Laws In New York State Regarding Wills

A will is a written statement that details what an individual wants to happen to their property when they pass away. In addition to addressing property division, these documents can also provide for guardians for the children to raise them or to manage their money from the inheritance until they reach the age of adulthood or the age designated for the child to inherit. Sometimes different people are in charge of the child and the child’s property, and sometimes the court only designates one guardian.

Each state has specific requirements for a valid will. Here are some of the most important requirements and details in New York.

Who Can I Name As My Executor

You can name anyone you want as your executor. Executors duties involve probating the will, distributing the assets and handling estate related issues.

Q: Can I name more than one person as my executor? A: Yes. You can appoint co-executors. Sometimes having more than one executor can complicate matters instead of simplifying them. If you name co-executors they both will have to be available to act together with regard to handling your estate.

Q: Does my executor have to live locally? A: There are generally no restrictions as to where your executor resides. However, in most situations your executor should live within the United States of America.

Q: What are the duties of an executor? A: An executor must arrange for the burial of the decedent. He or she must gather the assets of the estate. The executor must notify the parties to the will and the next of kin of the passing of the decedent and of the existence of an estate proceeding. The executor must collect the decedent=s property and pay the estate=s bills. In the end the executor must distribute the decedent=s assets pursuant to the terms of the will.

Q:How does an individual start a probate proceeding? A: To start a probate proceeding a probate petition must be prepared. Upon submission of the probate petition and will, an original raised seal death certificate, and an original paid funeral bill must be submitted to the Surrogates Court in the County in which the decedent resided prior to his or her death.

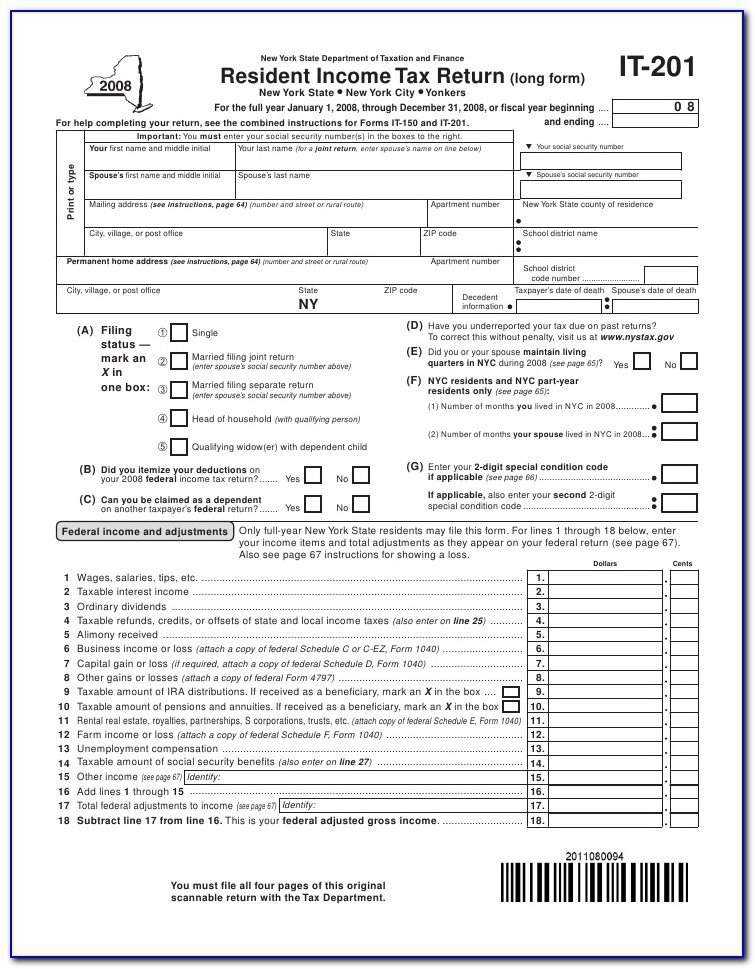

How Can I Paper File My Ny Return I Need To Attach A Form To The Return Because I Am Applying For Itins For Dependents

You may file a NY state tax return by mail.

The New York Department of Taxation and Finance removed the penalty so you may file a NY state tax return by mail . Please review the following link for more information: Is there a penalty if I don’t e-file my New York return?

To print and file your tax return by mail in the TurboTax for Windows CD/Download software, pleasereview the following link and the link embedded on the webpagefor more information:

See attached screenshot. You may Continue past the screen regarding “Filing your New York return on paper is not recommended.”

If those instructions are unhelpful, you should try selecting the Print Center icon in the upper right.

Don’t Miss: How To Delete New York Times Account

Complete The Bankruptcy Forms

This is probably the most technical part of any bankruptcy filing. If youâre eligible to file through Upsolve, we will handle the technical parts after collecting all of the necessary information from you. If youâre thinking of completing the forms on your own without anyone’s help, make sure to download and review the 49 page instructions manualfor important information about each one of the bankruptcy forms.

Of course, if you hire a bankruptcy lawyer theyâll do the heavy lifting in drafting all your bankruptcy forms based on the information you provide to their office. Regardless of which process you choose, make sure to take your time and be diligent and thorough in answering all of the questions. You will be signing these documents under penalty of perjury before theyâre filed with the court, and errors or omissions can delay or even prevent the entry of your discharge.

How To Create A Will In New York City

A will, or last will and testament, is a document that protects your family and property in the event of your death. It serves many purposes, including to:

- Distribute your property and/or assets to specific individuals or organizations

- Appoint a personal guardian to look after your minor children

- Name a person you trust to manage any property you leave to your minor children

- Appoint an executor to ensure that the terms of your will are carried out according to your last wishes

The best way to start creating your will is to make a detailed list of your property and assets. Once you have compiled the entirety of your estate, you should create a list of beneficiaries and determine who will receive your belongings. It is imperative that you use clear and easy-to-understand language to avoid any conflicts among your heirs.

For a will to be valid in New York, it must be signed and dated by you the person writing it. Additionally, your will must be signed and dated by two witnesses. Furthermore, to avoid any discrepancies or confusion, ensure that your will is typed and not handwritten.

You will also want to name an executor to make sure your property is distributed in accordance with your last wishes.

Read Also: Cost To Get Car Registered

Failure To Consider Taxes And Other Legal Issues

A will does more than just name who gets the house and who will take care of young children if both parents die. A properly drafted will should also address taxes, payment of debts, dispositions of the estate, and meet probate requirements.

In recent years, estate taxes have changed dramatically. An experienced NYC estate planning attorney can help to ensure that your will is created, and updated, to make use of all potential tax savings.

Common Mistakes In Do

We create wills to ensure that our wishes are carried out if we die. This is one of the reasons why a will should never be created without the help of an experienced estate planning attorney if you are dead, you will be unable to address any unforeseen problems that an improperly drafted will may cause. Below are some of the most common mistakes seen in do-it-yourself wills.

You May Like: Ny State Arrest Records

Get Your Case On The Court Calendar

If your spouse agrees to the divorce or defaults by failing to respond, the next thing you need to do is get your case on the court’s calendar.

In order to get your divorce case on the calendar, you will have to fill out the remaining applicable forms . When you’ve completed the necessary forms, you can file them with the clerk.

If approved by the judge, they will issue a divorce judgment.

What Happens To My New York Estate When I Die

Assets that are in your name alone with no beneficiaries or joint owners will pass by either:

- Probate, through an Executorif you have a Will/Codicil.

- Intestacy through an Administrator if you do not have a Will.

- Small Estate, through a Voluntary Administrator if you have no real estate and your assets are worth $50,000 or less.

You May Like: Ny Vehicle Registration

What Not To Do With A Will After Someone Dies

Any time there is a will, there is potential that someone may challenge its sufficiency. Consequently, it is a good idea to refrain from doing anything that makes the document appear as if it was tampered with in some way, making it invalid.

For example, do not remove staples from the paperwork when making copies. When staple removal occurs, the remover of the staples must provide a signed, notarized affidavit detailing why the staples were removed, the location of the paperwork since the time it was executed, and the staple remover’s belief that no substitutions or changes occurred since the time the document was executed.

Essential Elements Of A Will

The legal requirements for a valid will in New York include:

- The author is 18 or older.

- The author is of sound mind.

- The author wrote the document freely and voluntarily.

- It must state it is the last will and specifically revoke all previous versions.

- The author and two witnesses must sign it.

The document may be either printed or written out longhand, so long as it is personally written by the author. Oral wills are only valid in extremely rare circumstances.

Don’t Miss: Pay New York Ticket

Take Bankruptcy Course 2

You took a credit counseling course before your Chapter 7 bankruptcy in New York was filed in order to be eligible to be a debtor in bankruptcy. Now that your case has been filed, you have to take bankruptcy course 2 in order to be eligible to receive your bankruptcy discharge. This course focuses on financial management tools and aims to help folks filing bankruptcy in New York take full advantage of their fresh start, while managing their finances responsibly.

The course itself only takes about 1 – 2 hours and, as before, can be taken online, over the phone, or in person. If you were happy with the company you used to complete the first bankruptcy course, you should find out if they are approved to offer the financial management course to folks filing bankruptcy in New York as well. If so, you can go through them again for this second course and may even be able to get a discount for taking both classes with them. If not, check out the list of providers approved to offer this course for New York bankruptcy cases published by the Office of the United States Trustee.

You Can File For A Divorce In New York In Case Of Any Of The Following:

- If your spouse and you were married in New York and either one of you at least has lived in New York for a minimum of 1 year before filing for divorce.

- Your spouse and you have lived in New York as a couple and either one of you at least has lived in New York for a minimum of 1 year before filing for divorce.

- The grounds of divorce have occurred in the state and either one of you at least has lived in New York for a minimum of 1 year before filing for divorce.

- The grounds of divorce have occurred in the state and both your spouse and you have lived in New York when the process of divorce started.

- Either your spouse or you have been a resident of the state for a minimum of 2 years immediately before filing for divorce.

There is no waiting period in New York before a judge will enter a decree of divorce.

Don’t Miss: Nys Medical Marijuanas Card Renewal

Serving Your Spouse In Ny

The state of New York requires that the defendant must be informed about the divorce in person and so, the Summons and Complaint or Summons with Notice must be delivered personally to the defendant. If you are unable to locate your spouse or dont know where he/she is, then you can check with the clerks office at the supreme court for information about the alternative ways of serving your spouse.

- The plaintiff has a period of 120 days to serve the defendant from the day the Summons and Complaint or Summons with Notice was filed with the clerk at the county courthouse.

- The plaintiff cannot serve the papers to the defendant and must ask any person over 18 years to serve the papers.

- The person serving the defendant should complete the Affidavit of Service, which is proof that the papers were served to the defendant properly.

New York Bankruptcy Forms

Since New York bankruptcy cases are filed in federal court, a majority of the New York bankruptcy forms are national forms used in bankruptcy cases across the United States. While the clerk’s office may not be able to provide you with the official forms, you can each one of them, for free, as a fillable PDF. Additionally, each one of the bankruptcy districts in the Empire State has created certain local forms for use in cases filed within each district. These New York bankruptcy forms are available for download on the individual web pages for the four districts.

Recommended Reading: Cremation Cost In Nyc

Filing Your Certificate Of Assumed Name Ny

If your business is incorporated, you are required to set up your DBA with the New York Department of State.

First, print a copy of the certificate of assumed name form. The application will ask for your new DBA name and information about your business, such as:

- Line 2: Your business entity type, ie. corporation, LLC, a general partnership.

- Line 4: Number and street of your principal New York business location or out of state address for foreign entities.

- Line 5: All counties where you do business or intend to do business.

- Line 6: Number and street of all of your New York business locations where you transact business.

A DBA does not offer any protection for your personal assets in the event that your business is sued. For more information on setting up an LLC , visit our How to Form an LLC page and select your state.

Submit Your Certificate of Assumed Name Form

Walk In

New York State Department of StateDivision of Corporations

474-1418

Include the and your written request for a certified copy, if required.

Payment and Fees

- $25 for the Certificate of Assumed Name

- $10 Certified Copy of Certificate of Assumed Name

- $150 2-hour processing, $75 Same day, $25 within 24 hours

Additional Fees For Corporations Only

- $100 for each NYC county where the business is or will be conducted within New York City

- $25 for each county where the business is or will be conducted outside New York City

- $1,950 to include every New York State county and the Certificate of Assumed Name combined

Who Raises My Children When I Die

You can name a guardian in a will to raise your children. Usually if one parent dies and the other parent is still alive, the living parent will raise the children. If both parents die simultaneously, the court first looks to see if there is a will that appoints a guardian in it. In the event you do not have a will naming an individual or individuals as guardians for your children, the Surrogates Court will appoint the guardians for your children. This is accomplished by family members, friends or other individuals bringing a proceeding in the Surrogates Court to be appointed the guardian of your children. It is the responsibility of the guardians to see to the childrens health, education, general well being, manage the childrens property and deal with all other needs for the children.

Don’t Miss: Nyc Toll Calculator

Complete The New York Publication Requirement

Section 206 of the New York Limited Liability Company Act mandates that new LLCs must publish a Notice of LLC Formation. The notice must be published:

in two newspapers a daily and a weekly

within 120 days of formation

in newspapers circulated in the county where the LLCs principal office will be located and

once a day and once a week for six consecutive weeks.

You must include the following information in your notice:

the name of your LLC

the date the LLC was formed

the county where your main office is located

your LLC’s street address

a statement that the Secretary of State has been designated as an agent of the LLC upon whom process against it may be served

the address where the NY Secretary of State may forward any process against the LLC

the name and address of your Registered Agent

a statement that the Registered Agent is to be the agent of the LLC upon whom process against it may be served

the purpose of the LLC, which can be a statement such as the purpose of the LLC is to engage in any lawful act or activity and

the date the LLC will dissolve. If you plan to run your LLC indefinitely, you can use the word perpetual here.

Contact the County Clerks office in the county where your business is located to ensure you choose newspapers that fulfill this requirement.

Where to File Your

Albany, NY 12231-0001

Important:

Know The Grounds For Divorce In New York

In addition to the residency requirements, you also have to show your reasons for getting a divorce. New York recognizes seven grounds on which you can ask for a divorce. These are:

- Relationship has been broken down for at least 6 months

- Inhuman and cruel treatment. In these cases, a spouse is emotionally or physically in danger and it is unsafe for them to continue living with their partner.

- Abandonment. To use this ground, the plaintiff must show that their spouse has abandoned them for at least one year.

- Adultery during the marriage

- Imprisonment of a spouse for three or more years in a row after the marriage began

- Judgment separation drawn up by the court. The spouses must live apart for one year

Recommended Reading: Wax Museums New York City

New York Legal Aid Organizations

If hiring a lawyer to help you with your Chapter 7 bankruptcy in New York is simply not something you can afford, you can seek assistance from one of the organizations offering free legal aid in New York. Since the law only entitles people dealing with a criminal matter to free legal representation, New York legal aid organizations assist low-income New Yorkers with a variety of civil matters, including New York bankruptcy matters.