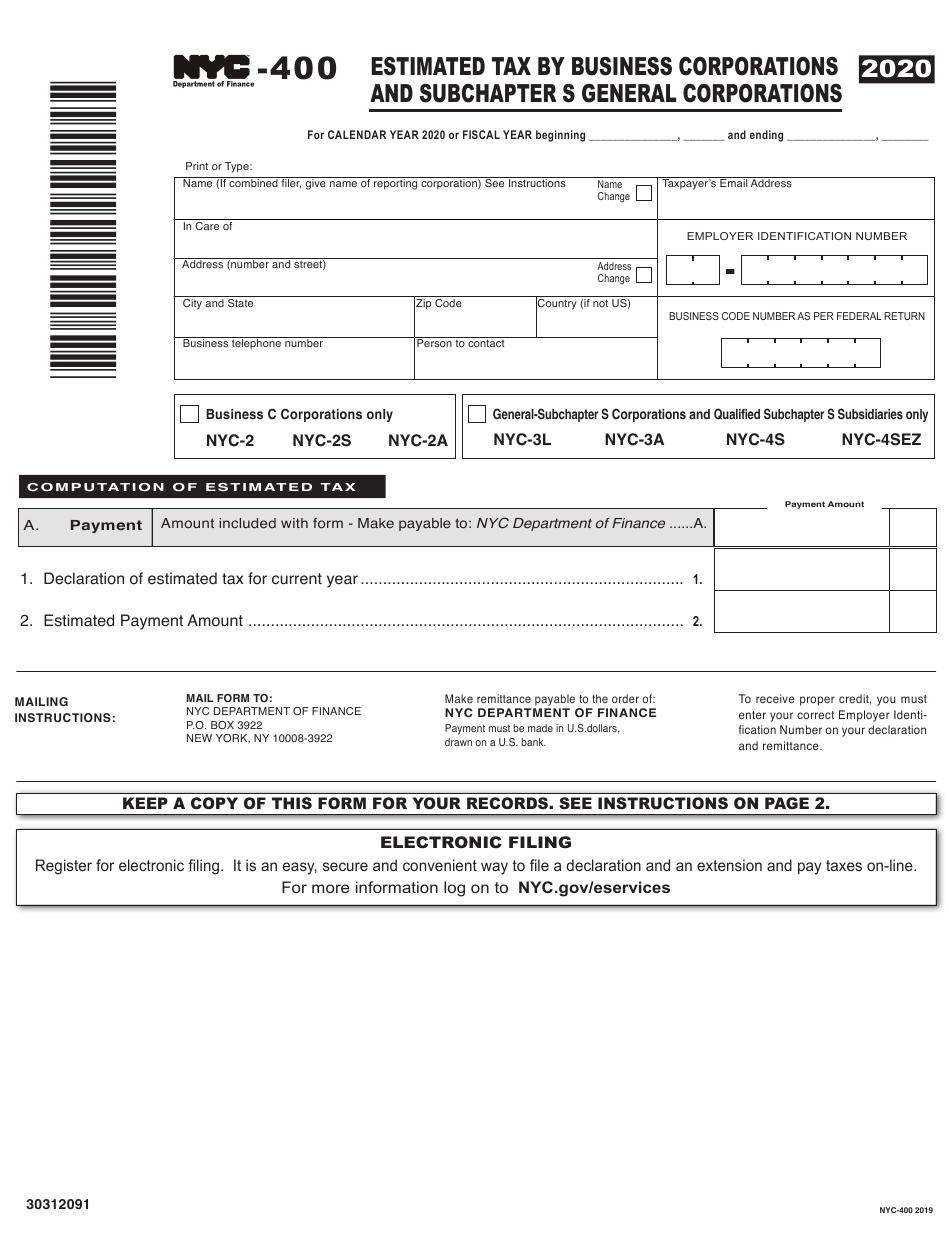

How Is A New York C Corporation Taxed

Shareholders that have invested in a C corporation will be subject to double taxation because they will pay taxes as both a stockholder and as an individual. The main advantage of an S corporation is the pass-through taxation that a shareholder receives. To be more specific, the income generated from the business is passed onto the stockholder instead of being taxed at both the corporate and personal level, like with a C corporation. In other words, S corporations in the state of New York will pay no federal income tax at the business level and are not exposed to double taxation. However, they must file Form CT-6 with the New York Tax Department.

File A Dba In Ny For A Sole Proprietorship Or General Partnership

General partnerships and sole proprietors are required to file their New York DBA with the County Clerk in the county that their business is located. Estates and real estate investment companies are also required to file with the county.

A sole proprietorship is a business owned by a single individual that isn’t formally organized. If you run a business and file taxes under your own name, you are a sole proprietor.

A DBA is only used for branding. We recommend forming an LLC to separate your business and personal assets.

Read Also: Wax Museum In Nyc

Step : Follow New York Llc Publication Requirements

What is New York’s LLC publication requirement? Within 120 days of formation, LLCs must publish a notice of LLC formation in two newspapers for six successive weeks in the county of the LLC’s principal office or designated registered agent’s office.

Can I pick any newspapers I want? No. The newspapers must be approved by the local county clerk of the county you designate in your Articles of Organization. After publication, the printer or publisher of each newspaper will provide you with an affidavit of publication.

Where do I file my Certificate of Publication? You must submit your Certificate of Publication along with your affidavits of publication to the New York Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

Read our full New York publication requirements guide to learn more.

File a Certificate of Publication With the New York Division of Corporations, State Records and Uniform Commercial Code

Fee: $50 payable to the Department of State

New York City has fees upwards of $1,500$2,000 for newspaper publishing. One way to save on fees is to designate a registered agent service thats located outside of the city.

Recommended: ZenBusiness Registered Agent Service is located in Albany, where typical newspaper publishing fees range from $80$100.

FAQ: New York LLC Publication Requirements

What doe a notice of formation look like?

Format:

Example:

New York Corporation Licenses And Permits

Do I need business licenses and permits?

To operate your corporation in New York, you must comply with federal, state, and local government regulations. For example, restaurants likely need health permits, building permits, signage permits, etc.

The details of business licenses and permits vary from state to state. Make sure you read carefully. Don’t be surprised if there are short classes required as well.

Fees for business licenses and permits will vary depending on what sort of license you are seeking to obtain.

Obtain the correct New York business licenses and permits for your corporation, or have a professional licensing service do it for you:

- Federal: Use the US Small Business Administration guide to federal business licenses and permits.

- State: Apply for or learn more about licenses, permits, and registration with the State of New York’s Business Express website.

- Local: Contact your local county clerk and ask about local business licenses and permits.

You May Like: New York Times Travel Submissions

How Do I Open A Bank Account For My New York Corporation

To open a corporate bank account in New York, youll need to bring the following with you to the bank:

-

A copy of the New York corporations Certificate of Incorporation

-

The corporations bylaws

-

The corporations EIN

If your bylaws dont specifically assign the power to open a bank account, you may also want to bring a corporate resolution to open a bank account. The resolution would state that the person going to the bank is authorized by the business to open the account in the name of the corporation. At Northwest, we provide free corporate bank resolutions, along with many other free corporate forms, to help you get started fast.

File Your New York Llc Biennial Statement

The State of New York requires all LLCs to file a biennial statement every two years with the New York Department of State. The biennial statement typically includes information about your business and can be filed online.

Fee: $9

Due Date: New York LLC biennial statements are due every second year by the end of your LLCs anniversary month .

Late Filings: Any biennial statement received after the due date will result in your LLC losing its good standing status with the state.

You May Like: Ny Pay Ticket Online

Obtain Your Federal Employer Identification Number

Your EIN is like your Social Security Number for your company. Its required for Corporations and LLCs and optional for DBAs . However, if you are a DBA and dont obtain an EIN you will be forced to use your Social Security Number on many documents so its typically recommended you obtain the EIN to prevent identity theft.

To obtain an EIN you can apply online with the IRS or via IRS Form SS-4.

TIP: We will obtain your EIN for you if we form your company.

Choose A Name For Your Business

The first step will be to decide on a name for your business. Choose a name that is memorable and unique, easy to understand and pronounce, and accurately represents your business. When picking out a name, remember to conduct a name search to find out whether it is available. Jot down one or two alternatives, in case the name you settle on is not available for registration in New York.

There are a few rules that New York Corporations must follow in order to register a name.

First and foremost, the name you choose must be unique and not “deceptively similar” to the name of any other New York business. This is to prevent fraud or misrepresentation and is a common rule in all 50 states. You can find out whether a name is available in New York by searching the New York Department of State business entity database Opens in a new window for possible conflicts.

You can also utilize MyCorporation’s business name search service. Our team of skilled professionals will conduct a thorough search on your behalf and report back with the name’s availability. As an added bonus, when you complete your corporation filings with MyCorporation we also include a business name search for free.

Tip:

Also Check: How Much Is The Wax Museum In Nyc

How Can I Get A New York Phone Number For My Corporation

Its a conundrum: you need a local number to display on your website and give to customers, but you dont want to make your personal number quite sopublic. We get it. And weve got you covered with Northwest Phone Service. We can provide you with a virtual phone number in any stateplus unlimited call forwarding and tons of easy-to-use features. You can try Phone Service free for 60 days when you hire us to form your corporation, and maintaining service is just $9 monthly after that. No contract required.

How Long Does It Take To Start A New York Corporation

Filing online processes instantly. Mailed-in certificates can take a month or more to process, though there are expediting options. Pay an extra $150 to have your mailed in certificate processed in 2 hours or $25 extra to have it processed in 24 hours.

If you hire Northwest to start your corporation, we file online and typically have your corporation approved within a day.

Also Check: How To Delete New York Times Account

Step : Get A New York Llc Ein

What is an EIN? EIN stands for Employer Identification Number. EINs are a nine-digit number assigned by the Internal Revenue Service to help identify businesses for tax purposes. It is essentially a Social Security number for a business.

An EIN is sometimes referred to as a Federal Employer Identification Number or Federal Tax Identification Number .

Why do I need an EIN? An EIN is required to:

- Open a business bank account

- File and manage federal and state taxes

- Hire employees

What if I already have an EIN for my sole proprietorship? The IRS requires that sole proprietorships get a new EIN when converting to an LLC.

Where do I get an EIN? You can get an EIN for free from the IRS. Getting an EIN is an easy process that can be done online or by mail.

FOR INTERNATIONAL EIN APPLICANTS: You do not need a SSN to get an EIN. For more information, read our How to Get an EIN as a Foreign Person guide.

How Do I Write Bylaws

Creating bylaws can be overwhelmingwhere do you start? Northwest can help. We give you free corporate bylaws when you hire us to form your New York corporation. We know what kinds of topics and questions corporations need to address, and weve spent years refining and improving our forms. We offer many other free corporate forms as well, including templates for resolutions and meeting minutes.

You May Like: How Much To Save Before Moving To Nyc

Forming A Corporation In New York Is Easy

You can open a corporation in New York by filing the Certificate of Incorporation, creating corporate bylaws, and choosing your initial director.

Not sure if a corporation is right for you? Check out our LLC vs. Corporation guide to help you make your decision.

Follow the steps in our How to Start a Corporation in New York guide below to get started:

Step 5: Get an EIN

Requirements For The Certificate Of Incorporation

The document required to form a corporation in New York is called the Certificate of Incorporation. The information required in the formation document varies by state. New York’s requirements include:

- Officers.Officer names and addresses are not required to be listed in the Certificate of Incorporation.

- Stock.Authorized shares and par value must be listed in the Certificate of Incorporation. An increase in the number of shares or par value can affect initial filing fees.

- Registered agent.Listing the name and address of a registered agent is optional in New York. Corporations must, however, include the address to which legal documents, such as Service of Process, should be sent. The registered agent or person at the Service of Process address must be available during normal business hours.

Recommended Reading: Selling Your Eggs Nyc

Obtain Ny Business Permits

Every state and locality has different requirements for operating businesses. In New York, over 30 professions require a license from the state. Examples include barbers, security guards, healthcare professionals, home inspectors and real estate brokers. If your business is in a highly regulated industry, such as food service or childcare, youll likely need a special permit to operate. New York States Business Express Wizard can help identify the licensing regulations for your business. You can also contact your city, borough or county licensing agency to learn more.

Filing A Dba In Ny For Sole Proprietors And General Partnerships

Sole proprietors and partnerships are required to file their NYS DBA with the County Clerk where their business is located. Estates and real estate investment companies are also required to file with the county.

A sole proprietorship is a business owned by a single individual that isn’t formally organized. If you run a business and file taxes under your own name, you are a sole proprietor.

A DBA doesn’t offer any protection for your personal assets in the event that your business is sued. For more information on setting up an LLC , visit our How to Form an LLC page and select your state.

SKIP AHEAD

If you need to create a DBA for an LLC or Corporation, you can .

Also Check: New York Dmv Registration

How Much Does A Dba Cost In Ny

DBA filing fees vary depending on the location of the business and the business type.

Sole proprietor and partnership DBA fees are assessed by the county where the business is located. You must access your county directly for specific fee information. You can do this online or by calling the county clerk. You can find your counties’ contact information on the NYSAC.org website.

Fees for incorporated businesses like LLCs and corporations are as follows:

$25 for the Certificate of Assumed Name$10 Certified Copy of Certificate of Assumed Name$150 2-hour processing, $75 Same day, $25 within 24 hours

Additional Fees For Corporations Only

$100 for each NYC county where the business is or will be conducted within New York City $25 for each county where the business is or will be conducted outside New York City$1,950 to include every New York State county and the Certificate of Assumed Name combined

A Guide To Choosing The Best Business Entity In New York

Are you interested in starting a business in New York, but not sure if you should form an LLC or start a corporation? Active Filings has the guide for you! Well walk you through the advantages and disadvantages of incorporating or forming an LLC in New York. Throughout this New York-specific corporation and LLC formation guide, youll discover exactly how to form either an LLC or corporation in New York, and learn the disadvantages and advantages of each business type.

Once youve decided which business structure best meets your needs, you can hire Active Filings and have our professionals streamline your incorporation process. Sure you can sign up with a more expensive company managed by hedge fund billionaires where youll just be a number, or you can choose Active Filings, a small company like yours. Our professional staff will ease you through the business formation process, and pretty soon youll see why Active Filings is Americas most reliable business incorporation service.

Read Also: How Much It Cost To Register A Car In Ny

Open Company Bank And Credit Accounts

To keep business and personal expenses separate, you should open a separate account for your business. In addition, getting business credit cards is how you begin to build a company credit profile and can later qualify for larger loans and lines of credit. To open the account simply call your chosen bank and ask for the steps to open a business bank account. Typically youll need a) your filed paperwork, b) your EIN and c) a company resolution authorizing your company to open the account .

What Is An S Corporation

An S corporation is an incorporated business that is taxed as a pass-through entity. This means that S corps do not pay federal taxes on their business income. Instead, the business profits “pass-through” to the owners of the S corp, who are also known as shareholders. Then, the shareholders pay income tax and report their share of the profits in the form of salaries on their individual tax returns, which are then taxed.

In order to elect an S corporation status for tax purposes, corporations will need to file Form 2553 – Election by a Small Business Corporation. The form must be signed by all shareholders and must be filed within two months and 15 days after the start of the initial tax year.

To learn more, read our What is an S corporation guide.

Recommended Reading: Flights To Italy From New York